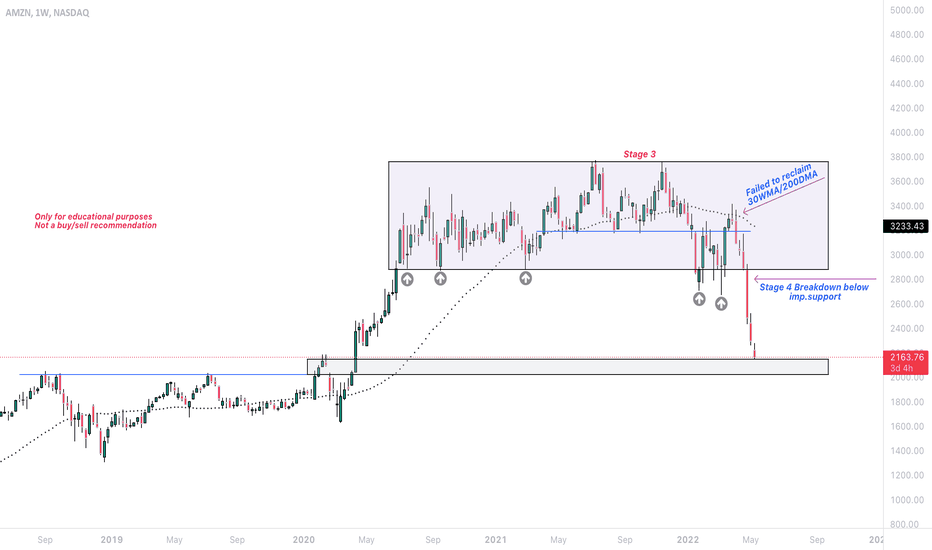

Amazon weekly TF chart.. Stage Analysis. Only for educational purposes, not a recommendation.

Apple Inc. weekly TF chart. On crucial stage 3 base support zone. Only for educational purposes, not a recommendation.

Google weekly TF chart - In Stage 4. Only for educational purposes, not a buy/sell recommendation.

Netflix (NFLX) weekly chart with Stage Analysis - Stage 4 stock. Only for educational purposes, Not a buy/sell recommendation.

Stage 4 breakdown, early base formation stage1 may be in progress. Only for educational purposes, not a recommendation.

Page Industries. BO soon candidate with nice consolidation near BO zone, RS positive shows outperforming stock. Only for educational purposes, not a buy/sell recommendation.

Godrejcp - Triple Bottom pattern marked at support levels. Neckline yet to be broken. RS line is increasing, on the verge of moving above 0. Moved above 200 DEMA and 50 DEMA. Will keep on watchlist. Only for educational purposes, not a recommendation.

Happiest Minds: BO from Pennant formation after good consolidation range. Target 1561. Only for educational purpose. Not a recommendation.

Tata power in uptrend rising channel. BO above 137 may proceed for target of 154. SL 121. Only for educational purpose. Not a recommendation.

Tata Elxsi - Pennant pattern formation with 30 DEMA support. - Volume and Price contracting within the pennant triangle. - On the verge of breakout, prefer with good volumes. - Can go long on breakout of pennant triangle. - On weekly chart, stock in Stage 2 uptrend, this pullback may be an entry opportunity in uptrend for traders. Only for educational purposes....

BO done above 935 today out of long consolidation range. - Stop loss - 819 Target - 1120. - RS rising into the positive zone. *only for educational purpose not a recommendation

Larsen & Toubro - Major BO confirmation on weekly closing basis. - Inverse Head and shoulders pattern. - Looks good for major uptrend. Only for educational purpose not a recommendation.

TCS confirmed breakout on weekly closing basis. - Breakout after good consolidation zone. - Stock in Stage 2 continuation uptrend. - Giving a good opportunity to add. Only for educational purpose. Not a recommendation.

#LaurusLabs poised for further upmove. Positional view. - BO done above 700 level. - Slight RSI divergence, may slow down the progress till it is sorted. - May be a entry opportunity for target 810. - Stop loss may be at 635. *Only for educational purposes, not a recommendation.

Hind Copper: Avoid - Moving in downtrend channel. - No trade entry till a breakout above the channel and negation of LH-LL pattern. Only for educational purposes. Not a recommendation.

Metal Index obervations: - Metals retest of BO line done today. Whether successful?? need to check chart for next few days. - Level closed on 20 DEMA support. - Super trend is still in buy zone. Need to wait for uptrend continuation confirmation on chart in coming days. *Analysis only for educational purposes. Not a recommendation,

Bharti Airtel will plan entry only on below levels being met: - In breakout zone from rounding consolidation range, entry only above 625 which is previous resistance. - Preferably with volume expansion. - Target may be 740, SL - 555 - RS is positive and rising, MACD positive, Super trend buy signal, price action is supreme. Don't jump into trade, wait for levels...

- BO done above 4178. - RSI negative divergence seen, may slow the uptrend till sorted. - May look for entry after divergence is sorted out for targets of 4580. SL may be 3749. *only for educational purpose not a recommendation