BLS International Services LtdDate 25.08.2025

BLS International Services

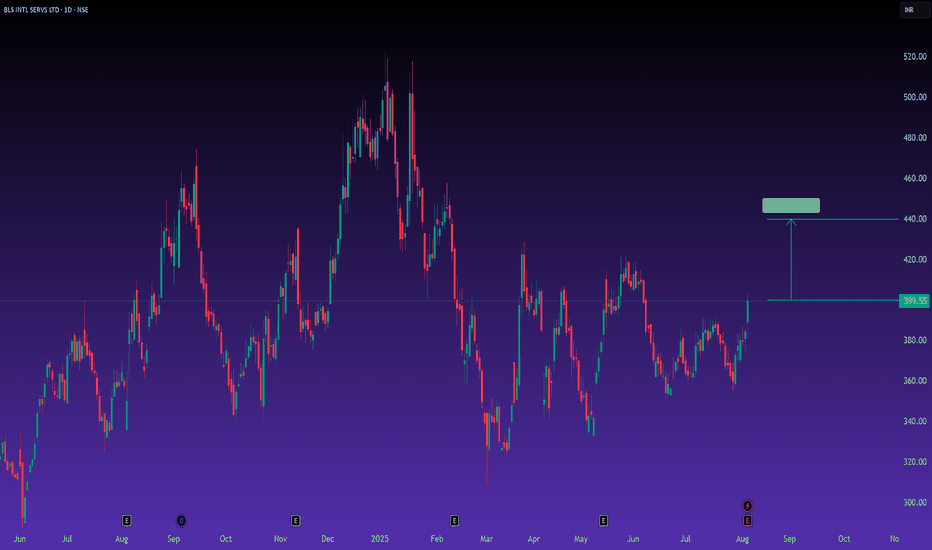

Timeframe : Day Chart

Business Segments

(1) Visa and Consular Services 83%

(2) Digital Services 14%

(3) Others 3%

Geographical Split

(1) Middle East: 39%

(2) North America: 26%

(3) India: 23% in FY24

(4) Europe: 6%

(5) Africa: 3%

(6) Asia-Pacific: 3%

BLS International Services Ltd.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

14.65 INR

5.08 B INR

21.93 B INR

105.91 M

About BLS International Services Ltd.

Sector

Industry

Website

Headquarters

New Delhi

Founded

1983

IPO date

Jun 10, 2016

Identifiers

2

ISIN INE153T01027

BLS International Services Ltd. is a holding company, which engages in the provision of visa and other allied services. It includes outsourced visa processing, verification of documents, attestation of documents, passport services, e-visa services. It operates through the following geographical segments: Middle East, Asia Pacific, North America, Europe, South Africa, and India. The company was founded on November 7, 1983 and is headquartered in New Delhi, India.

Related stocks

Difference Between Investing and TradingIntroduction

In the world of finance, two of the most common approaches people take to grow their wealth are investing and trading. At first glance, these two activities may look similar—both involve putting money into financial instruments like stocks, bonds, mutual funds, or derivatives with the

Sectoral Rotation & Thematic TradingIntroduction

The stock market is like a living organism – it breathes, evolves, and reacts differently under various economic and business conditions. If you observe closely, not all stocks move the same way at the same time. Some industries boom while others struggle, depending on interest rates,

IPO & SME Boom in IndiaIntroduction: The Buzz Around IPOs & SMEs

If you’ve been tracking Indian markets over the past few years, one thing stands out — the IPO wave and the SME listing boom. Almost every week, there’s news about a company raising money from the public, debuting on stock exchanges, and often giving blockb

News & Event-Driven Trading1. Introduction

News & Event-Driven Trading is one of the most dynamic and high-impact trading approaches in financial markets. Unlike purely technical strategies that rely on chart patterns and indicators, this style focuses on real-time events, economic announcements, and breaking news to predict

Smart Money Concepts (SMC) & Liquidity Trading1. Introduction

In financial markets, price does not move randomly — it’s influenced by the decisions of big players often called Smart Money. These players include institutional investors, hedge funds, prop firms, and high-frequency trading algorithms. Unlike retail traders, they have vast capital

Option Chain Terms1. Introduction: What is an Option Chain?

An Option Chain (also called an options matrix) is like a detailed menu for all the available Call and Put options of a particular underlying asset (such as a stock, index, or commodity) for different strike prices and expiry dates.

If you’re a trader, the

Zero-Day Options Trading 1. Introduction

In recent years, one segment of the options market has gone from a niche tool for sophisticated traders to one of the hottest topics in global finance — Zero-Day-to-Expiration (0DTE) options. These contracts are bought and sold on the same day they expire, creating ultra-short-term o

Thematic trading1. Introduction to Thematic Trading

Thematic trading is the art (and science) of building investment or trading positions based on a central, long-term theme rather than just stock-specific fundamentals or short-term technical signals.

Instead of asking “Which stock will go up tomorrow?”, thematic t

BLS International – Breakout in Progress?## 📊 BLS International – Breakout in Progress?

BLS International has shown strong resilience on the charts as well as in fundamentals.

### 🔹 Technical View:

* Price is consolidating around **₹399–400** with a breakout attempt visible.

* On the **2W timeframe**, the stock is forming higher lows, s

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SMALLCAP

Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF Units Exchange Traded FundWeight

0.38%

Market value

318.07 K

USD

MIDSMALL

Mirae Asset Nifty MidSmallcap400 Momentum Quality 100 ETFWeight

0.14%

Market value

60.79 K

USD

MOSMALL250

Motilal Oswal Nifty Smallcap 250 ETF Units Exchange Traded FundWeight

0.19%

Market value

31.07 K

USD

MULTICAP

Mirae Asset Nifty500 Multicap 502525 ETF Exchange Traded Fund UnitsWeight

0.05%

Market value

3.34 K

USD

SMALL250

Mirae Asset Nifty Smallcap 250 ETF Exchange Traded Fund UnitsWeight

0.19%

Market value

2.99 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of BLS is 257.35 INR — it has increased by 1.24% in the past 24 hours. Watch BLS International Services Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange BLS International Services Ltd. stocks are traded under the ticker BLS.

BLS stock has fallen by −6.72% compared to the previous week, the month change is a −18.56% fall, over the last year BLS International Services Ltd. has showed a −40.40% decrease.

We've gathered analysts' opinions on BLS International Services Ltd. future price: according to them, BLS price has a max estimate of 607.00 INR and a min estimate of 445.00 INR. Watch BLS chart and read a more detailed BLS International Services Ltd. stock forecast: see what analysts think of BLS International Services Ltd. and suggest that you do with its stocks.

BLS stock is 9.33% volatile and has beta coefficient of 2.28. Track BLS International Services Ltd. stock price on the chart and check out the list of the most volatile stocks — is BLS International Services Ltd. there?

Today BLS International Services Ltd. has the market capitalization of 104.62 B, it has decreased by −6.95% over the last week.

Yes, you can track BLS International Services Ltd. financials in yearly and quarterly reports right on TradingView.

BLS International Services Ltd. is going to release the next earnings report on Feb 3, 2026. Keep track of upcoming events with our Earnings Calendar.

BLS net income for the last quarter is 1.75 B INR, while the quarter before that showed 1.71 B INR of net income which accounts for 2.47% change. Track more BLS International Services Ltd. financial stats to get the full picture.

Yes, BLS dividends are paid annually. The last dividend per share was 1.00 INR. As of today, Dividend Yield (TTM)% is 0.39%. Tracking BLS International Services Ltd. dividends might help you take more informed decisions.

BLS International Services Ltd. dividend yield was 0.25% in 2024, and payout ratio reached 8.10%. The year before the numbers were 0.32% and 13.15% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 3, 2026, the company has 737 employees. See our rating of the largest employees — is BLS International Services Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BLS International Services Ltd. EBITDA is 7.49 B INR, and current EBITDA margin is 29.65%. See more stats in BLS International Services Ltd. financial statements.

Like other stocks, BLS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BLS International Services Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BLS International Services Ltd. technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BLS International Services Ltd. stock shows the sell signal. See more of BLS International Services Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.