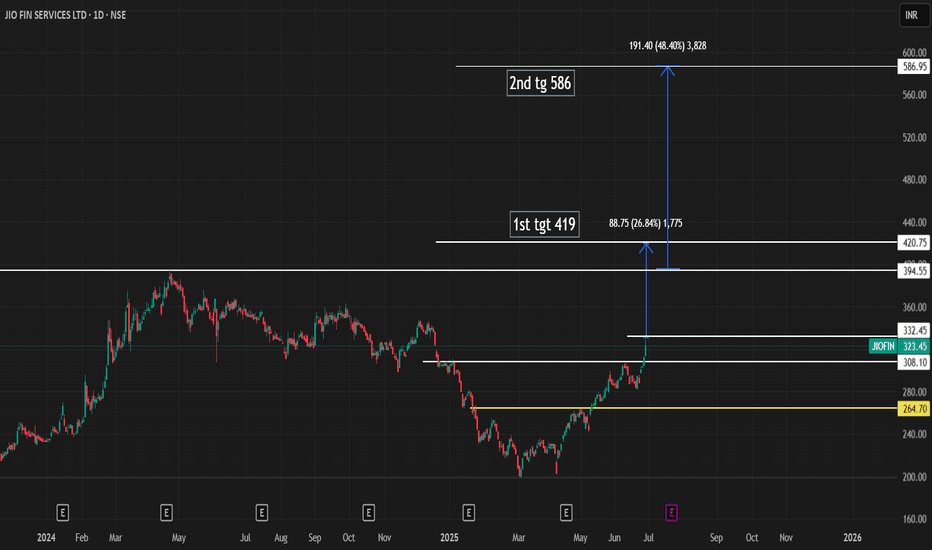

Leading Diagonal to Double Zigzag – Jio Financial’s Full CycleFrom the lows of ₹198.65 , the stock kicked off with a classic leading diagonal — an overlapping structure, exactly how impulsive moves often begin when sentiment is still uncertain. This marked the start of a larger impulsive advance.

Post the Wave 2 low at ₹203.10 , price surged into a power

Jio Financial Services Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.55 INR

16.13 B INR

17.67 B INR

3.33 B

About Jio Financial Services Limited

Sector

Industry

CEO

Hitesh Kumar Sethia

Website

Headquarters

Mumbai

Founded

1999

IPO date

Aug 21, 2023

Identifiers

2

ISIN INE758E01017

Jio Financial Services Ltd. operates as a non-banking financial company. It offers finance, trading and investment services. The company was founded on July 22, 1999 and is headquartered in Mumbai, India.

Related stocks

Jio Financial Services Ltd (NSE: JIOFIN)Current price action shows consolidation above the breakout zone.

📈 Outlook:

As long as the price holds above ₹309–₹305, the bullish bias remains intact.

A sustained move above ₹340 can open upside potential towards ₹360–₹375.

On the downside, a close below ₹305 may invalidate the bullish structu

JIOFIN 1 Day Time Frame 📌 Current Price (Approx):

~₹297.7–₹300.5 range this morning on NSE (latest intraday data)

📊 🔹 Daily Technical Levels (1‑Day Timeframe)

Pivot & Range (Today)

Pivot Point: ~₹300

Day Low / High Today: ~₹296.7 – ₹302.3

Resistance Levels

1️⃣ R1: ~₹305

2️⃣ R2: ~₹308

3️⃣ R3: ~₹312

Support Levels

1️⃣

Part 1 Ride The Big Moves 1. Single-Leg Strategies

A. Long Call

Directional bullish bet.

Maximum loss = premium paid.

B. Long Put

Directional bearish view.

Great for hedging.

C. Short Call

Range-bound strategy; unlimited risk.

D. Short Put

Used to accumulate stocks.

2. Multi-Leg Strategies (Spreads)

These reduce ris

JIOFIN : Strong Story, Weak Chart — Waiting for the Breakout.NSE:JIOFIN

📊 Jio Financial Services – Quick Analysis (Weekly)

CMP: ~₹297

🔹 Technical

Above ₹301, price may see a technical rebound with pullback buyers becoming active.

Primary trend bearish (lower highs–lower lows)

Price inside descending channel / falling wedge

Resistance: ₹330–335

Suppo

Jio Financial Services: The Art of Trading Inside a ChannelA down-channel isn’t chaos — it’s structure.

It exposes who understands rhythm… and who trades out of impulse.

Jio Financial has been moving inside a clear descending channel for months.

Nothing random about it — price is respecting every touch.

🔎 Technical Context

Price continues to oscillate be

JIOFIN 1 Day Time Frame 📊 Key Daily Levels (1-Day Timeframe)

1. Support Levels

~ ₹309.8 — identified by Research360 as a support.

~ ₹307.6 — second support per Research360.

~ ₹304.1 — a lower support per pivot-point analysis.

Broader support zone (per some analysts) lies around ₹305–325, but for day trading, the

Jio Financial – Breakout Base Forming | Momentum Rebuilding

Structure

Price forming a clean ascending triangle with horizontal resistance near ₹285–289.

Higher lows forming consistently → accumulation behaviour visible.

Trend & Momentum

Trading above 21 EMA and 200 EMA, trend supportive.

RSI holding above 55, bull-range intact.

MACD flattening & att

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of JIOFIN is 263.95 INR — it has decreased by −1.35% in the past 24 hours. Watch Jio Financial Services Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Jio Financial Services Limited stocks are traded under the ticker JIOFIN.

JIOFIN stock has fallen by −2.22% compared to the previous week, the month change is a −6.38% fall, over the last year Jio Financial Services Limited has showed a 15.68% increase.

We've gathered analysts' opinions on Jio Financial Services Limited future price: according to them, JIOFIN price has a max estimate of 305.00 INR and a min estimate of 305.00 INR. Watch JIOFIN chart and read a more detailed Jio Financial Services Limited stock forecast: see what analysts think of Jio Financial Services Limited and suggest that you do with its stocks.

JIOFIN reached its all-time high on Apr 23, 2024 with the price of 394.70 INR, and its all-time low was 198.65 INR and was reached on Mar 3, 2025. View more price dynamics on JIOFIN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

JIOFIN stock is 1.79% volatile and has beta coefficient of 1.93. Track Jio Financial Services Limited stock price on the chart and check out the list of the most volatile stocks — is Jio Financial Services Limited there?

Today Jio Financial Services Limited has the market capitalization of 1.68 T, it has increased by 2.01% over the last week.

Yes, you can track Jio Financial Services Limited financials in yearly and quarterly reports right on TradingView.

Jio Financial Services Limited is going to release the next earnings report on Apr 17, 2026. Keep track of upcoming events with our Earnings Calendar.

JIOFIN net income for the last quarter is 2.69 B INR, while the quarter before that showed 6.95 B INR of net income which accounts for −61.30% change. Track more Jio Financial Services Limited financial stats to get the full picture.

Yes, JIOFIN dividends are paid annually. The last dividend per share was 0.50 INR. As of today, Dividend Yield (TTM)% is 0.19%. Tracking Jio Financial Services Limited dividends might help you take more informed decisions.

Jio Financial Services Limited dividend yield was 0.22% in 2024, and payout ratio reached 19.70%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 15, 2026, the company has 1 K employees. See our rating of the largest employees — is Jio Financial Services Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Jio Financial Services Limited EBITDA is 17.28 B INR, and current EBITDA margin is 92.73%. See more stats in Jio Financial Services Limited financial statements.

Like other stocks, JIOFIN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Jio Financial Services Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Jio Financial Services Limited technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Jio Financial Services Limited stock shows the strong sell signal. See more of Jio Financial Services Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.