INDIGO-Technical & Elliott Wave Breakdown📊 Technical & Elliott Wave Breakdown

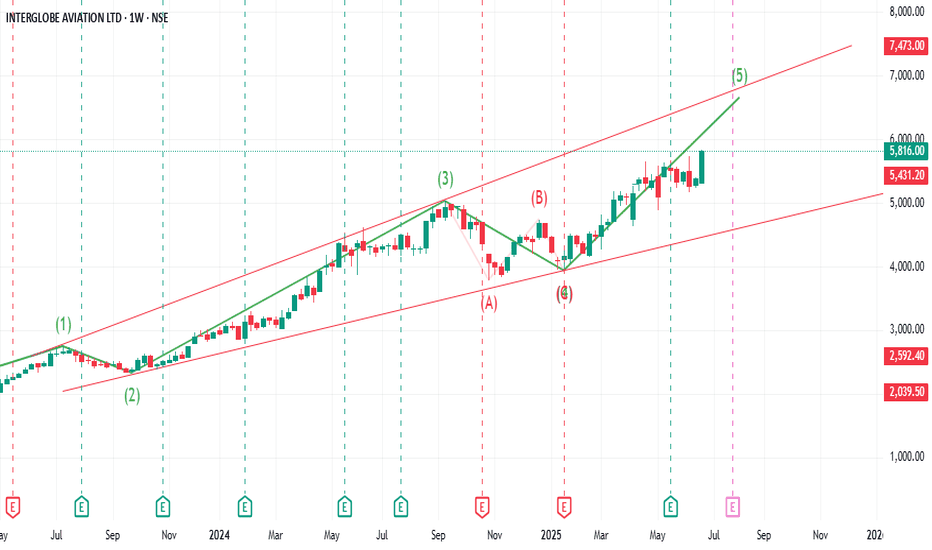

✅ Wave Count:

The wave count appears complete or nearing completion:

• Wave (1): ₹1,666 → ₹2,748

• Wave (2): ₹2,748→ ₹2,333 (corrective)

• Wave (3): ₹2,333 → ₹5,032 (extended impulse)

• Wave (4): ₹5,032 → ₹3,780 → ₹3,945 (complex ABC correction)

• Wave (5): No

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

173.50 INR

72.58 B INR

804.96 B INR

222.51 M

About InterGlobe Aviation Ltd

Sector

Industry

CEO

Peter T. M. Elbers

Website

Headquarters

Gurgaon

Founded

2004

ISIN

INE646L01027

FIGI

BBG009QLQHZ1

InterGlobe Aviation Ltd. engages in the provision of air transportation services. Its activities include the transportation of passengers, cargo, and mail on regularly scheduled flights and the provision of car rental, airport lounge, visa information, and insurance services. The company was founded by Rahul Bhatia and Rakesh Gangwal on January 13, 2004 and is headquartered in Gurgaon, India.

Related stocks

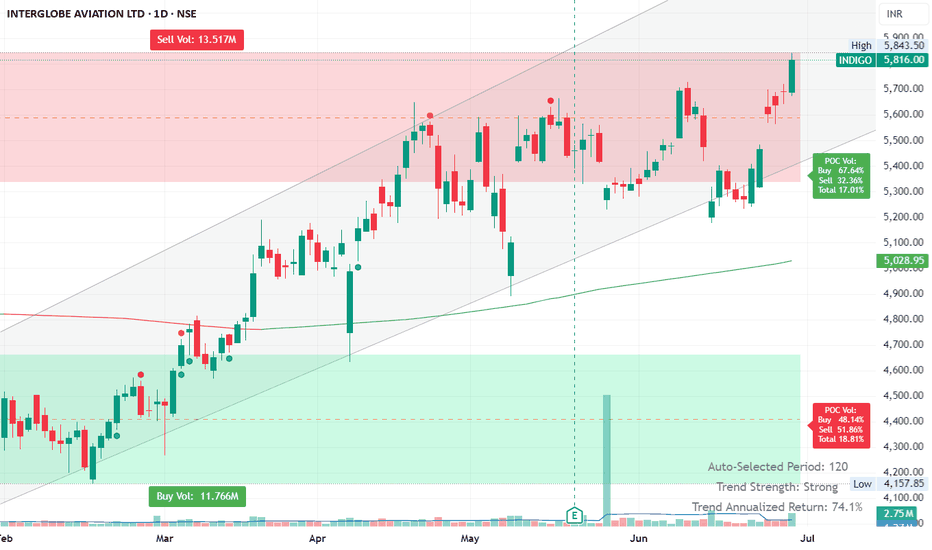

Stock Analysis: InterGlobe Aviation Ltd (INDIGO)Indigo is showing a strong breakout from consolidation near the ₹6000 zone, sustaining well above crucial resistance at ₹5928. This indicates renewed bullish momentum.

✅ Key Levels to Watch:

Support: ₹5606 (must hold to maintain bullish structure)

Immediate Resistance: ₹6268

Next Targets: ₹6968

INDIGO PRZ at 5800Indigo PRZ is around 5800 levels. Expecting a good pullback (below 5K) once it reaches the PRZ. Not a place to go long at this price.. Waiting for the pattern to mature and reversal signs along with confirmation to initiate the trade..

Trading is 80% waiting :)

Disclaimer: I am not a SEBI register

INDIGO As we Observe on INDIGO Daily time frame, one can notice a clear RSI Divergence along with Price rejection area (Supply Zone) as it was retested once and became a valid Resistance zone and we may see some correction in coming days with a Stoploss of Recent Swing high + 0.25% on Price closing basis w

INTERGLOBE AVIATION – Elliot & Harmonic Pattern TargetsElliot Wave reading-

Indigo, has been range bound for last 6 months from a level of 5038, where wave-3 was completed, and then corrective wave -4 completed at 3960 levels.

Wave-1 completed at 2745.10

Wave-2 Completed at 2333.35

Motive wave-5 is in formation, Probable Targets of wave-5 as per

Momentum Stocks to Watch: INDIGO & NH Gear Up for Rally◉ Interglobe Aviation NSE:INDIGO

● The stock has formed a Symmetrical Triangle pattern on the daily chart.

● Following a recent breakout, the price is anticipated to witness substantial upward movement in the coming days.

◉ Narayana Hrudalaya NSE:NH

● After a prolonged consolidation phase,

IndiGo Stock: Symmetric Triangle Breakout & Growth ProspectsTechnical Analysis:

IndiGo stock has been in an uninterrupted uptrend since ₹900, reaching ₹5,000 over time. The stock had been in a range-bound situation since early 2024, forming a symmetric triangle pattern marked by higher lows and lower highs.

On January 24, the company released its Q3 FY25

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of INDIGO is 5,848.00 INR — it has decreased by −0.56% in the past 24 hours. Watch InterGlobe Aviation Ltd stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange InterGlobe Aviation Ltd stocks are traded under the ticker INDIGO.

INDIGO stock has risen by 2.22% compared to the previous week, the month change is a 1.72% rise, over the last year InterGlobe Aviation Ltd has showed a 24.23% increase.

We've gathered analysts' opinions on InterGlobe Aviation Ltd future price: according to them, INDIGO price has a max estimate of 7,256.00 INR and a min estimate of 3,030.00 INR. Watch INDIGO chart and read a more detailed InterGlobe Aviation Ltd stock forecast: see what analysts think of InterGlobe Aviation Ltd and suggest that you do with its stocks.

INDIGO reached its all-time high on Aug 18, 2025 with the price of 6,232.50 INR, and its all-time low was 691.00 INR and was reached on Oct 9, 2018. View more price dynamics on INDIGO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

INDIGO stock is 1.58% volatile and has beta coefficient of 1.34. Track InterGlobe Aviation Ltd stock price on the chart and check out the list of the most volatile stocks — is InterGlobe Aviation Ltd there?

Today InterGlobe Aviation Ltd has the market capitalization of 2.27 T, it has increased by 0.97% over the last week.

Yes, you can track InterGlobe Aviation Ltd financials in yearly and quarterly reports right on TradingView.

InterGlobe Aviation Ltd is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

INDIGO earnings for the last quarter are 56.35 INR per share, whereas the estimation was 59.66 INR resulting in a −5.55% surprise. The estimated earnings for the next quarter are −29.95 INR per share. See more details about InterGlobe Aviation Ltd earnings.

InterGlobe Aviation Ltd revenue for the last quarter amounts to 204.96 B INR, despite the estimated figure of 208.72 B INR. In the next quarter, revenue is expected to reach 186.04 B INR.

INDIGO net income for the last quarter is 21.76 B INR, while the quarter before that showed 30.68 B INR of net income which accounts for −29.05% change. Track more InterGlobe Aviation Ltd financial stats to get the full picture.

Yes, INDIGO dividends are paid annually. The last dividend per share was 10.00 INR. As of today, Dividend Yield (TTM)% is 0.17%. Tracking InterGlobe Aviation Ltd dividends might help you take more informed decisions.

InterGlobe Aviation Ltd dividend yield was 0.20% in 2024, and payout ratio reached 5.32%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 17, 2025, the company has 42.89 K employees. See our rating of the largest employees — is InterGlobe Aviation Ltd on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. InterGlobe Aviation Ltd EBITDA is 198.33 B INR, and current EBITDA margin is 24.23%. See more stats in InterGlobe Aviation Ltd financial statements.

Like other stocks, INDIGO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade InterGlobe Aviation Ltd stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So InterGlobe Aviation Ltd technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating InterGlobe Aviation Ltd stock shows the strong buy signal. See more of InterGlobe Aviation Ltd technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.