Kpit Pull back from 198 with volume might go higher Possible buy at current level with stop loss 209 for target 232 above insight. Use stop loss and trail stop loss

NSE:DHFL After a big fall to touch 176 level, pull back momentum continues Price is moving between 176 and 252 level Trend bias is positive but not very strong at this point Possible buy at current level with stop loss 205 and target 236, 252 insight. For further upside need strong momentum and break out above 252 levels that will take time So far 214 and 205...

NSE: Navin Fluorine Pullback from 582 to high of 777 formed a consolidation channel. Price is moving between high and low. Formation of Symmetric triangle suggest a bounce from 667 level Possible buy @ current level above 667 with stop loss 640 for a bounce back target of 712 to 735. Strong resistance at 735, if break out will push price upwards towards 777

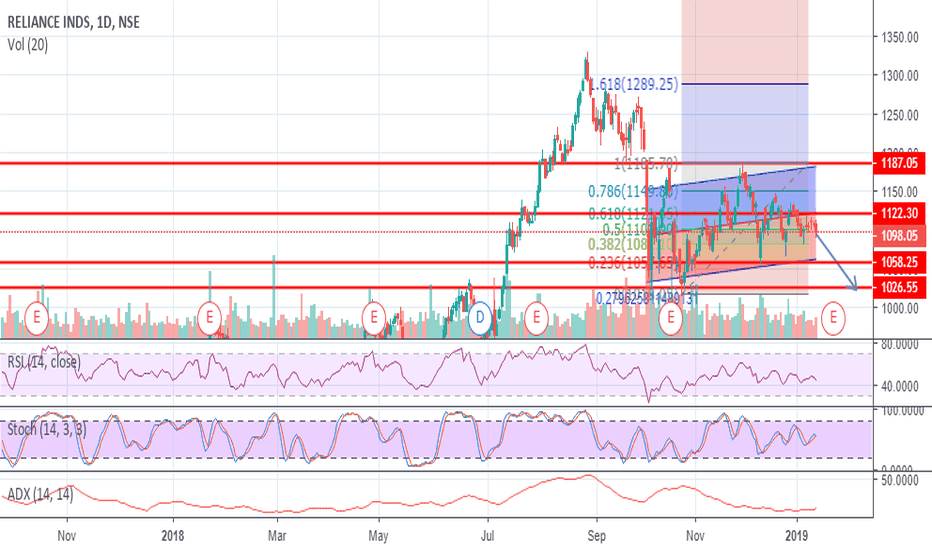

NSE: Reliance Industries From High of 1329 fall to low of 1016 Since then consolidation range from October to Jan shifted to 1187 to 1058 until 1122 level is strong resistance One can initiate short @ current level 1098 with stop loss @ 1122 and target 1058, 1025, 1016 in sight. Break below 1025 will open levels for further downside. Over all pull back from...

NSE: JustDial Dialing Breakdown below 459 to 410 Brief 1 year price range consolidation 640 to 360, price oscillating between this range Chart is showing weakness built up. Triangle formation shown bearish move. One can initiate Short at current level @ 476 with stop loss 498/512 for a target of 459, 410. Break below 410 can push price further to 370.

NSE: Praj Industries Breakout above 131 Breakout from long consolidation rage of 131 to 73 with heavy volume More upside on daily charts Possible long with stoploss of 131 for a target of 157, 167, 190 & 224 in short term

NSE: Aditya Birla Fashion Possible Breakout above 215 After consolidation from August 2018 to Jan 2019, showing signs for breakout The brief range of consolidation from low of 160 to high of 215 Possible Long at current level with stop loss of 190 and target 228, 236 and 249. Time frame looks 4 weeks

NSE: Varun Beverages One more attempt for Breakout . Since July 31 till Jan 15, Stock was oscillating between 670 to 829 Flat consolidation with 2 attempt for breakout Stock is consolidating near 829 level since last few days, might be one more attempt for breakout Possible Long after close on daily chart above 830 for a target of 873 and 920 in short term.

NSE: BATAIndia Momentum play for 1282 Breakout momentum play for short term 1282 Trapped in range 833 to 1110 from June 20 to Jan 08 Current momentum can take stock to 1282 Possible Long above 1110 with stop loss 1088 for targets 1179, 1225, 1282 + If momentum continues price may be pushed beyond 1282 Use stop loss and trail stop loss

NSE: Vaibhav Global -Is it a Buy for Second Breakout to 921? Since the last breakout from level of 621 on Oct 30, 2017 Stock is consolidating in the range of 796 to 639. During correction fell from 779 to 579 level. Bounced back from 579 to 767 and trading between 735 to 701 Charts showing triangle formation Technically with long at current level, stop loss @ 678...

NSE: CONCOR -Near to break resistance @ 703 Stock has corrected since May 2018 from 703 to 541 Since then bounced back to touch 700 level and moving sideways near to 703 Formed triangle like pattern between 541 to 700 Technically make or break situation Possible Long @ current/ above 703 close level with stop loss 642 Target insight 740, 763 & 801 Below 642...

NSE: BANK Of Baroda Possible downside below 115 Stock is trying pull back from low of 90 on Oct 11. Crossed 61.8 Fibo level from Sept 3, high @ 156 1 Year trend is negative, Pullback is loosing momentum. Possible short below 115 for a target of 105 below Stop loss on closing basis 123. Close above 123 level will continue momentum on upside. 123 level is strong...

NSE: Yes Bank Out of Ascending triangle might move for 225+ . Since Nov 29 till Jan 15, Stock was oscillating between 195 to 146 This has formed Ascending triangle like pattern 195 level was strong resistance that stock has crossed Possible Long at current level with stop loss around 176 level and target of 225, 246 and above in sight Time frame looks 4 to 5 weeks.

NSE: Kotak Bank Possible Long for resistance break above 1268 From High of 1408 on July 19 to Low of 1133 on Sept 28 Pull back is in progress with triangle pattern Today closed above 61.8 retracement level from 1408 fall. Level 1268 looks like resistance. Possible Long for resistance break to take 1321 level, Further break above triangle can touch 1400...

NSE: KILITCH DRUG Volume Breakout for 247, 271 Break out Momentum play From Oct 15 to Jan 07 consolidation between 149 to 209 On Jan 08, break out with unusual high volume compare to normal day volume, closed above 209. Level 209 seems to be strong resistance. Possible long at current level with strict stoploss 186 and target for 232, 247, 271. If momentum...

NSE: Muthoot Finance Upside momentum from low of 389 continues with strong participation. One can initiate a buy to ride the wave. Price breakout above 500 suggests momentum will continue with stop loss of 480 and can achieve target level of 550, 558, 568, 598 With further breakout above 598, target of 726 insight. At current level strength of pull back is...

NSE: Hindustan Petro Pullback continue from selloff to 164 level Trend is not very strong but can initiate a long position @ current level with stop loss 225 and target 245. Trend is loosing movement, might retreat from 245 level for further downside. Need to break out above 262 for further momentum on long side.