In previous post we analysed that nifty has minimum target near 17600 for wave "e" of wave d... today made high near 17560 now previous resistance of 17442--17326 is acting as support... and upside resistance zone 17550--17650.. nifty till date continue HH- HL swings in upward channel

Indhotel looking good above 237 .. to be kept in radar volume coming up

Deltacorp given breakout of the rectangle sustaining above 300... it will move towards 350++ in short term

ABFRL looking strong above 295 and moving towards 310---320

vipind given breakout from the triangle with volume .. moving towards 800 from long term perspective stock looking good and buy on dip mode

NIFTY stuck between two important fib ratio 50& & 61.8%... i,e, 17010 & 17326 currently sideways consolidation going on for wave d of d.. playing support resistance worked out best in past few days.... trading in a upward channel with HH-HL SWINGS

pvr will give breakout above 1870 if sustains... volume is good

MCX copper i a triangle and range contraction happening... 790 is important multitime support... whereas immediate hurdle is 800--803 breaing out of the triangle will give move towards 820+++ whereas breaking down of 790 will take to another important support 780 views are educational

US CRUDE oil paused near important fib ratio 50% & 61.8% near $116 if sustains above $116 than will see move towards $130 currently wave 2 (c) consolidation going on.... no shorting will be recommended till it is above $100 views are educational

nifty started up wave "d" from 15671 and till now made high 16442 currently it is making higher high and higher low swings... with narrow consolidation between 17050-----17450 being 17010 is 50% fib ratio giving support and 17326 is the 61.8% fib ratio Till index making higher swings of HH -- HL.... upside targets of 16600 remain open for nifty calculation : ...

Birla soft given breakout from inverse h&s pattern... bias bullish.. buy on dip targets 520+++ views are educational...

Auropharma rounding bottom... today good volume is seen... immediate hurdle 695... if sustained than 715+++ downside 640--650 seens good support views are educational

Timken India has given volume breakout from the triangle The stock is ready to fly towards 2500 in coming days buy on dip mode... views are educational

cyient breakout if sustains above 900 will move towards 1000++

Oriental Aromatics given breakout with strong candle.. BUY ON DIP MODE moving above 800.... immediate hurdle 850.... if that crossed than will move towards 1000 in short time views are educational

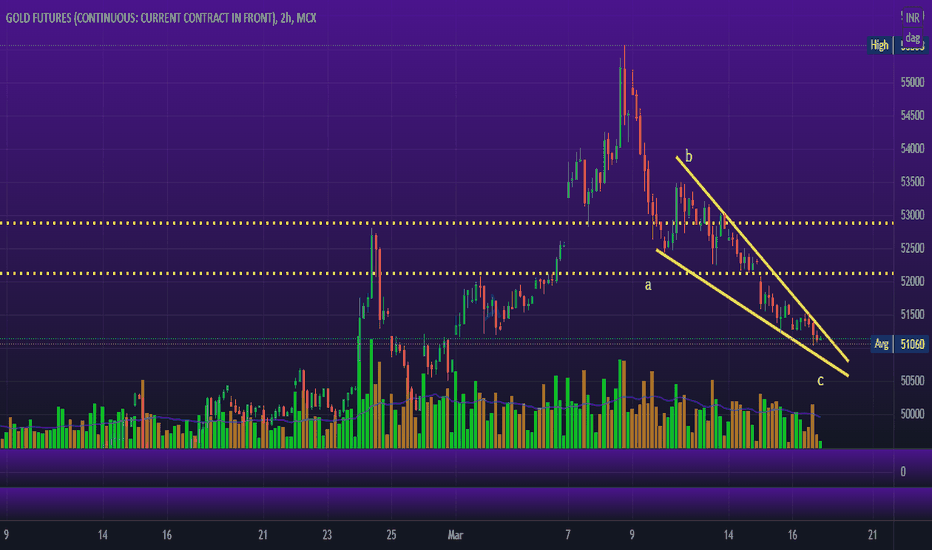

MCX gold in falling wedge... and breakout of the wedge will give upside move towards 52000+++ gold doing abc correction and coming out of the wedge will confirm completion of corrective abc wave views are educational

orbitexp given trendline breakout with strong candle and than again breakout with strong candle from rounding bottom.. volume is good price is the engine and volume is the fuel more the fuel ... more the power ... more the movement views are educational

chambal fertiliser moving in upward channel.. moving towerds 450++ views are educational