TCS: Quietly ConstructiveQuarterly Results Snapshot

TCS reported a better-than-expected quarterly performance , with EPS of ₹37.14 versus Dalal Street expectations of ₹35.97 . Revenue also came in marginally higher at ₹670.9 billion compared to estimates of ₹668.3 billion .

While the beat is not outsized, it does

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

131.90 INR

485.53 B INR

2.55 T INR

1.02 B

About Tata Consultancy Services Limited

Sector

Industry

CEO

Kunchitham Krithivasan

Website

Headquarters

Mumbai

Founded

1968

IPO date

Aug 25, 2004

IPO offer price

18.32 USD

Identifiers

2

ISIN INE467B01029

Tata Consultancy Services Limited (TCS) is engaged in providing information technology (IT) services, digital and business solutions. The Company's segments include banking, finance and insurance services (BFSI); manufacturing; retail and consumer packaged goods (CPG); telecom, media and entertainment, and others, such as energy, resources and utilities, hi-tech, life science and healthcare, s-Governance, travel, transportation and hospitality, and other products. Its services portfolio consists of IT and assurance services, business intelligence and performance management, business process services, cloud services, connected marketing solutions, consulting, engineering and industrial services, enterprise solutions, IT infrastructure services, mobility products and services and platform solutions. Its software offerings include Digital Software and Solutions, TCS BaNCS and TCS MasterCraft, among others. It serves industries, including insurance, healthcare, retail, telecom and others.

Related stocks

TCS at Support: Breakdown Fear or Bounce Setup?📊 Tata Consultancy Services Limited – 1H Technical Analysis

Timeframe: 1-Hour

Trend Structure: Rising channel (higher highs & higher lows)

Current Phase: ABC corrective pullback within an uptrend

CMP Zone: ~₹3,160

🔍 Big Picture Structure (Context First)

TCS is trading inside a well-defined rising

PCR Trading Strategies A. Premium

The price you pay to buy an option.

Premium depends on:

Underlying price

Strike price

Time to expiry

Volatility

Interest rates

Premium is the cost of buying the right (call or put).

B. Strike Price

The predetermined price at which you can buy (call) or sell (put) the asset.

Exam

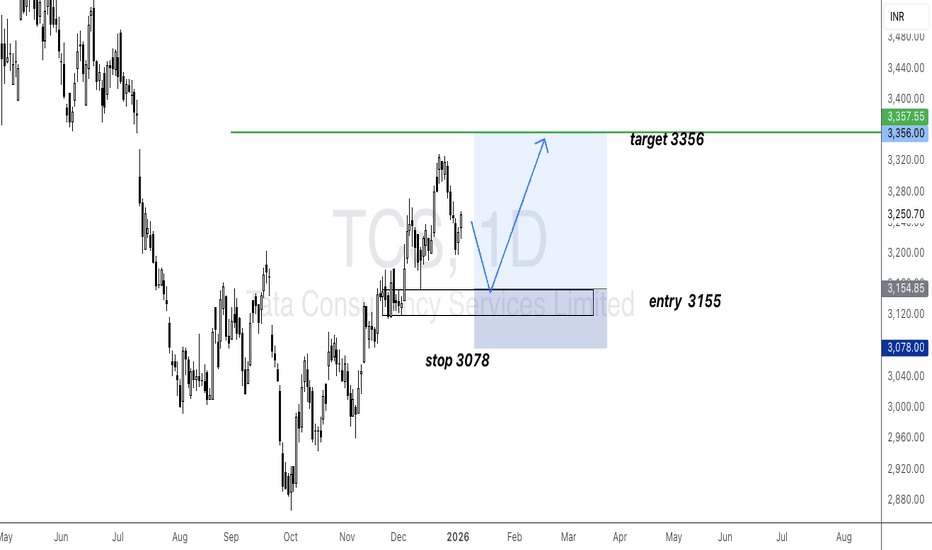

WAITING FOR LONG TRADE ON TCS.TCS is showing signs of strength after consolidating near key support levels, with positive volume buildup and a potential breakout above recent highs. The stock looks poised for an upside move in the near term, supported by improving IT sector sentiment and strong fundamentals.

Trade Idea (Long):E

Part 1 Support and Resistance Options Trading vs. Stock Trading

Compared to stock trading, options trading offers:

Lower capital requirement

More strategic flexibility

Ability to profit in rising, falling, or sideways markets

However, it also demands deeper knowledge, discipline, and continuous monitoring.

TCS 1 Week Time Frame 📊 Weekly Price Range & Levels

Current share price is trading around ₹3,250–₹3,280 (recent data).

Key Weekly Resistance

R3 / Upper resistance: ~₹3,382–3,383 (stronger barrier)

R2: ~₹3,335

R1: ~₹3,293–3,315 (first hurdle)

Interpretation:

If price breaks above ₹3,315–₹3,335, bulls may aim toward ₹3

A quality stock at a heavy discount TCS CMP 3250

Elliott- A very good example of how the 4th waves tend to cluster together. A strong 5th wave will emerge from here. This will the final impulse wave.

Fib- I have taken a conservative approach by taking a lower confluence as the mid point of the move. The tgts are on ur screen.

Mastering Option TradingA Complete Guide to Building Skill, Discipline, and Consistency

Mastering option trading is a journey that blends market knowledge, mathematical understanding, strategic thinking, and emotional discipline. Unlike simple buying and selling of stocks, options are multi-dimensional instruments whose v

Geopolitical Risk: Understanding Its ImpactGeopolitical risk refers to the uncertainty and potential disruption arising from political, military, diplomatic, and strategic tensions between nations or regions. In an increasingly interconnected global economy, geopolitical developments in one part of the world can quickly transmit shocks acros

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of TCS is 3,123.20 INR — it has decreased by −1.34% in the past 24 hours. Watch Tata Consultancy Services Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Tata Consultancy Services Limited stocks are traded under the ticker TCS.

TCS stock has fallen by −1.23% compared to the previous week, the month change is a −4.10% fall, over the last year Tata Consultancy Services Limited has showed a −24.67% decrease.

We've gathered analysts' opinions on Tata Consultancy Services Limited future price: according to them, TCS price has a max estimate of 4,810.00 INR and a min estimate of 1,775.00 INR. Watch TCS chart and read a more detailed Tata Consultancy Services Limited stock forecast: see what analysts think of Tata Consultancy Services Limited and suggest that you do with its stocks.

TCS stock is 1.36% volatile and has beta coefficient of 1.11. Track Tata Consultancy Services Limited stock price on the chart and check out the list of the most volatile stocks — is Tata Consultancy Services Limited there?

Today Tata Consultancy Services Limited has the market capitalization of 11.60 T, it has decreased by −0.62% over the last week.

Yes, you can track Tata Consultancy Services Limited financials in yearly and quarterly reports right on TradingView.

Tata Consultancy Services Limited is going to release the next earnings report on Apr 15, 2026. Keep track of upcoming events with our Earnings Calendar.

TCS earnings for the last quarter are 37.14 INR per share, whereas the estimation was 36.00 INR resulting in a 3.16% surprise. The estimated earnings for the next quarter are 37.21 INR per share. See more details about Tata Consultancy Services Limited earnings.

Tata Consultancy Services Limited revenue for the last quarter amounts to 670.87 B INR, despite the estimated figure of 668.42 B INR. In the next quarter, revenue is expected to reach 686.96 B INR.

TCS net income for the last quarter is 106.57 B INR, while the quarter before that showed 120.75 B INR of net income which accounts for −11.74% change. Track more Tata Consultancy Services Limited financial stats to get the full picture.

Tata Consultancy Services Limited dividend yield was 1.66% in 2024, and payout ratio reached 44.71%. The year before the numbers were 1.42% and 43.69% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jan 20, 2026, the company has 607.98 K employees. See our rating of the largest employees — is Tata Consultancy Services Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Tata Consultancy Services Limited EBITDA is 682.86 B INR, and current EBITDA margin is 26.49%. See more stats in Tata Consultancy Services Limited financial statements.

Like other stocks, TCS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Tata Consultancy Services Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Tata Consultancy Services Limited technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Tata Consultancy Services Limited stock shows the sell signal. See more of Tata Consultancy Services Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.