SOLUST trade ideas

$SOL 15mins Chart Analysis CRYPTOCAP:SOL 15mins Chart Analysis

A Head & Shoulders pattern has formed with the left shoulder near 210, head at 212, and right shoulder around 211.

Key Technical Levels

Neckline Support: Around 208 – if this breaks decisively, we could see stronger bearish momentum.

Immediate Resistance: 210–212 (right shoulder + recent high). A breakout above invalidates the bearish pattern.

Downside Targets: If the neckline fails, price could test 205 → 202 → 197 support zones.

Bullish Case: Sustaining above 212 would flip the structure invalid, pushing price back into 215–220 zone.

Right now, #SOLANA is at a critical point – holding above the neckline keeps bulls alive, but losing it confirms a bearish breakdown.

Sol 1 Pending Market Crash so wait for thisSol 1 Pending Market Crash so wait for this

Sol 1 Pending Market Crash so wait for thisSol 1 Pending Market Crash so wait for thisSol 1 Pending Market Crash so wait for thisSol 1 Pending Market Crash so wait for thisSol 1 Pending Market Crash so wait for thisSol 1 Pending Market Crash so wait for thisSol 1 Pending Market Crash so wait for this

[SeoVereign] SOLANA BULLISH Outlook – August 11, 2025Recently, Solana’s price movement has been showing a very classic Elliott Wave pattern.

Based on this, I would like to present a bearish outlook this time.

The basis for this idea is as follows:

Wave 5 = 50% of the length of Waves 0–3

Wave 5 = equal length to Wave 1 (1:1 ratio)

In addition, the fact that Wave 5 is forming an ending diagonal pattern strongly suggests the possibility of a decline.

Please refer to the chart for more details.

Accordingly, the first target price has been set at 175 USDT.

I plan to continue updating this idea as the movement unfolds.

Thank you.

SOL/USDT weekly chart1. Price Structure & Break of Structure (BOS)

• The chart shows a clear break of structure:

• Price has broken above the previous lower high formed during the last downtrend (~$170–$175 zone).

• This suggests a shift from bearish to bullish market structure on the weekly timeframe.

• Current price: $178.97 — retesting the broken structure zone.

• Major resistance: ~$200 (historical rejection area).

• Major support: ~$150–$155 zone (recent higher low + strong buying interest).

⸻

2. Volume

• Volume appears relatively low compared to the large green bars seen during the late 2023–early 2024 rally.

• A breakout above $200 will require higher-than-average volume to confirm buyer commitment.

⸻

3. RSI (14 close)

• Currently around 55–60, which is in the neutral-to-bullish zone.

• RSI has been making higher lows, aligning with bullish momentum.

• No overbought conditions yet — room for upward movement.

⸻

4. MACD (12,26 close)

• MACD line crossed above signal line recently, signaling bullish momentum.

• Histogram turning positive, indicating increasing bullish pressure.

• Still in early stages of an uptrend cycle from a MACD perspective.

⸻

5. Key Takeaways

• Market Structure: Bullish shift confirmed on the weekly after BOS.

• Momentum: RSI & MACD both show strengthening bullish conditions.

• Caution: $200 remains a key psychological and technical resistance — could trigger profit-taking.

• Bullish Scenario: If $200 breaks with strong volume, next targets could be $240, then $260+.

• Bearish Scenario: If price fails at $200 and closes below $170, could retest $150 support.

SOLANA CHART For shorts📉 SOL/USDT - Short Setup (1H TF)

Price has tapped into a significant resistance zone around $179–$185, where it faced immediate rejection. This zone aligns with multiple supply levels and previous price reaction areas. The current rejection hints at a possible short-term reversal or retracement.

🔻 Entry: $179.29 (resistance rejection)

🎯 Target 1 (TP1): $174.90

🛑 Stop Loss: $185.77

📊 Risk/Reward Ratio: Favorable (~1:2)

🔍 Technical Highlights:

• Strong bearish rejection from the resistance zone.

• Volume spike indicates potential exhaustion of buyers.

• Clean structure: potential lower high formation after a strong bullish leg.

• Break below $174.90 may open room for deeper retracement toward $172.05 or even $160.15.

⚠️ Notes:

• Monitor BTC for correlation.

• Watch price behavior near TP1 – if it consolidates or holds support, consider partial profit booking.

$SOL's 4-hour chart shows a Falling Wedge pattern

BINANCE:SOLUSDT

CRYPTOCAP:SOL 's 4-hour chart shows a Falling Wedge pattern—get ready for a bullish breakout! 🚀

• Falling Wedge, sloping downward with converging trendlines

• Price has respected both upper and lower bounds of the wedge with multiple touches

• SOLANA corrected from a high of $206 down to the wedge’s base near $174-$176

Latest candle shows buying pressure at the wedge support, hinting at a potential bounce

Support Zone: $174 → $176 (bottom of the wedge)

Resistance to Watch: $184 (upper wedge line), followed by breakout level at $188

Breakout Confirmation: Clean close above $188 on solid volume

📈 Probable Scenarios:

Bullish: Breakout from the wedge could lead to a move back toward $195-$200

Bearish: Rejection at upper wedge line could push price back to test $174 again

Wedge formations after extended rallies often act as bullish continuation patterns. If momentum picks up, CRYPTOCAP:SOL could trigger a short squeeze rally above the $190 mark.

$SOL has printed a falling wedge, a classic bullish reversalBINANCE:SOLUSDT

CRYPTOCAP:SOL has printed a falling wedge, a classic bullish reversal setup, after correcting from the recent high near $206.

🔻 Price compressed inside descending resistance and support lines

🔄 Volume faded – typical in wedge ends

⚡ Breakout potential above $183–185 zone

🟢 Support Zone: $175 – $178

🔴 Resistance Zone: $184.5 – $188

🔼 Breakout Confirmation: Above $188 with volume spike

🎯 Targets ~ $192 – $198 – $204 - $220 - $250

🛑 Suggested SL (if entering on breakout): Below $170

Solana at a Critical Juncture!

BINANCE:SOLUSDT

CRYPTOCAP:SOL has rallied hard from $125 → $192 — a whopping +50% move in just 30 days! But here’s what’s cooking now:

🔺 Rising Wedge Pattern spotted — a structure that often signals trend exhaustion at the top.

Price is hugging the upper trendline

Historically, rising wedges near local highs often precede short-term corrections or fakeouts before breakout

🚨 Key Levels to Watch:

$200–$210 → Breakout zone

$180 → Mid-support, potential bounce zone

$165–$150 → Wedge base and strong demand

➡️ Break above $200 with volume = bullish continuation

⬇️ Breakdown from $180 = pullback toward $150–$165

A breakout from this wedge could catapult CRYPTOCAP:SOL into $230+ territory. But failure here could trigger a retest of lower support.

$BTC 45-min Chart Analysis

Bitcoin 💰 has just completed a clean 5-wave impulse move, peaking near $109K, and is now entering a short-term ABC correction phase.

Wave Count Overview🔎

(1)-(5) impulse wave completed

Wave (a) correction underway – already bounced off local support

Currently tracking Wave (b) relief rally

🔁 Wave B Retracement Key Level

0.618 Fib = $108,004

This level is a critical rejection zone. If CRYPTOCAP:BTC faces resistance here, expect continuation toward Wave C next.

🔻 Short-Term Scenarios

Bearish Case (ABC plays out)

🅰️ Wave (b) bounce may fade near $108K

🅱️ Wave (c) could drag price down toward $105.5K–$106K zone for completion

Bullish Case (Shallow Correction)

Holding above $107K and breaking $108K cleanly could invalidate Wave C

Price may resume impulsive structure if no deeper correction follows

⚠️ Key Observations

This is a standard post-rally correction, not a reversal

No panic unless $105K breaks

Next 12–24 hours crucial: will CRYPTOCAP:BTC reclaim $108K or head into deeper Wave C?

The trend is still bullish — this short-term ABC is a healthy cooldown. If bulls defend above $106K and reclaim $108K, momentum could quickly flip back in favor of a new rally.

SOL/USDT 1H Chart Analysis – Bullish Reversal Targeting Resistan🚀 SOL/USDT 1H Chart Analysis – Bullish Reversal Targeting Resistance Zone 🎯

📊 Pair: SOL/USDT

🕐 Timeframe: 1H

📈 Platform: Binance

🔍 Technical Overview:

🔵 Support Zone (145.00 – 147.50 USDT)

Price has bounced multiple times from this strong demand zone marked in light blue.

Recent price action shows buyers defending this level aggressively — potential accumulation area. ✅

🔴 Resistance Zone (159.50 – 162.00 USDT)

Marked in red, this zone has historically rejected price twice (confirmed by red & yellow arrows).

Currently, the market is expected to retest this supply area once again. ⚠️

📈 Bullish Pathway:

Current structure suggests a reversal from support, aiming for:

TP1: $150.46

TP2: $154.31

TP3 / Final Target: $160.89 (within resistance)

🔄 Trend Structure:

Price is forming higher lows, hinting at early reversal stages.

Break above $150.46 would confirm bullish momentum. 🟢

🧠 Conclusion:

SOL/USDT is setting up for a bullish reversal from a strong support zone, with targets aligned toward previous resistance. Traders should monitor the reaction at $150.46 and $154.31 — a clean break may propel price to $160.89.

📌 Watch for:

Confirmation candle at support zone

Break and retest patterns on intraday resistance levels

📉 Support: 145.00 – 147.50

📈 Resistance: 159.50 – 162.00

🎯 Bullish Targets: 150.46 → 154.31 → 160.89

🔔 Stay updated, manage risk, and trade wisely! 💹📈

Pump.fun Sells $741M in SOL After X Suspension – What’s Really?Pump.fun Sells $741M in SOL After X Suspension – What’s Really Happening?

PumpFun (@pumpdotfun), a popular Solana-based meme token launch platform, was recently suspended from X — but they’ve been making major moves behind the scenes.

Since May 19, 2024, the platform has sold around 4.1 million SOL, worth nearly $741 million, at an average price of $180.

Here’s the full breakdown:

🔹 264,373 SOL sold for $41.64 million USDC at $158

🔹 3.84 million SOL, worth $699 million, sent to Kraken at $182

Why is Pump.fun selling so much?

Is this an exit strategy, or are they just managing risk?

Is $SOL about to DUMP… or set up a MASSIVE BUY ZONE?Is CRYPTOCAP:SOL about to DUMP… or set up a MASSIVE BUY ZONE?

Solana is now at a critical level on the higher timeframe chart:

✅ After a breakdown, SOL is now retesting the bearish retest zone

✅ Strong resistance seen at $170–$180

✅ If rejected → price could dip toward the $100 range

But here’s the key: A dip to $100 would be a massive long-term buying opportunity for many investors (including me).

Long-term targets? I’m still eyeing $500 → $1000 if the macro trend plays out.

👉 Keep a close eye — the next few weeks could set up the next big move for $SOL.

Are you ready? Will you be buying the dip? Comment below! 👇

NFA & DYOR

MY ANALYSIS IS HITTING THE TARGET! WHAT A CATCHING VIEW!🎯🔥 MY ANALYSIS IS HITTING THE TARGET! WHAT A CATCHING VIEW! 🔥🎯

✨📈 Everything is playing out as I expected – let’s keep riding this wave! 🌊💹

🚀 SOL/USDT Analysis Update 🚀

📅 Date: June 11, 2025

📊 Timeframe: 4H

✅ Key Zones & Levels:

🟢 Support Level Zone: 144.00 – 147.24

🔴 Resistance Level Zone: 184.00 – 187.99

⚠️ Mini Support/Resistance: Around 160.00

🎯 Current Price Action:

The price has respected my previously marked Support Zone (🟢), resulting in a strong rebound. After forming a bottom at the support level (marked with green arrows), SOL/USDT is now on an impressive upward move.

🟡 The current upward momentum is targeting the Resistance Level Zone near 187.99.

💡 Expected Movement:

If the price approaches the Resistance Zone (🔴), a reversal may occur, creating a potential short-term sell opportunity. Conversely, if it breaks above, we might see further bullish momentum.

🟦 Potential Path:

🔁 Expect a retest of the resistance zone → Possible rejection → Revisit the mini support (~160.00) before a decisive move either back to support or a breakout above 187.99.

💪 Key Takeaways:

Support Zone held strongly, confirming my analysis.

Mini Support/Resistance acts as a pivot for short-term reactions.

Watch closely as the price nears the Resistance Zone – this will be a key area for possible reversals or breakouts.

🔥 Let’s keep an eye on the next moves! Your feedback and thoughts are always welcome. Happy trading! 💪📈

SOL/USDT 4H Chart Analysis📊 SOL/USDT 4H Chart Analysis

🟢 Key Zones:

🔴 Resistance Level Zone:

Marked at approximately 185–188 USDT

Multiple rejections in this area (red arrows 📉), confirming it as a significant supply zone.

🟩 Support Level Zone:

Found around 140–147 USDT

Price has previously bounced off this zone (green arrows 📈), indicating strong demand.

⚖️ Mini Levels:

🟡 Mini Support/Resistance:

Around 157 USDT, previously acted as both support and resistance (yellow box).

Price reacts to this zone during its downtrend and uptrend, highlighting its significance.

🔮 Current Price Action:

The price is currently at 153.36 USDT.

The recent low was just above 140 USDT, confirming a higher low formation.

A small pullback is visible after testing the support zone.

📝 Trade Outlook & Scenarios:

🔵 Bullish Scenario (Main Bias):

If the price maintains above the support zone (140–147 USDT) and breaks the mini resistance (~157 USDT):

Possible continuation towards the resistance zone (185–188 USDT).

Target 🎯 at 187.99 USDT (highlighted in the yellow zone).

🔴 Bearish Scenario:

If the price breaks below the 140 USDT support:

Downward continuation to 132 USDT or lower, as shown in the chart (red zone).

🔧 Risk Management:

🛑 Stop Loss:

Conservative traders: below 140 USDT (red zone 🚨).

Aggressive traders: below the last swing low (~144 USDT).

💡 Professional Takeaway:

✅ Support and resistance zones are well-defined.

✅ Current bounce from support zone suggests a possible reversal.

✅ A break and close above the mini-resistance at 157 USDT would confirm strength.

✅ Risk management and patience are key for this potential upside move.

SOLANA Short Position Update – June 11, 2025We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

🚀 Boosts provide strong motivation and drive to the SeoVereign team.

--------------------------------------------------------------------------------------------------------

Solana downside perspective shared.

The first target is set at 162.94.

The bearish outlook is based on the Elliott Wave structure and volume flow.

Currently, upward momentum appears to be exhausted, and decreasing volume is increasing the possibility of a trend reversal.

Additional analysis will be shared through an idea update once the first target is reached.

Solana Short Position Update – June 9, 2025We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

--------------------------------------------------------------------------------------------------------

Solana (SOL) Short Position Strategy

DEPP CRAB Short

1st Target: 150

Analysis Summary:

Recently, SOL's price movement faced downward pressure after a short-term rebound and resistance in the overbought zone. From a technical perspective, a short position was taken near the Fibonacci retracement zone and previous resistance level, with targets set based on a gradual decline.

Each target is considered a zone with a high probability of support testing, and a partial take-profit strategy may be effective depending on market conditions. Risk management is essential, and a stop-loss should be set in case of an unexpected rebound.

Solana Short Position Update – June 7, 2025We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

--------------------------------------------------------------------------------------------------------

Solana Short Position Share

Currently, Solana appears to have entered an overbought zone after a technical rebound, and the pattern is reaching the completion area of a 0.382 ratio ALT BAT (Alternative Bat) pattern.

This pattern typically appears in areas with a high possibility of price reversal, and especially the 0.382 retracement is an early reversal form unique to the ALT BAT, indicating conditions where selling pressure in the market may strengthen again.

Accordingly, entering a short position at the current level is considered meaningful in terms of pattern reliability and risk-reward ratio.

The first target price is set at $150, which corresponds to a structural support level and the target range of a short-term corrective wave.

After entry, additional downside targets can be reviewed depending on market flow and candlestick development.

Solana Long Setup – Chart Analysis (June 5, 2025)We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

--------------------------------------------------------------------------------------------------------

Solana technical analysis is presented as follows.

Currently, Solana appears to have entered the final WAVE 5 phase of the 5-wave upward structure. The technical basis is as follows.

WAVE 5 = (WAVE 1 ~ WAVE 3) × 0.618

This length ratio is commonly observed in Elliott Wave Theory and often appears in the final wave of a strong trend. At the current level, this ratio is applied accurately, leaving room for further upside.

Confirmation of the Shark Pattern

One of the advanced harmonic patterns, the Shark pattern, has been completed within a valid zone, acting as a bullish reversal signal. In particular, reversals occurring at the 88.6% and 113% levels provide high reliability.

Comprehensive Assessment

With both of these technical elements satisfied simultaneously, the current level offers a solid basis for entering a long position.

1st target: 158.20

This price level aligns with a major structural resistance and Fibonacci extension zone, making it an appropriate target for short-term profit-taking.

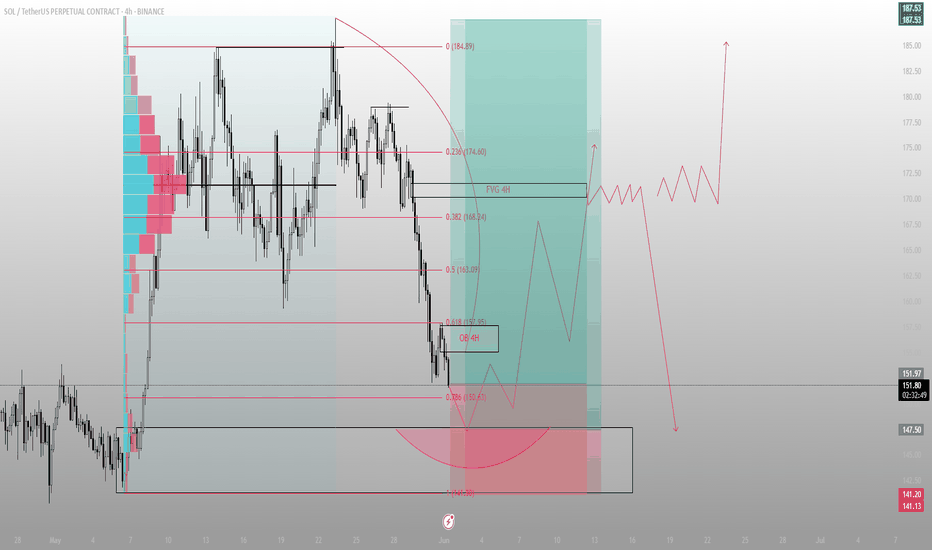

Liquidity tagged. Sentiment shaken. Now the real move begins.SOL just kissed the 0.786 retracement at 150.6 — and did so with precision, not hesitation.

Below that sits a 4H OB that hasn’t been touched since the impulse leg began. That zone, now swept, resets the auction. We’ve completed the delivery cycle down, and Smart Money is reloading while the herd panics.

The rejection from this OB aligns with a thin LVN pocket — a classic bounce zone for engineered reaccumulation. From here, I’m watching for expansion into the inefficiency above: the 4H FVG at 174.6. That’s the draw.

Structure shows that the 163–168 zone (0.5 to 0.382) will act as a decision shelf. If price respects that as a new support, this entire move becomes the foundation for a higher macro expansion into 185+.

If we fail? The resting liquidity at 141 is still untouched.

Execution bias:

🟩 Bid zone: 150.6–147.5 (OB + 0.786)

🎯 Target 1: 163.09

🎯 Target 2: 174.6 (4H FVG)

❌ Invalidation: Full body breakdown below 141.13

This isn’t about catching a bounce.

It’s about understanding where Smart Money needs to rebalance.

I don’t trade candles. I trade consequences.

Bearish Setup Loading on Solana? Bearish Setup Loading on Solana? Watch This Key Level Closely

Solana just retested the breakdown zone after losing key support — currently sitting in a danger zone.

Short Interest Zone: $180 – $190

If this area holds as resistance, we could see another move below $150 soon.

Bearish Setup Invalidation: Break above $200 will flip this bias.

Long-Term View? I’m still super bullish on SOLANA in the bigger picture — my long-term target remains $1000 🚀

Risk Management is Key

Never trade without a STOP LOSS — protect your capital.

This is NOT financial advice — DYOR before investing.

Let the chart guide you, not emotions. Stay sharp.