INRUSD trade ideas

USDINR - all time highs will be taken out in November?USD is making some serious inroads. INR trailing behind unable to maintain the equilibrium.

83.4210 is the current ATH. Today we went up to 83.3010. TVC:DXY at 107.

Continued FII selling will only add fuel to the fire. When the Indian media houses are gung-ho about the decadal that belongs to India & its growth story - the people outside are not that interested.

TVC:US30Y quoting 4.945% looks exciting from a debt perspective !

--

A rising USDINR means the INR is getting devalued. Calendar year 2022 saw an erosion of 11.07%, YTD is only 0.61% - will the rising US yield + war in middle east further erode the Indian Rupee??

USDINR-Weekly Outlook-Venkat's BlogThe currency pair spent another week in the familiar narrow range of 82.97-83.31. As the base gradually shifting higher closer to 83, the market is no mood to believe decline towards even 82.75 and that the Central Bank would hold 83.30 for long. That is a risk. The sharp moves happen when no one expects. Expect the range of 82.90-83.30 would continue to hold for the week with a crucial support at 82.90 and there could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

As noted in the previous blog, continue to keep the following input for quick reference.

The 82.75-83.25(with error adjustments) zone is the Fib projection of July 2011 to July 2013. Alternatively, the Fib projection of the move from Jan 22(Low) to Oct 22(High) and Nov 22 low also suggest the projection as 82.92. Hence, the importance. If breached, we may see another spike towards 85.70. With last week’s move we are back in the same trading range of 83.00-83.30

On analyzing the quarterly and half yearly charts, the risk on the higher side is till 85.70 followed by 86.10 which is the channel top and the down side is 77.70

Incidentally, the big move from 80 to 83 happened during third week of Sep 22 to first week of Oct 22. Appears to be saved this time?

On an analysis of conflicts leading to change in perception of Geo-political risks there may be a scenario to “Let-Go”. The big move in INR from 75.28 to 82.80 happened 3-4 weeks after the start of Russia-Ukraine war. However, there was a deceptive down move prior to the full blown up-move. So, it’s a wait and watch?

We have been witnessing depreciation for the past 12 years starting 2011 with exception of 2017. We are nearing close of the tenth month. Will 2023 is be another 2017 or as usual? Monthly/Quarterly/Half yearly charts do not show significant signs of lower levels yet. Only a weekly close below 82.70 can help chances of lower levels.

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

USDINR-Weekly Outlook-Venkat's BlogThe currency pair spent another week in the familiar narrow range of 83.03-83.29. As the base gradually shifting higher above 83, the market is no mood to believe decline towards even 82.75. That is a risk. The sharp moves happen when no one expects. A stray chance of a quick move towards 82.65 cannot be ruled out. Expect the range of 82.90-83.30 would continue to hold for the week with a crucial support at 82.90 and there could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

As noted in the previous blog, continue to keep the following input for quick reference

The 82.75-83.25(with error adjustments) zone is the Fib projection of July 2011 to July 2013. Alternatively, the Fib projection of the move from Jan 22(Low) to Oct 22(High) and Nov 22 low also suggest the projection as 82.92. Hence, the importance. If breached, we may see another spike towards 85.70. With last week’s move we are back in the same trading range of 83.00-83.30

On analyzing the quarterly and half yearly charts, the risk on the higher side is till 85.70 followed by 86.10 which is the channel top and the down side is 77.70

Incidentally, the big move from 80 to 83 happened during third week of Sep 22 to first week of Oct 22. Appears to be saved this time

On an analysis of conflicts leading to change in perception of Geo-political risks there may be a scenario to “Let-Go”. The big move in INR from 75.28 to 82.80 happened 3-4 weeks after the start of Russia-Ukraine war. However, there was a deceptive down move prior to the full blown up-move. So, it’s a wait and watch?

We have been witnessing depreciation for the past 12 years starting 2011 with exception of 2017. We are nearing close of the tenth month. Will 2023 is be another 2017 or as usual? Monthly/Quarterly/Half yearly charts do not show significant signs of lower levels yet. Only a weekly close below 82.70 can help chances of lower levels.

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

USDINR-Weekly Outlook-Venkat's BlogPast week witnessed repeat of the same narrow range by taking 83.20 as pivot moved 0.10 on either side. As the base gradually shifting higher above 83, the market is no mood to believe decline towards even 82.75. Expect the range of 82.90-83.30 would continue to hold for the week with a crucial support at 82.90 and there could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

As noted in the previous blog, continue to keep the following input for quick reference.

The 82.75-83.25(with error adjustments) zone is the Fib projection of July 2011 to July 2013. Alternatively, the Fib projection of the move from Jan 22(Low) to Oct 22(High) and Nov 22 low also suggest the projection as 82.92. Hence, the importance. If breached, we may see another spike towards 85.70. With last week’s move we are back in the same trading range of 83.00-83.30

On analyzing the quarterly and half yearly charts, the risk on the higher side is till 85.70 followed by 86.10 which is the channel top and the down side is 77.70

Incidentally, the big move from 80 to 83 happened during third week of Sep 22 to first week of Oct 23. Are we in to another such move?

On an analysis of conflicts leading to change in perception of Geo-political risks there may be a scenario to “Let-Go”. The big move in INR from 75.28 to 82.80 happened 3-4 weeks after the start of Russia-Ukraine war. However, there was a deceptive down move prior to the full blown up-move. So, it’s a wait and watch?

We have been witnessing depreciation for the past 12 years starting 2011 with exception of 2017. We are in the ninth month. Will 2023 is be another 2017 or as usual? Monthly/Quarterly/Half yearly charts do not show significant signs of lower levels yet. Only a weekly close below 82.20 can help chances of lower levels.

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

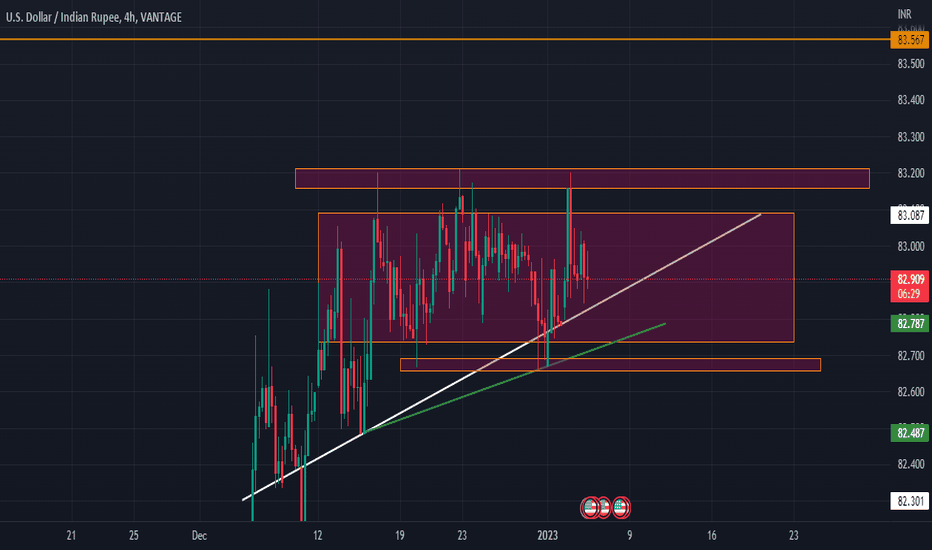

USDINR USDINR 1 HRS Time Frame

Validation level 83.42

Zigzag Formation on going (Zigzag Structure A5-B3-C5) before next impulse move

Wave ((A)) of Minute degree internal five waves or subdivision (i),(ii),(iii),(iv),(v).

Wave ((B)) of Minute Degree expended triangle because internal structure is (3-3-3-3-3) nature, of Wave ((B))

I anticipate wave ((C)), tagging of wave ((A)) before going to next move because this structure does not allow to go for next impulse due to incomplete correction or wave ((B)) indicate to me expended triangle so I anticipate (i),(ii),(iii), (iv), (v) for down side which may be complete in 82.21 to 81.76 area and I again anticipate for next impulse when reached around my buying area 82.21 to 81.76.

Conclusion my main idea for first to short USDINR with stop loss 83.42 and my shorting trade cover in 82.21 to 81.76 area and again i see buying setup in this area.

Declaimer it is my personal research before taking any trade please advise your financial adviser i am not SEBI registered financial adviser.

USDINR-Weekly Outlook-Venkat's BlogPast week witnessed repeat of the same narrow range by taking 83.15 as pivot moved 0.14 on either side. One more attempt of 83.30 and reversal is fairly a good sign for a small correction towards 82.75. Market is no mood to believe decline towards even 82.50. At best we can presume that the range is gradually shifted higher between 82.90 and 83.30. Expect the range of 82.90-83.30 would continue to hold for the week with a crucial support at 82.90 and there could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

As noted in the previous blog, continue to keep the following input for quick reference.

The 82.75-83.25(with error adjustments) zone is the Fib projection of July 2011 to July 2013. Alternatively, the Fib projection of the move from Jan 22(Low) to Oct 22(High) and Nov 22 low also suggest the projection as 82.92. Hence, the importance. If breached, we may see another spike towards 85.70. With last week’s move we are back in the same trading range of 82.70-83.30

On analyzing the quarterly and half yearly charts, the risk on the higher side is till 85.70 followed by 86.10 which is the channel top and the down side is 77.70

Incidentally, the big move from 80 to 83 happened during third week of Sep 22 to first week of Oct 23. Are we in to another such move?

We have been witnessing depreciation for the past 12 years starting 2011 with exception of 2017. We are in the ninth month. Will 2023 is be another 2017 or as usual? Monthly/Quarterly/Half yearly charts do not show significant signs of lower levels yet. Only a weekly close below 82.20 can help chances of lower levels.

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

USDINR-Weekly Outlook-Venkat's BlogPast week saw a narrow range by taking 83.10 as pivot moved 0.17 on either side. One more attempt of 83.27 and reversal is fairly a good sign for a small correction towards 82.75. Market is no mood to believe decline towards even 82.50. At best we can presume that the range is gradually shifted higher between 82.70 and 83.30. Expect the range of 82.70-83.30 would continue to hold for the week with a crucial support at 82.70 and there could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

As noted in the previous blog, continue to keep the following input for quick reference.

The 82.75-83.25(with error adjustments) zone is the Fib projection of July 2011 to July 2013. Alternatively, the Fib projection of the move from Jan 22(Low) to Oct 22(High) and Nov 22 low also suggest the projection as 82.92. Hence, the importance. If breached, we may see another spike towards 85.70. With last week’s move we are back in the same trading range of 82.50-83.30

On analyzing the quarterly and half yearly charts, the risk on the higher side is till 85.70 followed by 86.10 which is the channel top and the down side is 77.70

Incidentally, the big move from 80 to 83 happened during third week of Sep 22 to first week of Oct 23. Are we in to another such move?

We have been witnessing depreciation for the past 12 years starting 2011 with exception of 2017. We are in the ninth month. Will 2023 is be another 2017 or as usual? Monthly/Quarterly/Half yearly charts do not show significant signs of lower levels yet. Only a weekly close below 82.20 can help chances of lower levels.

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

USDINR-Weekly Outlook-Venkat's Blog

Past week saw a narrow range by taking 83.05 as pivot moved 0.27 on either side. One more attempt of 83.30 and reversal is fairly a good sign for a small correction towards 82.50.and the 82.20. Market is no mood to believe decline towards even 82.20. At best we can presume that the range is gradually shifted higher between 82.50 and 83.30. Expect the range of 82.50-83.30 would continue to hold for the week with a crucial support at 82.80 and there could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

As noted in the previous blog, continue to keep the following input for quick reference.

The 82.75-83.25(with error adjustments) zone is the Fib projection of July 2011 to July 2013. Alternatively, the Fib projection of the move from Jan 22(Low) to Oct 22(High) and Nov 22 low also suggest the projection as 82.92. Hence, the importance. If breached, we may see another spike towards 85.70. With last week’s move we are back in the same trading range of 82.50-83.30

On analyzing the quarterly and half yearly charts, the risk on the higher side is till 85.70 which is the channel top and the down side is 77.70

Incidentally, the big move from 80 to 83 happened during third week of Sep 22 to first week of Oct 23. Are we in to another such move?

We have been witnessing depreciation for the past 12 years starting 2011 with exception of 2017. We are in the ninth month. Will 2023be another 2017 or as usual?

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

USDINR - REVERSAL PLAYThe Indian Rupee (INR) has depreciated by 1 RS against the US dollar in the past month and is approaching its historical peak, a potential reversal opportunity. Consider taking a short position, using a tight stop loss set at the all-time high of 83.6 . This decision is bolstered by the presence of a bearish divergence, lending further support to this strategy.

USDINR Asceding Trangle Pattern The weekly chart of the USD INR is the ascending trangle pattern formation: In the techanical view the probability of the brackout is high as compare to the brackdown.

Currently the crude price hike, this is negative effect the USDINR

Next year is the election, previous chart patter show election year Rupee is fall

Foreign investor sold the indian market

USDINR-Weekly Outlook-Venkat's BlogPast week saw a narrow range by taking 83 as pivot moved 0.18 on either side. It is evident from the market action that the declines are used as opportunity to hedge the Imports. Market is no mood to believe decline towards even 82.20. At best we can presume that the range is gradually shifted higher between 82.50 and 83.30. Expect the range of 82.50-83.30 would continue to hold for the week with a crucial support at 83.80 and there could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

As noted in the previous blog, continue to keep the following input for quick reference.

The 82.75-83.25(with error adjustments) zone is the Fib projection of July 2011 to July 2013. Alternatively, the Fib projection of the move from Jan 22(Low) to Oct 22(High) and Nov 22 low also suggest the projection as 82.92. Hence, the importance. If breached, we may see another spike towards 85.70. With last week’s move we are back in the same trading range of 82.50-83.30

On analyzing the quarterly and half yearly charts, the risk on the higher side is till 85.70 which is the channel top and the down side is 77.70

Incidentally, the big move from 80 to 83 happened during third week of Sep 22 to first week of Oct 23. Are we in to another such move?

We have been witnessing depreciation for the past 12 years starting 2011 with exception of 2017. We are in the ninth month. Will is be another 2017 or as usual?

When India is projected as doing better than many countries, why should the currency have one-way move is a puzzle.

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

De-dollarisation - I don't think soI have just tried to count waves here in USDINR pair for period of around last one year

(almost).

Well it doesnt look atall that dollar is weakning in near future.

In fact it may remain strong for next couple of year (approx).

Huge huge consolidation almost at same place for last 1 year and now

its almost completed.

Should start heading north very soon and with some good momentum.

Lets see how it goes.

Stay alert

All the best.,

Ascending triangle pattern in USD/INRForming an overall bias is really important when you want to participate in any asset class.

As most of us are equity participants, it is crucial to know the influencing factors for the equity market.

Dollar is one of the most important indicator of equity movement as most of the trades happen through Dollar and it is the biggest currency in the world.

At a high level, we have have a notion that when dollar goes high, Indian equity goes down.

In this chart, I am sharing a bullish pattern on the USD/INR chart which is not a good sign for the equity market.

If the Dollar breaks out above this triangle, it can lead to some clouds in the equity.

Keep an eye!

USDINR-Weekly Outlook-Venkat's BlogPast week saw a a sharp move past 83 and attempted 83.22. Every time the currency pair attempt above 83 the panic buttons are pressed. The earlier breach above 83.10 is still fresh in the minds, the buying interest continues as the market is still not sure of a decline below 82.20. It is evident from the market action that the declines are used as opportunity to hedge the Imports. At best we can presume that the range is gradually shifted higher between 82.50 and 83.30. Expect the range of 82.50-83.10 would continue to hold for the week and there could be choppy moves within this range. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

As noted in the previous blog, continue to keep the following input for quick reference.

The 82.75-83.25(with error adjustments) zone is the Fib projection of July 2011 to July 2013. Alternatively, the Fib projection of the move from Jan 22(Low) to Oct 22(High) and Nov 22 low also suggest the projection as 82.92. Hence, the importance. If breached, we may see another spike towards 85.70. With last week’s move we are back in the same trading range of 82.20-82.90

On analyzing the quarterly and half yearly charts, the risk on the higher side is till 85.70 which is the channel top and the down side is 77.70

We have been witnessing depreciation for the past 12 years starting 2011 with exception of 2017. We are in the ninth month. Will is be another 2017 or as usual?

When India is projected as doing better than many countries, why should the currency have one-way move is a puzzle.

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.