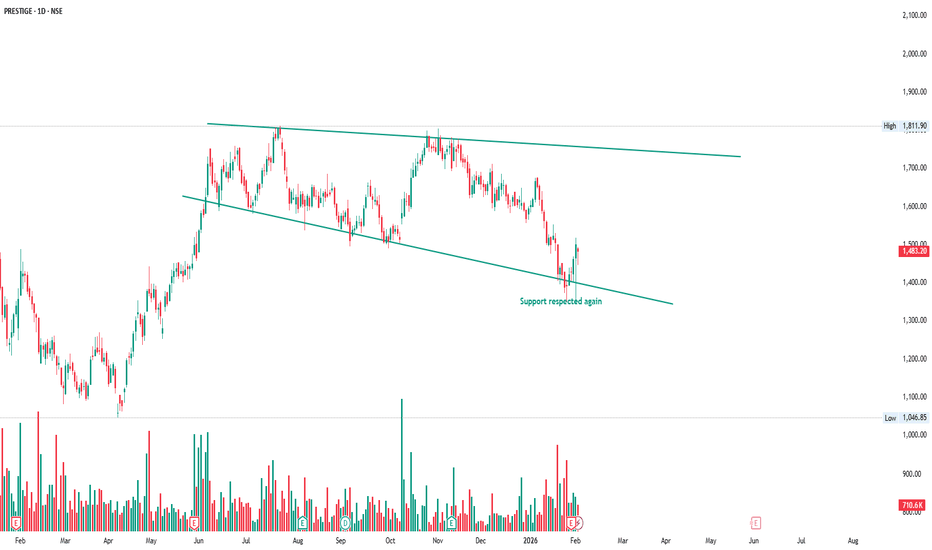

PRESTIGE: Controlled Correction Inside a Falling ChannelPrestige Group is currently moving inside a clear falling channel, where price is making lower highs and lower lows in a controlled manner.

This shows that the stock is going through a correction phase rather than panic selling.

Each time price reaches the upper trendline, sellers step in and push

Prestige Estates Projects Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

22.55 INR

4.67 B INR

76.91 B INR

168.23 M

About Prestige Estates Projects Limited

Sector

Industry

Website

Headquarters

Bangalore

Founded

1997

IPO date

Oct 27, 2010

Identifiers

2

ISIN INE811K01011

Prestige Estates Projects Ltd. engages in the development, construction and leasing of properties. It operates through the following segments: Residential, Retail, Commercial/Office, Property Management and hospitality. The company was founded by Irfan Razack and Rezwan Razack on June 4, 1997 and is headquartered in Bangalore, India.

Related stocks

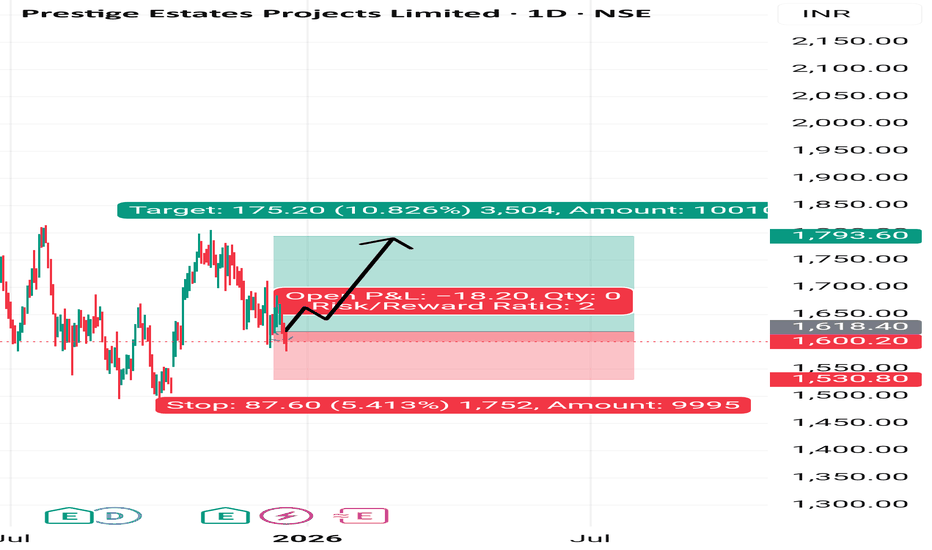

PRESTIGE- LongThis setup shows a strong momentum breakout pattern, combining price action with volume and indicator confirmation. Here’s a step-by-step trading strategy using what’s visible in the chart.

Strategy Overview

1. The upper Bollinger Band is expanding, suggesting volatility is rising and a big move ma

Prestige on breakout, this is ready to fly in blue sky!Hey Traders! Today, I’m sharing a stock that has broken out from a falling resistance trendline. This breakout sets the stage for a potential move towards its all-time high zone. It looks promising for both short-term and long-term trades. In my opinion, this could be a solid trade for the next few

PRESTIGE – Bullish Continuation with Aggressive Call Build-Up________________________________________________________________________________📈 PRESTIGE – Bullish Continuation with Aggressive Call Build-Up

📅 Setup Date: 18.07.2025 | ⏱ Timeframe: Daily

📍 Strategy: Options Trade Setup

______________________________________________________________________________

Buy Prestige Estate target 1773/1831

After completion of sub-wave 3 of wave (iii) on 9 June, Prestige Estate has been undergoing correction in the form of a flat (3-3-5) (sub-wave 4) and in all probability has completed the same.

All the wave markings are given in the chart.

It is expected that stock may complete sub-wave 5 (i.e.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PRESTIGE is 1,530.40 INR — it has increased by 0.57% in the past 24 hours. Watch Prestige Estates Projects Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Prestige Estates Projects Limited stocks are traded under the ticker PRESTIGE.

PRESTIGE stock has fallen by −2.26% compared to the previous week, the month change is a 0.91% rise, over the last year Prestige Estates Projects Limited has showed a 27.25% increase.

We've gathered analysts' opinions on Prestige Estates Projects Limited future price: according to them, PRESTIGE price has a max estimate of 2,300.00 INR and a min estimate of 1,350.00 INR. Watch PRESTIGE chart and read a more detailed Prestige Estates Projects Limited stock forecast: see what analysts think of Prestige Estates Projects Limited and suggest that you do with its stocks.

PRESTIGE reached its all-time high on Jun 24, 2024 with the price of 2,074.80 INR, and its all-time low was 57.55 INR and was reached on Dec 20, 2011. View more price dynamics on PRESTIGE chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PRESTIGE stock is 1.76% volatile and has beta coefficient of 2.17. Track Prestige Estates Projects Limited stock price on the chart and check out the list of the most volatile stocks — is Prestige Estates Projects Limited there?

Today Prestige Estates Projects Limited has the market capitalization of 653.29 B, it has increased by 3.15% over the last week.

Yes, you can track Prestige Estates Projects Limited financials in yearly and quarterly reports right on TradingView.

Prestige Estates Projects Limited is going to release the next earnings report on Jun 2, 2026. Keep track of upcoming events with our Earnings Calendar.

PRESTIGE earnings for the last quarter are 5.20 INR per share, whereas the estimation was 14.85 INR resulting in a −64.98% surprise. The estimated earnings for the next quarter are 9.76 INR per share. See more details about Prestige Estates Projects Limited earnings.

Prestige Estates Projects Limited revenue for the last quarter amounts to 38.73 B INR, despite the estimated figure of 29.49 B INR. In the next quarter, revenue is expected to reach 28.20 B INR.

PRESTIGE net income for the last quarter is 2.23 B INR, while the quarter before that showed 4.30 B INR of net income which accounts for −48.27% change. Track more Prestige Estates Projects Limited financial stats to get the full picture.

Yes, PRESTIGE dividends are paid annually. The last dividend per share was 1.80 INR. As of today, Dividend Yield (TTM)% is 0.12%. Tracking Prestige Estates Projects Limited dividends might help you take more informed decisions.

Prestige Estates Projects Limited dividend yield was 0.15% in 2024, and payout ratio reached 16.09%. The year before the numbers were 0.15% and 5.25% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 17, 2026, the company has 9.51 K employees. See our rating of the largest employees — is Prestige Estates Projects Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Prestige Estates Projects Limited EBITDA is 37.06 B INR, and current EBITDA margin is 38.95%. See more stats in Prestige Estates Projects Limited financial statements.

Like other stocks, PRESTIGE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Prestige Estates Projects Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Prestige Estates Projects Limited technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Prestige Estates Projects Limited stock shows the neutral signal. See more of Prestige Estates Projects Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.