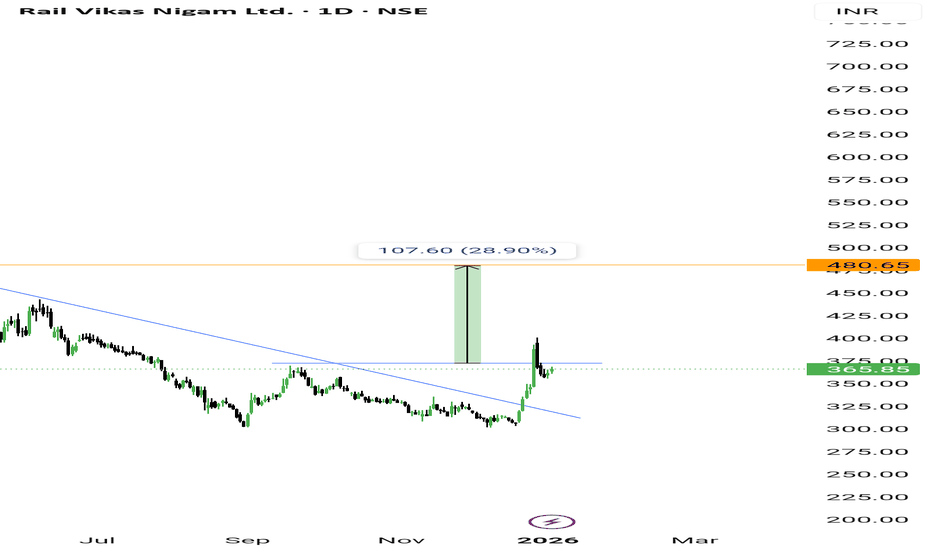

RVNL 1 Week Time Frame 📍 Current Status (as of latest market data):

RVNL trading around ₹356–₹360 on NSE/BSE.

📈 Key Levels for this Week (Intraday / Swing)

🔹 Resistance Levels

1. ₹369‑₹373 — Immediate resistance zone where short‑term counter may face selling pressure.

2. ₹377‑₹380 — Higher resistance; a breakout above

Rail Vikas Nigam Ltd.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.45 INR

12.81 B INR

199.23 B INR

566.28 M

About Rail Vikas Nigam Ltd.

Sector

Industry

CEO

Saleem Ahmad

Website

Headquarters

New Delhi

Founded

2003

IPO date

Apr 11, 2019

Identifiers

2

ISIN INE415G01027

Rail Vikas Nigam Ltd. engages in the development and construction of railway infrastructure. The firm also provides vital port linkage including the corridors connecting the port of Hinterlands. It railway projects include new lines, doubling, gauge conversion, railway electrification, metro projects, workshops, major bridges, construction of cable stayed bridges, and institution buildings. The company was founded on January 24, 2003 and is headquartered in New Delhi, India.

Related stocks

RVNL Can Give 20–30% Upside Move🚀 One Stock That Can Give 20–30% Upside Move

Stock: RVNL Limited 🚆 - NSE:RVNL

🔥 Why This Stock Is On The Radar

• Railways capex cycle remains strong with execution visibility

• Order inflow momentum continues to support earnings outlook

• PSU rail stocks remain leadership names in the current

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that

RVNL 1 Week Time Frame 📊 Recent Price Context

RVNL has been rallying sharply this week, up ~20–25% over the last 5–7 sessions amid sector optimism (rail fares hike & pre‑budget buying).

Current prices have now moved well off recent lows and are trading near short‑term resistance zones.

📈 Key Levels to Watch (1‑Week Swi

RVNL – Technical Setup Analysis RVNL has been in a sustained downtrend over the past few weeks, marked by consistent lower highs and lower lows. Recently, the selling pressure has started to fade near the ₹300 zone, leading to price stabilization and consolidation.

On the daily chart, ₹300 has emerged as a very strong support lev

RVNL cmp 319.15 by Daily Chart viewRVNL cmp 319.15 by Daily Chart view

- Support Zone 294 to 306 Price Band

- Resistance Zone 332 to 345 Price Band

- Support Zone tested retested over past few days

- Support Zone since January 2025 seems been sustained

- Volumes below avg traded quantity, need to increase for fresh upside

- Breakout

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RVNL is 343.40 INR — it has increased by 0.57% in the past 24 hours. Watch Rail Vikas Nigam Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Rail Vikas Nigam Ltd. stocks are traded under the ticker RVNL.

RVNL stock has risen by 3.75% compared to the previous week, the month change is a −4.74% fall, over the last year Rail Vikas Nigam Ltd. has showed a −20.69% decrease.

We've gathered analysts' opinions on Rail Vikas Nigam Ltd. future price: according to them, RVNL price has a max estimate of 334.00 INR and a min estimate of 204.00 INR. Watch RVNL chart and read a more detailed Rail Vikas Nigam Ltd. stock forecast: see what analysts think of Rail Vikas Nigam Ltd. and suggest that you do with its stocks.

RVNL reached its all-time high on Jul 15, 2024 with the price of 647.00 INR, and its all-time low was 10.00 INR and was reached on Mar 24, 2020. View more price dynamics on RVNL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RVNL stock is 3.95% volatile and has beta coefficient of 2.50. Track Rail Vikas Nigam Ltd. stock price on the chart and check out the list of the most volatile stocks — is Rail Vikas Nigam Ltd. there?

Today Rail Vikas Nigam Ltd. has the market capitalization of 712.03 B, it has increased by 2.31% over the last week.

Yes, you can track Rail Vikas Nigam Ltd. financials in yearly and quarterly reports right on TradingView.

Rail Vikas Nigam Ltd. is going to release the next earnings report on Feb 5, 2026. Keep track of upcoming events with our Earnings Calendar.

RVNL net income for the last quarter is 2.30 B INR, while the quarter before that showed 1.35 B INR of net income which accounts for 71.18% change. Track more Rail Vikas Nigam Ltd. financial stats to get the full picture.

Yes, RVNL dividends are paid annually. The last dividend per share was 1.72 INR. As of today, Dividend Yield (TTM)% is 0.50%. Tracking Rail Vikas Nigam Ltd. dividends might help you take more informed decisions.

Rail Vikas Nigam Ltd. dividend yield was 0.49% in 2024, and payout ratio reached 27.99%. The year before the numbers were 0.83% and 28.37% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jan 31, 2026, the company has 885 employees. See our rating of the largest employees — is Rail Vikas Nigam Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Rail Vikas Nigam Ltd. EBITDA is 9.42 B INR, and current EBITDA margin is 5.88%. See more stats in Rail Vikas Nigam Ltd. financial statements.

Like other stocks, RVNL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Rail Vikas Nigam Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Rail Vikas Nigam Ltd. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Rail Vikas Nigam Ltd. stock shows the sell signal. See more of Rail Vikas Nigam Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.