UPL: The Post-Budget Recovery Play!UPL is currently in a high momentum phase. Following a volatile Budget Day where the broader market crashed, UPL staged a powerful recovery on February 2, surging over 5-6% to hit an intraday high of ₹706.90.

This rally was fueled by Q3 FY26 results that beat street estimates, featuring 12% revenue

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

20.80 INR

7.59 B INR

464.51 B INR

564.02 M

About UPL Limited

Sector

Industry

CEO

Jaidev Rajnikant Shroff

Website

Headquarters

Mumbai

Founded

1969

IPO date

Feb 26, 1996

Identifiers

2

ISIN INE628A01036

UPL Ltd. engages in the business of manufacturing and sale of pesticides, insecticide, and micronutrients. It operates through the following segments: Crop Protection, Seeds Business, and Non-Agro. The Crop Protection segment includes the manufacture and marketing of conventional agrochemical products, and other agricultural related products. The Seeds Business segment manufactures seeds. The Non-Agro segment focuses on the manufacturing and marketing of industrial chemical and other non-agricultural related products. The company was founded by Rajnikant Devidas Shroff on May 29, 1969 and is headquartered in Mumbai, India.

Related stocks

UPL Short Trade Setup UPL has broken a prior pivot low signaling potential weakness. Price is retracing toward supply zone which aligns with the 50 and 21 EMA confluence on the daily chart—a strong area of resistance.

This zone offers a high-probability short entry, targeting a move back toward the higher time frame d

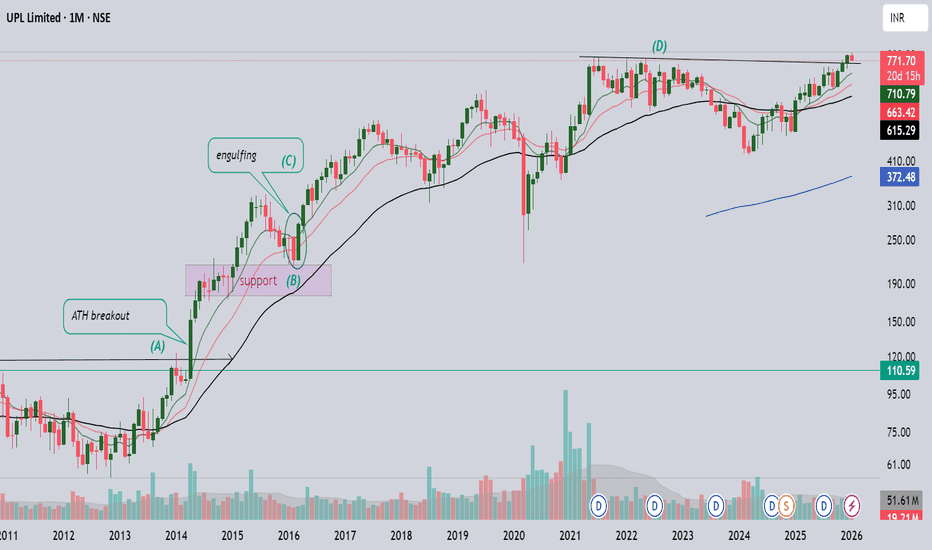

UPL LIMITEDI have a chart open on TradingView in the monthly time frame.

The focus here is on identifying entry opportunities using support and resistance levels. The black trend line on the chart shows a clear all-time high breakout, which could have been a valid entry point. After the breakout, the stock mo

UPL - Multi time frame analysis...Happy New Year, my dear followers!!! 🎉

The price in the lower time frame(15 minutes) and higher time frame(daily) is forming a bull flag breakout pattern, which is bullish.

We can use the lower time frame for trade entry.

Support zones are 780 and 800.

Buy above 801 - 804 with the stop loss of 796 f

UPL 1 Week Time Frame 📌 Current Price Snapshot

Approx Current Price (NSE): ₹770–₹780 range (varies slightly by source and time) — ~₹774 area recently quoted.

52‑week High: ~₹786.30

52‑week High: ~₹786.30

📊 Weekly Support & Resistance (Accurate Levels)

🔥 Key Weekly Pivot (Bias Level)

Weekly Pivot: ~₹770.8–₹773.8 — cent

12 MONTHS CANDLE_UPL_LONGTERM TRADEHi traders,

Posting the interesting Topic on UPL with Technical Analysis long-term view.

Currently UPL is trading at INR 787.35 with longer term bullish basis.

Entry at current level with stoploss of 12 Months low. Ride the trend until it closes previous yearly low price or Market Structure.

Not

Best to exit this counterUPL CMP 772

Elliott- The entire rally post the 2020 correction is corrective in rally. The current rally is also corrective in nature. The stock has reached its previous highs and is a natural resistance. To me a fresh set of three wave correction should start from here. The correction should be

UPL - Multi time frame analysisThe price is consolidating between the range of 710 to 720. Buying levels are 710, 720, depending on your trading style. As per the daily chart, the price is giving a trend line breakout.

Buy above 715 to 718 with the stop loss of 705 for the targets 724, 736, 748 and 756.

If the price shows bearis

UPLUPL remains technically bullish, trading above its rising trendline and key moving averages, with price consolidating in a healthy ascending channel near resistance. Momentum indicators like RSI (~62) and MACD above the zero line suggest continuation rather than exhaustion. As long as the stock hold

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

UPLC5000773

UPL Corporation Limited 4.625% 16-JUN-2030Yield to maturity

5.70%

Maturity date

Jun 16, 2030

UPLC4611648

UPL Corporation Limited 4.5% 08-MAR-2028Yield to maturity

5.65%

Maturity date

Mar 8, 2028

78KL45

Kerala Enviro Infrastructure Ltd. 7.8% 02-NOV-2045Yield to maturity

—

Maturity date

Nov 2, 2045

See all UPL bonds

EEDM

iShares IV PLC - iShares MSCI EM CTB Enhanced ESG UCITS ETF Unhedged USDWeight

0.18%

Market value

17.74 M

USD

EDM2

iShares IV PLC - iShares MSCI EM CTB Enhanced ESG UCITS ETF Accum Shs Unhedged USDWeight

0.18%

Market value

17.74 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of UPL is 746.00 INR — it has increased by 0.26% in the past 24 hours. Watch UPL Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange UPL Limited stocks are traded under the ticker UPL.

UPL stock has risen by 0.54% compared to the previous week, the month change is a −5.45% fall, over the last year UPL Limited has showed a 16.34% increase.

We've gathered analysts' opinions on UPL Limited future price: according to them, UPL price has a max estimate of 980.00 INR and a min estimate of 630.00 INR. Watch UPL chart and read a more detailed UPL Limited stock forecast: see what analysts think of UPL Limited and suggest that you do with its stocks.

UPL stock is 2.17% volatile and has beta coefficient of −0.17. Track UPL Limited stock price on the chart and check out the list of the most volatile stocks — is UPL Limited there?

Today UPL Limited has the market capitalization of 627.89 B, it has increased by 2.20% over the last week.

Yes, you can track UPL Limited financials in yearly and quarterly reports right on TradingView.

UPL Limited is going to release the next earnings report on May 11, 2026. Keep track of upcoming events with our Earnings Calendar.

UPL earnings for the last quarter are 5.40 INR per share, whereas the estimation was 6.46 INR resulting in a −16.41% surprise. The estimated earnings for the next quarter are 15.10 INR per share. See more details about UPL Limited earnings.

UPL Limited revenue for the last quarter amounts to 122.69 B INR, despite the estimated figure of 115.66 B INR. In the next quarter, revenue is expected to reach 169.79 B INR.

UPL net income for the last quarter is 3.96 B INR, while the quarter before that showed 5.53 B INR of net income which accounts for −28.39% change. Track more UPL Limited financial stats to get the full picture.

Yes, UPL dividends are paid annually. The last dividend per share was 6.00 INR. As of today, Dividend Yield (TTM)% is 0.81%. Tracking UPL Limited dividends might help you take more informed decisions.

As of Feb 10, 2026, the company has 12 K employees. See our rating of the largest employees — is UPL Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. UPL Limited EBITDA is 95.49 B INR, and current EBITDA margin is 17.17%. See more stats in UPL Limited financial statements.

Like other stocks, UPL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade UPL Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So UPL Limited technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating UPL Limited stock shows the buy signal. See more of UPL Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.