NBCC (India) Ltd. (NSE) on the DTF🔎 Technical Chart Analysis (Daily)

1. Price Structure & Trend

The stock rallied sharply till June 2025 (~₹129), followed by a correction.

Formed a falling trendline resistance, which has now been broken on the upside, indicating a shift from correction to recovery.

Currently consolidating around

NBCC (INDIA) LIMITED

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.42 INR

5.41 B INR

116.65 B INR

1.03 B

About NBCC (INDIA) LIMITED

Sector

CEO

K. P. Mahadevaswamy

Website

Headquarters

New Delhi

Founded

1960

IPO date

Apr 12, 2012

Identifiers

2

ISIN INE095N01031

NBCC (India) Ltd. engages in the real estate development, project management, and consultancy services. It operates through the following segments: Project Management Consultancy (PMC); Real Estate; and Engineering Procurement and Construction (EPC). The PMC segment provides consultancy services to residential, office, commercial and educational institutions, border fencing and infrastructure projects like roads, water supply system, and water storage solutions. The Real Estate segment focuses on residential and commercial projects. The EPC segment aims at high value projects. The company was founded on November 15, 1960 and is headquartered in New Delhi, India.

Related stocks

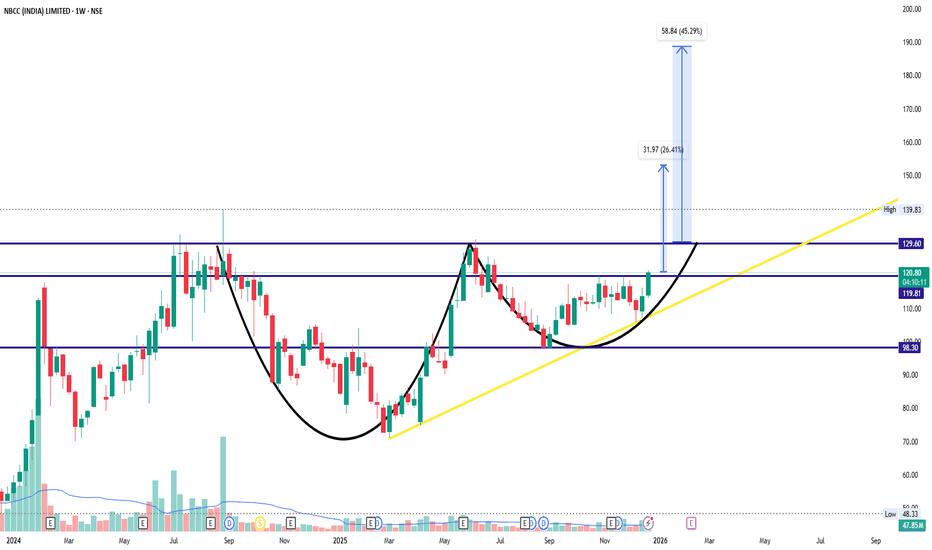

NBCC (India) Ltd | Weekly Consolidation Breakout SetupNBCC is showing a constructive weekly structure after a healthy pullback.

Price is holding above key moving averages

Higher lows indicate trend continuation

Tight consolidation near resistance suggests accumulation

Setup favors a range breakout on strength

Trade View:

Buy on strength above ₹125

Su

NBCC 1 Day Time Frame 📌 Live Price (Daily)

Current trading price: ~₹122.0 – ₹122.7 per share during the session.

Today’s range: ₹121.7 – ₹123.1.

52-Week range: ₹70.80 – ₹130.70.

📊 Daily Pivot & Key Levels

Daily Pivot Point (standard):

Pivot (P): ~₹122.7 – Acts as the central bias level.

Daily Support Levels:

S1: ~

NBCC : Ready to Moove UpsideNBCC has started upside above 120 and will breakout above 132. after that a very sharp upside will start, CUP Handle pattern will give a enormous energy to to rise very high, 140, 151, 162, 183,w ill be seen in future. This whole analysis will be negated if it closes below 105.

Put Stoploss on closi

NBCC 4x Possibility in next 5 Years suggest Monthly charts.NBCC 4x Possibility in next 5 Years suggest Monthly charts.

LTP - 122

Targets - 510+

Timeframe - 5 Years

Fundamentals:

NBCC (India) Limited is a Government of India Navratna Enterprise under the Ministry of Housing and Urban Affairs. The Co. operates in three major segments - Project Management

NBCC LONG setupLogic: Nbcc has been in Uptrend on Daily and weekly. The demand zone formed is evident on most time frames.

2 scenario can be seen

Scenario 1: if price tries to retrace to the level then entering long is definitely an opportunity

Scenario 2: if price does not retrace and a small inside candle is

NBCC(India ) Ltd: At the verge of Tri-Angle Break OutNBCC (India) Ltd :

Trading at 122 and above all its moving Averages)10/20/50/100 DEMA)

Golden Cross over of 10 DEMA in Daily & Weekly Charts

Formed a Tr-angle pattern in daily chart and is about to cross the resistance line

Facing resistance at around 125-130 ,in the event of holding above 130 on cl

NBCC - Weekly LONGNBCC on the weekly chart shows a clear improvement in trend after a long corrective phase. The stock has shifted into a bullish structure by forming higher lows and is now trading above its key moving averages, which have started to slope upward. This indicates that the broader trend has turned posi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SMALLCAP

Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF Units Exchange Traded FundWeight

0.90%

Market value

757.37 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of NBCC is 99.81 INR — it has increased by 1.76% in the past 24 hours. Watch NBCC (INDIA) LIMITED stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange NBCC (INDIA) LIMITED stocks are traded under the ticker NBCC.

NBCC stock has risen by 0.76% compared to the previous week, the month change is a −5.39% fall, over the last year NBCC (INDIA) LIMITED has showed a 15.84% increase.

We've gathered analysts' opinions on NBCC (INDIA) LIMITED future price: according to them, NBCC price has a max estimate of 167.00 INR and a min estimate of 146.00 INR. Watch NBCC chart and read a more detailed NBCC (INDIA) LIMITED stock forecast: see what analysts think of NBCC (INDIA) LIMITED and suggest that you do with its stocks.

NBCC reached its all-time high on Aug 28, 2024 with the price of 139.83 INR, and its all-time low was 3.24 INR and was reached on May 17, 2012. View more price dynamics on NBCC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NBCC stock is 4.63% volatile and has beta coefficient of 2.31. Track NBCC (INDIA) LIMITED stock price on the chart and check out the list of the most volatile stocks — is NBCC (INDIA) LIMITED there?

Today NBCC (INDIA) LIMITED has the market capitalization of 264.87 B, it has increased by 1.55% over the last week.

Yes, you can track NBCC (INDIA) LIMITED financials in yearly and quarterly reports right on TradingView.

NBCC (INDIA) LIMITED is going to release the next earnings report on Jun 1, 2026. Keep track of upcoming events with our Earnings Calendar.

NBCC net income for the last quarter is 1.93 B INR, while the quarter before that showed 1.54 B INR of net income which accounts for 25.72% change. Track more NBCC (INDIA) LIMITED financial stats to get the full picture.

Yes, NBCC dividends are paid semi-annually. The last dividend per share was 0.21 INR. As of today, Dividend Yield (TTM)% is 0.57%. Tracking NBCC (INDIA) LIMITED dividends might help you take more informed decisions.

NBCC (INDIA) LIMITED dividend yield was 0.82% in 2024, and payout ratio reached 33.43%. The year before the numbers were 0.53% and 42.36% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 16, 2026, the company has 1.17 K employees. See our rating of the largest employees — is NBCC (INDIA) LIMITED on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NBCC (INDIA) LIMITED EBITDA is 6.12 B INR, and current EBITDA margin is 0.06%. See more stats in NBCC (INDIA) LIMITED financial statements.

Like other stocks, NBCC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NBCC (INDIA) LIMITED stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NBCC (INDIA) LIMITED technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NBCC (INDIA) LIMITED stock shows the neutral signal. See more of NBCC (INDIA) LIMITED technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.