Broker Platform Selection: A Guide for Traders and Investors1. Understanding What a Broker Platform Is

A broker platform is a digital interface provided by a brokerage firm that allows users to buy and sell financial instruments such as equities, derivatives, commodities, currencies, and cryptocurrencies. It includes trading software (web-based, desktop, or

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

49.90 INR

335.56 B INR

1.73 T INR

2.64 B

About Bharti Airtel Limited

Sector

Industry

CEO

Shashwat Sharma

Website

Headquarters

New Delhi

Founded

1995

IPO date

Jul 7, 1995

Identifiers

2

ISIN INE397D01024

Bharti Airtel Ltd. engages in the provision of telecommunication, tower infrastructure, and direct-to-home digital television services. It operates through the following segments: Mobile Services India, Mobile Services South Asia, Mobile Services Africa, Airtel Business, Tower Infrastructure Services, Homes Services, Digital TV Services, and Others. The Mobile Services India segment covers voice and data telecom services provided through wireless technology in India. The Mobile Services South Asia segment includes voice and data telecom services provided through wireless technology in Sri Lanka. The Mobile Services Africa segment consists of voice and data telecom services provided through wireless technology in Africa. The Airtel Business segment offers end-to-end telecom solutions being provided to large Indian and global corporations by serving as a single point of contact for all telecommunication needs across data and voice, network integration, and managed services. The Tower Infrastructure Services segment is involved in setting up, operating, and maintaining wireless communication towers in India. The Homes Services segment is composed of voice and data communications through fixed-line network and broadband technology for homes. The Digital TV Services segment refers to digital broadcasting services provided under the direct-to-home platform. The Others segment relates to other strategic investment in joint venture; associates and administrative; and support services provided to other segments. The company was founded by Sunil Bharti Mittal on July 7, 1995 and is headquartered in New Delhi, India.

Related stocks

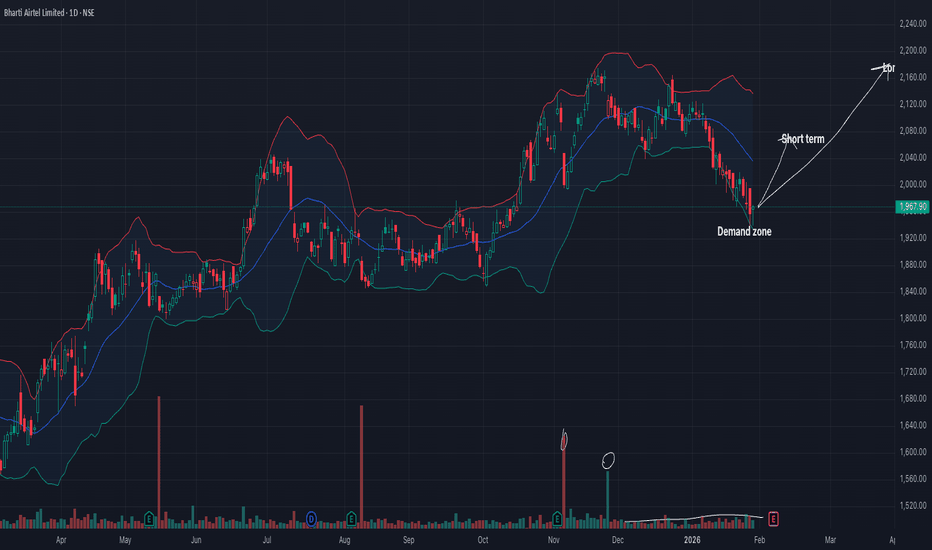

AIRTEL-SELL LIMITTrading Plan

For Sellers (short-term trade):

Entry: Near ₹2,050 – ₹2,080

Stop Loss: Above ₹2,110

Targets:

T1: ₹1,990

T2: ₹1,960

T3: ₹1,920

On the current chart:

Price has retested the supply zone and shown clear rejection wicks

Structure shows a lower high formation near resistance

Bearis

Bharti Airtel: Strategic Premiumization Signals Path to ₹2,100Bharti Airtel maintains a strong bullish outlook as it capitalizes on industry-leading growth metrics and a favorable technical setup. Fundamentally, the company’s focus on premiumization has pushed ARPU to a robust ₹256, supported by a rapid transition of users to its 167-million-strong 5G network.

BHARTIARTL (Airtel) – Daily Chart | Simple Long SetupBharti Airtel is currently pulling back after a strong up-move and has reached an important support area. Price is also near an upward trendline, which often acts as support.

🔹 Trend: Overall trend is up

🔹 Support Zone: Marked grey area

🔹 Entry Idea: Buy if price holds above support

🔹 Stop Loss: Be

Part 2 Support and ResistanceRisks in Option Trading

Option trading can be rewarding but has risks:

1. For Buyers

High probability of premium loss (because theta works against them).

Market must move fast and in the right direction.

2. For Sellers

Unlimited loss possible (especially in naked selling).

Requires big margin

Quarterly Results Trading: Profiting from Earnings-Driven MarketUnderstanding Quarterly Results

Quarterly results are financial statements published every three months, usually including the profit and loss statement, balance sheet highlights, cash flow summary, and key operational metrics. Markets closely track parameters such as net profit growth, revenue gro

BHARTIARTL 1 Day Time Frame 📌 Live/Recent Price (as of today)

Current Price: ~₹2,095 – ₹2,098 on NSE (approx live market price).

📊 Daily Support & Resistance Levels (Technical)

📍 Pivot‑Based Levels (Typical daily structure)

These levels are derived from recent data and pivot calculations (may vary slightly by source):

Bull

Part 6 Learn Institutional Trading Risks in Option Trading

While options offer unique advantages, they also carry risks:

Time Decay: Options lose value as expiration approaches, especially for buyers.

Complexity: Advanced strategies require deep understanding and precise execution.

Unlimited Loss Potential: Some option selling st

Candle Patterns The Power of Context: Where Patterns Truly Work

Patterns are not standalone signals. Their effectiveness depends on context:

Trend Direction: Patterns aligned with the higher-timeframe trend have higher probability.

Support and Resistance: Patterns near key levels carry more weight.

Volume: Brea

BHARTIARTL Pullback to Demand with Trail Target AboveBharti Airtel has corrected from recent highs into a confluence support zone around 2,050–2,080, aligning with the prior investment area, short-term EMAs, and a minor demand pocket. A stable close above this band can set up a fresh upswing toward the 2,170–2,220 trail‑target region, while a breakdow

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BHARTIARTL is 2,029.40 INR — it has increased by 1.23% in the past 24 hours. Watch Bharti Airtel Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Bharti Airtel Limited stocks are traded under the ticker BHARTIARTL.

BHARTIARTL stock has fallen by −1.06% compared to the previous week, the month change is a 0.47% rise, over the last year Bharti Airtel Limited has showed a 18.40% increase.

We've gathered analysts' opinions on Bharti Airtel Limited future price: according to them, BHARTIARTL price has a max estimate of 2,750.00 INR and a min estimate of 1,710.00 INR. Watch BHARTIARTL chart and read a more detailed Bharti Airtel Limited stock forecast: see what analysts think of Bharti Airtel Limited and suggest that you do with its stocks.

BHARTIARTL reached its all-time high on Nov 21, 2025 with the price of 2,174.50 INR, and its all-time low was 9.30 INR and was reached on Jan 10, 2003. View more price dynamics on BHARTIARTL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BHARTIARTL stock is 1.86% volatile and has beta coefficient of 1.16. Track Bharti Airtel Limited stock price on the chart and check out the list of the most volatile stocks — is Bharti Airtel Limited there?

Today Bharti Airtel Limited has the market capitalization of 11.42 T, it has increased by 2.07% over the last week.

Yes, you can track Bharti Airtel Limited financials in yearly and quarterly reports right on TradingView.

Bharti Airtel Limited is going to release the next earnings report on May 19, 2026. Keep track of upcoming events with our Earnings Calendar.

BHARTIARTL earnings for the last quarter are 11.02 INR per share, whereas the estimation was 11.65 INR resulting in a −5.42% surprise. The estimated earnings for the next quarter are 12.16 INR per share. See more details about Bharti Airtel Limited earnings.

Bharti Airtel Limited revenue for the last quarter amounts to 539.82 B INR, despite the estimated figure of 534.22 B INR. In the next quarter, revenue is expected to reach 538.56 B INR.

BHARTIARTL net income for the last quarter is 66.31 B INR, while the quarter before that showed 67.92 B INR of net income which accounts for −2.37% change. Track more Bharti Airtel Limited financial stats to get the full picture.

Yes, BHARTIARTL dividends are paid annually. The last dividend per share was 16.00 INR. As of today, Dividend Yield (TTM)% is 0.80%. Tracking Bharti Airtel Limited dividends might help you take more informed decisions.

Bharti Airtel Limited dividend yield was 0.92% in 2024, and payout ratio reached 27.59%. The year before the numbers were 0.65% and 61.10% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 17, 2026, the company has 85.45 K employees. See our rating of the largest employees — is Bharti Airtel Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Bharti Airtel Limited EBITDA is 1.15 T INR, and current EBITDA margin is 50.32%. See more stats in Bharti Airtel Limited financial statements.

Like other stocks, BHARTIARTL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Bharti Airtel Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Bharti Airtel Limited technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Bharti Airtel Limited stock shows the buy signal. See more of Bharti Airtel Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.