KPIT Technologies Downtrend Reversal with RSI ConfirmationKPIT Technologies Ltd is currently trading near ₹1271 on the daily chart. The stock has been in a downtrend, forming lower highs and lower lows, but is now attempting a trend reversal by breaking out of its downtrend line. Alongside this, the RSI indicator has moved above 50, signaling renewed buyin

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

28.45 INR

8.40 B INR

58.42 B INR

150.31 M

About KPIT Technologies Limited

Sector

Industry

Website

Headquarters

Pune

Founded

2018

Identifiers

2

ISININE04I401011

KPIT Technologies Ltd. engages in the provision of software for the automobile and mobility industry. It operates through the following geographical segments: Americas, UK and Europe, and Rest of the World. The company was founded by Shashishekhar Pandit, Kishore Parshuram Patil, and Sachin Dattatraya Tikekar on January 1, 2018 and is headquartered in Pune, India.

Related stocks

KPIT Rounding Bottom Continues Rally of Failed H&S PatternLogical Buy Projection

Trend Context

Strong trend change confirmation after Rounding Bottom.(Near Term)

Inverse H&S pattern indicates a bullish reversal structure.(Failed to breakout)

Volume supports accumulation in the demand zone.

Entry Zone

Around ₹1,280–₹1,300 (CMP, near breakout of

KPIT Technologies – Support, Resistance & Breakout ProjectionReasoning

The stock has corrected significantly (from its highs) and is seen by some analysts to be forming technical reversal signs.

A support zone around ₹1,178 is considered strong; it has held recently after pulling back.

A breakout above ₹1,420 is seen as critical by some for pushing towa

KPIT Technologies - Bullish viewKPIT Technologies s formation of Flag - Pole t pattern on Weekly time frame.

Target calculated is 1680 subject to good quarterly results. Also should break the resistance about 1350 and sustain.

Disclaimer : Iam not a SEBI registered investment advisor. This published idea is for education purpos

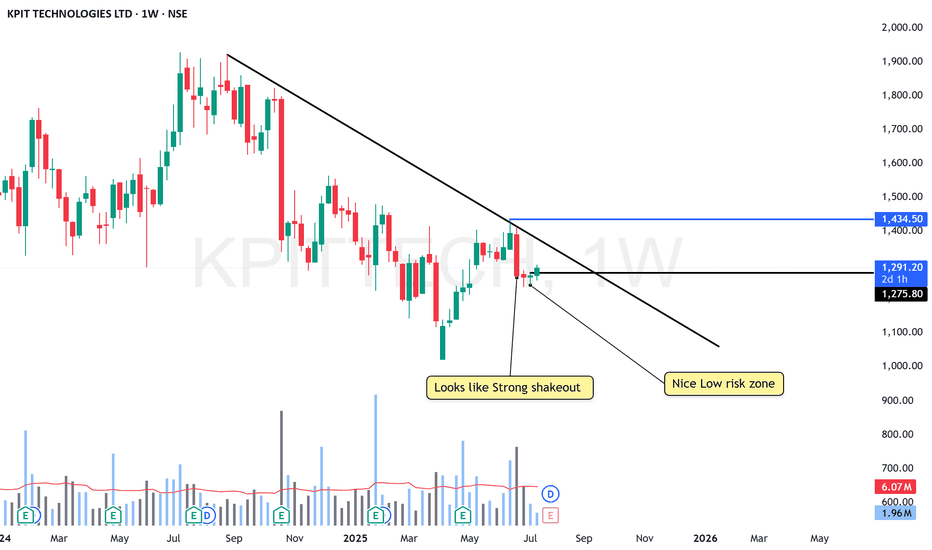

KPIT At low risk Zone - Getting ready to BlastNSE:KPITTECH

Its at Nice low risk Zone

KEEP IN MIND: The 6Rs Dividend Announced at QTR is on 28th JULY

Good to keep on the radar

Always respect SL & position sizing

========================

Trade Secrets By Pratik

========================

Disclaimer

NOT SEBI REGISTERED

This is our person

KPITTECH At Cloud Support - Time for the 3rd wave?Between 1150 and 1250, this looks like a good accumulation price/zone

Price had an impulse upmove from 1020 levels and went on to break the swing high at 1400

Faced Rejection at 200 DEMA and pulled back.

The correction is now seem to be over as the price is exhibiting bullish behavior at the supp

KPIT TECHNOLOGIES - Bullish Inverted H&S Breakout (Daily T/F)Trade Setup

📌 Stock: KPIT TECHNOLOGIES ( NSE:KPITTECH )

📌 Trend: Strong Bullish Momentum

📌 Risk-Reward Ratio: 1:3 (Favorable)

🎯 Entry Zone: ₹1400.00 (Breakout Confirmation)

🛑 Stop Loss: ₹1247.00 (Daily Closing Basis) (-10 % Risk)

🎯 Target Levels:

₹1467.95

₹1539.15

₹1613.85

₹1692.20

₹1774.30

₹18

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of KPITTECH is 1,230.20 INR — it has increased by 0.38% in the past 24 hours. Watch KPIT Technologies Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange KPIT Technologies Limited stocks are traded under the ticker KPITTECH.

KPITTECH stock has fallen by −0.62% compared to the previous week, the month change is a 2.78% rise, over the last year KPIT Technologies Limited has showed a −16.16% decrease.

We've gathered analysts' opinions on KPIT Technologies Limited future price: according to them, KPITTECH price has a max estimate of 1,565.00 INR and a min estimate of 995.00 INR. Watch KPITTECH chart and read a more detailed KPIT Technologies Limited stock forecast: see what analysts think of KPIT Technologies Limited and suggest that you do with its stocks.

KPITTECH reached its all-time high on Jul 12, 2024 with the price of 1,928.70 INR, and its all-time low was 34.35 INR and was reached on Mar 26, 2020. View more price dynamics on KPITTECH chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

KPITTECH stock is 1.66% volatile and has beta coefficient of 1.79. Track KPIT Technologies Limited stock price on the chart and check out the list of the most volatile stocks — is KPIT Technologies Limited there?

Today KPIT Technologies Limited has the market capitalization of 336.79 B, it has decreased by −6.26% over the last week.

Yes, you can track KPIT Technologies Limited financials in yearly and quarterly reports right on TradingView.

KPIT Technologies Limited is going to release the next earnings report on Feb 3, 2026. Keep track of upcoming events with our Earnings Calendar.

KPITTECH earnings for the last quarter are 6.20 INR per share, whereas the estimation was 7.09 INR resulting in a −12.60% surprise. The estimated earnings for the next quarter are 7.07 INR per share. See more details about KPIT Technologies Limited earnings.

KPIT Technologies Limited revenue for the last quarter amounts to 15.88 B INR, despite the estimated figure of 15.63 B INR. In the next quarter, revenue is expected to reach 16.39 B INR.

KPITTECH net income for the last quarter is 1.69 B INR, while the quarter before that showed 1.72 B INR of net income which accounts for −1.64% change. Track more KPIT Technologies Limited financial stats to get the full picture.

KPIT Technologies Limited dividend yield was 0.65% in 2024, and payout ratio reached 27.48%. The year before the numbers were 0.45% and 30.53% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 24, 2025, the company has 10.47 K employees. See our rating of the largest employees — is KPIT Technologies Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. KPIT Technologies Limited EBITDA is 12.94 B INR, and current EBITDA margin is 21.33%. See more stats in KPIT Technologies Limited financial statements.

Like other stocks, KPITTECH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade KPIT Technologies Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So KPIT Technologies Limited technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating KPIT Technologies Limited stock shows the neutral signal. See more of KPIT Technologies Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.