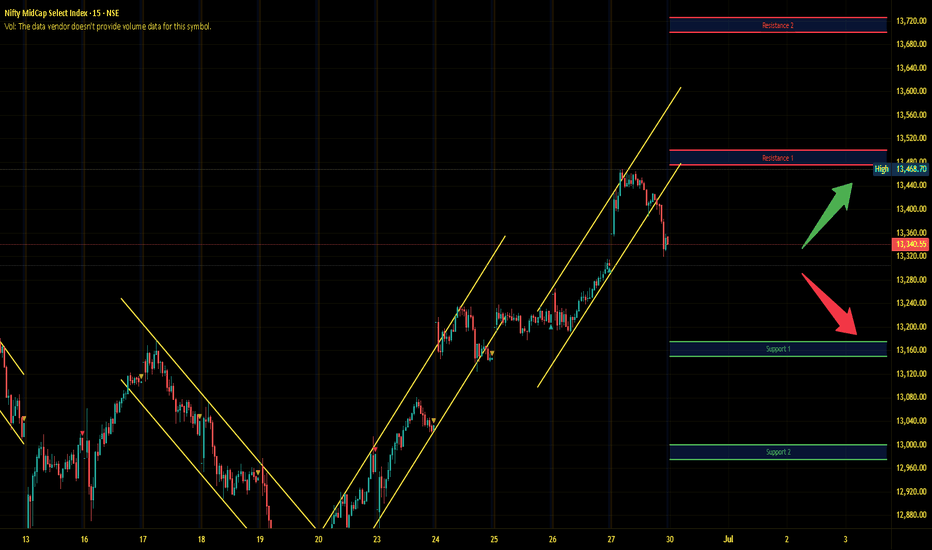

Midnifty Intraday Analysis for 02nd July 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13525 – 13550 range and if index crosses and sustains above this level then may reach 13700 – 13725 range.

Midnifty has immediate support near 13300 – 13225 range and if this support is broken then index may tank near 13175 – 13150 range.

NIFTY_MID_SELECT trade ideas

Midnifty Intraday Analysis for 01st July 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13525 – 13550 range and if index crosses and sustains above this level then may reach 13700 – 13725 range.

Midnifty has immediate support near 13300 – 13225 range and if this support is broken then index may tank near 13175 – 13150 range.

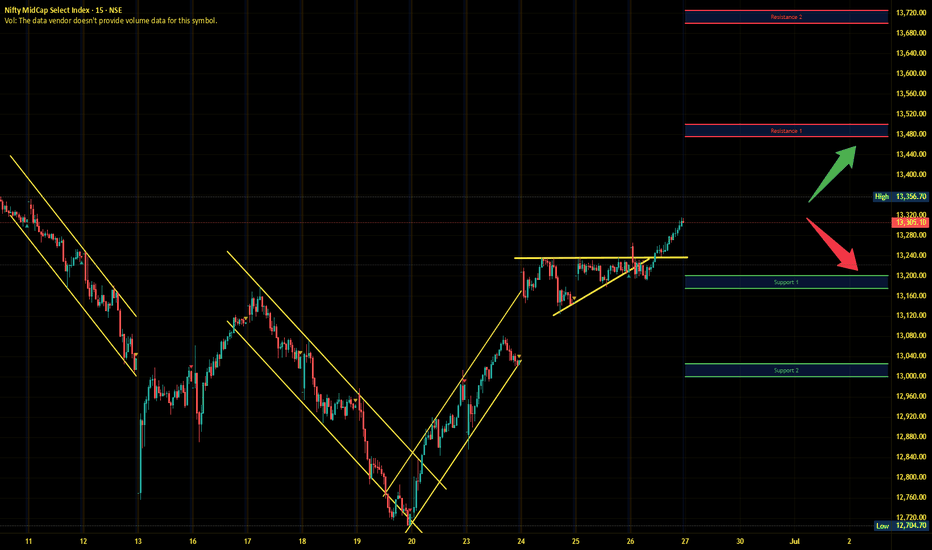

Midnifty Intraday Analysis for 30th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13475 – 13500 range and if index crosses and sustains above this level then may reach 13700 – 13725 range.

Midnifty has immediate support near 13175 – 13150 range and if this support is broken then index may tank near 13000 – 12975 range.

Midnifty Intraday Analysis for 27th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13475 – 13500 range and if index crosses and sustains above this level then may reach 13700 – 13725 range.

Midnifty has immediate support near 13200 – 13175 range and if this support is broken then index may tank near 13025 – 13000 range.

Midnifty Intraday Analysis for 26th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13375 – 13400 range and if index crosses and sustains above this level then may reach 13500 – 13525 range.

Midnifty has immediate support near 13075 – 13050 range and if this support is broken then index may tank near 12950 – 12925 range.

Midnifty Intraday Analysis for 25th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13300 – 13325 range and if index crosses and sustains above this level then may reach 13475 – 13500 range.

Midnifty has immediate support near 13000 – 12975 range and if this support is broken then index may tank near 12850 – 12825 range.

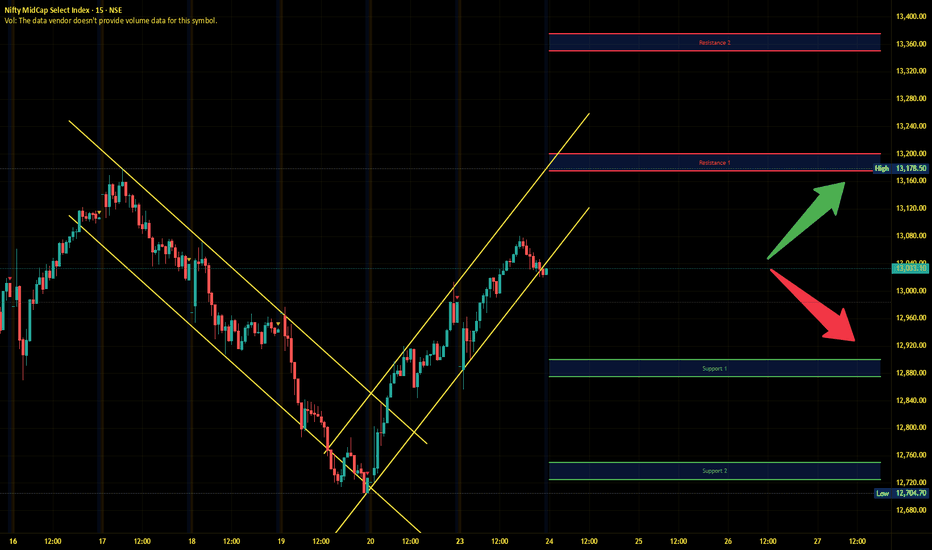

Midnifty Intraday Analysis for 24th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13175 – 13200 range and if index crosses and sustains above this level then may reach 13350 – 13375 range.

Midnifty has immediate support near 12900 – 12875 range and if this support is broken then index may tank near 12750 – 12725 range.

Midnifty Intraday Analysis for 23rd June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13075 – 13100 range and if index crosses and sustains above this level then may reach 13275 – 13300 range.

Midnifty has immediate support near 12800 – 12775 range and if this support is broken then index may tank near 12600 – 12575 range.

High volatility expected due to the fresh escalation of the Israel Iran war.

Midnifty Intraday Analysis for 20th June 2025NSE:NIFTY_MID_SELECT

Index has immediate support near 12550 – 12525 range if gap down opening and if this support is broken then index may tank near 12400 – 12375 range.

Midnifty has immediate resistance near 12850 – 12875 range and if index crosses and sustains above this level then may reach 12975 – 13000 range.

High volatility expected due to the escalation of the Israel Iran war.

Midnifty Intraday Analysis for 19th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13050 – 13075 range and if index crosses and sustains above this level then may reach 13250 – 13275 range.

Midnifty has immediate support near 12800 – 12775 range and if this support is broken then index may tank near 12650 – 12625 range.

Midnifty Intraday Analysis for 18th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13175 – 13200 range and if index crosses and sustains above this level then may reach 13350 – 13375 range.

Midnifty has immediate support near 12900 – 12875 range and if this support is broken then index may tank near 12750 – 12725 range.

Midnifty Intraday Analysis for 17th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13200 – 13225 range and if index crosses and sustains above this level then may reach 13350 – 13375 range.

Midnifty has immediate support near 12950 – 12925 range and if this support is broken then index may tank near 12750 – 12725 range.

Midnifty Intraday Analysis for 16th June 2025NSE:NIFTY_MID_SELECT

Bearish Trend expected due to Israel Iran conflict in Middle east.

Midnifty has immediate support near 12775 – 12750 range and if this support is broken then index may tank near 12575 – 12550 range.

Index has immediate resistance near 13175 – 13200 range and if index crosses and sustains above this level then may reach 13350 – 13375 range.

Heikin Ashi + RSI: Clean TrendFor traders who prefer clarity over noise, combining Heikin Ashi candles with the Relative Strength Index (RSI) can help reveal clean trend setups and momentum confirmations.

This duo is especially effective on TradingView for identifying smoother entries and exits.

What is Heikin Ashi?

Heikin Ashi is a chart type that modifies how candles are calculated:

It averages price data to create smoother trends.

Green candles indicate uptrends; red candles suggest downtrends.

Wicks are often shorter, reducing market noise.

What is RSI?

The Relative Strength Index (RSI) is a momentum oscillator ranging from 0 to 100:

Above 70: Overbought (potential pullback)

Below 30: Oversold (potential bounce)

RSI also helps confirm trend strength and entry points.

Why Combine Them?

Heikin Ashi filters out noise, making trend direction easier to identify.

RSI validates the trend with momentum strength.

Together, they help you enter trades with higher conviction.

How to Trade It

Identify trend direction with Heikin Ashi candles.

Consecutive green candles = uptrend

Consecutive red candles = downtrend

Confirm with RSI:

RSI above 50 supports bullish trend

RSI below 50 supports bearish trend

Look for divergence or reversals using RSI near overbought/oversold levels.

Using on TradingView

Select Heikin Ashi from chart type options.

Add RSI from the Indicators tab.

Use both together to align entries with the trend and strength.

Conclusion

This clean, visual strategy is perfect for traders who want to reduce whipsaws and act on strong signals. Whether you're swing trading or intraday trading, Heikin Ashi + RSI can bring clarity to your charts.

Midnifty Intraday Analysis for 13th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13175 – 13200 range and if index crosses and sustains above this level then may reach 13350 – 13375 range.

Midnifty has immediate support near 12925 – 12900 range and if this support is broken then index may tank near 12775 – 12750 range.

Midnifty Intraday Analysis for 12th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13400 – 13425 range and if index crosses and sustains above this level then may reach 13525 – 13550 range.

Midnifty has immediate support near 13100 – 13075 range and if this support is broken then index may tank near 12925 – 12900 range.

Upside momentum is expected to continue.

Midnifty Intraday Analysis for 11th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13475 – 13500 range and if index crosses and sustains above this level then may reach 13725 – 13750 range.

Midnifty has immediate support near 13150 – 13125 range and if this support is broken then index may tank near 13000 – 12975 range.

Upside momentum is expected to continue.

Midnifty Intraday Analysis for 10th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13475 – 13500 range and if index crosses and sustains above this level then may reach 13725 – 13750 range.

Midnifty has immediate support near 13150 – 13125 range and if this support is broken then index may tank near 13000 – 12975 range.

Upside momentum is expected to continue.

Midnifty Intraday Analysis for 09th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13325 – 13350 range and if index crosses and sustains above this level then may reach 13500 – 13525 range.

Midnifty has immediate support near 12975 – 12950 range and if this support is broken then index may tank near 12825 – 12800 range.

Nifty Mid_Select IndexHello & welcome to this analysis

From July 2022 to Sep 2024 it appears to have completed an impulse 5 waves up structure forming a Primary Wave 1

From Sep 2024 to Apr 2025 is a corrective ABC wave that has done a 38 Fibonacci retracement.

While it is too early to suggest whether that zigzag fall was a Primary Wave 2 or Wave A of B. The unfolding in the daily time frame suggest the probability of the former and start of a Primary Wave 3.

A weekly close above 13250 would increase the conviction of an impulse wave for probable levels where it could make swing highs along its path at approx 14300, 15000, 18000 & 20000.

Keep in mind where I have plotted Intermediate Wave 3 could also be an expanded Wave B. Therefore, keep an alternate count in hand till it gives more and more confirmation for bullishness.

I am going with the probability of this being a bullish structure as of now

All the best

Midnifty Intraday Analysis for 06th June 2025NSE:NIFTY_MID_SELECT

Volatility expected on RBI June’25 MPC Meeting outcome.

Index has immediate resistance near 13025 – 13050 range and if index crosses and sustains above this level then may reach 13250 – 13275 range.

Midnifty has immediate support near 12775 – 12750 range and if this support is broken then index may tank near 12650 – 12625 range.

Midnifty Intraday Analysis for 05th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13000 – 13025 range and if index crosses and sustains above this level then may reach 13200 – 13225 range.

Midnifty has immediate support near 12675 – 12650 range and if this support is broken then index may tank near 12525 – 12500 range.

Midnifty Intraday Analysis for 04th June 2025NSE:NIFTY_MID_SELECT

Index has immediate resistance near 12850 – 12875 range and if index crosses and sustains above this level then may reach 13075 – 13100 range.

Midnifty has immediate support near 12525 – 12500 range and if this support is broken then index may tank near 12400 – 12375 range.