Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

23.35 INR

3.10 B INR

31.06 B INR

71.62 M

About CCL Products (India) Limited

Sector

Industry

CEO

Praveen Jaipuriar

Website

Headquarters

Hyderabad

Founded

1994

ISIN

INE421D01022

FIGI

BBG000F33HW0

CCL Products (India) Ltd. engages in the production, trading, and distribution of instant coffee and coffee related products primarily in India. It offers spray dried coffee powder and granules, freeze dried coffee, freeze concentrate liquid coffee, roast and ground coffee, roasted coffee beans, and premix coffee. The company was founded in 1994 and is headquartered in Guntur, India.

Related stocks

CCL ProductsCCL Products is a global leader in private-label coffee manufacturing. It has a diversified client base across 90+ countries, strong R&D, and efficient operations. For FY24, revenue grew 10% YoY , and PAT rose 21% . The company maintains healthy EBITDA margins (20%) and a strong ROE (18%). Expansion

CCL Bullish 927CCL stock (currently at 927) presents an interesting opportunity, and I am adopting a bullish stance. My analysis suggests potential upward movement based on . However, it's crucial to acknowledge inherent market volatility and the possibility of unforeseen events. Therefore, I strongly advocate fo

CCL PRODUCTS (INDIA) LIMITED EQUITY RESEARCH REPORTRecommendation: BUY

Target Price: ₹1,050 (12-month horizon)

Stop Loss: ₹850

Rationale

CCL Products represents a compelling investment opportunity in India's food processing sector. The company's strong financial performance, market leadership position, and strategic expansion plans provide solid fu

CCL Price Action CCL Products (India) Ltd is currently trading around ₹852 to ₹890 as of early August 2025, with a market capitalization near ₹11,370–₹12,000 crore. The stock has shown strong recent momentum, rising about 37% over six months and around 50% in the past three months, reflecting robust investor confide

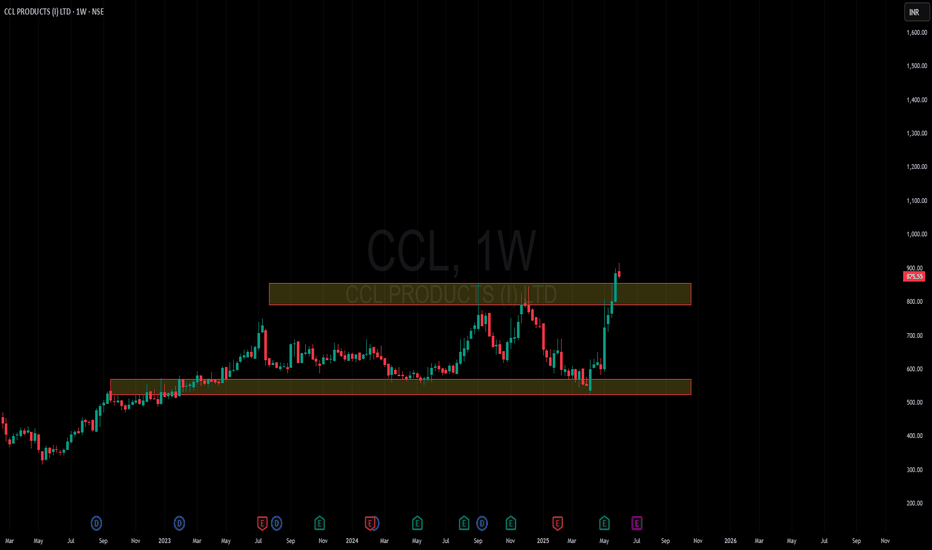

Amazing breakout on WEEKLY Timeframe - CCLCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the break

CCL PRODUCTS READY TO BREW SOME BIG RETURNSCCL Products (India) is engaged in the production, trading and distribution of Coffee. The Company has business operations mainly in India, Vietnam and Switzerland countries

Products

Spray Dried Coffee Powder

Spray Dried Coffee Granules

Freeze Dried Coffee

Freeze-Concentrated Liquid Coffee

Roast &

CCL - Beautiful Chart Structure Post Q4NSE:CCL made a Beautiful Chart Structure today after Q4 Results.

Keep in the Watchlist.

NO RECO. For Buy/Sell.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interprete

CCL: TESTING CRITICAL DEMAND ZONE!⚡️Price Analysis:

1️⃣ Price testing major EMA confluence demand zone

2️⃣ Double top formation indicating distribution at higher levels although.

3️⃣ However, break below Dz could trigger further downside momentum

✨ Key Observations:

➡️ Strong Dz confluence at current levels (EMA + previous support)

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where CCL is featured.

Frequently Asked Questions

The current price of CCL is 870.90 INR — it has decreased by −1.01% in the past 24 hours. Watch CCL Products (India) Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange CCL Products (India) Limited stocks are traded under the ticker CCL.

CCL stock has risen by 0.70% compared to the previous week, the month change is a 0.36% rise, over the last year CCL Products (India) Limited has showed a 21.24% increase.

We've gathered analysts' opinions on CCL Products (India) Limited future price: according to them, CCL price has a max estimate of 1,140.00 INR and a min estimate of 840.00 INR. Watch CCL chart and read a more detailed CCL Products (India) Limited stock forecast: see what analysts think of CCL Products (India) Limited and suggest that you do with its stocks.

CCL stock is 2.92% volatile and has beta coefficient of 0.74. Track CCL Products (India) Limited stock price on the chart and check out the list of the most volatile stocks — is CCL Products (India) Limited there?

Today CCL Products (India) Limited has the market capitalization of 118.45 B, it has increased by 0.23% over the last week.

Yes, you can track CCL Products (India) Limited financials in yearly and quarterly reports right on TradingView.

CCL Products (India) Limited is going to release the next earnings report on Nov 14, 2025. Keep track of upcoming events with our Earnings Calendar.

CCL earnings for the last quarter are 5.40 INR per share, whereas the estimation was 6.50 INR resulting in a −16.92% surprise. The estimated earnings for the next quarter are 6.30 INR per share. See more details about CCL Products (India) Limited earnings.

CCL Products (India) Limited revenue for the last quarter amounts to 10.56 B INR, despite the estimated figure of 8.68 B INR. In the next quarter, revenue is expected to reach 8.34 B INR.

CCL net income for the last quarter is 724.49 M INR, while the quarter before that showed 1.02 B INR of net income which accounts for −28.88% change. Track more CCL Products (India) Limited financial stats to get the full picture.

Yes, CCL dividends are paid annually. The last dividend per share was 5.00 INR. As of today, Dividend Yield (TTM)% is 0.56%. Tracking CCL Products (India) Limited dividends might help you take more informed decisions.

CCL Products (India) Limited dividend yield was 0.90% in 2024, and payout ratio reached 21.45%. The year before the numbers were 0.77% and 23.94% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 29, 2025, the company has 3.59 K employees. See our rating of the largest employees — is CCL Products (India) Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. CCL Products (India) Limited EBITDA is 5.84 B INR, and current EBITDA margin is 17.40%. See more stats in CCL Products (India) Limited financial statements.

Like other stocks, CCL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CCL Products (India) Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CCL Products (India) Limited technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CCL Products (India) Limited stock shows the buy signal. See more of CCL Products (India) Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.