Hindustan Unilever Limited (HINDUNILVR)Company: India's largest FMCG company with 50+ brands across 16 categories, market cap ₹5.92 lakh Cr, subsidiary of global giant Unilever with strong fundamentals.

Technical Pattern: Stock forming strong support zone around ₹2,500 levels after sharp correction from October highs of ₹3,035; horizontal support visible with potential reversal setup.

Key Levels: Critical support at ₹2,400-2,500, resistance at ₹2,650-2,700; break above ₹2,700 could target ₹2,850+, failure below ₹2,400 may test ₹2,200-2,300.

Fundamentals: Q4 FY25 profit up 3.6% YoY to ₹2,493 Cr, revenue ₹15,000 Cr; new CEO Priya Nair appointed from Aug 2025, strong brand portfolio with defensive FMCG characteristics.

Outlook: Blue-chip FMCG stock offering safety in volatile markets - good accumulation opportunity near support levels for long-term investors with 200 DMA as key resistance.

Disclaimer: This is for educational purposes only, not investment advice - consult your financial advisor before trading.

Trade ideas

HUL has given Breakout from an inverted H & S pattern.Hindustan Unilever has given Breakout from an inverted Head and Shoulder pattern on daily candle with a good volume.

Entry, SL and Target are mentioned in chart.

Also, respective index is also in positive structure which gives more assurance of the target hit.

However, one should be cautious about price being slip to SL as the Nifty has changed its structure to lower high lower low. Which may drag price downwards for short term or with momentum.

Note: This analysis is for Educational Purpose Only. Please invest of trade after consulting a professional financial advisor.

HINDUNILVR – TECHNICAL ANALYSIS________________________________________

📈 HINDUNILVR – TECHNICAL ANALYSIS

📆 Date: July 8, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________

🔹 Price Action Zones

• 🔴 Top Range: 2602

• Resistance: 2437.07 – 2463.73 – 2511.77

• 🟢 Bottom Range: 2136

• Support: 2287.67 – 2314.33 – 2362.37

________________________________________

🔹 Chart Pattern: ✅ Bullish Marubozu Breakout

Price bounced from a demand zone near 2326.90 – 2304| SL: 2302.50 with a powerful Marubozu candle and reclaimed structure strength. This breakout aligns with STWP’s HNI setup and suggests the beginning of a strong bullish leg.

________________________________________

🔹 Reversal Candlestick Patterns:

✅ Bullish Marubozu

✅ Strong follow-through near support

✅ High conviction breakout from base – Open = Low

________________________________________

🔹 Volume Footprint:

✅ Volume spiked to 2.7M (vs average 1.63M)

✅ Indicates institutional participation backing the breakout

🚨 Watch for continuation volume above 2415 to confirm momentum

________________________________________

🔹 Trend Bias: ✅ Bullish

Clear bullish trend forming after breakout. Supports are holding, and resistance levels are now being tested with strength.

________________________________________

📌 What’s Catching Our Eye:

• STWP HNI Setup triggered at 2400–2415 range

• Breakout above strong support near 2300–2320

• OI Data and Option Chain analysis supports upward continuation

________________________________________

👀 What We’re Watching For:

• Sustained close above 2415 = bullish continuation

• Option build-up hints at possible follow-through toward higher zones

• Strong CE activity at 2420, 2440, and 2460 levels

________________________________________

🔹 OPTION CHAIN ANALYSIS – KEY TAKEAWAYS

💥 CALL Side (Bullish Builds):

• 2420 CE: 40.05 – 📈 OI up +158%, Long Build-Up

• 2440 CE: 31.25 – 📈 OI up +182%, Long Build-Up

• 2460 CE: 24.50 – 📈 OI up +345%, Long Build-Up

• 2500 CE: 14.45 – 📈 OI up +22%, Long Build-Up

🚀 Indicates participants are positioning for extended upside toward 2460–2500

📉 PUT Side (Writers in Control):

• 2300 PE: Down -60%, Short Build-Up

• 2400 PE: Down -52%, Short Build-Up

💡 Suggests confidence that price will hold above 2400

🧠 Conclusion from OI Data:

Strong bullish sentiment — Call Writers/Buyers increasing exposure at higher strikes, Puts being shorted. Volume + OI = directional strength.

________________________________________

⚠️ Risks to Watch:

• Close below 2390–2395 = early weakness sign

• Bearish divergence + volume fade risk

• Watch 2460–2512 for rejection

________________________________________

🔮 What to Expect Next:

• ⚡ Price retesting 2460 zone likely

• 🔄 Pullbacks toward 2395–2405 may offer low-risk re-entry

• ⚠️ Watch for spikes in volatility near 2500

________________________________________

📊 Trade Plan (Educational Only – Based on Logic + Volume Confirmation)

🔼 Breakout Long Setup

• Entry: Above 2415

• Stop Loss: 2339.30

• Risk–Reward: 1:1 to 1:2 +

📌 Why:

• Bullish Marubozu + Volume

• OI Long Build-Up at 2420–2460

• STWP HNI Setup alignment

🔁 Pullback Long Setup

• Entry Zone: 2395–2400

• Stop Loss: 2365

• Risk–Reward: 1:1 to 1:2 +

📌 Why:

• Breakout retest zone

• Tight SL with continuation logic

🔽 Bearish Setup (Only on Failure)

• Entry: Below 2360

• Stop Loss: 2410

• Risk–Reward: Flexible (trader-defined)

📌 Why:

• Only valid on strong breakdown with volume

• Reversal below structure

________________________________________

📊 Option Trade Ideas – For Learning Purpose Only

🔼 Best CE (Bullish Bias)

➡️ 2420 CE @ 40.05

• Risk–Reward Potential: 1:1 to 1:2+

🛑 SL: 26

📌 Why: Clean momentum zone, well-aligned with breakout

🟡 Alternate CE (Momentum Extension)

➡️ 2440 CE @ 31.25 – if expecting further move toward 2490–2510

• Slightly lower Delta, higher risk-reward

🔽 Best PE (Only if Breakdown)

➡️ 2400 PE @ 34.40

• Use only below 2390 with high-volume reversal

• Risk–Reward Potential: 1:1 to 1:2 +

🛑 SL: 21

________________________________________

❌ Invalidation Triggers:

• Daily close below 2360

• Long unwinding on CE strikes

• PE Long Build-Up + Volume = Bearish Shift

________________________________________

⚠️ Disclaimer:

This analysis is for educational purposes only.

“STWP HNI Setup” is a proprietary internal model shared for study and learning.

STWP is not a SEBI-registered advisor.

This is not a buy/sell recommendation.

Please consult your financial advisor before taking any action.

STWP is not responsible for trading decisions based on this post.

________________________________________

💬 Found this helpful?

Did the STWP HNI Setup help you anticipate the move?

💭 Drop your thoughts in the comments ⬇️

🔁 Share this with fellow traders

✅ Follow STWP for volume-based, logic-driven setups

🚀 Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________

HUL Breaks Out of Rounding Cup Pattern – Targeting ₹2400 Technical Breakdown

HUL has successfully broken out of a rounding cup pattern, a classic bullish continuation setup that often precedes strong upward momentum. Here's what stands out:

Cup Formation: Smooth, rounded base formed over several sessions, indicating gradual accumulation.

Breakout Confirmation: Price surged past the neckline at ₹2325 with increased volume, confirming the breakout.

Consolidation: Post-breakout, the stock is consolidating just above the neckline—a healthy sign of base-building before the next leg up.

EMA Support: Price is comfortably trading above the 20, 50, and 100 EMAs, reinforcing bullish sentiment.

🎯 Target Projection

Using the height of the cup (approx. ₹75) and projecting it from the breakout point:

Breakout Point: ₹2325

Cup Depth: ₹75

Projected Target: ₹2400

Stop-Loss: ₹2290 (below consolidation zone)

This aligns with the classic cup breakout strategy, where the target equals the depth of the cup added to the breakout level.

🧠 Trading Insight

This setup is ideal for swing traders looking for a low-risk, high-reward opportunity. The consolidation post-breakout offers a potential re-entry zone before the next impulse move.

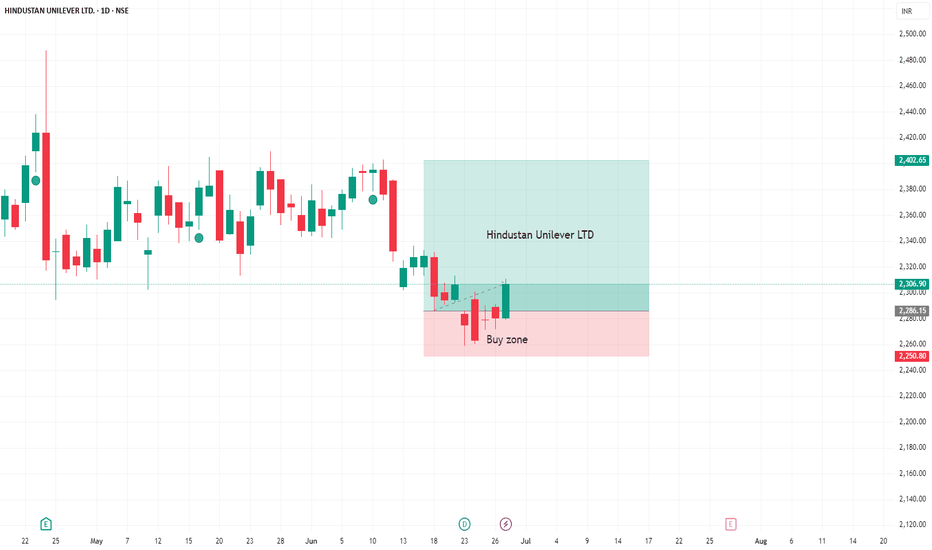

let's see what will happened nextWhy I Bought Hindustan Unilever LTD (HUL):

📌 1. Bullish Engulfing Pattern at the Bottom:

After a series of red candles, a strong bullish engulfing candle formed — signaling a potential trend reversal. This candle completely covered the previous red candle, showing buyer dominance.

📌 2. Rejection from Support Zone:

Price respected a strong support zone (highlighted in the buy area). Multiple wick rejections and no further breakdown confirmed buyer interest.

📌 3. Tight Stop-Loss & High Risk/Reward:

SL was placed just below the engulfing candle (₹707), and the target (₹2,330) offered a solid risk/reward ratio of 3.3 — meaning the reward was over 3 times the risk.

📌 4. Volume Confirmation (Optional):

If volume increased on the bullish candle (you can check this on chart), it adds further conviction that institutional buying may have stepped in.

📌 5. Clean Structure:

No nearby resistance, wide room for price movement, and a clear swing high made this trade setup clean and reliable.

Hindustan Unilever Trades Sideways with Clear Swing Levels in FoTopic Statement:

Hindustan Unilever has been moving in a sluggish sideways range for the past four years, offering defined zones ideal for swing trading.

Key Points:

* The stock has well-defined accumulation and distribution zones, making it suitable for clear swing trade setups

* Price is currently just above the distribution zone and trading below the 180-day EMA, making the stock relatively cheap

* A breakout from either zone could trigger a strong directional move depending on the breakout side

HUL Bullish View **Hindustan Unilever Ltd (HUL) Business Model**:

---

### **Hindustan Unilever Ltd (HUL) – Business Model Overview**

**1. Company Profile:**

* **Founded:** 1933

* **Headquarters:** Mumbai, India

* **Parent Company:** Unilever PLC (UK)

* **Industry:** FMCG (Fast-Moving Consumer Goods)

* **Market Cap (as of 2024):** ₹6.5+ lakh crore

---

### **2. Core Business Segments:**

HUL operates across **three main segments**:

| Segment | Products Included |

| -------------------------- | ---------------------------------------------------------- |

| **Home Care** | Surf Excel, Rin, Vim, Domex, Comfort, etc. |

| **Beauty & Personal Care** | Dove, Lux, Lifebuoy, Clinic Plus, Sunsilk, Pepsodent, etc. |

| **Foods & Refreshments** | Brooke Bond, Lipton, Knorr, Horlicks, Boost, Kissan, etc. |

---

### **3. Revenue Model:**

* **Primary Revenue Source:** Sale of FMCG products via retail and online channels.

* **Secondary Revenue Source:** Royalties & licensing fees from Unilever IP.

* **Strategy:** High-volume, low-margin model; focus on scale and reach.

---

### **4. Key Business Strategies:**

| Strategy | Description |

| ------------------------------ | ---------------------------------------------------------------------------- |

| **Brand Portfolio Management** | Owns 50+ brands across categories; premium to mass-market coverage. |

| **Distribution Network** | Over 8 million retail outlets across India; strong rural & urban reach. |

| **Innovation & R\&D** | Focus on local consumer needs, product customization, sustainable packaging. |

| **Digital Transformation** | Leveraging data, analytics, and e-commerce platforms for sales and outreach. |

| **Sustainability Focus** | Water conservation, plastic recycling, and zero-waste manufacturing. |

---

### **5. Cost Structure:**

* **Raw Materials:** A significant portion of costs; affected by global commodity prices.

* **Marketing & Advertising:** High spend to maintain brand recall.

* **Distribution & Logistics:** Critical for reach in both urban and rural areas.

---

### **6. Target Market:**

* **Urban Middle & Upper-Class**

* **Rural Consumers**

* **Health-Conscious & Youth Segments** (growing focus)

---

### **7. Competitive Advantages:**

* Strong **brand loyalty**.

* Deep **distribution** network.

* Parent support from **Unilever Global**.

* **Scale of operations** gives cost efficiency.

---

### **8. Challenges:**

* Rural slowdown or inflation impacting volumes.

* Raw material price volatility.

* Intense competition from both domestic (Patanjali, Dabur) and global players (P\&G, Colgate).

---

### **9. Growth Drivers:**

* Premiumization of products.

* Expanding into wellness, ayurveda, and healthy food.

* Increasing e-commerce and digital sales channels.

* Rural penetration and aspirational consumption.

---

### **10. Conclusion:**

HUL runs a **resilient, scalable, and consumer-centric business model** that thrives on branding, distribution, and deep consumer insight. With a focus on **sustainability, innovation**, and **digitalization**, it remains a leader in the Indian FMCG space.

---

Thanks & Regards

The Golden Farms of Equity

Hindustan Uniliver Bullish StructureHere's a detailed explanation of the **Hindustan Unilever Ltd (HUL) Business Model**:

---

### **Hindustan Unilever Ltd (HUL) – Business Model Overview**

**1. Company Profile:**

* **Founded:** 1933

* **Headquarters:** Mumbai, India

* **Parent Company:** Unilever PLC (UK)

* **Industry:** FMCG (Fast-Moving Consumer Goods)

* **Market Cap (as of 2024):** ₹6.5+ lakh crore

---

### **2. Core Business Segments:**

HUL operates across **three main segments**:

| Segment | Products Included |

| -------------------------- | ---------------------------------------------------------- |

| **Home Care** | Surf Excel, Rin, Vim, Domex, Comfort, etc. |

| **Beauty & Personal Care** | Dove, Lux, Lifebuoy, Clinic Plus, Sunsilk, Pepsodent, etc. |

| **Foods & Refreshments** | Brooke Bond, Lipton, Knorr, Horlicks, Boost, Kissan, etc. |

---

### **3. Revenue Model:**

* **Primary Revenue Source:** Sale of FMCG products via retail and online channels.

* **Secondary Revenue Source:** Royalties & licensing fees from Unilever IP.

* **Strategy:** High-volume, low-margin model; focus on scale and reach.

---

### **4. Key Business Strategies:**

| Strategy | Description |

| ------------------------------ | ---------------------------------------------------------------------------- |

| **Brand Portfolio Management** | Owns 50+ brands across categories; premium to mass-market coverage. |

| **Distribution Network** | Over 8 million retail outlets across India; strong rural & urban reach. |

| **Innovation & R\&D** | Focus on local consumer needs, product customization, sustainable packaging. |

| **Digital Transformation** | Leveraging data, analytics, and e-commerce platforms for sales and outreach. |

| **Sustainability Focus** | Water conservation, plastic recycling, and zero-waste manufacturing. |

---

### **5. Cost Structure:**

* **Raw Materials:** A significant portion of costs; affected by global commodity prices.

* **Marketing & Advertising:** High spend to maintain brand recall.

* **Distribution & Logistics:** Critical for reach in both urban and rural areas.

---

### **6. Target Market:**

* **Urban Middle & Upper-Class**

* **Rural Consumers**

* **Health-Conscious & Youth Segments** (growing focus)

---

### **7. Competitive Advantages:**

* Strong **brand loyalty**.

* Deep **distribution** network.

* Parent support from **Unilever Global**.

* **Scale of operations** gives cost efficiency.

---

### **8. Challenges:**

* Rural slowdown or inflation impacting volumes.

* Raw material price volatility.

* Intense competition from both domestic (Patanjali, Dabur) and global players (P\&G, Colgate).

---

### **9. Growth Drivers:**

* Premiumization of products.

* Expanding into wellness, ayurveda, and healthy food.

* Increasing e-commerce and digital sales channels.

* Rural penetration and aspirational consumption.

---

### **10. Conclusion:**

HUL runs a **resilient, scalable, and consumer-centric business model** that thrives on branding, distribution, and deep consumer insight. With a focus on **sustainability, innovation**, and **digitalization**, it remains a leader in the Indian FMCG space.

---

Thanks & Regards

Mohinder Singh

Hindunilvr longing for a breakout??!!Chart patterns inflict me the above titled opinion

Breakout can be expected as it has not breached the low made on 25th april 2025 and has been consistently making higher highs and higher lows(seen clearly on hourly charts)

Entry after the breakout.. ...

Godrejcp also seen for a up move!!!!

will update once it breaks out!!!!

Thank you.

This is just my opinion...not a advice!!!!

Hindustan Uniliver Ltd Charts AnalysisHere is a detailed business model for **Hindustan Unilever Limited (HUL)**, one of India’s largest fast-moving consumer goods (FMCG) companies:

---

# **HUL Ltd – Detailed Business Model**

## **1. Company Overview**

* **Name:** Hindustan Unilever Limited (HUL)

* **Parent Company:** Unilever Plc (UK-based multinational)

* **Founded:** 1933 (as Lever Brothers)

* **Headquarters:** Mumbai, Maharashtra, India

* **Sector:** FMCG (Fast-Moving Consumer Goods)

* **Stock Listing:** NSE and BSE (Ticker: HINDUNILVR)

---

## **2. Value Proposition**

HUL offers a diverse portfolio of trusted brands across multiple categories that cater to the everyday needs of Indian consumers. Its core value propositions include:

* High-quality products at affordable prices

* Deep understanding of Indian consumer preferences

* Nationwide reach with strong brand loyalty

* Sustainability-driven business practices

---

## **3. Key Products & Brands**

### **A. Home Care**

* **Brands:** Surf Excel, Rin, Wheel, Comfort, Vim, Domex

* **Products:** Detergents, Dishwashers, Surface cleaners, Toilet cleaners

### **B. Beauty & Personal Care**

* **Brands:** Dove, Lux, Lifebuoy, Sunsilk, Clinic Plus, Pepsodent, Close-Up, Lakmé, Pond’s

* **Products:** Soaps, Shampoos, Toothpastes, Deodorants, Skincare, Cosmetics

### **C. Foods & Refreshments**

* **Brands:** Brooke Bond, Lipton, Bru, Knorr, Kissan, Horlicks, Boost

* **Products:** Tea, Coffee, Health Drinks, Jams, Soups, Sauces

---

## **4. Customer Segments**

* **Mass Market:** Products targeted at a wide range of income groups

* **Urban & Rural Consumers:** Tailored product SKUs (stock-keeping units) for affordability

* **Health & Wellness Seekers:** Nutritional and hygiene-focused products

* **Premium Consumers:** Premium ranges under brands like Dove, Lakmé, etc.

---

## **5. Channels (Distribution Model)**

HUL has a **multi-tiered distribution system** that reaches over 8 million retail outlets across India.

### **A. General Trade (GT)**

* Traditional mom-and-pop stores (kirana stores)

* Rural distribution with direct coverage of over 250,000 villages

### **B. Modern Trade (MT)**

* Supermarkets, hypermarkets, convenience stores

* Partnerships with large retail chains (e.g., Big Bazaar, Reliance Retail)

### **C. E-Commerce**

* Presence on platforms like Amazon, Flipkart, BigBasket

* Direct-to-consumer channels via brand websites

### **D. HUL Shikhar App**

* A digital ordering platform for retailers and distributors

---

## **6. Key Activities**

* Product innovation and R\&D

* Brand building and marketing

* Supply chain and logistics management

* Customer and retailer relationship management

* Sustainability and CSR initiatives

---

## **7. Key Resources**

* Strong brand portfolio

* Human capital (employees, management, R\&D experts)

* Manufacturing facilities (30+ factories across India)

* Distribution network

* Digital capabilities and data analytics

---

## **8. Revenue Streams**

HUL earns revenue primarily from the **sale of consumer products**, categorized into:

* Home Care (\~35–40%)

* Beauty & Personal Care (\~40–45%)

* Foods & Refreshments (\~15–20%)

Revenue is generated via both **domestic sales** and **exports**.

---

## **9. Cost Structure**

* Raw materials (agriculture-based & chemicals)

* Advertising and marketing (\~12% of revenues typically)

* Distribution and logistics

* Manufacturing and operations

* Research and development

---

## **10. Partnerships**

* Parent company Unilever provides R\&D, global brand assets

* Distributors, logistics providers, and retailers

* Third-party manufacturers

* NGOs and government bodies (for social initiatives)

---

## **11. Sustainability & CSR**

HUL integrates sustainability into its core strategy through:

* **Plastic reduction and recycling**

* **Water conservation (Project Jalagraha)**

* **Women empowerment (Project Shakti)**

* **Health and hygiene awareness (Lifebuoy campaigns)**

---

## **12. Competitive Advantage**

* Massive distribution footprint across India

* Strong brand equity and consumer trust

* Innovation tailored to Indian market

* Operational efficiency and scale

* Digital transformation and data-driven decision making

---

## **13. Challenges**

* Intense competition from other FMCG players (e.g., P\&G, ITC, Dabur, Patanjali)

* Price sensitivity of Indian consumers

* Rural supply chain complexities

* Regulatory and environmental pressures

---

## **14. Growth Strategies**

* Expanding rural reach

* Digital and e-commerce expansion

* Health and wellness product innovation

* Premiumization of existing brands

* Strategic acquisitions (e.g., GSK Consumer Health – Horlicks)

---

Thanks @ Regards

The Golden Farms of Equity

Available On Social Media Handles

Hindustan Uniliver Ltd Long Term View At Least 52 WeeksHere is a **brief profile of Hindustan Unilever Limited (HUL):**

---

### **Hindustan Unilever Limited (HUL) – Company Profile**

* **Full Name**: Hindustan Unilever Limited

* **Type**: Public Company

* **Industry**: Fast-Moving Consumer Goods (FMCG)

* **Founded**: 1933 (as Lever Brothers India Limited)

* **Headquarters**: Mumbai, Maharashtra, India

* **Parent Company**: Unilever PLC (UK)

---

### **Overview**

Hindustan Unilever Limited is one of India’s largest and most respected FMCG companies. It operates as a subsidiary of the global consumer goods giant **Unilever**. HUL has a wide-ranging portfolio that touches the daily lives of millions of consumers across India.

---

### **Key Business Segments**

1. **Home Care** – Surf Excel, Rin, Vim, Domex

2. **Beauty & Personal Care** – Dove, Lifebuoy, Lux, Sunsilk, Pond's, Fair & Lovely (now Glow & Lovely)

3. **Foods & Refreshments** – Brooke Bond, Lipton, Kissan, Horlicks, Knorr, Kwality Wall’s

---

### **Key Facts**

* **Revenue**: ₹60,000+ crore (FY 2023-24, approx.)

* **Employees**: \~21,000

* **Listed On**: BSE & NSE (Ticker: HINDUNILVR)

* **CSR Focus Areas**: Health, hygiene, nutrition, sustainability, water conservation

* **Notable Acquisition**: GSK Consumer Healthcare India (Horlicks, Boost brands)

---

### **Mission Statement**

“To make sustainable living commonplace.”

-

HUL on the Rise: Strong Support & Bullish Outlook Ahead of Q4🔍Technical Analysis: Resilience in a Defined Range

Over the past decade, Hindustan Unilever Ltd (HUL) has exhibited a commendable upward trajectory, characterized by a consistent pattern of higher highs and higher lows from 2018 to 2021. Since 2021, the stock has been oscillating within a well-defined range of ₹2,000 to ₹3,000. Notably, the ₹3,000 mark has acted as a significant resistance level, while the ₹2,100–₹2,200 zone has provided robust support.

In recent weeks, HUL has demonstrated resilience by rebounding from the ₹2,100–₹2,200 support zone, indicating renewed buying interest. This movement suggests a potential bullish momentum, especially if the stock sustains above this support.

Key Technical Levels:

Support Zones: ₹2,100–₹2,200 (Primary), ₹1,900 (Secondary)

Resistance Levels: ₹2,800 (Initial Target), ₹2,900 (Secondary Target), ₹3,000 (Tertiary Target)

Investors should monitor these levels closely, especially with the upcoming Q4 FY25 results scheduled for April 24, 2025. A positive earnings report could propel the stock towards its all-time high, while any negative surprises might test the established support zones.

📊Fundamental Analysis:

Over the past two months, HUL's stock has witnessed an upward movement. Several factors contribute to this trend:

Positive Q3 FY24 Earnings: The company's ability to maintain profitability despite market headwinds has instilled confidence among investors.

Anticipation of Q4 Results: With the Q4 FY25 results scheduled for April 24, 2025, market participants are optimistic about continued positive performance, potentially driving the stock higher.

Defensive Sector Appeal: As a leading player in the FMCG sector, HUL is considered a defensive stock, attracting investors seeking stability amidst market volatility.

📌Q3 FY24 Key Financial Highlights:

Total Income: ₹15,818 Cr (vs ₹15,926 Cr in Q2 FY24 and ₹15,567 Cr in Q3 FY23)

Total Expenses: ₹12,123 Cr (vs ₹12,139 Cr in Q2 FY24 and ₹11,902 Cr in Q3 FY23)

Total Operating Profits: ₹3,695 Cr (vs ₹3,787 Cr in Q2 FY24 and ₹3,665 Cr in Q3 FY23)

Profit Before Tax: ₹3,982 Cr (vs ₹3,542 Cr in Q2 FY24 and ₹3,445 Cr in Q3 FY23)

Profit After Tax: ₹2,989 Cr (vs ₹2,595 Cr in Q2 FY24 and ₹2,508 Cr in Q3 FY23)

Diluted Normalized EPS: ₹12.70 (vs ₹11.03 in Q2 FY24 and ₹10.68 in Q3 FY23)

🔹 Growth in the Home Care and Beauty & Wellbeing segments contributed to the rise.

🔹 Operating margins improved due to better cost controls and volume-led growth.

🔹 Investor sentiment has been optimistic ahead of Q4 results, helping the stock gain in the past 2 months.

✅Conclusion:

HUL is showing signs of bullish continuation if Q4 results support it. Key levels are clear — ₹2,100 is your safety net, and ₹3,000 your breakout goal. Watch results on April 24, and plan accordingly.

Disclaimer: lnkd.in

HUL on the Rise: Strong Support & Bullish Outlook Ahead of Q4🔍 Technical Analysis: Resilience in a Defined Range

Over the past decade, Hindustan Unilever Ltd (HUL) has exhibited a commendable upward trajectory, characterized by a consistent pattern of higher highs and higher lows from 2018 to 2021. Since 2021, the stock has been oscillating within a well-defined range of ₹2,000 to ₹3,000. Notably, the ₹3,000 mark has acted as a significant resistance level, while the ₹2,100–₹2,200 zone has provided robust support.

In recent weeks, HUL has demonstrated resilience by rebounding from the ₹2,100–₹2,200 support zone, indicating renewed buying interest. This movement suggests a potential bullish momentum, especially if the stock sustains above this support.

Key Technical Levels:

Support Zones: ₹2,100–₹2,200 (Primary), ₹1,900 (Secondary)

Resistance Levels: ₹2,800 (Initial Target), ₹2,900 (Secondary Target), ₹3,000 (Tertiary Target)

Investors should monitor these levels closely, especially with the upcoming Q4 FY25 results scheduled for April 24, 2025. A positive earnings report could propel the stock towards its all-time high, while any negative surprises might test the established support zones.

📊 Fundamental Analysis:

Over the past two months, HUL's stock has witnessed an upward movement. Several factors contribute to this trend:

Positive Q3 FY24 Earnings: The company's ability to maintain profitability despite market headwinds has instilled confidence among investors.

Anticipation of Q4 Results: With the Q4 FY25 results scheduled for April 24, 2025, market participants are optimistic about continued positive performance, potentially driving the stock higher.

Defensive Sector Appeal: As a leading player in the FMCG sector, HUL is considered a defensive stock, attracting investors seeking stability amidst market volatility.

📌 Q3 FY24 Key Financial Highlights:

Total Income: ₹15,818 Cr (vs ₹15,926 Cr in Q2 FY24 and ₹15,567 Cr in Q3 FY23)

Total Expenses: ₹12,123 Cr (vs ₹12,139 Cr in Q2 FY24 and ₹11,902 Cr in Q3 FY23)

Total Operating Profits: ₹3,695 Cr (vs ₹3,787 Cr in Q2 FY24 and ₹3,665 Cr in Q3 FY23)

Profit Before Tax: ₹3,982 Cr (vs ₹3,542 Cr in Q2 FY24 and ₹3,445 Cr in Q3 FY23)

Profit After Tax: ₹2,989 Cr (vs ₹2,595 Cr in Q2 FY24 and ₹2,508 Cr in Q3 FY23)

Diluted Normalized EPS: ₹12.70 (vs ₹11.03 in Q2 FY24 and ₹10.68 in Q3 FY23)

🔹 Growth in the Home Care and Beauty & Wellbeing segments contributed to the rise.

🔹 Operating margins improved due to better cost controls and volume-led growth.

🔹 Investor sentiment has been optimistic ahead of Q4 results, helping the stock gain in the past 2 months.

✅ Conclusion :

HUL is showing signs of bullish continuation if Q4 results support it. Key levels are clear — ₹2,100 is your safety net, and ₹3,000 your breakout goal. Watch results on April 24, and plan accordingly.

⚠️ Disclaimer :

This report is for educational and informational purposes only and does not constitute investment advice. Please consult your financial advisor before investing.

HINDUSTAN UNILEVER Head & shoulder Pattern Making 16/04/25NSE INDIA, Symbol : HINDUSTAN UNILEVER Timeframe : Daily. HINDUSTAN UNILEVER I was predicted on dated 24/02/2025 HINDUSTAN UNILEVER on demand zone. Lot of time trade on demand zone and today bonus back HINDUSTAN UNILEVER trade over demand zone . HINDUSTAN UNILEVER also detected Head and shoulder pattern then next target is Left shoulder height 2670

HUL Trade Setup: Breakout Retest Play LevelsHindustan Unilever (HUL) Trading Plan

▬▬▬▬▬▬▬▬▬▬▬▬

Context

Gap Down Recovery: Massive gap down on 7th April followed by sustained upward momentum.

Breakout Confirmation: Closed above key horizontal resistance (2295) and trendline confluence.

Entry Strategy

Organic Entry: Wait for retest of 2295 (now support) for bullish confirmation (e.g., bounce, volume surge).

Aggressive Entry: Enter directly above 2295 with a strict stop loss at 2289.

Target & Risk Management

Target: 2452 (aligns with swing high structure).

Stop Loss: 2289 (below breakout level to invalidate the setup).

Key Notes

Confluence of horizontal + trendline breakout strengthens bullish bias.

Monitor price action for retest confirmation; avoid chasing if momentum stalls.

Risk-Reward: ~1:5 (SL: 16 pts | Target: 157+ pts).

▬▬▬▬▬▬▬▬▬▬▬▬

Trade with discipline. Adjust SL to breakeven at 2350 if target 1 (2400) is hit. 🎯