US Natural Gas (Spot) (XNGUSD)

3.049USDR

−0.133−4.18%

As of today at 15:32 GMT

USD

No trades

XNGUSD trade ideas

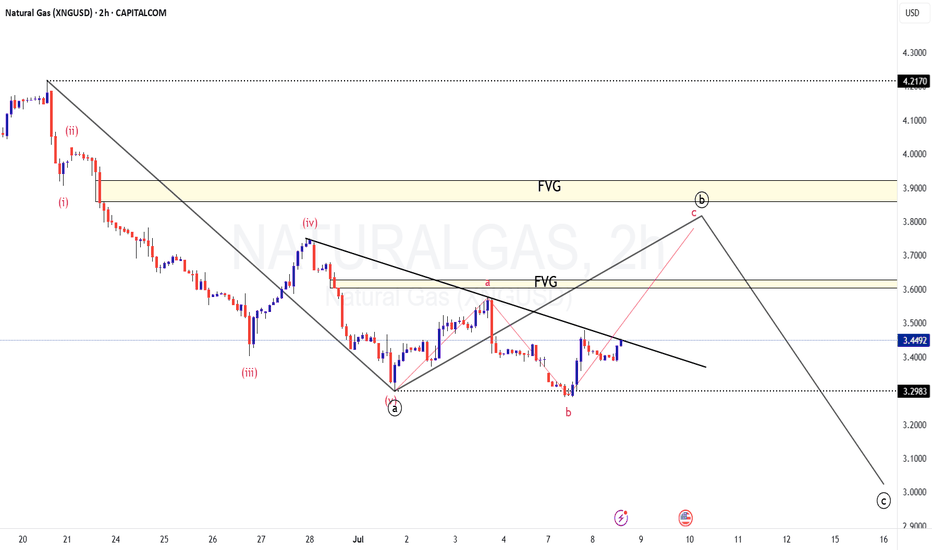

NATURALGAS - Corrective Rise in action?

TF: 120 minutes

Primary View is that the first leg of correction from 4.2170 has ended at 3.2983 in a 5 wave impulse on the downside and the price is moving higher (in corrective rise) to complete the B wave.

Internal counts are marked in this chart.

The ALT view is that, the A wave isn't complete yet and we are at the last leg of the A wave (by forming an abcde diagonal) and make one more low and then move up (This view negates if we trade above 3.5745)

Chart for this ALT view is here

In either case, A FVG (Fair Value GAP) is left at 3.9 and the price could potentially test that zone before resuming the move on the downside.

For the Primary view (Bullish bias C of B in play), SL is at 3.386

Disclaimer: I am not a SEBI registered Analyst and this is not a trading advise. Views are personal and for educational purpose only. Please consult your Financial Advisor for any investment decisions. Please consider my views only to get a different perspective (FOR or AGAINST your views). Please don't trade FNO based on my views. If you like my analysis and learnt something from it, please give a BOOST. Feel free to express your thoughts and questions in the comments section.

Gas in the Tank

Trade View: Natural Gas (XNGUSD) — Buy

CMP: $3.5722

Stop Loss: $3.51

Target 1: $3.68

Target 2: $3.74

Duration: 3–5 sessions

Risk–Reward: ~1:2

Rationale

1. Price Structure — Trendline Respect

Natural Gas is respecting a rising trendline with a clear series of higher lows on the 15-min chart. These are not fluke bounces — they are coordinated pullbacks with rising volume toward the end, suggesting smart money accumulation. THe market respects levels when there’s underlying belief in the story, not just chart patterns. Here, price isn’t violating trendlines despite volatility.

2. Macro Tailwinds

• US heatwave in key regions like Texas and California is expected to increase demand for power generation GENERALLY a bullish driver for NG due to AC loads and cooling demand.

• Inventories have been tight with draws exceeding expectations in recent weeks (EIA data). Markets are slowly pricing in tighter forward supply.

• Geopolitics in Russia/Ukraine and LNG export updates continue to keep upside optionality alive.

3. Positioning & Sentiment

• Sentiment is still mixed, with many retail participants shorting around resistance. This creates the perfect fuel for a short squeeze if price pushes above $3.60 again.

• Commitment of Traders (CoT) data shows moderate long build-up from managed money, not extreme — indicating a measured rally, not frothy euphoria.

“If the story is good and the price structure is right, you don’t wait for perfection ,you size the trade sensibly and ride the wave." This is one such setup. We’re not trying to call the bottom we’re simply stepping in where the downside risk is limited, and the narrative has legs.

When the Market Yawns at a Breakdown — It’s Time to Look? Bullish Positional Setup Emerging

Despite relentless downward pressure, Natural Gas has landed into a previous demand pocket, holding the lows with surgical precision. A textbook case of seller exhaustion paired with invisible buying interest is unfolding on the 15-minute chart.

⸻

Structure Observation:

• Rejection from Key Demand Zone: The $3.55–$3.545 range has been tested twice and is being defended with volume.

• Volume Divergence: Notice the increasing red bars met with dry-up in follow-through selling — indicating distribution is likely over.

• Liquidity Sweep Setup: We’ve likely witnessed a liquidity grab under the prior support zone, shaking out weak hands before a move higher.

• Tight Accumulation: Price is stabilizing in a tight band — a typical precursor to vertical expansion if sustained above $3.56.

• Micro Timeframe Reversal: Subtle shift in market character. From lower highs/lows to possible higher low confirmation here.

⸻

The Trade – Stealthy Long

• Entry Zone: $3.56–$3.565 (as price reclaims structure)

• Stop Loss: Below $3.542 (just under demand)

• Target 1: $3.60 (supply shelf)

• Target 2: $3.625–$3.63 (gap-fill zone + fib confluence)

• Risk-Reward: ~1:2.5 to 1:3 — excellent reward-to-risk if the zone holds

⸻

This is the kind of setup where the market doesn’t scream; it whispers. The price doesn’t need to show fireworks — it just needs to stop bleeding, consolidate, and start climbing while everyone’s looking elsewhere. If this isn’t smart money accumulation, it’s doing a very good job pretending to be.

This is not about catching the bottom. It’s about understanding when the odds shift quietly in your favor.

⸻

Let it play out.

Let others react late.

You just needed to observe — and position early.

Natural Gas: Coiling for a Pop

After a steep downtrend, Natural Gas is showing early signs of a trend reversal. Price has formed a rounded base with volume pickup and a clean breakout attempt over intraday supply.

⸻

Technical Rationale:

• Base Formation: Price consolidating in a tight range after exhaustion selling – classic accumulation zone.

• Resistance Flip: Immediate resistance at $3.77 being tested multiple times. Sustained break may trigger momentum buying.

• Volume Confirmation: Gradual increase in volume on green candles suggests demand is building up.

• Support Zone: Strong base formed between $3.69–3.71, acting as a cushion for longs.

• Momentum Setup: Bullish structure on 15-min forming higher lows – potential to scale into swing long.

⸻

Trade Plan:

• Buy Above: $3.775 (on candle close above zone)

• Stop Loss: $3.695 (below support zone)

• Target 1: $3.88 (gap-fill + previous support)

• Target 2: $3.97 (supply zone)

• Risk-Reward: ~1:2.5 — favourable setup for positional long

⸻

Why Now?

After panic unwinding, smart money often steps in quietly. This pattern fits the Wyckoff Accumulation Phase B, where price fakes out on downside and reclaims value area — now pushing toward Phase C markup.

⸻

Bias: Bullish

Trade Type: Positional (1–4 days horizon)

Catalyst: Breakout + volume surge + price acceptance above $3.775

Let the gas ignite the move.

Natural Gas – Blow-Off Exhaustion Meets Supply Wall

⸻

Trade Details:

• Sell Entry: 4.045–4.050 (current zone)

• Stop Loss: Above 4.065 (recent high and breakout wick)

• Target 1: 3.980 (minor support and first structure break)

• Target 2: 3.940 (gap-fill and prior consolidation)

• Target 3: 3.910 (trendline retest area)

⸻

Thesis:

1. False Breakout: Price attempted to break above resistance at 4.06 but failed to close above it. Rejection candles suggest buyers were absorbed and trapped.

2. Volume Confirmation: Breakout occurred on declining volume, indicating lack of conviction from buyers.

3. Bearish Price Action: Lower high and a bearish engulfing candle near resistance suggest a shift in momentum.

4. Support Breach: Minor intraday support near 4.040 has been broken, confirming short-term weakness.

⸻

Risk Management:

• Maintain a risk-reward ratio of at least 1:2.

• Re-evaluate the position if price reclaims and sustains above 4.065 on strong volume.

Tactical Breakout Play on NG

Before diving into the setup:

It’s important to acknowledge that recent long trades on Natural Gas have underperformed, largely due to:

• Muted global demand amid mild temperatures

• Weak industrial offtake

• Limited U.S. LNG export activity, despite geopolitical tensions

This has translated into a persistent bearish bias and fading upside momentum on every rally. However, the current technical structure warrants a tactical long trade with well-defined risk.

⸻

Technical Thesis – 15-Min Chart Analysis

1. Breakout from Tight Consolidation

Price has broken out of a narrow consolidation band (range: $3.600–$3.615) with a strong bullish candle and follow-through. The break above horizontal resistance is supported by steady volume expansion.

2. Higher Lows Formation

The chart shows a sequence of higher lows, indicating buyers defending key support zones, especially around the $3.565–$3.570 level.

3. Retest & Hold of Breakout Zone

After the breakout, price is currently retesting the zone around $3.615, holding it well. This is a textbook breakout-retest continuation setup, which allows a long entry with limited risk.

4. Momentum Shift

The previous downtrend was halted and reversed over several hours, showing signs of buyer re-emergence. If this move sustains, it may mark the beginning of a short-term uptrend.

⸻

Trade Plan

• Entry: Buy above $3.625

• Stop Loss: Below $3.605

• Target 1: $3.68

• Target 2: $3.72

• Time Frame: Intraday to 24 hours

Reward to Risk: > 2:1

Trade Type: Tactical, not positional. Close if $3.605 is breached.

⸻

Caveats & Strategy Note

This is not a conviction long on fundamental grounds — LNG demand remains subdued, and seasonality is not favorable yet. This is purely a technical trade based on price action and pattern structure.

Time to Light the Fuse Again

Entry Zone: 3.740-3.744

Target: 3.80

Stop Loss: 3.715

Rationale:

• Strong bounce off demand zone near 3.715 confirms buyer interest.

• Double bottom setup suggests reversal from intraday lows.

• Increasing volume on recovery candles adds conviction.

• Clear path toward the next resistance zone around 3.80.

This is a momentum-backed bounce with limited downside and a clean upside target.

Gas It Up Before It Blows UpCMP: $3.728

Direction: BUY

Target: $3.78

Stop Loss: $3.71

Rationale:

• Strong support retested around $3.718–$3.720 with buyers stepping in.

• Multiple wicks rejecting downside hint at accumulation.

• Volume picking up on green candles—momentum building.

Trade Plan:

• Buy between $3.725–$3.730

• TP: $3.78 (resistance zone)

• SL: $3.71 (below support)

Risk-Reward: ~1:2.5 — worth the spark.

Gas It Up: Ready to Explode Above $3.70

Trade Setup:

Buy above: $3.705 (breakout confirmation above minor resistance marked in blue)

CMP: $3.697 (awaiting breakout confirmation)

Target Levels (Upside potential):

• T1: $3.735 – minor resistance from recent wick top

• T2: $3.765 – swing high from the previous impulse

• T3: $3.795 – high of the breakout candle before major drop

Stop-Loss:

• SL: $3.678 (below the recent demand zone & wick support area)

Rationale:

• Strong volume seen at lows around $3.67–3.68 indicating absorption and buying interest.

• Price is consolidating above the support box and just under breakout level – a bullish flag/pennant structure.

• MACD crossover likely if breakout occurs, confirming upward momentum.

Risk-Reward (from entry $3.705):

• T1: ~1:1

• T2: ~1.8:1

• T3: ~3:1

Wait for a candle close above $3.705 with volume for confirmation before entering.

Trail SL once T1 is hit to secure partial profits.

Fueling the Rebound: Natural Gas Ready to Ignite from the Dip!Observatiions:

• Support Zone: Around $3.67–$3.68, tested multiple times with good volume absorption.

• Price Action: Strong bullish recovery candle after a sharp fall, forming a potential bear trap / demand absorption setup.

• Volume Spike: High volume near lows indicating possible smart money buying.

Short-Term Positional Buy – Natural Gas (XNGUSD)

CMP: $3.694

Buy Zone: Between $3.68–$3.695

Targets:

• Target 1: $3.73

• Target 2: $3.76

• Target 3: $3.80 (only if momentum sustains)

Stop Loss: $3.65 (strict close basis, below support)

Holding Period: 1–3 sessions

Risk-Reward Outlook

• Risk: ~$0.04

• Reward: $0.06–$0.10

• R:R Ratio: 1:1.5 to 1:2.5

Short on NG AgainDespite earlier false starts, Natural Gas is once again showing clear signs of rejection near recent highs, with price action around $3.76 indicating seller dominance and exhaustion in upward momentum.

A strong rejection wick coupled with declining volumes and bearish divergence on intraday indicators strengthens the case for a short setup with a clean risk-reward profile.

Entry: Short at $3.76

Targets:

• T1: $3.68 – near-term support

• T2: $3.669 – demand zone base

• T3: $3.61 – swing target on deeper retracement

Stop-Loss: Above $3.80 (clear invalidation above resistance zone)

Bias: Bearish reversal from resistance

Conviction: Medium-High (based on price action and rejection structure)

Timeframe: Intraday to short swing (1–3 days)

This presents an opportunity to fade the recent strength with a controlled downside play, especially if $3.76 continues to act as a ceiling.

Natural Gas Shorting Opportunity AgainTrade Setup: Short Natural Gas (XNGUSD)

Natural Gas is approaching a key overhead resistance near 3.7176, a level that has previously acted as a supply zone. Price action shows weak bullish momentum with lower highs on intraday charts, suggesting potential exhaustion.

Volumes are thinning on the recent upmove, hinting at lack of conviction from buyers. If price fails to convincingly break above 3.7176, a mean-reversion trade becomes favorable.

🔽 Short Entry: Below 3.7176 (ideal trigger confirmation with rejection candle or bearish engulfing)

🎯 Targets:

• T1: 3.680 – minor intraday support

• T2: 3.669 – base of previous demand zone

• T3: 3.610 – stronger structural support

🛑 Stop-Loss: Above 3.74 (tight risk placement above resistance)

Bias: Bearish rejection near resistance

Conviction: Medium-High (confirmation preferred with price action)

Timeframe: Intraday to short swing

NATURALGAS - Time to Move up?CMP: 3.4020

Price is trading closer to the 0.618 fib retracement (3.3780)

AVWAP (On Daily TF) from the swing lows is placed at 3.4083

Price has been declining non stop without any meaningful pullback and I believe that the price will halt and reverse from here.

On Daily TF, it has left 2 FVGs at the top. Price most likely to be pulled up to these levels before going down (if the trend is to go down).

In my view, it is not a good idea to short at current levels of 3.4.

Actually, it is a LRHR set up in the making for long trades.

Daily chart with AVWAP

Disclaimer: I am not a SEBI registered Analyst and this is not a trading advise. Views are personal and for educational purpose only. Please consult your Financial Advisor for any investment decisions. Please consider my views only to get a different perspective (FOR or AGAINST your views). Please don't trade FNO based on my views. If you like my analysis and learnt something from it, please give a BOOST. Feel free to express your thoughts and questions in the comments section.

Long on Natural GasNatural Gas is showing signs of a potential reversal after retesting a key demand zone near $3.75. The chart suggests a false breakdown followed by an immediate recovery, which could trap shorts and trigger a move higher.

Trade Plan:

• Buy Trigger: On breakout above $3.78

• Stop Loss: Below $3.748 (well-defined horizontal support zone)

• Target: $3.90–$3.91 (previous supply zone and top of recent structure)

• Reward-to-Risk Ratio: ~3:1 (as per risk box on the chart)

Elliott Wave Analysis on Natural Gas (XNGUSD) – Potential Wave 5We are observing a classic Elliott Wave structure unfolding on the Daily timeframe of Natural Gas (XNGUSD). Here's a breakdown of the current wave count:

Wave (1) started the initial impulse move up breaking the previous downtrend.

Wave (2) retraced sharply but respected the Fibonacci support zone.

Wave (3) extended significantly, following typical wave dynamics.

Wave (4) appears to have completed near a key support zone, aligning with previous structure and a possible Fibonacci retracement level.

🔹 We are now potentially entering Wave (5) — a final impulse leg to the upside in this cycle.

🔹 Entry is anticipated at the completion of Wave (4), with targets projected near the previous swing highs.

🔹 A stop-loss is marked just below the Wave (4) support zone to manage risk effectively.

This setup offers a favorable risk-to-reward ratio , especially if price continues to respect the Elliott Wave pattern.

📌 Disclaimer:

This analysis is shared purely for educational and study purposes. It does not constitute financial advice or a trading recommendation. Please do your own research and consult a financial advisor before making any trading decisions.

Naturalgas downtrend Movement upto 3.2Symbol Naturalgas

Timeframe 1 hour

Analysis Breakout Below the suport line

can expect a downtrend movement upto 3.2

We hope our analysis is adding value to your trading journey.

Please note: Published ideas are for educational purposes only. Trade at your own risk.

Also, please respect the risk - stop loss (SL) should not be more than 2% of the capital.

DISCLAIMER: We are not SEBI registered. All the ideas uploaded in this channel are solely for educational purposes."