INRUSD trade ideas

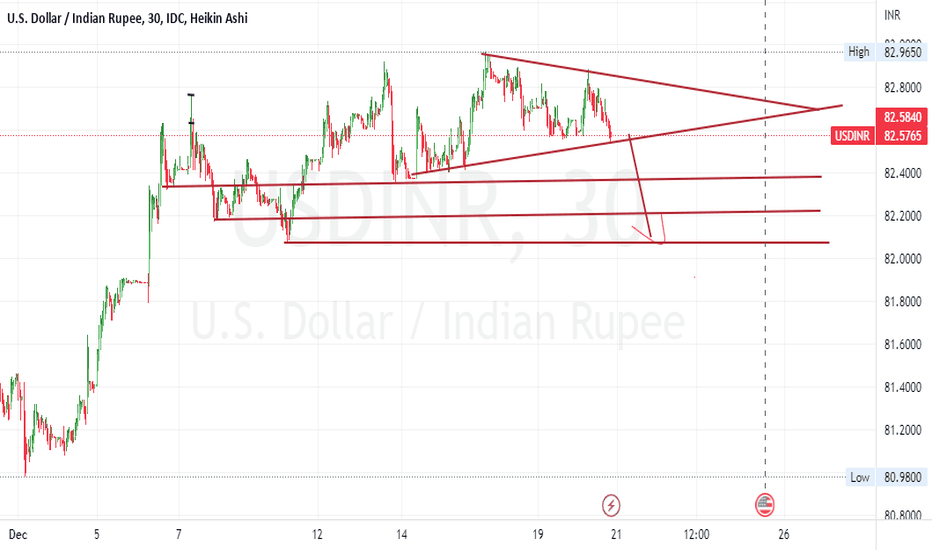

USDINR1st BUY 82.02 (30% of your capital)

2nd BUY 81.73 (30% of your capital)

3rd BUY 81.43 (30% of your capital)

A margin call of 10% must be maintained.

Note: Only buying (long FUT or Monthly CALL) is recommended here; no shorting or bearish trend is recommended; almost all events are happened so strong naturals (above > 82.39); do not buy weekly CALL options and OTM CALL options; only ITM or ATM monthly options are recommended.

USDINRPlease keep in mind that this is only for futures and positional traders.

You can buy USDINR in 3 different buy zones, as mentioned (Buy zone 1, Buy zone 2, Buy zone 3).

There is NO-STOPLOSS; simply purchase as much as you can. Don't panic if it reaches Zone 3; instead, buy as much as possible.

It is important to note that this view is for the next three months and is not recommended for short-term time frames.

Note 1: Do not trade CALL options based on this view because it is a long-term view and you may lose money buying OTM or ITM due to theta decay in the long run.

Note 2 : Because the USDINR is oversold, strong Bullishness is expected to continue, and only buying is recommended (avoid short selling or buying PUT options) at retracement levels.

USDINR signals Nifty has legsinter-market analysis can be tricky but even as the USDINR hit a new high yesterday, the last two days bounce on hourly charts is a-b-c, what that means is that it is not a new move but the end of something. If USDINR closes down today after that it would add weight to a positive near-term outlook for the Nifty given the historical inverse correlation between Nifty and USDINR.

USDINR multi time frame aligned Elliott wave counts analysisUSDINR possible and aligned Elliott wave structure of multi time frames from monthly to hourly.

Monthly chart

Weekly chart

Daily chart

4 Hourly chart

1 Hourly chart

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Disclaimer.

I am not sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

USDINR-Currency ViewThe pair moved in a range of 81.37-82.96 during last week. The pair seem to be in a dilemma and un-willing to breach either side. We may see one more week of narrow range of 83.10-82.40. While the monthly candle is still in progress, it appears that the pair may make one more attempt of the trend line resistance at 83.30. Deeper corrections cannot be expected till we see a close below 81.20. We can expect supply around the closer resistance at 83.10. This seems to be another phase where the demand is led by lower crude and other unhedged imports getting covered. Most likely scenario would be a consolidation between 82.20 and 83.20. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

The long term trend line till at 83.10-83.30 levels holds for now and we are likely to see a consolidation between 79-82

We may not see a runaway in DXY. We have once seen the support at 105 giving-up. There can be relief rallies.

Full impact of the correction has not yet been seen in USDINR currency pair. Hence, the spikes in DXY need not necessarily impact this pair

The raising upward channel indicate the broader range of 80.10-83.10

The increased volatility and wild swings likely to continue

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.