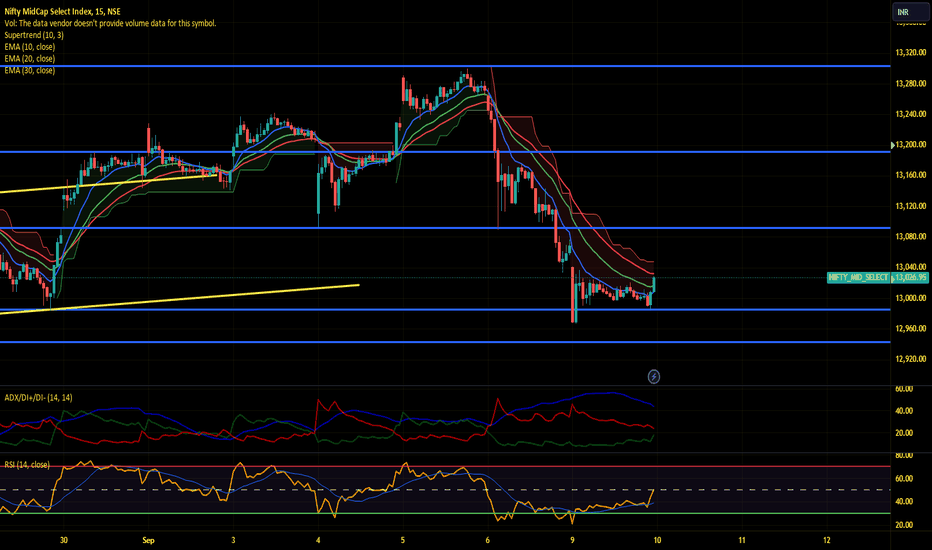

Midnifty Intraday Analysis for 12th September 2024NSE:NIFTY_MID_SELECT

Index closed near 13115 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

13500 Strike – 14.28 Lakh

13200 Strike – 9.53 Lakh

13300 Strike – 6.87 Lakh

Put Writing

13000 Strike – 16.98 Lakh

12800 Strike – 8.64 Lakh

13100 Strike –6.81 Lakh

Index has immediate resistance near 13250- 13300 range and if index crosses and sustains above 13300 level then may reach 13450 – 13500 range.

Index has immediate support near 13100 – 13000 range and if this support is broken then index may tank near 12900 – 12850 range.

NIFTY_MID_SELECT trade ideas

Midnifty Intraday Analysis for 11th September 2024NSE:NIFTY_MID_SELECT

Index closed near 13185 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

13500 Strike – 7.57 Lakh

13200 Strike – 7.55 Lakh

13300 Strike – 4.59 Lakh

Put Writing

13000 Strike – 16.29 Lakh

13200 Strike – 7.32 Lakh

13100 Strike – 6.58 Lakh

Index has immediate resistance near 13300- 13325 range and if index crosses and sustains above 13325 level then may reach 13450 – 13500 range.

Index has immediate support near 13100 – 13000 range and if this support is broken then index may tank near 12900 – 12850 range.

Midcap nifty select trades and targets - 11/9/24Hello Everyone. The market was in a bullish mode today. If the market opens flat then we can see continuation of trend. If it opens gap up then we need to see the resistance level to break before looking for CE trades. If it opens gap down then look for PE trades after support zone is broken. Let the market settle in first 15 to 30 minutes then look for directional trades. Book profits every 20 points as we are getting very few trending moves.

Midnifty Intraday Analysis for 10th September 2024NSE:NIFTY_MID_SELECT

Index closed near 13005 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

13000 Strike – 8.29 Lakh

13100 Strike – 5.20 Lakh

13200 Strike – 3.59 Lakh

Put Writing

13000 Strike – 10.31 Lakh

12700 Strike – 3.88 Lakh

12800 Strike – 2.40 Lakh

Index has immediate resistance near 13150- 13225 range and if index crosses and sustains above 13225 level then may reach 13450 – 13500 range.

Index has immediate support near 12950 – 12900 range and if this support is broken then index may tank near 12800 – 12750 range.

Midnifty Intraday Analysis for 09th September 2024NSE:NIFTY_MID_SELECT

Index closed near 13065 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

13500 Strike – 27.31 Lakh

13300 Strike – 24.21 Lakh

13400 Strike – 23.18 Lakh

Put Writing

12800 Strike – 14.52 Lakh

13000 Strike – 12.73 Lakh

13000 Strike – 12.38 Lakh

Index has immediate resistance near 13150- 13225 range and if index crosses and sustains above 13225 level then may reach 13450 – 13500 range.

Index has immediate support near 13000 – 12950 range and if this support is broken then index may tank near 12800 – 12750 range.

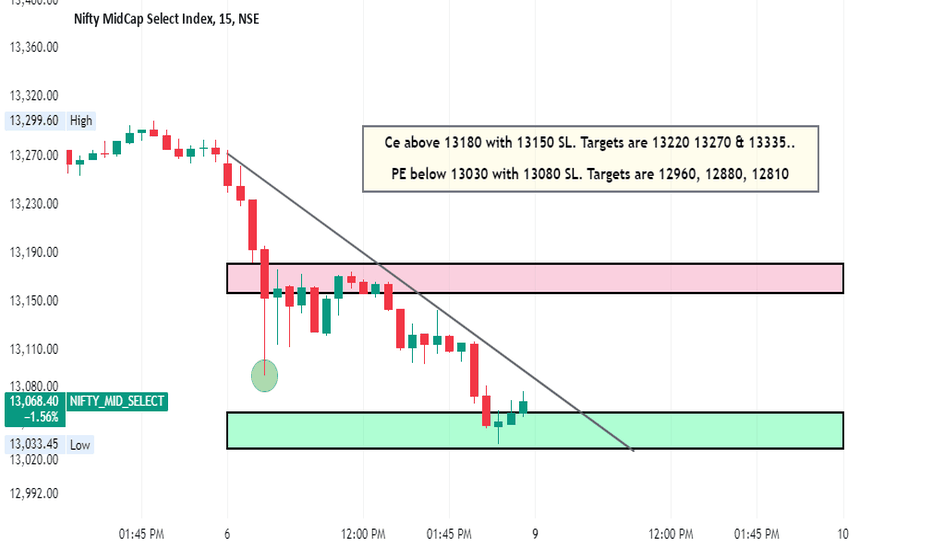

Midcap nifty select expiry trades and targets - 9/9/24Hello Everyone. The market was in a bearish mode today. If the market opens flat then we can see continuation of trend. If it opens gap up then we need to see the resistance level to break before looking for CE trades. If it opens gap down then look for PE trades after support zone is broken. Let the market settle in first 15 to 30 minutes then look for directional trades. Book profits every 20 points as we are getting very few trending moves.

Midnifty Intraday Analysis for 06th September 2024NSE:NIFTY_MID_SELECT

Index closed near 13275 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

13300 Strike – 14.68 Lakh

13200 Strike – 11.60 Lakh

13600 Strike – 11.06 Lakh

Put Writing

13200 Strike – 18.88 Lakh

13100 Strike – 12.49 Lakh

13000 Strike – 11.72 Lakh

Index has immediate resistance near 13300- 13325 range and if index crosses and sustains above 13325 level then may reach 13450 – 13500 range.

Index has immediate support near 13225 – 13175 range and if this support is broken then index may tank near 13050 – 13000 range.

Midcap nifty select trades and targets - 6/9/24Hello Everyone. The market was in a bullish mode today. This is one index which is giving returns everyday. If the market opens flat then we can see continuation of trend. If it opens gap up then we need to see the resistance level to break before looking for CE trades. If it opens gap down then look for PE trades after support zone is broken. Let the market settle in first 15 to 30 minutes then look for directional trades. Book profits every 30 points as we are getting very few trending moves.

Midnifty Intraday Analysis for 05th September 2024NSE:NIFTY_MID_SELECT

Index closed near 13220 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

13200 Strike – 13.11 Lakh

13500 Strike – 8.90 Lakh

13300 Strike – 8.20 Lakh

Put Writing

13200 Strike – 14.62 Lakh

13100 Strike – 8.63 Lakh

13000 Strike – 7.55 Lakh

Index has immediate resistance near 13275 - 13250 range and if index crosses and sustain above 13275 level then may reach 13450 – 13500 range.

Index has immediate support near 13150 – 13100 range and if this support is broken then index may tank near 12850 – 12800 range.

Midcap nifty select trades and targets - 5/9/24Hello Everyone. The market was in a bullish mode today. If the market opens flat then we can see continuation of trend. If it opens gap up then we need to see the resistance level to break before looking for CE trades. If it opens gap down then look for PE trades after support zone is broken. Let the market settle in first 15 to 30 minutes then look for directional trades. Book profits every 30 points as we are getting very few trending moves.

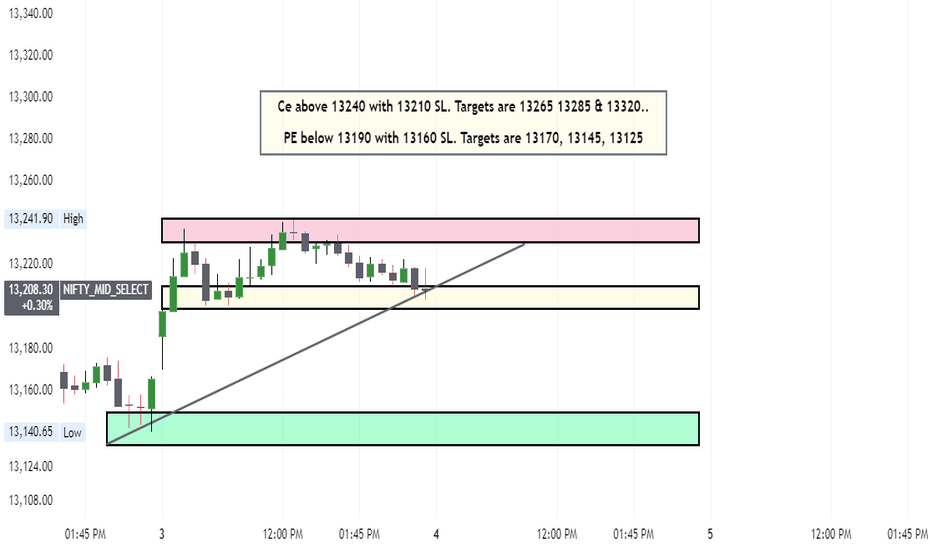

Midnifty Intraday Analysis for 4th September 2024NSE:NIFTY_MID_SELECT

Index closed near 13210 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

13200 Strike – 10.16 Lakh

13600 Strike – 8.21 Lakh

13500 Strike – 7.11 Lakh

Put Writing

13200 Strike – 12.91 Lakh

13100 Strike – 5.84 Lakh

13000 Strike – 4.49 Lakh

Index has immediate resistance near 13275 - 13250 range and if index crosses and sustain above 13275 level then may reach 13450 – 13500 range.

Index has immediate support near 13150 – 13100 range and if this support is broken then index may tank near 12850 – 12800 range.

Midcap nifty select trades and targets - 4/9/24Hello Everyone. The market was in a bullish and sideways today. If the market opens flat then we can see continuation of trend. If it opens gap up then we need to see the resistance level to break before looking for CE trades. If it opens gap down then look for PE trades after support zone is broken. Let the market settle in first 15 to 30 minutes then look for directional trades. Book profits every 30 points as we are getting very few trending moves.

Midnifty Intraday Analysis for 3rd September 2024NSE:NIFTY_MID_SELECT

Index closed near 13150 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

13200 Strike – 6.60 Lakh

13300 Strike – 6.16 Lakh

13500 Strike – 5.75 Lakh

Put Writing

13200 Strike – 7.40 Lakh

12900 Strike – 4.57 Lakh

13100 Strike – 4.37 Lakh

Index has immediate resistance near 13200 - 13250 range and if index crosses and sustain above 13250 level then may reach 13450 – 13500 range.

Index has immediate support near 13100 – 12950 range and if this support is broken then index may tank near 12850 – 12800 range.

Midcap nifty select trades and targets - 3/9/24Hello Everyone. The market was in a bearish mode today. If the market opens flat then we can see continuation of trend. If it opens gap up then we need to see the resistance level to break before looking for CE trades. If it opens gap down then look for PE trades after support zone is broken. Let the market settle in first 15 to 30 minutes then look for directional trades. Book profits every 30 points as we are getting very few trending moves.

Midnifty Intraday Analysis for 2nd September 2024NSE:NIFTY_MID_SELECT

Index closed near 13160 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

13500 Strike – 23.40 Lakh

13200 Strike – 18.90 Lakh

13300 Strike – 15.29 Lakh

Put Writing

13000 Strike – 28.12 Lakh

13100 Strike – 25.52 Lakh

13150 Strike – 13.90 Lakh

Index has immediate resistance near 13200 - 13300 range and if index crosses and sustain above 13300 level then may reach 13450 – 13500 range.

Index has immediate support near 13000 – 12950 range and if this support is broken then index may tank near 12850 – 12800 range.

Midcap nifty select trades and targets - 2/9/24Hello Everyone. The market was bullish but gave opposite moves to take SL few times today. Previous support has turned to resistance now and vise versa. Let the resistance or support range break with 15-minute candle before going for any trade book profits every 30 points. Its expiry so trade if levels are broke an there are clear signals of any trade. If we try to trade in between zones then our SL will be hit and capital will be wiped out. Preserve your capital on expiry is the most important thing to do. Look for hero zero trades after 2.00 P.m. and use 10% capital for this trade.

Mid-Cap Nifty Weekly Technical Chart Analysis 2-6 Sept., 24📈 Mid-Cap Nifty Weekly Technical Chart Analysis

📅 Week: 2nd - 6th September, 2024

📊 Range Trigger Point: 13162

📉 Weekly Range: 207

🟢 Buy Above: 13112

💼 Average Position: 13087

🎯 Buy Target 1: 13290

🎯 Buy Target 2: 13369

🔵 Stoploss: 13043

🔴 Sell Below: 13063

🎯 Sell Target 1: 13034

🎯 Sell Target 2: 12954

🔵 Stoploss: 13132

✨ Keep up with the latest technical insights! Follow for regular updates and trading tips. 🚀📈

#MidCapNifty #WeeklyAnalysis #TechnicalChart #StockMarket #TradingStrategy #MarketTrends #Investment #TradingTips

Midnifty Intraday Analysis for 30th August 2024NSE:NIFTY_MID_SELECT

Index closed near 13095 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

13100 Strike – 20.33 Lakh

13500 Strike – 13.86 Lakh

13200 Strike – 7.93 Lakh

Put Writing

13000 Strike – 15.81 Lakh

13100 Strike – 12.82 Lakh

12800 Strike – 6.19 Lakh

Index has immediate resistance near 13125 - 13150 range and if index crosses and sustain above 13150 level then may reach 13200 – 13300 range.

Index has immediate support near 13000 – 12950 range and if this support is broken then index may tank near 12850 – 12800 range.

Midcap nifty select trades and targets - 30/8/24Hello Everyone. The market was in a bullish/bearish mode today. If the market opens flat then we can see continuation of trend. If it opens gap up then we need to see the resistance level to break before looking for CE trades. If it opens gap down then look for PE trades after support zone is broken. Let the market settle in first 15 to 30 minutes then look for directional trades. Book profits every 30 points as we are getting very few trending moves.

Midnifty Intraday Analysis for 29th August 2024NSE:NIFTY_MID_SELECT

Index closed near 13085 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

13100 Strike – 15.32 Lakh

13500 Strike – 13.22 Lakh

13400 Strike – 7.45 Lakh

Put Writing

13100 Strike – 13.36 Lakh

13000 Strike – 11.24 Lakh

12700 Strike – 6.26 Lakh

Index has immediate resistance near 13100 - 13150 range and if index crosses and sustain above 13150 level then may reach 13200 – 13300 range.

Index has immediate support near 13000 – 12950 range and if this support is broken then index may tank near 12850 – 12800 range.

Mid Cap Nifty Intraday Analysis for 29th August, 2024📈 Mid Cap Nifty Technical Chart Analysis

📊 Range Trigger Point: 13085

📉 Day Range: 123

📅 Level Type: Daily

📅 Valid For: 29 Aug, 2024

📈 Buy Above: 13091

💼 Average Position: 13076

🎯 Buy Target 1: 13161

🎯 Buy Target 2: 13208

🛑 Stoploss: 13050

📉 Sale Below: 13062

🎯 Sale Target 1: 13010

🎯 Sale Target 2: 12963

🛑 Stoploss: 13103

✨ Follow and engage for more insightful updates. Your engagement fuels our dedication to providing top-notch content! 🚀❤️

#MidCapNifty #Intraday #TechnicalAnalysis #StockMarket #Trading #Investment #MarketAnalysis #TradingTips

Midcap nifty select trades and targets - 29/8/24Hello Everyone. The market was in a bullish/bearish mode today. If the market opens flat then we can see continuation of trend. If it opens gap up then we need to see the resistance level to break before looking for CE trades. If it opens gap down then look for PE trades after support zone is broken. Let the market settle in first 15 to 30 minutes then look for directional trades. Book profits every 30 points as we are getting very few trending moves.