Air Canada

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.66 CAD

1.72 B CAD

22.25 B CAD

292.61 M

About Air Canada

Sector

Industry

CEO

Michael Stewart Rousseau

Website

Headquarters

Saint-Laurent

Founded

1946

IPO date

Aug 1, 1988

Identifiers

3

ISIN CA0089118776

Air Canada engages in the provision of airline transportation services. Its services cover full-service airline, scheduled passenger and cargo services, serving more than two hundred airports on six continents. It operates through the following geographical segments: Canada, U.S. Transborder, Atlantic, Pacific, and Other. The company was founded on April 11, 1936 and is headquartered in Saint-Laurent, Canada.

Related stocks

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ACDVF5230438

Air Canada 3.875% 15-AUG-2026Yield to maturity

5.40%

Maturity date

Aug 15, 2026

ACDVF5043638

Air Canada 5.25% 01-APR-2029Yield to maturity

—

Maturity date

Apr 1, 2029

ACDVF4320743

Air Canada 4.125% 15-DEC-2027Yield to maturity

—

Maturity date

Dec 15, 2027

ACDVF4320744

Air Canada 3.75% 15-DEC-2027Yield to maturity

—

Maturity date

Dec 15, 2027

See all AC bonds

Frequently Asked Questions

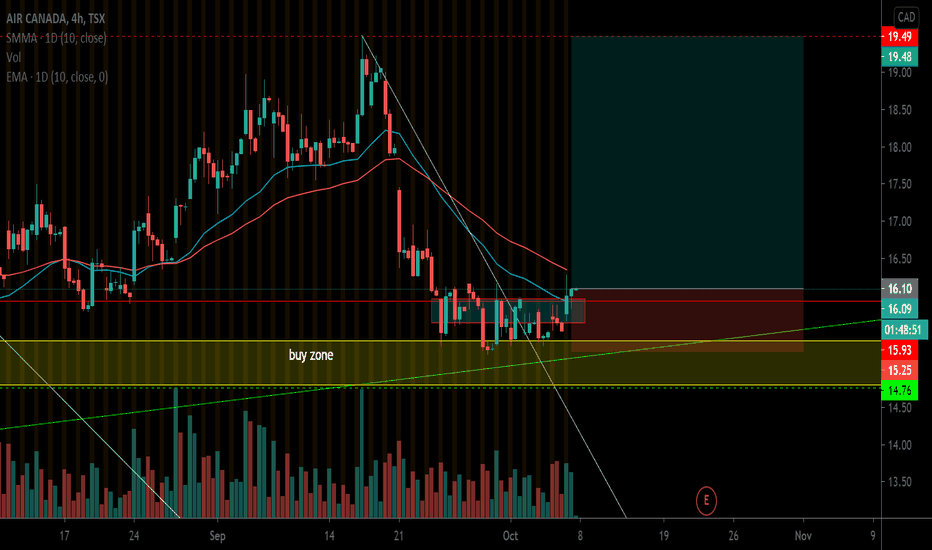

The current price of AC is 19.44 CAD — it has decreased by −0.56% in the past 24 hours. Watch Air Canada stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NEO exchange Air Canada stocks are traded under the ticker AC.

AC stock has fallen by −7.44% compared to the previous week, the month change is a 0.15% rise, over the last year Air Canada has showed a 8.79% increase.

We've gathered analysts' opinions on Air Canada future price: according to them, AC price has a max estimate of 32.00 CAD and a min estimate of 18.00 CAD. Watch AC chart and read a more detailed Air Canada stock forecast: see what analysts think of Air Canada and suggest that you do with its stocks.

AC stock is 2.90% volatile and has beta coefficient of 1.28. Track Air Canada stock price on the chart and check out the list of the most volatile stocks — is Air Canada there?

Today Air Canada has the market capitalization of 5.73 B, it has decreased by −2.58% over the last week.

Yes, you can track Air Canada financials in yearly and quarterly reports right on TradingView.

Air Canada is going to release the next earnings report on Feb 12, 2026. Keep track of upcoming events with our Earnings Calendar.

AC earnings for the last quarter are 0.75 CAD per share, whereas the estimation was 0.79 CAD resulting in a −4.94% surprise. The estimated earnings for the next quarter are 0.30 CAD per share. See more details about Air Canada earnings.

Air Canada revenue for the last quarter amounts to 5.77 B CAD, despite the estimated figure of 5.78 B CAD. In the next quarter, revenue is expected to reach 5.51 B CAD.

AC net income for the last quarter is 264.00 M CAD, while the quarter before that showed 186.00 M CAD of net income which accounts for 41.94% change. Track more Air Canada financial stats to get the full picture.

No, AC doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 12, 2026, the company has 39.7 K employees. See our rating of the largest employees — is Air Canada on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Air Canada EBITDA is 2.78 B CAD, and current EBITDA margin is 15.89%. See more stats in Air Canada financial statements.

Like other stocks, AC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Air Canada stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Air Canada technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Air Canada stock shows the buy signal. See more of Air Canada technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.