Breakout from Rounding Base after Long Consolidation in VoltasNSE:VOLTAS

📈Pattern & Setup:

Voltas has formed a large rounding base over many months after staying under pressure from the prior decline. Price has now pushed into the major horizontal resistance zone near 1,520–1,540, where supply had repeatedly emerged earlier.

Today’s move shows a decisive

Voltas Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

15.15 INR

8.41 B INR

153.84 B INR

217.75 M

About Voltas Limited

Sector

Industry

CEO

C. P. Mukundan Menon

Website

Headquarters

Mumbai

Founded

1954

IPO date

Nov 7, 1994

Identifiers

2

ISIN INE226A01021

Voltas Ltd. engages in the provision of engineering solutions. It operates through the following business segments: Electro-Mechanical Projects and Services; Engineering Products and Services; and Unitary Cooling Products for Comfort and Commercial Use. The Electro-Mechanical Projects and Services segment includes electrical, heating, ventilation, and air conditioning, plumbing, fire fighting, extra low voltages, and specialized services. The Engineering Products and Services segment comprises of textile machinery, and mining and construction equipment. The Unitary Cooling Products for Comfort and Commercial Use segment engages in manufacturing, selling and after sales services of cooling appliances and cold storage products. The company was founded on September 6, 1954 and is headquartered in Mumbai, India.

Related stocks

VOLTAS 1 Week Time Frame 💹 Current price range (approx): ₹1,430–₹1,485 (varies across platforms).

📊 Key Levels for Next Week

🔼 Upside / Resistance Levels

These are levels where price might face supply/selling pressure this week:

₹1,480–₹1,500 — near recent peaks and psychological zone

₹1,500–₹1,520 — secondary resistanc

$VOLTAS — watchout Double Bottom Breakout

Voltas formed a clear Double Bottom pattern, signaling a potential trend reversal.

Price broke above the neckline, confirming bullish strength and shift in momentum.

Post-breakout, the stock showed strong follow-through buying.

The pattern-measured target is 1444 .

The move validates the

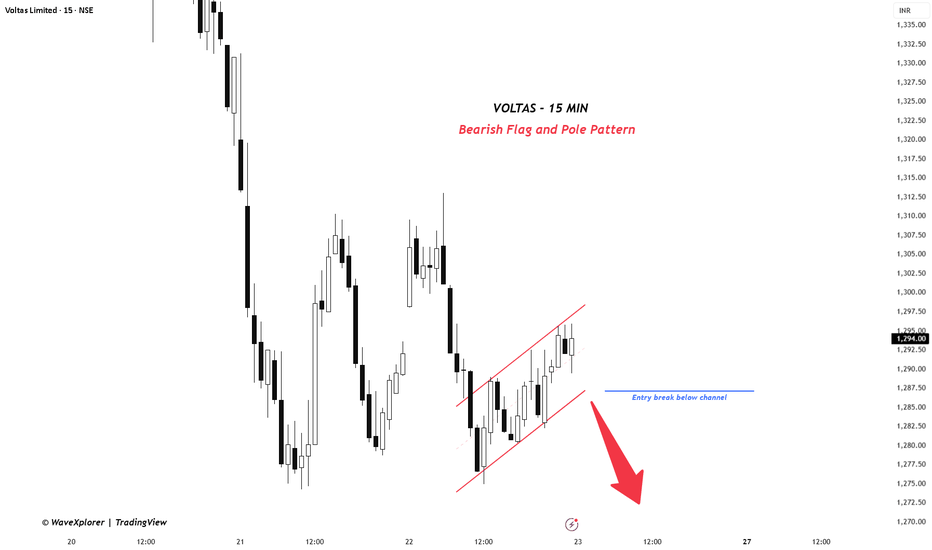

VOLTAS (15-Min) – Bearish Flag in PlayVOLTAS is forming a classic bearish flag & pole on the 15-minute timeframe. The sharp decline marks strong selling pressure, followed by a slow, overlapping upward channel, which is corrective in nature.

As long as price remains within this rising flag, the structure stays intact. A breakdown below

A Completed Impulse Now Gives Way to Correction in VoltasFrom its inception low near ₹2.60 , Voltas has unfolded a clear long-term 5-wave impulsive advance on the monthly timeframe , culminating near ₹1,994.90 . The structure of this move aligns well with classical Elliott Wave principles, suggesting that a larger-degree impulse cycle has likely con

Voltas Bullish viewThe 3% move created by Voltas, has changed the trend of the stock.

The demand zone at 1390 level and a trap zone at 1365 levels considered can be a bullish opportunity with the stock beginning to make up-move and at low range on higher time frame.

The move created has broken a prior pivot too.

VOLTAS Near Trendline Base – Reversal Structure Taking ShapeVoltas has been trading inside a long-term falling channel, but recent price action shows a clear shift from weakness to base formation near the lower channel support. The stock has repeatedly defended this rising support line, indicating strong demand at lower levels.

After a prolonged downtrend,

VOLTAS – Support Touch Inside Rising Channel | Bounce SetupDescription

VOLTAS has been moving inside a rising channel for several months — creating higher highs and higher lows.

Both the top and bottom trendline's are respected multiple times (marked by circles), proving this channel is valid and strong.

Recently:

The stock fell from the top of the chann

VOLTAS | Demand Zone Setup❄️ VOLTAS | Demand Zone Setup

- Chart Context: VOLTAS is currently trading near a historically respected demand zone on the daily chart.

- Zone Behavior: Multiple revisits to the zone with rejection wicks and tight-range candles suggest strong buyer defense.

- Historical Significance: The zone align

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

EEDM

iShares IV PLC - iShares MSCI EM CTB Enhanced ESG UCITS ETF Unhedged USDWeight

0.17%

Market value

18.39 M

USD

EDM2

iShares IV PLC - iShares MSCI EM CTB Enhanced ESG UCITS ETF Accum Shs Unhedged USDWeight

0.17%

Market value

18.39 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of VOLTAS is 1,525.40 INR — it has decreased by −0.68% in the past 24 hours. Watch Voltas Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Voltas Limited stocks are traded under the ticker VOLTAS.

VOLTAS stock has risen by 7.42% compared to the previous week, the month change is a 4.55% rise, over the last year Voltas Limited has showed a 17.34% increase.

We've gathered analysts' opinions on Voltas Limited future price: according to them, VOLTAS price has a max estimate of 1,900.00 INR and a min estimate of 1,100.00 INR. Watch VOLTAS chart and read a more detailed Voltas Limited stock forecast: see what analysts think of Voltas Limited and suggest that you do with its stocks.

VOLTAS reached its all-time high on Sep 20, 2024 with the price of 1,944.90 INR, and its all-time low was 2.60 INR and was reached on Oct 17, 2000. View more price dynamics on VOLTAS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

VOLTAS stock is 1.70% volatile and has beta coefficient of 0.86. Track Voltas Limited stock price on the chart and check out the list of the most volatile stocks — is Voltas Limited there?

Today Voltas Limited has the market capitalization of 504.67 B, it has increased by 9.98% over the last week.

Yes, you can track Voltas Limited financials in yearly and quarterly reports right on TradingView.

Voltas Limited is going to release the next earnings report on May 13, 2026. Keep track of upcoming events with our Earnings Calendar.

VOLTAS earnings for the last quarter are 2.57 INR per share, whereas the estimation was 3.41 INR resulting in a −24.73% surprise. The estimated earnings for the next quarter are 9.93 INR per share. See more details about Voltas Limited earnings.

Voltas Limited revenue for the last quarter amounts to 30.71 B INR, despite the estimated figure of 31.88 B INR. In the next quarter, revenue is expected to reach 53.37 B INR.

VOLTAS net income for the last quarter is 849.50 M INR, while the quarter before that showed 342.90 M INR of net income which accounts for 147.74% change. Track more Voltas Limited financial stats to get the full picture.

Yes, VOLTAS dividends are paid annually. The last dividend per share was 7.00 INR. As of today, Dividend Yield (TTM)% is 0.46%. Tracking Voltas Limited dividends might help you take more informed decisions.

Voltas Limited dividend yield was 0.48% in 2024, and payout ratio reached 27.53%. The year before the numbers were 0.50% and 72.22% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 15, 2026, the company has 14.6 K employees. See our rating of the largest employees — is Voltas Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Voltas Limited EBITDA is 7.59 B INR, and current EBITDA margin is 7.26%. See more stats in Voltas Limited financial statements.

Like other stocks, VOLTAS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Voltas Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Voltas Limited technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Voltas Limited stock shows the buy signal. See more of Voltas Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.