Crudeoil Seems Getting Ready for Bearish Correction in Near Future

Explaination on Chart. Strong Commercial Long Buildup. But Bottom is still not Visible.

Commercials Highest Ever Lifetime Shorts !!! Watch for Falling Momentum

Although i am having a shorter side bias in crude oil BUT ..... A word of caution - Trade with a strict stop loss, at least till it confirms the move by breaking the uptrending line on daily closing basis.

Correction or Impulsive Down Move - Only Time will tell. However one can stay with a short side bias for next month or so and play for a move to 2.3 Area (Green Line)

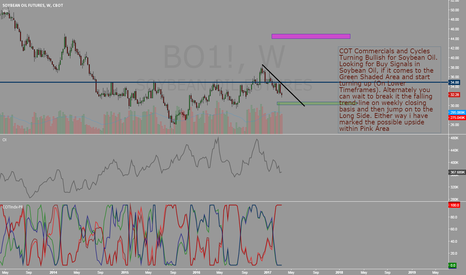

Start Looking for Upside in Soybean Oil, within a span of next 2-4 weeks. You can fine-tune your entries on Daily/240 min Timeframe

Let It Break decisively. Till then you can take advantages of intra-day short ranges. But do that with strict risk management. Finally the pattern at present looks Bullish, BUT it can go either way. Because on the flip side of it - COT reports are Bearish, open interest is at record high and Commercials are record short(more than they were at 2014 drop from...

The down move is looking exhausted. Look for good long setups on lower time-frames, with strict stoploss

Gold and Silver go the same way. Expecting Retracement move or Even a push below the recent lows. But let the momentum turn in your favour first

Expect a Healthy Retarcement in Gold, ONLY WHEN Daily momentum turns Bearish

Still has upward bias in longer time frames. just looking for good buy setups on D/240 min charts

Still Playing between the two Levels & DIRECTIONLESS Until it breaks either level convincingly, look for small and short term trades on lower time frames. I will personally have a short side bias.

Look for shorting setups if Nifty retest of breakdown level of 8375 on Monday. Happy weekend