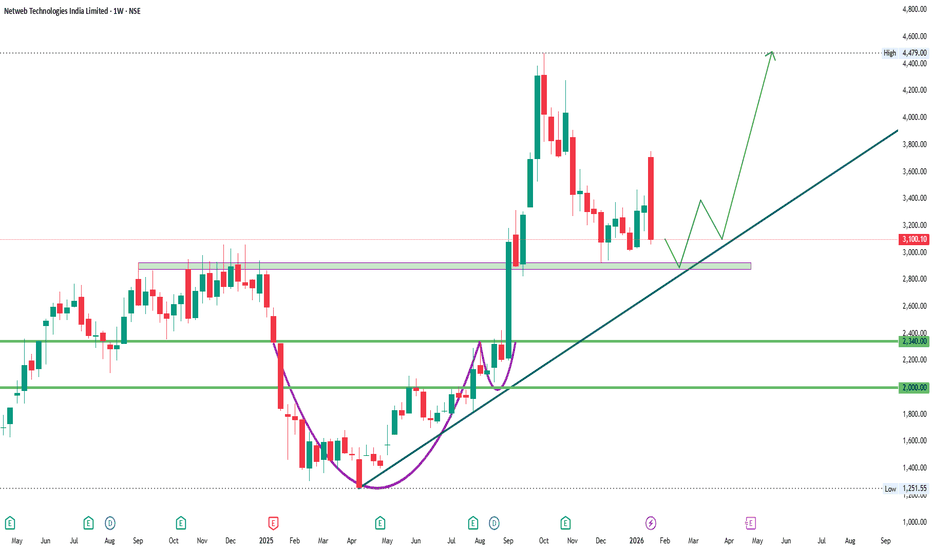

ATH Resistance to Support in NETWEB3000 level has been acting as resistance in 2024. Later it was broken in 2025 and now we see retest of the same level.

There is good buying interest seen at this level making it Low risk entry.

Also this support is near weekly 20sma which makes it high probability trade.

SL targets on chart. Note

Netweb Technologies India Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

31.45 INR

1.14 B INR

11.43 B INR

16.57 M

About Netweb Technologies India Limited

Sector

Industry

CEO

Sanjay Lodha

Website

Headquarters

Faridabad

Founded

1999

IPO date

Jul 27, 2023

Identifiers

2

ISIN INE0NT901020

Netweb Technologies India Ltd. engages in the computer server business. Its services include transforming storage and computing with servers, workstations, storage, cloud, and big data solutions. The company was founded on September 22, 1999 and is headquartered in Faridabad, India.

Related stocks

NETWEB: High-Conviction Support Bounce & Momentum ShiftNETWEB is demonstrating a powerful Breakout and Retest play. After clearing its 2024–2025 resistance levels near the ₹3,000 zone, the stock has pullbacked to test this area, which is now acting as a high-probability Demand Zone. This retest coincides with the weekly 20-SMA, increasing the conviction

NETWEB 1 Day Time Frame 📌 Current Price (Approx)

NETWEB ~ ₹3,347–₹3,368 on NSE (latest market price) — this is the recent traded range as markets open/continue today.

📊 Daily Technical Levels (1-Day Chart)

Pivot Point (Key Reference)

Pivot: ₹3,335–₹3,359 area — central decision zone for bulls vs bears.

🔥 Resistance Leve

Netweb: Breakout and retest playOn weekly chart, it is observed that netweb had broken out with high relative volume in the month of september 2025. Stock ran up on higher volumes. Since 2 months stock corrected to the same previous resistance levels which may now act as support.

This can be a breakout and retest trade. The volum

NETWEB

We identified change of trend around July 2025 (Rs.1962).

The stock witnessed a strong up-move after that supported with high volumes.

Currently, the stock has witnessed a pullback to its Support zone provided by important previous highs.

The stock is likely to resume its up-move from this su

Time to have a foot in the door of AI for India ?The NVIDIA of India.

The sock have rallied almost 8X since its IPO price.

Since the last month it has corrected over 25%.

> Reasons to consider the stock-

- Fastest growing company in segment.

- Strong growth(~66%).

- Backed by India AI Mission, NSM, and PLI schemes.

- India's digita

Netweb Volume distribution Technical -

Clear distribution chart , retail heavily trap show on volume, now that area work as

Trap resistance,

3 step distribution happened

1st, break out base ( Trending stock on social media ai hot sector)

2nd break out time volume that attracts retails

3nd after institute sell to retail

Netweb Technologies – Riding India’s AI BoomNetweb Technologies just posted another solid quarter — Q2 FY26 profit rose 19.8% YoY to ₹31.4 crore , and revenue climbed 20.9% to ₹303.7 crore .

The company also announced two large AI-infrastructure orders worth ₹2,184 crore , to be executed by FY27 — projects of national importance aimed at s

NETWEB - The Power Launch SetupThe Setup: Consolidation & Trend Continuation

NETWEB has successfully transitioned from a major correction (the large rounded dip, or "Cup") into a powerful, sustainable uptrend. This stock is now demonstrating a classic Continuation Flag just below its all-time high zone.

The stock staged a hu

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MOSMALL250

Motilal Oswal Nifty Smallcap 250 ETF Units Exchange Traded FundWeight

0.26%

Market value

40.87 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of NETWEB is 3,153.10 INR — it has decreased by −0.80% in the past 24 hours. Watch Netweb Technologies India Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Netweb Technologies India Limited stocks are traded under the ticker NETWEB.

NETWEB stock has fallen by −0.99% compared to the previous week, the month change is a −4.45% fall, over the last year Netweb Technologies India Limited has showed a 91.59% increase.

We've gathered analysts' opinions on Netweb Technologies India Limited future price: according to them, NETWEB price has a max estimate of 4,150.00 INR and a min estimate of 3,629.00 INR. Watch NETWEB chart and read a more detailed Netweb Technologies India Limited stock forecast: see what analysts think of Netweb Technologies India Limited and suggest that you do with its stocks.

NETWEB reached its all-time high on Oct 8, 2025 with the price of 4,479.00 INR, and its all-time low was 738.60 INR and was reached on Oct 26, 2023. View more price dynamics on NETWEB chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NETWEB stock is 2.80% volatile and has beta coefficient of 1.31. Track Netweb Technologies India Limited stock price on the chart and check out the list of the most volatile stocks — is Netweb Technologies India Limited there?

Today Netweb Technologies India Limited has the market capitalization of 180.06 B, it has decreased by −0.18% over the last week.

Yes, you can track Netweb Technologies India Limited financials in yearly and quarterly reports right on TradingView.

Netweb Technologies India Limited is going to release the next earnings report on May 1, 2026. Keep track of upcoming events with our Earnings Calendar.

NETWEB earnings for the last quarter are 12.90 INR per share, whereas the estimation was 7.00 INR resulting in a 84.29% surprise. The estimated earnings for the next quarter are 13.60 INR per share. See more details about Netweb Technologies India Limited earnings.

Netweb Technologies India Limited revenue for the last quarter amounts to 8.05 B INR, despite the estimated figure of 4.48 B INR. In the next quarter, revenue is expected to reach 8.01 B INR.

NETWEB net income for the last quarter is 733.11 M INR, while the quarter before that showed 314.33 M INR of net income which accounts for 133.23% change. Track more Netweb Technologies India Limited financial stats to get the full picture.

Yes, NETWEB dividends are paid annually. The last dividend per share was 2.50 INR. As of today, Dividend Yield (TTM)% is 0.08%. Tracking Netweb Technologies India Limited dividends might help you take more informed decisions.

Netweb Technologies India Limited dividend yield was 0.17% in 2024, and payout ratio reached 12.35%. The year before the numbers were 0.12% and 14.38% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 11, 2026, the company has 489 employees. See our rating of the largest employees — is Netweb Technologies India Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Netweb Technologies India Limited EBITDA is 2.48 B INR, and current EBITDA margin is 13.59%. See more stats in Netweb Technologies India Limited financial statements.

Like other stocks, NETWEB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Netweb Technologies India Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Netweb Technologies India Limited technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Netweb Technologies India Limited stock shows the buy signal. See more of Netweb Technologies India Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.