Oracle Financial Services Software Limited

No trades

What traders are saying

OFSS - STWP Equity SnapshotSTWP Equity Snapshot – OFSS (Educational | Chart-Based Interpretation)

📌 Intraday Reference Levels (Structure-based)

Reference Price Zone: 7,841

Risk Reference (Structure Invalidation): 7,432.87

Observed Upside Zones: 8,330.75 → 8,657.26

📌 Swing Reference Levels (Hybrid Model | 2–5 days | Observational)

Reference Price Zone: 7,841

Risk Reference (Structural Breakdown): 7,324.35

Higher Range Projection (If structure sustains): 8,874.29 → 9,649.27

Key Levels – Daily TF

Support: 7,643 | 7,455 | 7,356

Resistance: 7,931 | 8,030 | 8,219

🔍 STWP Market Read

Oracle Financial Services Software Ltd is attempting a base-building recovery after a prolonged corrective phase. Price has recently reacted positively from a defined demand zone, while overhead supply remains visible across clustered resistance bands. The latest rebound reflects improving participation, though confirmation is still evolving.

Momentum indicators are balanced rather than aggressive, with RSI near 48.48, suggesting stabilization without overextension. Volume remains around average (Vol X ~1.46), indicating participation but not yet a decisive expansion. Overall, the structure points to early stabilization with conditional upside, while risk remains elevated until price sustains beyond nearby supply.

📊 Chart Structure & Indicator Summary

Structure: Corrective base with early rebound

Trend: Improving, not yet dominant

Momentum: Strong recovery attempt, still developing

RSI: Healthy zone — neither stretched nor weak

MACD & ADX: Gradual improvement, trend strength building

Volume: Moderate, awaiting confirmation

📈 Final Outlook (Condition-Based)

Momentum: Strong (developing)

Trend: Improving / Early up-bias

Risk: High (overhead supply & confirmation pending)

Volume: Moderate

💡 STWP Learning Note

Recoveries are processes, not events. Strong outcomes emerge when price structure, momentum, and volume align over time — patience and risk discipline remain essential.

⚠️ Disclaimer:

This is an educational market interpretation based on chart structure and publicly available data. It is not a recommendation, advice, or solicitation. Equity markets involve risk. Please consult a SEBI-registered financial advisor before taking any investment or trading decision.

📘 STWP Approach:

Observe momentum. Respect risk. Let structure guide decisions.

💬 Did this add value?

🔼 Boost to support structured learning

✍️ Share your views or questions in the comments

🔁 Forward to traders who value disciplined analysis

👉 Follow for clean, probability-driven STWP insights

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

ORACLE FINANCIAL SERVICES SOFTWARE ( 1D ) 🎯 TRADING PLAN 🎯

✔ Price Action shows strong

Resistance at the 61.80% Fibonacci

Retracement with a Bearish Harami

Candlestick Pattern.

✔ RSI being Overbought adds weight to

The setup.

💡 Good Trader's focus on protecting their

Money. Bad Trader's focus on making

Money.

Disclaimer : All information is for

Educational & Informational

Purpose only. Not a buy / sell

Recommendation. You are

Solely responsible for your

Trading & Investment decision.

This IT stock is all ready to shootOFSS CMP 8724

Elliott - yet another example of how 4th waves tend to cluster together. This is the 5th wave and the last of the impulse waves. Hence expect a strong move from here.

Fib - the dip has halted at 50% of the rally which is strength.

RSI - the oscillator below the MA cross and above the bull zone is telling me its ready to take off.

Conclusion - this stock is a clear indication to me that the fall in IT is over. Every other stock that I follow is showing that it is ready to propel.

OFSS (ORACLE FIN SERVICE) By KRS Charts5th June 2025 / 12:35 PM

Why OFSS?

1. Fundamentally Good Company.

2. Technically, Bullish Stock for a long time and here again made higher low on bigger time frame.

3. Wave Theory vice it bounces back from 4th impulsive wave (Depth of Correction).

4. After that it has formed few bullish charts pattern like Invt. Head & Shoulder and Flag and Pole is also visible within.

5. Yesterday it Broke Neckline with good volume green candle.

Targets & SL (1D Closing Basis) is mentioned in Chart

ORACLE in BULL phase💻 ORACLE FIN SERV SOFT LTD | Technical Outlook (Daily Chart) – June 22, 2025

Strong bullish signals are emerging after a well-structured re-accumulation phase:

🟥 Sell-Off Zone Marked around ₹10,500-₹11,000 followed by a deep retracement—classic shakeout behavior.

🌊 “Spring” near ₹7,800 hinted at absorption and buyer re-entry.

📈 Higher Highs + Mark-Up Phase in motion—price reclaimed prior resistance with confidence.

🔊 Volume Breakout Confirmed post 30 EMA retest, supporting the rally with solid institutional intent.

🎯 Target in Focus: ₹12,000 in sight as momentum builds above ₹9,300.

Trend structure, volume behavior, and breakout dynamics align for a compelling long setup. Bullish bias intact unless invalidated below ₹8,600.

OFSS Price ActionOracle Financial Services Software Ltd (OFSS) is currently trading around ₹9,030, reflecting a volatile but active price environment. Over the past week, the stock declined by nearly 3%, but it has gained over 6% in the last month and more than 15% in the past three months. Despite this recent recovery, OFSS remains down about 29% over six months and approximately 13% over the past year.

Technically, the stock has faced strong resistance in the ₹9,060–₹9,288 range, with immediate supports at ₹8,837, ₹8,731, and ₹8,611. A close above ₹9,195 could trigger fresh buying momentum, while a sustained move below support levels may signal further downside. Options data indicates heightened volatility, with active trading in both calls and puts near the ₹8,000–₹9,500 strikes.

Fundamentally, OFSS reported a 7.4% year-on-year revenue increase in FY2025, with net income up 7.2% and a robust profit margin of 35%. The company’s earnings per share beat analyst expectations, though revenue was slightly below estimates. The dividend yield stands at a healthy 2.96%, and the company maintains a strong market capitalization above ₹77,000 crore.

Overall, OFSS is showing signs of stabilization after a sharp correction, with short-term price action suggesting a cautious but potentially positive outlook if key resistance levels are breached.

OFSS : Turning Back?📊 Technical Analysis: OFSS – Weekly Chart

🌀 Elliott Wave Count

The chart shows a classic impulsive 5-wave Elliott structure.

Currently, Wave 4 seems to have completed in the zone of ₹6824–₹9253.

The current price action indicates the beginning of Wave 5, targeting significant upside.

🟦 Wave 4 Completion Zone: ₹6824–₹9253

Strong buying interest observed in this zone.

Multiple bullish candles from the support band indicate trend resumption.

Wave structure suggests upside momentum may now pick up.

🟩 Long-Term Target Zone: ₹13,995 – ₹14,889

Based on the projected Wave 5 extension, the upside potential is nearly +70% from current levels.

Ideal for long-term investors and positional traders.

📝 Trade Setup

✅ Entry:

Current Market Price (CMP) ~ ₹8,957

🎯 Targets:

T1: ₹13,995

T2: ₹14,889

❌ Stop Loss:

Weekly close below ₹7,629 (Wave B retracement & structure invalidation)

📈 Risk-Reward Ratio: ~5.54

🔒 Risk per share: ₹1,106

🚀 Potential Gain per share: ₹6,124

🧠 Trade Logic

Strong Elliott wave structure favors Wave 5 continuation.

Risk is well-defined and acceptable for the expected return.

Ideal case of “buying into the start of an impulsive wave”.

📌 Summary:

OFSS has completed its Wave 4 corrective phase and is now positioned for a strong Wave 5 rally. Long-term investors may consider accumulating near current levels for a target of ₹14,800+, maintaining a strict SL below ₹7,620 on a weekly close basis.

OFSS: Setting Up for a Relief Rally?🔍 Introduction

This analysis starts from the 1-hour timeframe, where price action shows signs of exhaustion at the tail end of a 5-wave decline. A classic ending diagonal in wave c, along with bullish RSI divergence, points toward a potential short-term reversal — possibly the start of Wave B in a larger A-B-C corrective structure. We then zoom out to place this setup within a broader W-X-Y correction that began from the 13,220 high.

🕐 1H Chart: Ending Diagonal + RSI Divergence into Key Zone

Following the peak at 9775, price has been declining in what appears to be a ABC zigzag correction. Subwave 5 (within wave c) exhibits ending diagonal behavior, with overlapping internals and weakening thrust. Importantly, RSI has been printing higher lows, diverging strongly against lower price lows — a signal of potential bottoming.

Price is also testing the 1.618 Fibonacci extension level. A decisive breakout above the upper trendline would confirm a likely transition into Wave B.

🟢 Watching closely for a decisive breakout / close above the channel.

📆 Daily Chart: W-X-Y Structure from 13,220 High

Zooming out, ORACLE FIN SERV is unfolding a W-X-Y correction from its 13,220 high:

Wave W completed as a zigzag down to 7038.

Wave X unfolded as a zigzag rally, peaking at 9775. Notably, Wave C of X did not reach 100% of Wave A — signaling internal weakness.

Wave Y is now developing as a red A-B-C structure, with Wave A possibly ending near the 8930 level.

🧠 Conclusion & Key Levels to Watch

Wave A of Y appears to be nearing completion, supported by:

Ending diagonal structure in wave C (1H)

RSI bullish divergence

Price stalling at 1.618 extension

A breakout above the channel could mark the start of Wave B — potentially retracing 38–61.8% of the drop from 9775

📌 This setup offers both short-term and structural clues. I’ll post follow-ups as this unfolds.

⚠️ Disclaimer

This post is for educational purposes only and does not constitute financial advice. Please do your own research and manage risk appropriately.

Take OFSS for 58% upside Take entry at cmp 9680

Target 15239(58%)

Follow below method for your investment:

Buy 10 share at 9680

Buy 20 share at 7680

buy 30 share at 5130

You can start with 1,2,3 or 3,6,9 or 5,10,15 quantity..

5130 is 60% correction level for this counter and biggest support so it cant be break with any fall in future...Thats why we consider this level as a final investment.

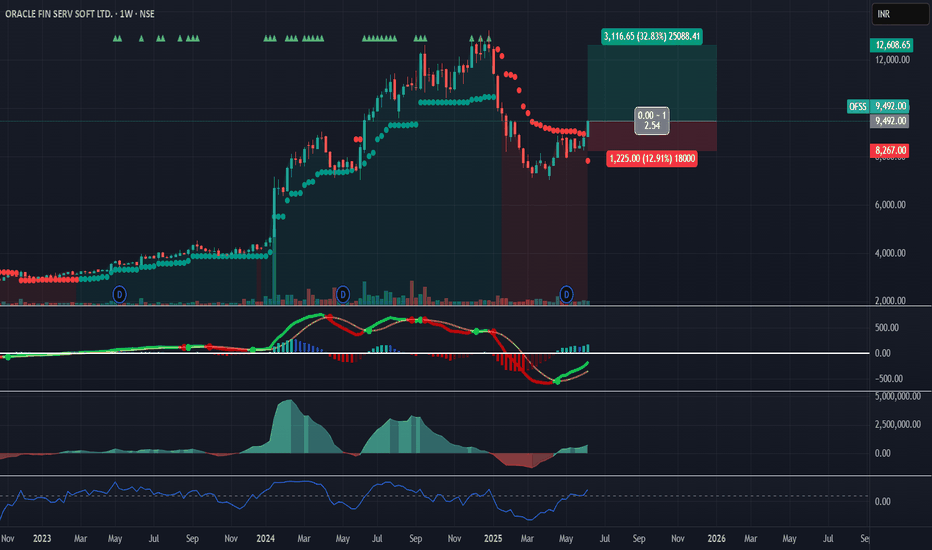

Oracle Fin Serv Soft LTD - Rounding Bottom📈 ORACLE FIN SERV SOFT LTD (OFSS) – Swing Long Setup Forming! 🚀

Ticker: NSE:OFSS

CMP: ₹9,492

Setup: MACD Reversal + Range Retest + PSAR Flip in Progress

Target: ₹12,600+

Upside Potential: +32%

🔍 Why I’m Watching This:

🔸 MACD Bullish Crossover confirmed with green dot + rising histogram

🔸 Price consolidating after a long correction – possible range breakout zone

🔸 PSAR about to flip from red to green on weekly

🔸 RSI recovering from oversold territory

🔸 Decent volume pickup after multi-week downtrend

🎯 Trade Plan:

Entry Zone: ₹9,200–₹9,500

Stop Loss: ₹8,267 (below range low)

Target 1: ₹10,800

Target 2: ₹12,600+

RR: ~2.5:1

A clean high base + confirmation across multiple indicators.

Will build position in legs – trend reversal could play out strong.

💬 What’s your view on OFSS? Are you tracking this too?

📌 Follow me for more high-probability swing setups based on momentum + structure logic.

OFSS | Cup and Handle | Breakout | Daily **Oracle Financial Services Software Ltd. (OFSS)** based on the charts you provided:

---

🔍 **Patterns and Structure Observed:**

* The chart shows a **Cup and Handle breakout** pattern, where the price formed a large rounding bottom (Cup) and a handle consolidation (Triangle).

* The breakout occurred above the **₹8,913** level with strong volume, confirming the bullish move.

---

🔹 **Key Levels:**

* **Breakout Level:** ₹8,913

* **Current Price:** \~₹9,161

* **Immediate resistance zone:** ₹9,538

* **Higher targets:** ₹10,685 based on the measured move of the Cup and Handle pattern.

* **Support zone:** ₹8,900–₹9,000.

---

🔹 **Volume & Momentum:**

* There is a **significant volume spike** at the breakout, suggesting institutional interest.

* If the price sustains above the ₹9,000–₹9,100 zone, the breakout is likely to be validated, with further upside likely.

---

🔹 **Implication:**

As long as the price stays above the breakout zone 8,900, the chart favors further upside toward the next resistance targets. If the price reverses below the ₹8,900 zone, the breakout could be invalidated.

---

OFSS | Symmetrical Triangle | BreakOut |DailyGot it! I see the **ORACLE FIN SERV SOFT LTD** chart.

Let’s break down what we’re seeing:

---

**🔍 Pattern Observed:**

✅ **Symmetrical Triangle / Ascending Triangle:**

The chart shows an **ascending triangle breakout** pattern — higher lows and horizontal resistance. Volume is starting to increase, suggesting an upcoming move.

✅ **Base Formation:**

* There was a **rectangle base** (accumulation zone) from March to April 2025, marked with a box.

* Post breakout from this rectangle (around 8,000 zone), the stock formed higher lows, consolidating into the triangle.

✅ **Resistance:**

* Horizontal resistance around ₹8,913.15 – key breakout level.

* Once price closes above this zone with volume, the pattern confirms.

---

**📈 Measured Move Target:**

* Height of the triangle / base: \~₹1,000

* Breakout level: \~₹8,900

* **Target:** ₹8,900 + ₹1,000 = **₹9,900 – ₹10,000** zone

---

**🔧 Indicators:**

* Volume increased during the breakout attempt – bullish sign.

* EMAs are starting to converge; above EMA-21 and EMA-55, showing short-term trend strength.

---

**✅ Conclusion:**

* **ORACLE FIN SERV SOFT LTD** is attempting an ascending triangle breakout.

* Confirmation comes with a strong close above ₹8,913 on increased volume.

* Target potential: ₹9,900 – ₹10,000.

Would you like me to highlight support/resistance, trendlines, and add potential trade setups (stop-loss/target zones) for this breakout? Let me know! 🚀📊

OFSS Breaks Trend, Enters Oversold ZoneTopic Statement:

OFSS has undergone a major correction in line with the broad market downturn after breaking down from its uptrending channel.

Key points:

- The breakdown from the uptrending channel triggered selling pressure and a sharp correction.

- The price has taken strong support at 7,000.

- The stock is trading below the 180-day EMA, making it oversold.

OFSS at a Critical Demand Zone – A Potential Reversal Ahead?Oracle Financial Services Software (OFSS) has approached a significant technical juncture. Let's dive into the key levels and possible price action scenarios.

📊 Key Observations

OFSS has reached a strong monthly demand zone .

Within this broader demand zone, there is a nested daily demand zone , reinforcing the possibility of a bounce.

Today's price action suggests that the stock is respecting this demand zone, showing signs of potential support.

🔍 What This Means for Traders

If the demand zone holds, we may witness a bullish reaction in the coming sessions. However, a confirmed breakdown below this zone could indicate further downside potential. Watching price action closely near these levels is crucial.

⚠️ Final Thoughts

This analysis is purely for educational purposes and should not be considered trading or investment advice. I am not a SEBI-registered analyst.

💡 "Patience and discipline separate traders from gamblers – let the market confirm your analysis before taking action!"

OFSS Stock of the Week.NSE:OFSS is at a perfect level for a Short Downside Swing as per the price action on daily charts. Although the RSI is in an Oversold Zone it may give a dead cat bounce.

F&O Activity:

11,000 Looks like a Big Resistance With Major Long's being Covered.

Trade Setup:

It can be a Good 1:1 RISK-REWARD Trade for Aggressive Swing Trader if the Level is Breached.

Target(Take Profit):

8866.65 Levels for Swing Trade.

Stop-Loss:

11187.65 Levels for Swing Trade.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FLLOW for more

👍BOOST if useful

✍️COMMENT Below your views.

Meanwhile, check out my other stock ideas below until this trade is activated. I would love your feedback.

Disclaimer: This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Harmonic Shark Pattern in OFSSThe price is trading below the trendline support and B-point support. This indicates that it will fall to the next support region (D point). Once it reaches the D point, buyers will take control of price movement. This is for educational purposes only.

Oracle Financial Services Software Ltd remains a strong player in the financial services IT sector with impressive historical returns and solid financial metrics. While recent price movements have shown volatility, the long-term growth trajectory appears promising based on current market conditions and company fundamentals.