Banks and Markets: Their Global Role1. Banks as Global Financial Intermediaries

At their core, banks act as intermediaries between savers and borrowers. On a global scale, this role expands dramatically. International banks collect savings from surplus economies and channel them into deficit economies, helping balance global capital

Dixon Technologies (India) Ltd.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

261.80 INR

10.96 B INR

385.93 B INR

37.36 M

About Dixon Technologies (India) Ltd.

Sector

Industry

CEO

Atul Behari Lall

Website

Headquarters

Noida

Founded

1993

IPO date

Sep 18, 2017

Identifiers

2

ISIN INE935N01020

Dixon Technologies (India) Ltd. engages in the manufacture and sale of electronic products. The firm offers consumer electronics such as LED television, home appliances such as washing machines and lighting products such as LED bulbs and tube lights, down lighters, and compact fluorescent bulbs and mobile phones. It also provides after sales services. The company was founded by Sunil Vachani and Atul Bihari Lall on January 15, 1993 and is headquartered in Noida, India.

Related stocks

FOXCONN of India - A overlook on DIXON TECHNSE:DIXON

Hey Folks,

Today we are talking about Dixon Technologies aka foxconn of India. the Q3 results shows +68% in PAT. which looks good as headline numbers. but diving deep I found that Dixon tech slides over a thin margin module as it is high-volume producer to marquee clients and that oper

Will Dixon give 100% returns in long run? cmp 11250Stock Update - *Dixon Technologies cmp 11250*

Dixon has corrected nearly 50% from its all time high, reflecting the sector wide pressure and recent proft booking.

Post Q3 results, revenue growth was muted due to softness in consumer electronics but margins remained stable, *management maintained a

AI-Driven Economy: Transforming Global GrowthUnderstanding the AI-Driven Economy

An AI-driven economy refers to an economic system in which artificial intelligence technologies play a central role in production, decision-making, innovation, and value creation. These technologies include machine learning, natural language processing, computer

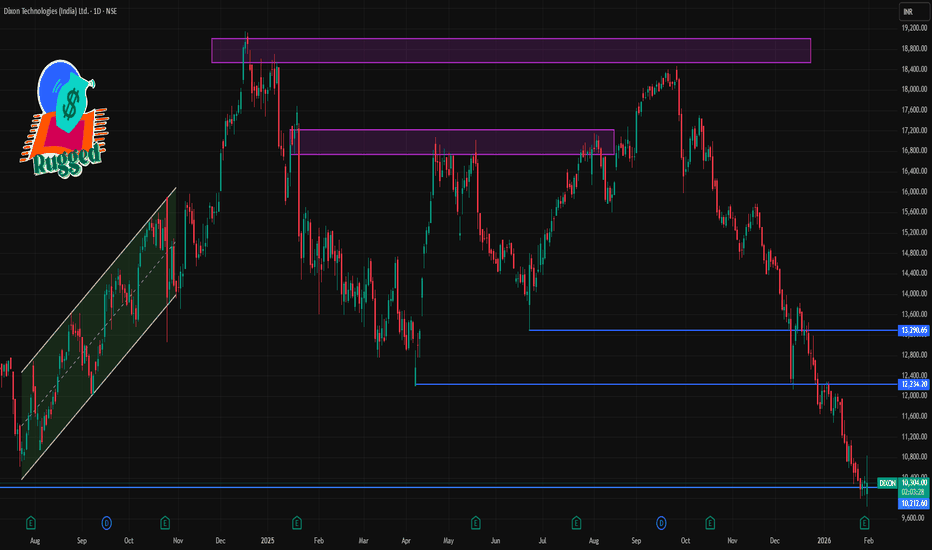

DIXON 1 Day Time Frame 📍 Live Price Snapshot

🔹 Approx Current Price: ~₹11,566 (INR) (up strong recently)

🔹 52-Week Range: ~₹9,835 – ₹18,471

📊 Daily Pivot & Support/Resistance Levels (1D Timeframe)

These are commonly used by traders to judge intraday/daily trend bias, entry/exit zones, and key price reactions:

Level Pr

DIXON 1 Day Time Frame 📊 Current Price Snapshot (Daily)

Latest traded price: ~₹10,300 – ₹10,460 approx on NSE/BSE (mid-day range).

Today’s price range: ₹9,835 (low) – ₹10,843 (high).

52-week range: ₹9,835 – ₹18,471.

Bias: The stock remains below key short-term averages (e.g., 20/50/100-day EMAs), indicating a bearish da

DIXON 1 Week Time Frame 📊 Current Price Context

Current share price is roughly around ₹10,150–₹10,300 on NSE/BSE.

📅 1‑Week Time‑Frame Key Levels

📌 Major Weekly Support Levels

These act as zones where buyers may step in if price dips:

Support 1 (S1): ~₹10,040–₹10,050 – first defensive zone this week.

Support 2 (S2): ~₹9

Dixon Ltd— A Fundamental Reset, Not a Broken StoryThe sharp decline in Dixon Technologies from its highs near ₹19,000 has raised concerns, but a fundamentals-only view suggests this move reflects a reset in expectations rather than deterioration in the business .

Business fundamentals remain intact. Dixon continues to deliver strong revenue gro

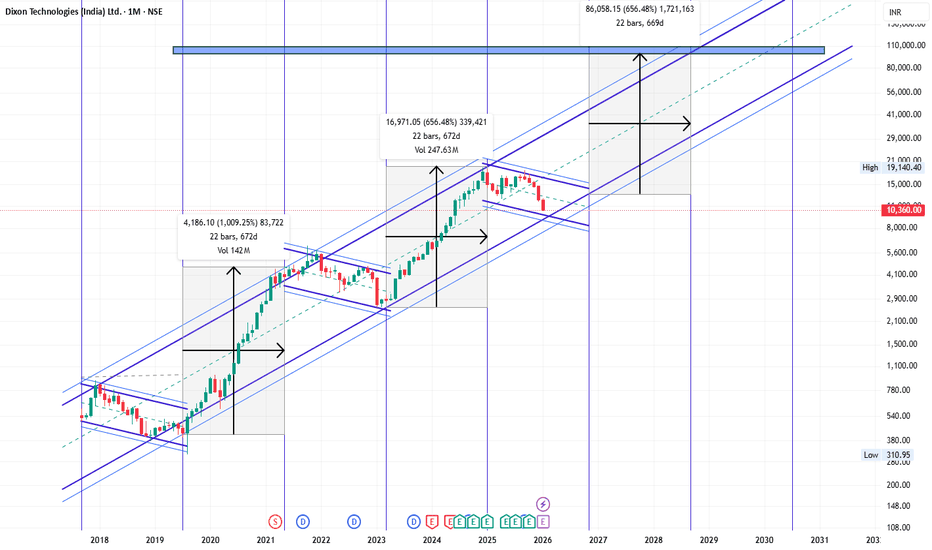

DIXON Monthly chart Suggest 5x ROI Possible in next 7-8 yearsDIXON Monthly chart Suggest 5x ROI Possible in next 7-8 years.

Fundamentals:

Company has delivered good profit growth of 45% CAGR over last 5 years

3 Years ROE 28.1%

Sales growth is 45% of last 10 years.

Technical:

DIXON is following Monthly cycle of 22 months. It may still correct a bit but up

DIXON 1 Day Time Frame 📉 Intraday Price Action (Today’s Range)

Day’s Range: ~₹10,274 – ₹10,790

This indicates where the stock has been trading so far today.

📊 Key Intraday Levels for 1‑Day Time Frame

🟢 Support Levels

S1: ~₹10,545 – ₹10,550

S2: ~₹10,359 – ₹10,360

S3: ~₹10,016 – ₹10,020

🔴 Resistance Levels

R1: ~₹11,070 –

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of DIXON is 11,751.00 INR — it has increased by 1.08% in the past 24 hours. Watch Dixon Technologies (India) Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Dixon Technologies (India) Ltd. stocks are traded under the ticker DIXON.

DIXON stock has risen by 1.68% compared to the previous week, the month change is a 3.89% rise, over the last year Dixon Technologies (India) Ltd. has showed a −20.52% decrease.

We've gathered analysts' opinions on Dixon Technologies (India) Ltd. future price: according to them, DIXON price has a max estimate of 20,600.00 INR and a min estimate of 8,157.00 INR. Watch DIXON chart and read a more detailed Dixon Technologies (India) Ltd. stock forecast: see what analysts think of Dixon Technologies (India) Ltd. and suggest that you do with its stocks.

DIXON reached its all-time high on Dec 17, 2024 with the price of 19,148.90 INR, and its all-time low was 312.00 INR and was reached on Aug 13, 2019. View more price dynamics on DIXON chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

DIXON stock is 4.19% volatile and has beta coefficient of 1.39. Track Dixon Technologies (India) Ltd. stock price on the chart and check out the list of the most volatile stocks — is Dixon Technologies (India) Ltd. there?

Today Dixon Technologies (India) Ltd. has the market capitalization of 692.71 B, it has increased by 6.61% over the last week.

Yes, you can track Dixon Technologies (India) Ltd. financials in yearly and quarterly reports right on TradingView.

Dixon Technologies (India) Ltd. is going to release the next earnings report on May 26, 2026. Keep track of upcoming events with our Earnings Calendar.

DIXON earnings for the last quarter are 52.62 INR per share, whereas the estimation was 27.10 INR resulting in a 94.15% surprise. The estimated earnings for the next quarter are 35.36 INR per share. See more details about Dixon Technologies (India) Ltd. earnings.

Dixon Technologies (India) Ltd. revenue for the last quarter amounts to 108.03 B INR, despite the estimated figure of 112.55 B INR. In the next quarter, revenue is expected to reach 114.74 B INR.

DIXON net income for the last quarter is 2.87 B INR, while the quarter before that showed 6.70 B INR of net income which accounts for −57.13% change. Track more Dixon Technologies (India) Ltd. financial stats to get the full picture.

Yes, DIXON dividends are paid annually. The last dividend per share was 8.00 INR. As of today, Dividend Yield (TTM)% is 0.07%. Tracking Dixon Technologies (India) Ltd. dividends might help you take more informed decisions.

Dixon Technologies (India) Ltd. dividend yield was 0.06% in 2024, and payout ratio reached 4.38%. The year before the numbers were 0.07% and 8.11% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 16, 2026, the company has 8.89 K employees. See our rating of the largest employees — is Dixon Technologies (India) Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Dixon Technologies (India) Ltd. EBITDA is 19.01 B INR, and current EBITDA margin is 3.36%. See more stats in Dixon Technologies (India) Ltd. financial statements.

Like other stocks, DIXON shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Dixon Technologies (India) Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Dixon Technologies (India) Ltd. technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Dixon Technologies (India) Ltd. stock shows the neutral signal. See more of Dixon Technologies (India) Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.