Could Zcash Price Break Through the $50 Barrier in August?Could Zcash Price Break Through the $50 Barrier in August?

Meta Description: Zcash has defied broader altcoin trends, rising over 35% in the past couple of weeks, breaking out of a correction phase.

The OI data has jumped over 100% in the last couple of weeks indicating a strong inflow.

Zcash has showcased a strong performance in the last couple of weeks rising over 35%

While most of the altcoins are struggling to maintain a firm footing in the last couple of weeks. On the contrary, Zcash defied the broader trends and has achieved significant gains in the same period.

Zcash has showcased a strong performance in the last couple of weeks rising over 35%. The recent surge in the price marked the end of a correction phase. At the time of writing, ZEC price was exchanging hands close to $44.2 Indicating a mild intraday loss of 0.29%.

Moreover, along with a strong rise in the price the analysts have recorded a significant change in the OI data. Let's analyze it in detail and try to figure out whether ZEC may be a good pick for next week.

Open Interest Contracts Showcases A Strong Inflow

Despite a weakness in the broader markets and altcoins, Zcash has managed to add significant returns in the last couple of weeks. In tandem with the price jump, the analysts noted a significant change in the OI data.

Source: app.santiment.net

In the last couple of weeks, the OI contracts have surged, taking a big leap from nearly $15 Million to $34 Million indicating a strong inflow. An almost 100% jump in the OI data helped the Zcash investors gain an impressive 35% returns in a short term.

Zcash market capitalization has jumped to $708.3 Million and now ranks at 79th in the cryptoverse. The volume to market capitalization at 10.3% suggests mild volatility in the crypto. Out of a total supply of 21 Million, nearly 77% i.e. 16.32 Million ZEC tokens are in circulation at present.

Zcash Price Technical Analysis

From a technical standpoint, Zcash price has surpassed all the key Exponential moving averages of 20, 50 and 200 days suggesting a positive outlook ahead. Moreover, the daily chart suggests a short term consolidation between the $40 and $44 levels.

Now, if ZEC price breaks out it may resume with a bullish trend and may look to test the higher supply of $50 level. whereas, if the price breaks down the $40 level, it may look to retest the previous breakout zone of $35 level.

Moreover, while applying Fibonacci tool from the recent swing low to swing high, the golden zone was obtained near the $35 level. The golden zone acts as a crucial for a trend continuation.

At the time of writing, the MACD line as well as the signal lines were placed above the zero line indicating a positive trend prevailing. Moreover, a bullish crossover of both the lines was observed indicating a trend continuation.

Zcash has defied broader altcoin trends, rising over 35% in the past couple of weeks, breaking out of a correction phase. Currently trading around $44.2, Zcash saw a significant increase in open interest contracts, jumping from $15 million to $34 million, boosting investor returns.

From a technical point of view, Zcash has surpassed key exponential moving averages, indicating a positive outlook. The price is consolidating between $40 and $44, with potential to test $50 if it breaks out, or retest $35 if it breaks down. MACD indicators suggest a continuing bullish trend.

ZECPERP trade ideas

Zcash (ZEC)Zcash (ZEC)

Zcash outperformed several altcoins and claimed the second spot in terms of weekly gainers. As of now, Zcash boasts an intraday rise of over 3% and a total of over 23% a week. It is a decentralized cryptocurrency focused on privacy and anonymity.

From a price point of view, Zcash has made a strong breakout of a range of nearly four weeks consolidation. The recent breakout has highlighted a bullish trend prevailing in the short term as well as long term.

On the higher side, the analysts are anticipating a potential of nearly 20% till the $43 level. Also, a bullish crossover between RSI line at 68 pints and that of the SMA line at 62.8 was noted on the charts which validates the possibility of a trend continuation.

How Long Can This Breakout Rally Last In Zcash (ZEC)?

At press time, it ranked 3rd in the list with nearly 19% intraday gains, massive gains of 50% this week, and a spectacular surge this month by more than 135% growth.

After deteriorating from an ATH ever price to a registered ATL of $15.87 by July 5th, the price has advanced higher and managed to surpass the YTD ATH of $35.62 mark.

The price structure seemed like a bullish pattern, precisely the falling wedge. The ZEC has pierced both dynamic EMA bands of 50-day and 200-day EMA, with recent liquidity grab bulls' urge for more gains crystal clear.

On continued bullish optimism, there seems to be a higher chance that the price could attain 2023 yearly highs of $51.68, contingent on buyers' activity.

Will #Zcash hit $800 in Bull Market?Would you believe #Zcash will hit $800 of it's Past ATH?

Bullish Engulfing in HTF but SEED_DONKEYDAN_MARKET_CAP:ZEC is a privacy coin and the current market scenario is very negative for Privacy coins.

You can enter between $20-$24 with Strong SL $19.

Major Resistance: $32/$130

Note: Currently #SEC is against Privacy Coins & #ZEC is a Privacy coin so investment in Securities coins is high risky.

NFA

💡Don't miss the great buy opportunity in ZECUSD @ElectricCoinCoTrading suggestion:

". There is a possibility of temporary retracement to the suggested support line (238.09).

. if so, traders can set orders based on Price Action and expect to reach short-term targets."

Technical analysis:

. ZECUSD is in an uptrend, and the continuation of the uptrend is expected.

. The price is above the 21-Day WEMA, which acts as a dynamic support.

. The RSI is at 53.

Take Profits:

TP1= @ 253.92

TP2= @ 266.83

TP3= @ 282.22

TP4= @ 305.09

TP5= @ 330.02

SL= Break below S2

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . Drop some feedback below in the comment!

❤️ Your support is very much 🙏 appreciated!❤️

💎 Want us to help you become a better Forex / Crypto trader?

Now, It's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

💡Don't miss the great buy opportunity in ZECUSD @ElectricCoinCoTrading suggestion:

". There is a possibility of temporary retracement to the suggested support line (188.4).

. if so, traders can set orders based on Price Action and expect to reach short-term targets."

Technical analysis:

. ZECUSD is in a range bound, and the beginning of an uptrend is expected.

. The price is above the 21-Day WEMA, which acts as a dynamic support.

. The RSI is at 65.

Take Profits:

TP1= @ 219.6

TP2= @ 227.9

TP3= @ 248.5

TP4= @ 263.4

TP5= @ 292.1

SL= Break below S2

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . Drop some feedback below in the comment!

❤️ Your support is very much 🙏 appreciated!❤️

💎 Want us to help you become a better Forex / Crypto trader?

Now, It's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

ZEC Constructing Bullish Path For $100ZEC performed a positive momentum on Wednesday’s trading session

Zcash coin price is $95.38, which is up by 3.68% in the last 24-hour time-frame and 11.03% up from the previous week

ZEC/BTC pair is positive with a gain of 1.46% in Wednesday’s trading session (0.002641)

themarketperiodical.com

💡Ascending Triangle in ZECUSD - "Learn More Earn More" With USAscending Triangle Definition:

An ascending triangle is a type of triangle chart pattern that occurs

when there is a resistance level and a slope of higher lows .

It is defined by two lines:

. A horizontal resistance line running through peaks.

. An uptrend line drawn through the bottoms.

The higher lows indicate more buyers are gradually entering the market

and buying pressure increases as price consolidates moving further towards the apex.

An ascending triangle is classified as a continuation chart pattern .

If price can break through the resistance level, that level will now act as a support level.

Breakouts can also happen in both directions. Statistically,

upward breakouts are more likely to occur, but downward ones seem to be more reliable.

In most cases, the buyers will win this battle and the price will break out past the resistance.

But Sometimes the resistance level is too strong,

and there is simply not enough buying power to push it through.

Therefore you should be ready for movement in EITHER direction.

ENTRY:

We would set an entry order above the resistance line and below the slope of the higher lows .

TARGET:

Target is approximately the same distance as the height of the triangle formation.

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated! ❤️

💎 Want us to help you become a better Forex trader ?

Now, It's your turn !

Be sure to leave a comment let us know how you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

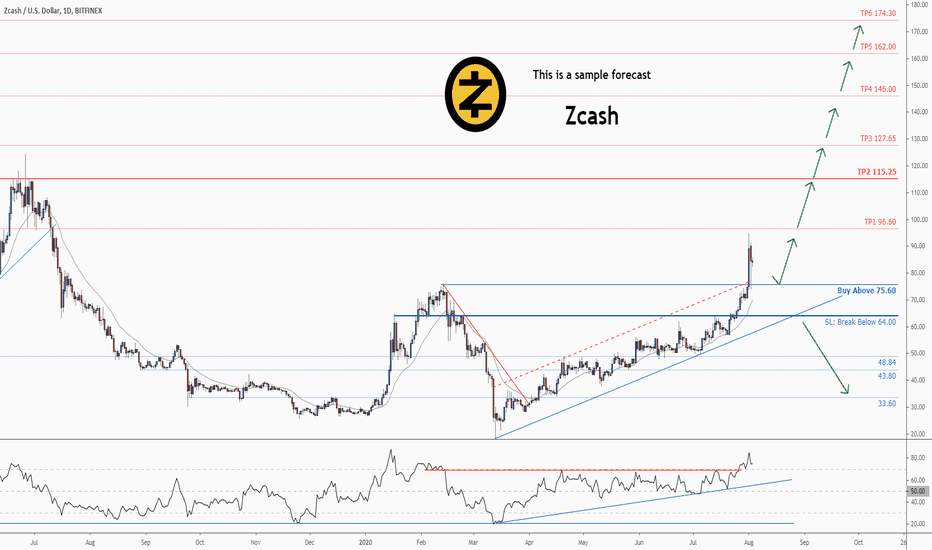

ZECUSD Second Chance: Profit=765% SL=70% Reward/Risk > 11:1Second Chance Trade Setup summary:

Profit targets=765% = {TP3= 35% + TP4= 61% + TP5= 79% + TP6= 104% + TP7= 127% + TP8= 144% + TP9= 215%}

Stop Loss =70%

Reward/Risk > 11: 1

New Trading suggestion:

". There is still a possibility of temporary retracement to suggested support line (71.35) again.

if so, traders can set orders based on Price Action and expect to reach short-term targets."

New Take Profits:

TP3= @ 96.60 (New)

TP4= @ 115.25

TP5= @ 127.65 (New)

TP6= @ 146.00 (New)

TP7= @ 162.00 (New)

TP8= @ 174.30 (New)

TP9= @ 225.40 (New)

SL= Break below 64.00

--------------------------------------------------------------------------------------------------

First Buy Current Status:

Total Profit: 136%

Closed trade(s): 85% Profit

Open trade(s): 51% Profit

Trade Setup:

We opened 3 BUY trade(s) @ 48.84 based on 'previous Forecast' at 2020.06.15 :

Closed Profit:

TP1 @ 64.00 touched at 2020.07.13 with 31% Profit.

TP2 @ 75.60 touched at 2020.07.31 with 54% Profit.

31% + 54% = 85%

Open Profit:

Open trade is 74.15(current price) - 48.84 (open price) = 51%

1 trade(s) still open, therefore total profit for open trade(s) is 51% x 1 = 51%

Technical analysis:

. ZECUSD is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 46.

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated!❤️

💎 Want us to help you become a better Forex trader?

Now, It's your turn!

Be sure to leave a comment let us know how do you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

ZECUSD Update: Profit=124950 SL=11600 Reward/Risk > 10.7:1 Trade Setup summary:

Profit targets=124950 pip (2100 + 3965 + 5205 + 7040 + 8640 +9870 + 14980 + 19540 + 23670 + 29940)

Stop Loss =11600 pip

Reward/Risk > 10.7 : 1

Current Status:

Total Profit: 7732 pip

Closed trade(s): 4192 pip Profit

Open trade(s): 3540 pip Profit

Trade Setup:

We opened 3 BUY trade(s) @ 48.84 based on 'previous Forecast' at 2020.06.12 :

Closed Profit:

TP1 @ 64.00 touched at 2020.07.22 with 1516 pip Profit.

TP2 @ 75.60 touched at 2020.08.01 with 2676 pip Profit.

1516 + 2676 = 4192

Open Profit:

Profit for one trade is 84.24(current price) - 48.84(open price) = 3540 pip

1 trade(s) still open, therefore total profit for open trade(s) is 3540 x 1 = 3540 pip

Technical analysis:

. ZECUSD is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 73.

New Trading suggestion:

. There is still a possibility of temporary retracement to suggested support line (75.60) again. if so, traders can set orders based on Price Action and expect to reach short-term targets.

New Take Profits:

TP1= @ 96.60

TP2= @ 115.25

TP3= @ 127.65

TP4= @ 146.00

TP5= @ 162.00

TP6= @ 174.30

TP7= @ 225.40

TP8= @ 271.00

TP9= @ 312.30

TP10= @ 375.00

SL= Break below 64.00

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated!❤️

💎 Want us to help you become a better Forex trader?

Now, It's your turn!

Be sure to leave a comment let us know how do you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

A trading opportunity to buy in ZECUSD Trading suggestion:

. There is a possibility of temporary retracement to suggested support line (48.84). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. ZECUSD is in a range bound and the resumption of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 66.

Take Profits:

TP1= @ 64.07

TP2= @ 75.60

TP3= @ 115.25

SL= Break below S2

Don't miss the great buy opportunity in ZECUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (28.13). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. ZECUSD is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 68.

Take Profits:

TP1= @ 33.36

TP2= @ 39.33

TP3= @ 43.65

SL= Break below S2

There is a possibility for the beginning of an uptrend in ZECUSDTechnical analysis:

. Zcash/US Dollar is in a downtrend and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 14.

. While the price downtrend in the daily chart is not broken, bearish wave in price would continue.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (43.30 to 49.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (49.00)

Ending of entry zone (43.30)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 56.50

TP2= @ 64.75

TP3= @ 73.80

TP4= @ 91.00

TP5= @ 106.70

TP6= @ 127.65

TP7= @ 157.05

TP8= @ 184.90

TP9= @ 220.60

TP10= @ 328.65

TP11= @ 375.70

TP12= @ 503.10

TP13= Free

There is a trading opportunity to buy in ZECUSD Technical analysis:

. ZCASH/DOLLAR is in a downtrend and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 41.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (164.00 to 142.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (164.00)

Ending of entry zone (142.00)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 199

TP2= @ 227

TP3= @ 261

TP4= @ 304

TP5= @ 377

TP6= @ 492

TP7= @ 560

TP8= @ 800

TP9= Free

A long-term trading opportunity to buy for Zcash !Technical analysis:

.ZCASH/DOLLAR is in a Range Bound and Beginning of up trend is expected.

.The price is below the 21-Day WEMA which acts as a dynamic resistance.

.The RSI is at 41.

Trading suggestion:

There is a possibility of temporary retracement to suggested support zone (227.00 to 173.00). if so, traders can set orders based on Daily-Trading-Opportunities and expect to reach short-term targets.

.Beginning of entry zone (227.00)

.Ending of entry zone (173.00)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 266.00

TP2= @ 312.00

TP3= @ 412.00

TP4= @ 486.00

TP5= @ 560.00

TP6= @ 800.00

TP7= Free

Go long slightly above the ascending triangleIn the daily chart it forms an ascending triangle denoted by the thick blue line.

Also, I see a perfect ascending triangle in the 4hr chart (denoted by the dashed/dotted red line). The candle sticks are hovering at the horizontal line of the triangle. This is good.

MACD looks like it has confirmed the uptrend and RSI is currently at 59. I guess there is some more room for the buyers I'd say.

To summarize, at the moment, it seems very likely that it'd break out. in case it doesn't then it'd follow the blue curve within the ascending triangle, accumulate for a while and eventually breakout at a slightly later point.

That said, I'd set my trade at the points below

Buy at the red line above the triangle @ 306

Take profit at 332 (note: this is also .618 fib level in the daily chart)

Stop loss at 294 - 296

This is a conservative approach. ie: i'll buy once the break out is confirmed.

A more aggressive approach would be

Buy @ 301 - 304

Profit @ 332

SL @ 294 - 296

As always, appreciate your feedback and thank you!