Smart Money Secrets: How Institutions Really Control the Markets1. Smart Money Thinks in Liquidity, Not Indicators

Retail traders focus on indicators like RSI, MACD, or moving averages. Smart money focuses on liquidity—where orders are resting.

Liquidity exists at:

Previous highs and lows

Trendline breaks

Obvious support and resistance

Round numbers (100,

ITC Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

28.00 INR

347.47 B INR

750.17 B INR

8.64 B

About ITC Limited

Sector

Industry

CEO

Sanjiv Puri

Website

Headquarters

Kolkata

Founded

1910

IPO date

Oct 14, 1993

Identifiers

2

ISIN INE154A01025

ITC Ltd. is a holding company, which engages in the manufacture and trade of consumer products. It operates through the following segments: Fast Moving Consumer Goods (FMCG) Cigarettes; FMCG Others; Hotels; Paperboards, Paper and Packaging, and Agri Business. The FMCG Cigarettes segment markets and sells tobacco and cigars. The FMCG Others segment distributes packaged foods, clothes, school and office supplies, safety matched, agarbattis, and personal care products. The Hotels segment manages and operates hotel and restaurant chains. The Paperboards, Paper and Packaging segment produces and supplies specialty boards, graphic boards, and printing papers. The Agri Business segment exports feed ingredients, food grains, processed fruits, coffee, and seafood. The company was founded on August 24, 1910 and is headquartered in Kolkata, India.

Related stocks

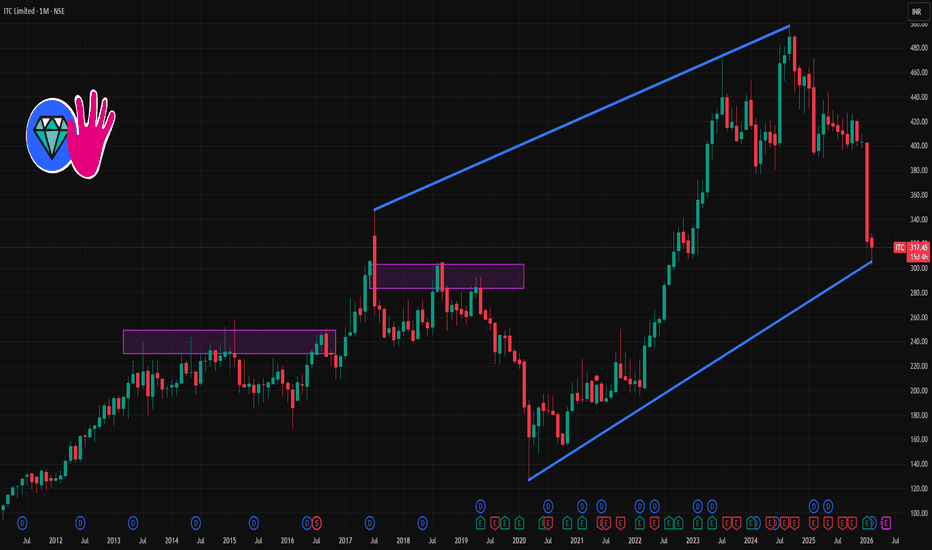

ITC 1 Month Time Frame 📌 Latest price context (today):

• Current stock price: ~₹317–₹320 range.

• RSI indicates weakness but oversold conditions.

📊 1-Month Support & Resistance Levels

🔵 Resistance Levels (Upside)

Short-term pullback levels where bears may push back:

1. R1: ~₹321–₹322

2. R2: ~₹324–₹325

3. R3: ~₹327–₹328

Dollar Strength and Weakness in the Trading MarketThe US Dollar (USD) is the most influential currency in the global financial system. It acts as the world’s primary reserve currency, the main medium for international trade, and the benchmark against which most assets are priced. Because of this central role, dollar strength or weakness directly im

Positional or Long Term Opportunity in ITCGo Long @ 327.8 for Targets of 357, 377, and 423 with SL 309.45

Reasons to go Long :

1. On Weekly timeframe If we draw Fibonacci retracement from the recent swing low (A) to the swing high (B) then the stock took support from the 0.5 Fibonacci level.

2. In addition to this, the stock formed a Bul

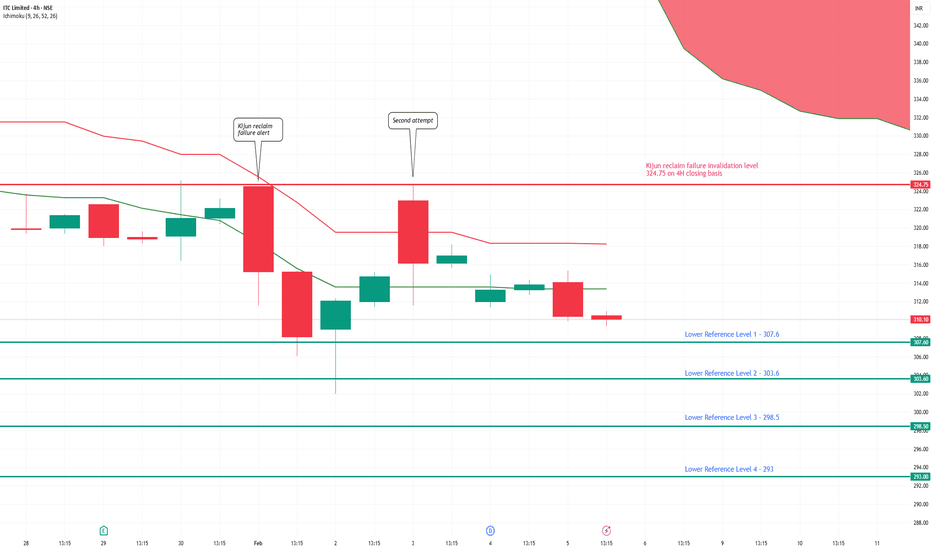

ITC Level Analysis for 04th FEB 2026+Contd. to 03rd Feb Post.....

⚠️ Due to Impact of EX-Dividend of Rs 6.50/Share,

ITC May Open Near "RLS#1" level

Best level to enter between "RLS#2 & USTgt

Screen shot in 5 min TF

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “

ITC: SLOW & STEDY WIN THE RACE 03rd FEB 2026+ Level AnalysisITC: SLOW & STEDY WIN THE RACE

Level Analysis: ITC for 03rd FEB 2026

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 &

ITC 4H Kijun Failure: Is the Downtrend Louder Than the Dividend?The dividend adjustment is complete — price action now carries the final verdict .

On the 4H chart, ITC attempted a Kijun reclaim but failed to gain acceptance. The probe above equilibrium was sold into, followed by compression and a delayed but decisive close back below Kijun. Weekly price a

the dip is an opportunityITC CMP 323

Elliott- this is the 4th wave correction and is still not over. Corrections tgt iv waves. I have marked that on the chart. The zone is 300/275. This is the likely place where this correction should end.

Fibs- the confluence zone at 317 is where it should halt temporarily. In my view

ITC 1 Week Time Frame🔎 Current Market Snapshot

• Live price: ~₹326 – ₹328 range on NSE/BSE today.

• Fresh declines and bearish sentiment recently seen (underperforming broader market).

• Stock near its 52-week low (~₹325.5).

📈 Weekly Timeframe – Key Levels (Accuracy from multiple pivot sources)

Resistance (Upside Leve

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of ITC is 317.95 INR — it has increased by 1.34% in the past 24 hours. Watch ITC Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange ITC Limited stocks are traded under the ticker ITC.

ITC stock has fallen by −3.05% compared to the previous week, the month change is a −5.79% fall, over the last year ITC Limited has showed a −22.78% decrease.

We've gathered analysts' opinions on ITC Limited future price: according to them, ITC price has a max estimate of 486.00 INR and a min estimate of 314.00 INR. Watch ITC chart and read a more detailed ITC Limited stock forecast: see what analysts think of ITC Limited and suggest that you do with its stocks.

ITC stock is 1.63% volatile and has beta coefficient of 0.32. Track ITC Limited stock price on the chart and check out the list of the most volatile stocks — is ITC Limited there?

Today ITC Limited has the market capitalization of 3.93 T, it has increased by 1.85% over the last week.

Yes, you can track ITC Limited financials in yearly and quarterly reports right on TradingView.

ITC Limited is going to release the next earnings report on May 14, 2026. Keep track of upcoming events with our Earnings Calendar.

ITC earnings for the last quarter are 4.30 INR per share, whereas the estimation was 4.18 INR resulting in a 2.95% surprise. The estimated earnings for the next quarter are 3.93 INR per share. See more details about ITC Limited earnings.

ITC Limited revenue for the last quarter amounts to 180.17 B INR, despite the estimated figure of 183.70 B INR. In the next quarter, revenue is expected to reach 191.35 B INR.

ITC net income for the last quarter is 49.31 B INR, while the quarter before that showed 51.26 B INR of net income which accounts for −3.80% change. Track more ITC Limited financial stats to get the full picture.

ITC Limited dividend yield was 3.50% in 2024, and payout ratio reached 51.63%. The year before the numbers were 3.21% and 83.75% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 17, 2026, the company has 47.36 K employees. See our rating of the largest employees — is ITC Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ITC Limited EBITDA is 269.13 B INR, and current EBITDA margin is 34.65%. See more stats in ITC Limited financial statements.

Like other stocks, ITC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ITC Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ITC Limited technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ITC Limited stock shows the sell signal. See more of ITC Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.