BPCL Long Trade Setup: 3:1 Risk/Reward Reversal Play

Analysis

BPCL has shown a potential reversal after a significant downtrend, with a clear break of structure and liquidation of sell-side liquidity. The chart marks a key Fair Value Gap (FVG) entry zone, aligning with a bullish momentum confirmation and a strong recovery from recent lows.

Trade Par

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

57.60 INR

133.37 B INR

4.40 T INR

1.97 B

About Bharat Petroleum Corporation Limited

Sector

Industry

CEO

Sanjay Khanna

Website

Headquarters

Mumbai

Founded

1952

IPO date

Nov 29, 1994

Identifiers

2

ISIN INE029A01011

Bharat Petroleum Corp. Ltd. is a holding company, which engages in the business of refining of crude oil and marketing of petroleum products. It operates through the Downstream Petroleum and Exploration & Production (E&P) segment. The Downstream Petroleum segment includes the refining and marketing of petroleum products. The E&P segment focuses on hydrocarbons. The company was founded on November 3, 1952 and is headquartered in Mumbai, India.

Related stocks

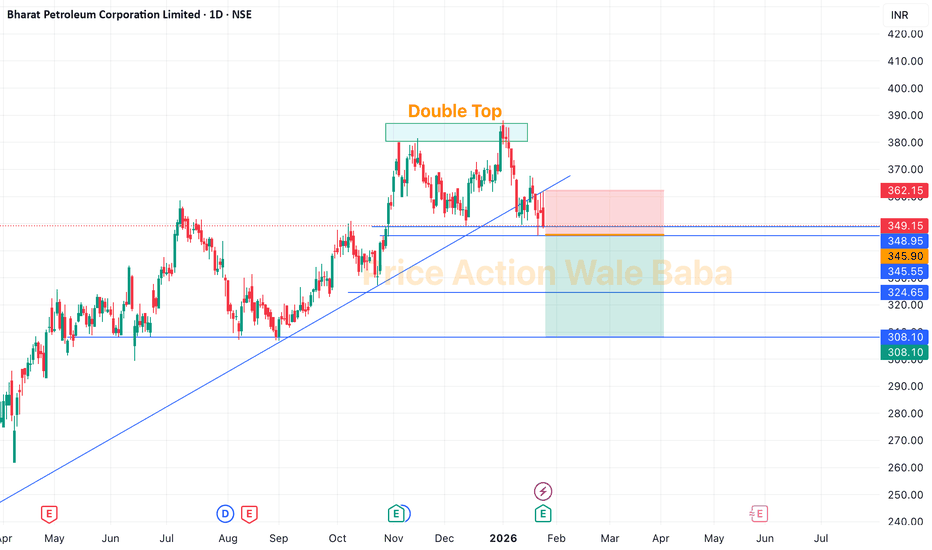

BPCL - Double TopBPCL is forming a Double Top which is has neckline of 345.

Delivery Based Selling Strategy:

Sell below 345,

Keep SL on high of 23rd Jan candle, which is 361.

Targets are 320-300.

Option Buying Strategy

So, for the option trading in this stock, you can choose any PUT option on BPCL, mark high o

BPCL : Trading the Confluence of Price Action & Macro TailwindsThe stock has been consolidating within a defined range over the past few weeks and has recently started forming a solid base. While the breakout volume isn’t a classic “God-candle,” price action continues to hold firmly above key moving averages, which is a constructive sign. That said, the price i

BPCL (1H) – Counter-Trend Bounce, Bigger Downside Still OpenPrice action in Bharat Petroleum Corporation Limited (BPCL) is currently unfolding inside a falling channel, suggesting the ongoing move is corrective rather than impulsive.

This channel could allow a short-term upside breakout, potentially completing a W–X–Y corrective structure. However, any such

BPCL 1 MOnth Time Frame 📌 Live / Current Price (Approx)

• BPCL share price is around ₹368–₹382 on NSE at the latest available updates.

📈 Key Short‑Term Levels (1 Month)

🔹 Resistance Levels (Where stock may face selling pressure)

Primary resistances:

1. ₹385–₹389 — near recent short‑term swing highs.

2. ₹390–₹396 — next

BPCL 1 Week Time Frame 📌 Current Price Context (approx):

BPCL is trading around ₹360–₹366 on NSE in recent sessions.

📈 1-Week Key Levels (Weekly Timeframe)

🔹 Resistance Levels (Upside Targets)

These are important zones where price may pause or reverse if buying pressure weakens:

~₹370–₹372 — Immediate weekly resistanc

BPCL Breaks Structure, Big Targets Ahead: Long-Term Chart TurnsBPCL is currently positioned at a highly important zone on the higher-timeframe chart where price is attempting to shift from a prolonged consolidation into a potential expansion phase. The stock has respected a long-term structure and is now trading near a critical breakout region, making it an int

BPCL Pullback Long from Demand Zone Toward 400 Bharat Petroleum (BPCL) is consolidating after a strong rally and has pulled back into a previously tested support / investment zone around 345–355, which coincides with major moving averages and short‑term swing demand on the daily time frame. A fresh bullish candle from this grey box keeps the lon

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

B

BPRL4464304

BPRL International Singapore Pte Ltd. 4.375% 18-JAN-2027Yield to maturity

4.31%

Maturity date

Jan 18, 2027

758BPCL26

Bharat Petroleum Corporation Limited 7.58% 17-MAR-2026Yield to maturity

—

Maturity date

Mar 17, 2026

See all BPCL bonds

Frequently Asked Questions

The current price of BPCL is 374.10 INR — it has decreased by −0.95% in the past 24 hours. Watch Bharat Petroleum Corporation Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Bharat Petroleum Corporation Limited stocks are traded under the ticker BPCL.

BPCL stock has fallen by −2.20% compared to the previous week, the month change is a 5.53% rise, over the last year Bharat Petroleum Corporation Limited has showed a 46.02% increase.

We've gathered analysts' opinions on Bharat Petroleum Corporation Limited future price: according to them, BPCL price has a max estimate of 530.00 INR and a min estimate of 300.00 INR. Watch BPCL chart and read a more detailed Bharat Petroleum Corporation Limited stock forecast: see what analysts think of Bharat Petroleum Corporation Limited and suggest that you do with its stocks.

BPCL reached its all-time high on Feb 5, 2026 with the price of 391.65 INR, and its all-time low was 5.45 INR and was reached on Apr 26, 1999. View more price dynamics on BPCL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BPCL stock is 1.46% volatile and has beta coefficient of 1.19. Track Bharat Petroleum Corporation Limited stock price on the chart and check out the list of the most volatile stocks — is Bharat Petroleum Corporation Limited there?

Today Bharat Petroleum Corporation Limited has the market capitalization of 1.62 T, it has increased by 3.90% over the last week.

Yes, you can track Bharat Petroleum Corporation Limited financials in yearly and quarterly reports right on TradingView.

Bharat Petroleum Corporation Limited is going to release the next earnings report on May 27, 2026. Keep track of upcoming events with our Earnings Calendar.

BPCL earnings for the last quarter are 17.66 INR per share, whereas the estimation was 16.10 INR resulting in a 9.71% surprise. The estimated earnings for the next quarter are 16.83 INR per share. See more details about Bharat Petroleum Corporation Limited earnings.

Bharat Petroleum Corporation Limited revenue for the last quarter amounts to 1.37 T INR, despite the estimated figure of 1.09 T INR. In the next quarter, revenue is expected to reach 918.90 B INR.

BPCL net income for the last quarter is 71.88 B INR, while the quarter before that showed 61.91 B INR of net income which accounts for 16.10% change. Track more Bharat Petroleum Corporation Limited financial stats to get the full picture.

Bharat Petroleum Corporation Limited dividend yield was 3.59% in 2024, and payout ratio reached 32.04%. The year before the numbers were 6.97% and 66.63% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 15, 2026, the company has 36.38 K employees. See our rating of the largest employees — is Bharat Petroleum Corporation Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Bharat Petroleum Corporation Limited EBITDA is 388.62 B INR, and current EBITDA margin is 5.93%. See more stats in Bharat Petroleum Corporation Limited financial statements.

Like other stocks, BPCL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Bharat Petroleum Corporation Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Bharat Petroleum Corporation Limited technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Bharat Petroleum Corporation Limited stock shows the buy signal. See more of Bharat Petroleum Corporation Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.