Infy is plaing hide & seek with traders, in the last 3 sessions it formed 3 dojis (tri star doji) these formations comes close to a very high intensity supply zone. While all other IT stocks were faltering infy kept itself tightly clinged to the range, if the range is not taken out buy the buyers in a session or two, it will result into some fast corrections. The...

In my last Friday’s update I mentioned that we may see banknifty trading at 31000 levels. The index registered a close at 31160 today. Now it’s trading close to a support level the KS line. A major support is at 30600. Most of the time KS acts as a very good support for prices, so a bounce from it is not ruled out. 31600 will be the decider level for coming...

Nifty left behind an important support level. After giving away 12000 levels which was a physiological support level this will act as an important pivot in the coming sessions. Next support can be seen at 11700 (Lead 1) on the charts, expecting some bounce from these levels. Major area of demand is 11420 (hopefully we may visit it). RSI is moving towards 40 levels...

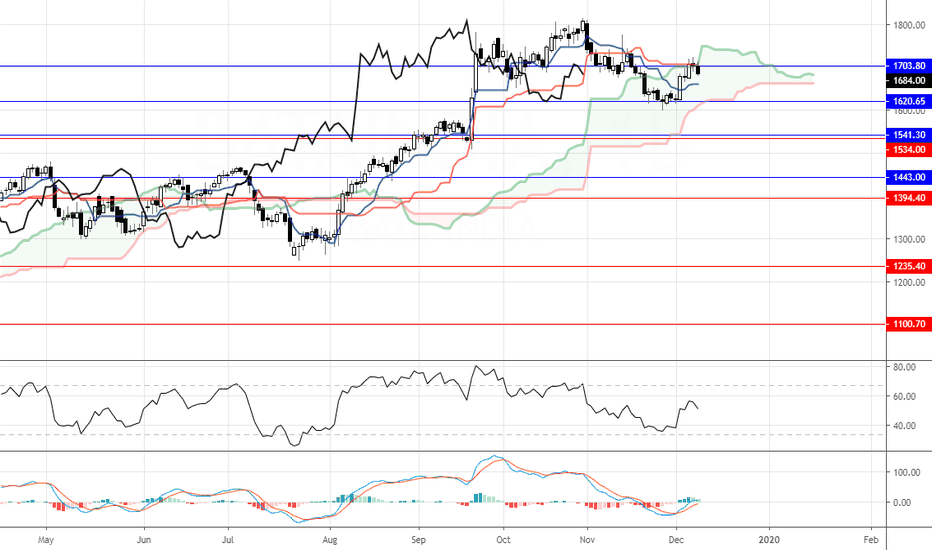

The stock was into dominant trend up, last few months the stock hasn’t displayed any zeal to move up. Now at a high intensity resistance level, the price consolidated and formed a negative candle pattern. The RSI is into neutral zones creating bearish signs. Macd is into bearish zone. The stock is expected to correct to 1620-1540 levels where it may find support....

MARUTI SUZUKI: The stock was holding support levels for last few sessions, in today’s move it broke down from an important pivot and negated the bullish view. Now the stock is expected to remain sideways to down for a couple of weeks. The RSI is close to 40, which may result into some bounce, till 7000 levels. This level will now serve as a resistance instead of a...

NIFTY: Nifty took beating from the bears in the last two sessions. Now at a very key juncture, a break and close below the 12000 levels have shattered the physiological support levels, still the bullish nature is not wiped out fully, if the fall continues the index may tumble to 11420 levels, again the levels I am mentioning may be vague & outrageous but still...

BANKNIFTY: Selloff was dominant on the last two sessions on daily charts. After the RBI policy, weakness took over resulting in a sell off. Prices closed below the TS line almost after 45 days of holding it. A minor support has been given away. The next key support zone is close to 30790 levels, the index is expected to take support here, breaking this key level...

Infosys took resistance at a very strong pivot point and fell back. The stock is still into down trend and the move up may be classified as a mere pullback. The last bar is a bear bar. A small support is at 694 levels, breaking this will result in sell off and infy may travel down towards 656 zones.

CONCOR: The stock opened with a gap up and the prices continued up during the day. The prices closed near the highs. The prices have been making a falling wedge pattern with falling volumes. The RSI took support at the 40 levels and bounced up, MACD turned positive (though it is below zero line) there is a minor resistance at 585 levels, the stock is expected to...

HINDUSTAN UNILEVER LIMITED: The stock had a fabulous run in the last few months. In the last few weeks, the stock displayed a loss of momentum and correction occurred. Now the stock took a hit at an important pivot and corrected. The stock has minor support at 1995 – 2000 levels below which there may be a further correction to 1920 levels. However, a move above...

USDINR: The currency pair has pulled back in the past week, the last two sessions were positive and the prices managed to close above all resistance and pivot levels. The RSI is into a bullish zone and bounced from the bullish extreme zones. The MACD is positive and above zero. The pair is expected to move higher in the coming sessions. The pair may move to 72.25...

NIFTY: The index corrected in the last session and closed just at a support level. The TS line serves as a good support to strong trends, in the coming sessions 12000 will play an important role for the index, as long as the level is safe the index is expected to move higher however giving away 12000 may install weakness in Nifty and drag it to 11800, this is...

CANBANK: Recent rally in public sectors banks have been good and strong. Almost every public sector bank rallied more than 20% from their recent lows. Canbank is now hovering at a resistance point. There is a strong supply area ahead, if the stock fumbles here, there may be a small correction which may rest close to 208 -205 levels, if a breakout is successful...

APOLLO HOSPITALS: Prices are ranging between a symmetrical triangle pattern, this leg up missed the upper boundary of the pattern indicating weakness probably. Symmetrical patterns are neutral patterns, let’s have cues from the indicators. The RSI is into neutral zone has formed a NR, MACD is just at neutral zone. The prices have faced resistance at important...

BRITANNIA INDUSTRIES: The stock is hovering around a very strong support zone. The RSI bouncing off from 40’s further indicate the momentum support in the stock. MACD is neutral and picking up (though not positive yet). A minor bottle neck is placed at 3130 – 3145 levels, above which 3280 &3360 may be evident.

BALKRISKHNA INDS: The stock has took support at an important level and bounced back. The price action is strong – a bull sash pattern. Also noticed a bounce & support at the KS & TS line (both pointing north). Chikou free above the prices and kumo. RSI into bullish zone just below 60 while MACD is strong above 0. The stock is into bullish momentum and expected to...

The movement of Nifty was directionless this week. From last three weeks Nifty has kept traders on the edge and has been teasing both buyers and sellers. We can see a tri star doji formation on the weekly charts at resistance, tough doji does not mean outright sell, it depicts chaos and confusion. We should not discount the fact that the trend is up and yet no...

The stock has made healthy retracement and have now it’s resting on the Kumo. Today’s price action was quite convincing to re-establish the buyers into the stock. The RSI is taking support on the bullish extreme levels with MACD curling up indicating momentum is picking up. If ONCG gets overall support from Nifty, the stock is expected to pull up strongly from...