"DXY Bearish Setup: Sell from SBR Zone with Target at 97.800"1. Trendline Support Break:

🟡🟡🟡🟡

These yellow dots mark previous higher lows on the ascending trendline — now broken, hinting at a possible bearish reversal.

2. EMA (7):

🟠 ➖

This orange line is the 7-period EMA, hovering above the price, showing bearish momentum in the short term.

3. SBR + DBD Zone (Sell Zone):

🔵 SBR/DBD Zone

📍 Entry Point: 99.880

❌ Stoploss: 100.390

This blue zone is a Sell on Rally area. The chart suggests price might revisit this zone and then face rejection.

4. Price Projection Path:

↗️🔁📉

A potential retest of resistance followed by a strong drop is projected. The zigzag line drawn shows the expected movement.

5. Target Point:

🎯 Target: 97.800

📉 Expected drop of 2.04% from entry.

This is the price where the trade aims to take profit.

6. Summary:

🔽 Bearish Bias

🎯 Sell near 99.880

❌ SL at 100.390

✅ TP at 97.800

Trade ideas

EMA 30 (Red Line): Currently at 99.700 — tracks short-term trendEMA 30 (Red Line): Currently at 99.700 — tracks short-term trend, and price is hovering near this level.

EMA 200 (Blue Line): At 100.935 — indicates long-term trend, acting as dynamic resistance above.

📈 Trade Setup

✅ Entry Point:

Price: 99.699

Rationale: This level has been tested multiple times, forming a support zone. A bounce here signals a potential long entry.

🎯 Target Point (Take Profit):

Price: 102.738

Distance: ~3.04 points or 3.43% potential move upward.

Note: Marked as EA TARGET POINT, which suggests a calculated area possibly based on previous resistance or algorithmic strategy.

🛑 Stop Loss:

Price: 98.624

Reasoning: Just below the defined support zone (highlighted purple area), ensuring protection against downside breakouts.

📊 Risk-to-Reward Ratio

Entry: 99.699

Target: 102.738 → Gain of ~3.04

Stop: 98.624 → Risk of ~1.08

R/R Ratio: ~2.8:1 — favorable setup

📌 Overall Sentiment

This chart indicates a bullish reversal setup from a strong support zone, possibly targeting a mean reversion or trend reversal toward the 200 EMA and beyond.

However, keep in mind:

The price is currently below both EMAs, so the trend is still bearish.

The trade is counter-trend, relying on support holding and momentum shifting.

"USD Index Short Setup – Bearish Rejection from Supply Zone (DBD📉 Downtrend confirmed

➖ Lower highs and lower lows

➖ EMA (7) is sloping downward and acting as resistance

➖ Bearish momentum continues

Key Zones & Levels

🔵 Supply Zone (DBD)

🔹 Zone: 99.540 – 99.681

🔹 Label: “Drop-Base-Drop”

🔹 This is where sellers stepped in before – price is retesting it

🔹 Expecting a rejection from this area.

Trade Setup

📍 Entry Point:

🔹 Enter short around 99.540 – 99.681

❌ Stop Loss:

🔺 Set above the zone at 100.211

🚫 Protects against fakeouts

🎯 Target Point:

🔻 Target at 97.300

💰 Risk-Reward: 1:2.4 (Good!)

Visual Summary

📍 Entry: 99.540

❌ Stop Loss: 100.211

🎯 Target: 97.300

📉 Overall Bias: Bearish

✅ Strong RR setup with trend confirmation

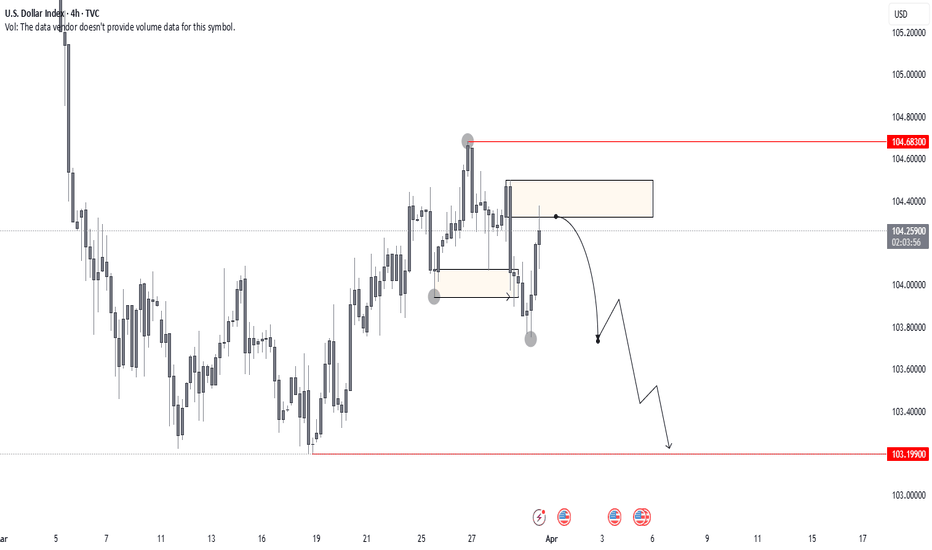

US DOLLARTo confirm my EU view, here is DXY.

The buy zone didn’t hold—price broke through, sustained below, and established a strong new trading range. It just reacted off the 4H sell zone, confirming weakness. Now, all eyes on DXY for a sell-off.

With that being said, fundamentals are heavy this week, so keeping risk in check is key.

Blessings, T

DXY Building Momentum — "Cash is King" Narrative Returns?📌 DXY is showing clear signs of recovery on the H4 timeframe — and that tells us something deeper: risk sentiment is shifting. Investors are pulling capital from risk-on assets and moving to cash. Yes, "Cash is King" might be making a comeback.

🔍 What’s Driving the Move?

As fear ripples through global markets:

📉 Equities are shaky.

🟡 Gold dropped sharply under profit-taking pressure.

🪙 Crypto lacks new capital.

Now, capital is rotating back into USD — not necessarily because of strong fundamentals, but due to defensive positioning.

🔺 On the geopolitical side, Trump’s aggressive tariff threats are shaking confidence. As import/export tension rises, the global appetite for USD-denominated assets (especially U.S. bonds) is also climbing.

🧭 Key Technical Levels (4H Chart)

Support Zones:

🟦 101.467 – historical structure low

🟦 102.113 – minor intraday demand

🟦 102.660 – neckline & retest zone (key area to hold)

Resistance Zones:

🟧 103.803 – consolidation top

🟥 104.506 – key resistance and EMA crossover zone

🟥 105.632 / 106.157 / 106.622 – higher-timeframe targets if momentum continues

🔮 Outlook by AD | Money Market Flow

The market is on the edge right now.

If U.S. equities fail to bounce and global risk sentiment continues to deteriorate, we could see: ✅ A strong USD breakout ✅ DXY bottoming and reclaiming the 104–106 zone ✅ Major asset correction across risk-on markets (Gold, Stocks, Crypto)

“When markets panic, smart money rotates to USD. It’s not bullishness — it’s protection.”

— AD | Money Market Flow

🔁 What to Watch:

Fed’s next steps (Will they ignore Trump’s tariffs and focus on growth?)

Global equity market reactions

Bond yields (demand for U.S. debt could rise again)

📌 Stay sharp and follow the money. DXY is giving early signals — don’t ignore the shift.

🧠 Manage risk. Protect capital. Let the market come to you.

U.S. Dollar Index (DXY) –Key Resistance& Bearish Target Analysis📊 Key Observations:

🔵 Resistance Zone (📍~103.5 Level)

A strong resistance area (🔵 blue box) is marked, indicating potential selling pressure if the price reaches this level.

The price is moving upwards (📈) towards this resistance, so watch for rejection or breakout.

🔵 Support/Target Zone (📍~101.5 Level)

A lower support zone (🔵 blue box) is marked as the bearish target 🎯.

If the price fails at resistance, it may head downwards (📉) to this level.

📉 Recent Price Action:

🚀 Sharp drop followed by a rebound (📈).

The price is currently moving back up (🔼), possibly forming a lower high before another drop.

📌 Exponential Moving Average (DEMA 9 - 102.488)

The price is hovering above the 9-period DEMA (📏), showing short-term bullish momentum.

If the price rejects resistance and falls below the DEMA, a bearish continuation (📉) is likely.

🚀 Potential Scenarios:

✅ Bullish Breakout: If price breaks above 🔵 resistance, it may continue rising (📈) to higher levels.

❌ Bearish Rejection: If price fails at resistance, expect a drop (📉) towards 101.5 🎯.

DXY Monthly Analysis: Key Support Holding, Bullish Move Ahead?📊 DXY Monthly Chart Analysis (March 27, 2025)

Key Observations:

Current Price Action:

The U.S. Dollar Index (DXY) is trading near 104.267, with notable resistance ahead.

Price is consolidating within a key demand zone (~102.5–104) after rejecting higher levels.

Technical Levels:

Support Zone: 100.2–104 (Highlighted in purple)

Resistance Zone: 112.5–114.7 (Highlighted in purple)

Major Resistance: 114.77 (Previous high, acting as a supply zone)

200-MA Support: Located below current price, offering a long-term bullish confluence.

Market Structure:

Price remains in a higher time-frame bullish trend but is experiencing a correction.

The "BOSS" level (Break of Structure) suggests a prior bullish breakout.

If the demand zone holds, a bullish continuation towards 112.5–114.7 is possible.

Projected Move:

A bounce from 102–104 could trigger a rally toward the upper resistance zone (~112.5).

A break below 100.2 could indicate a shift in trend and further downside.

Conclusion:

DXY is at a critical decision point. Holding the current support zone (~102–104) could fuel a bullish continuation toward 112–114, while a breakdown below 100.2 would weaken bullish momentum.

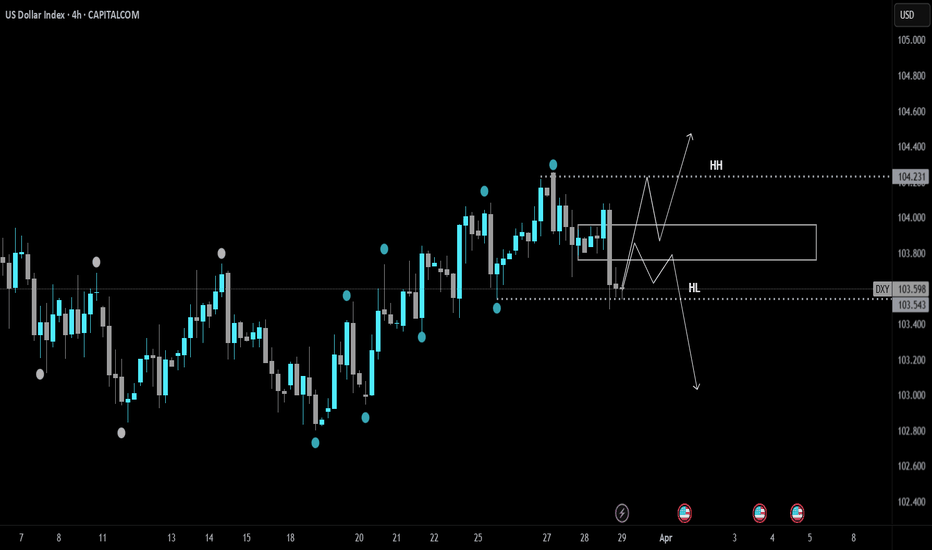

BULLISH ON US DOLLAR!As you can see on the chart, I am bullish on DXY. If you look at it from a technical perspective, you can see that after the accumulation schematic was complete, the dollar started gaining value. Price now needs to enter the markup phase. Looking at the current structure, price has formed a new trading range while breaking the high/structure to the left. A sharp reaction from that zone is a good sign. If the 4H candle closes bullish like this, it could be a strong indicator of bullish momentum building. Let's see. Overall, a pretty straightforward read.

Blessings, T

U.S. Dollar Index (DXY) – Bearish Outlook with Key Levels📉 Bearish Bias on U.S. Dollar Index (DXY) – 4H Chart

🔹 Resistance Zone & Stop Loss 🚫

📍 Resistance: 104.200 - 104.432

🛑 Stop Loss: 104.432 (Above resistance zone)

🔸 Support Zone 🛠️

📍 Intermediate Support: 103.300 (Possible bounce)

🔻 Target Point 🎯

📍 Target Price: 102.232 (Expected downside)

📊 Price Action Outlook:

✅ Bearish Scenario:

Price rejected from resistance 🔽

Lower highs forming ⚡

Breakdown expected toward 102.232 🎯

❌ Invalidation:

If price breaks above 104.432, bearish setup fails 🚫

🔥 Conclusion:

⬇️ Sell Bias below 104.200 targeting 102.232

❌ Cut losses if price closes above 104.432

US Dollar Index (DXY) – Pre-FOMC Update💥 US Dollar Index (DXY) – Pre-FOMC Update: Expert Analysis and Trading Strategies 💥

In just a few hours, the Federal Reserve (Fed) will announce its interest rate decision and update its economic projections in the Summary of Economic Projections (SEP). This is a highly anticipated event that will shape trading decisions in the coming weeks. The US Dollar Index (DXY) is currently fluctuating within the 103.00 - 104.00 range, reflecting investor caution ahead of the critical updates.

1. Interest Rate Decision and Its Impact on DXY

The policy rate is expected to remain unchanged at 4.25% - 4.50%. However, the market is more focused on signals about future rate cuts, particularly in 2025.

Chair Jerome Powell's post-meeting speech will be the key driver. The market will closely watch for hints on monetary policy, inflation, and the US economic outlook.

If the Fed adopts a hawkish tone (indicating sustained high rates or even further hikes), the DXY could rally strongly. Conversely, a dovish signal could weaken the USD.

2. Technical Analysis of DXY

🔴 Key Support: 103.18

The DXY is currently under pressure at the 103.18 support level. A break below this level could push the index further down to 103.00 or even 102.50.

This is a crucial zone, as failure to hold here would signal continued USD weakness in the short term.

🟢 Major Resistance: 105.00 and 105.57

If the DXY rebounds from current support levels, the next challenges will be the resistance zones at 105.00 and 105.57.

The 50-day and 200-day Moving Averages (MA) on the daily chart are also key indicators to watch. A break above these MAs could reinforce the bullish trend.

📉 Short-Term Trend:

On the 4H chart, the DXY is in a downtrend, with lower highs and lower lows. However, upcoming macroeconomic factors (the rate decision and Powell’s speech) could trigger a reversal or increased volatility.

Technical indicators like the RSI and MACD are in neutral territory, suggesting the market is awaiting clearer signals.

3. Trading Strategy Before and After the FOMC Decision

🔍 Before the Fed Announcement:

Caution is key. The market may experience mild fluctuations during the wait. Traders should avoid large positions and wait for clearer signals.

Closely monitor key support and resistance levels: 103.18 (support) and 105.00 (resistance).

🔥 After the Fed Announcement:

Scenario 1: Fed Holds Rates and Signals Hawkish Tone

The DXY could rally strongly, targeting resistance levels at 105.00 and 105.57.

Strategy: Look for buy opportunities when the DXY bounces off support or breaks above resistance.

Scenario 2: Fed Signals a Dovish Tone

The DXY could drop sharply, breaking below 103.18 and heading toward 102.50.

Strategy: Look for sell opportunities when the DXY breaks support or fails to surpass resistance.

Scenario 3: Fed Holds Rates Without Clear Signals

The DXY may continue to fluctuate within the 103.00 - 104.00 range.

Strategy: Trade within the range, using identified support and resistance levels.

4. Advice for Investors and Traders

📊 Risk management: Always set appropriate stop-loss and take-profit levels to protect your capital. Post-FOMC volatility can be intense, so prepare mentally and have a solid trading plan.

📰 Stay updated: Keep a close eye on Fed updates and market reactions. Jerome Powell’s speech could create significant trading opportunities.

🛠️ Use technical tools: Combine indicators like RSI, MACD, and Fibonacci to identify precise entry points.

5. Conclusion

Tonight’s FOMC meeting will be a decisive factor for the DXY’s short-term direction. With clear support and resistance levels identified, traders should prepare their strategies to capitalize on market movements.

🚨 Stay tuned for the latest updates on TradingView to ensure you don’t miss any trading opportunities!

Wishing you successful trades and profitable outcomes! 💪💰

DXY (U.S. Dollar Index) Bearish Trade Setup – Potential DowntrenThis chart is a technical analysis of the U.S. Dollar Index (DXY) on a 1-hour timeframe. Here's a breakdown of the analysis:

🔹 Chart Overview:

DXY Price: 103.773

Trend: The price has been in an uptrend, but there's a potential for reversal.

Entry Point: 103.816

Stop Loss: 104.096 (Marked in red)

Take Profit (TP) Levels:

TP1: 103.608

TP2: 103.400

Next Target: 103.133

🔹 Analysis:

Trendline Break: The price had been following an ascending trendline, which appears to be broken. This suggests a potential downtrend continuation.

Bearish Setup: The trade setup suggests a short (sell) position.

Risk-Reward Ratio:

The stop loss (104.096) is placed above the recent resistance.

The take profit levels are set at key support zones.

Market Sentiment: If the price stays below 103.816, it may continue dropping toward TP1, TP2, and the Next Target.

🔹 Conclusion:

Bearish Bias 📉: The market could see further downside if the price stays below the entry point.

Trade Idea: Short below 103.816, with a stop at 104.096, and targets at 103.608, 103.400, and 103.133.

USD PLUNGES – IS THIS THE START OF A VOLATILE YEAR?📌 MARKET OVERVIEW

The US Dollar (USD) is experiencing a sharp decline, with the DXY index dropping by 3.5% in the past week, marking its second-largest drop since the 2020 pandemic. More importantly, USD is now on a three-month losing streak, sending ripples across global financial markets.

👉 The Euro is the primary driver behind USD’s weakness, surging 4.7% against the USD, the biggest jump since 2009.

📌 DXY weakness amid escalating trade wars is a crucial signal – it indicates that major shifts are about to unfold in the financial markets!

📊 WHY IS THE USD DROPPING?

🔹 1. The Euro’s Strong Recovery

The Euro is benefiting from the European Central Bank (ECB) maintaining stable monetary policies, while the US Federal Reserve (FED) leans towards rate cuts.

This policy divergence has reduced the appeal of the USD, pushing the Euro to its highest level in over a decade.

🔹 2. Market Expectations of Fed Rate Cuts

Recent US economic data shows weaker inflation, increasing the likelihood that the FED may ease monetary policy soon.

Lower interest rates diminish the attractiveness of the USD, encouraging investors to shift capital into alternative assets like gold and the Euro.

🔹 3. Trade War & Economic Uncertainty

Tensions between the US and China continue to escalate, with Trump’s aggressive tariff policies adding to global trade instability.

However, instead of strengthening the USD, these policies are creating negative market sentiment, leading investors to pull away from USD-based assets.

📌 USD is now in a difficult position:

✔️ The FED may loosen monetary policy, weakening USD further.

✔️ The ongoing trade war is eroding confidence in the USD.

📉 HOW USD WEAKNESS AFFECTS GLOBAL MARKETS

🔸 Gold Surges as USD Declines

Gold prices rally whenever USD weakens, as investors move funds into safe-haven assets.

If USD continues to drop, gold could break its all-time high (ATH) and surge towards $2,970 - $3,000.

🔸 Stock Markets Could Benefit

Lower interest rates and a weaker USD generally support the US stock market, especially export-driven companies.

However, if recession fears intensify, investors may move towards safer investments like gold and government bonds.

🔸 Other Global Currencies May Strengthen

A weaker USD boosts major currencies like the Euro (EUR), British Pound (GBP), and Japanese Yen (JPY).

This could shift global trade dynamics, influencing economic trends in the coming months.

⚡️ CONCLUSION – IS USD IN FREE FALL?

📌 The USD’s three-month decline is a major warning sign, signaling potential shifts in global financial markets.

📌 If USD continues its downtrend, gold could hit new highs, while stocks may see increased volatility.

📌 Traders must closely monitor FED decisions on monetary policy and ongoing trade tensions between the US and China.

U.S. Job Growth Slows: Impact on USD and Indian InvestorsIn the first two months of 2025, the U.S. economy experienced a notable slowdown in job creation, as reflected in consecutive Nonfarm Payroll (NFP) reports falling short of expectations. According to the U.S. Bureau of Labor Statistics, February saw an addition of 151,000 jobs, below the anticipated 160,000, though an improvement from January's revised 125,000.

reuters.com

+1

tradingeconomics.com

+1

Impact on the U.S. Dollar Index (DXY) 📉

The consecutive underperformance in job growth has exerted pressure on the U.S. Dollar, leading to a decline in the U.S. Dollar Index (DXY), which measures the greenback against a basket of major currencies. As of March 10, 2025, the DXY stood near a four-month low at 103.59, reflecting diminished investor confidence in the U.S. economy.

reuters.com

Federal Reserve's Response 🏦

Weak labor market data often prompts the Federal Reserve to reassess its monetary policy stance. With two consecutive NFP reports missing expectations, the Fed may consider slowing the pace of interest rate hikes or even exploring economic stimulus measures to support growth and employment. However, any policy adjustments will also weigh factors such as inflation trends and overall GDP growth.

Implications for Indian Investors 🇮🇳

The U.S. labor market's performance holds significant implications for global economies, including India:

Currency Exchange Rates 💱: A weakening U.S. Dollar can lead to the appreciation of the Indian Rupee, affecting export competitiveness and import costs.

Gold Prices 🪙: Traditionally, a softer USD boosts gold prices. Indian investors, who have a cultural affinity for gold, might see increased returns on their gold investments.

m.economictimes.com

Stock Market 📈: Global equity markets, including India's, often react to U.S. economic indicators. A slowing U.S. economy might lead to cautious sentiment among Indian investors, influencing market dynamics.

Expert Insights 🧠

Economists note that while recent U.S. job data indicates a slowdown, it's essential to consider the broader economic context. Factors such as consumer spending patterns, international trade policies, and geopolitical developments play pivotal roles in shaping both U.S. and global economic landscapes.

Conclusion 📝

The recent underwhelming NFP reports serve as a cautionary signal regarding the U.S. economy's momentum. For Indian investors, staying informed about these developments is crucial, as they can influence currency valuations, commodity prices, and equity markets. A diversified investment approach, coupled with vigilance, can help navigate the potential ripple effects stemming from shifts in the U.S. economic environment.

U.S. Dollar Index (DXY) – Key Technical Levels & Market OutlookU.S. Dollar Index (DXY) Monthly Chart Analysis 📊💵

The U.S. Dollar Index (DXY) is currently navigating a critical price structure, with key supply and demand zones influencing market direction. Here’s a professional breakdown of the chart’s technical outlook:

📍 Key Technical Insights

✅ Supply & Demand Zones

Supply Zone (Resistance): 109 - 114 📈 – A key area where selling pressure has historically emerged. A decisive breakout above this level could signal further upside potential.

Demand Zone (Support): 100 - 103 📉 – A strong accumulation zone where buyers have stepped in previously. A breakdown below could indicate a shift in market sentiment.

✅ Market Structure & Momentum

A Break of Structure (BOSS) has been identified, signaling a shift in trend dynamics.

The market is currently ranging between major resistance (~109) and support (~100).

✅ 200-Month Moving Average 📊

The long-term moving average (red line) is acting as dynamic support, reinforcing the bullish bias unless decisively breached.

📊 Potential Scenarios

🔹 Bullish Outlook: If DXY maintains support above 100-103 and breaks past 109, the index could aim for 114+ in the coming months. 🚀

🔹 Bearish Risk: A sustained drop below 100 may open the door for further downside towards 95-89, signaling a broader correction. ⚠️

📌 Conclusion

The DXY remains in a consolidation phase, with key inflection points around 103 (support) and 109 (resistance). A breakout or breakdown from this range will determine the next major trend. Traders should monitor these levels closely for potential trading opportunities.

Bearish Outlook on the Dollar IndexBearish Outlook on the Dollar Index: Supply Zone Resistance Signals a Reversal

The Dollar Index (DXY), a widely watched measure of the U.S. dollar’s strength against a basket of major currencies, is a pivotal indicator in global financial markets. Viewed through the lens of a long-term supply-demand structural cycle, the index appears to be approaching a turning point. It is currently testing a critical supply zone, suggesting that its recent upward momentum may be faltering. This article explores why a bearish outlook is warranted, drawing on technical analysis, fundamental factors, and market sentiment to argue that a reversal could be imminent.

Technical Analysis: Supply Zone as a Formidable Barrier

In technical analysis, a supply zone represents a region where selling pressure has historically overwhelmed buying interest, acting as a ceiling that limits upward price movement. On longer-term charts, such as weekly or monthly timeframes, the Dollar Index is now encountering such a zone. This area has consistently halted past rallies, with the index struggling to maintain gains before retreating. As it approaches this level again, early signs of hesitation—such as declining volume and weaker upward momentum—are becoming apparent. These patterns suggest that the current uptrend may not have the strength to push through, increasing the likelihood of a downward correction.

Fundamentals: Economic Dynamics Undermine Dollar Strength

The fundamental backdrop also supports a bearish view. Since mid-2024, the Federal Reserve has begun lowering interest rates, a shift that reduces the yield advantage of U.S. assets over time. While markets may have priced in some short-term effects, the sustained impact of lower rates weakens the dollar’s appeal relative to other currencies. If other major central banks adopt or maintain tighter monetary policies, capital could shift toward alternatives like the euro or yen. Additionally, changing global trade dynamics and rising geopolitical uncertainties may drive investors toward traditional safe-haven assets like gold, rather than the dollar. Together, these factors limit the dollar’s potential for further gains.

Market Sentiment: Overbought Conditions Hint at Reversal

Market sentiment provides another layer of evidence for a bearish turn. Recent reports indicate that speculative bets on a rising dollar have reached unusually high levels, reflecting widespread optimism among traders. However, such extreme positioning often serves as a contrarian signal, foreshadowing a potential reversal—especially when the index is stalling at a supply zone. Should the dollar fail to break through this resistance, a cascade of profit-taking and triggered stop-loss orders could amplify downward pressure, hastening a decline.

Conclusion: A Bearish Turn Looms for the Dollar

In summary, the Dollar Index’s current position at a key supply zone, coupled with technical resistance, fading fundamental support, and overstretched market sentiment, points to an impending reversal. Investors should stay alert as the index navigates this critical juncture. A failure to sustain its upward trajectory could mark the start of a bearish phase, opening up new possibilities in currency and asset markets.

DXY MULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

DOLLAR INDEX - WILL IT BREAK DOWN OR CLIMB HIGHER?Symbol - DXY

The U.S. Dollar Index (DXY) is currently trading within a key support zone, which has historically acted as a pivotal level for price action. A clear double top pattern has emerged on the larger time frame, signaling a potential bearish reversal. A breakdown below this support area would likely signify a shift in the short-term trend of the U.S. Dollar, with the potential for a move lower.

Despite this, there remains an underlying expectation in the global markets that the U.S. Dollar will stay elevated in the medium term due to factors such as President Trump’s policies, tariffs, and rising geopolitical fragmentation. However, much of this has already been priced into the currency, and the current price action is showing signs of weakness, suggesting that the Dollar may be poised for a pullback.

From a technical perspective, a decisive breakdown below the support zone would imply a trend change, with further downside potential. Traders and investors may need to reassess their outlook for the U.S. Dollar if this level is breached.

Key support levels: 107.60, 107.40

Key resistance levels: 108.35, 108.50

On the other hand, if the price holds above the support area and key upcoming data, such as the Non-Farm Payrolls (NFP) and Consumer Price Index (CPI), continue to support the Dollar’s strength, there is potential for the index to continue its upward trajectory. In this alternate scenario, the previous bullish trend for the U.S. Dollar could resume, especially if these data points align with expectations and signal ongoing economic strength. Therefore, the outlook for the U.S. Dollar remains contingent on the price action at the current support level and upcoming economic data releases.

DXY Oversold >>>>>>>>>>>>>>>>>The U.S. Dollar Index (DXY) is heavily oversold despite strong fundamental backing. Institutions may be accumulating at these levels before a major move. Watching for potential reversals as smart money steps in.

Key Levels to Watch:

📌 Support Zone: 107.600 – 107.800

📌 Resistance Target: 108.400 – 108.600

Nifty Prediction for Wednesday 12 February 25 Hello Early Investor,

Our objective at #HELPINGSTOCKINVESTOR is to build financial discipline in traders by simplifying Stock Market Education and Financial concepts with an expertise knowledge in Derivative Analysis, Market Trend Analysis and Technical analysis of a Stock. Here you can learn different trading strategies along with market fundamentals. Daily Market Analysis on this channel is most helpful for traders. #Experience of almost 7+ years in the market. Happy Trading!

Like

Share

Subscribe