Here is interesting perspective to look at BankNIfty. Chart is comparing BankNifty with Nifty. BankNifty has not performed better than Nifty since December 2019. Even the ATH did not breach highs of Feb 2021. Traders like volatility and BankNifty has served them well. Chart sets a tone for underperformance in future. Most likely interest rate cuts will be the...

Nifty is in supply zone of previous two tops. The price breakout must also be confirmed with RSI this time. For bullish bias - one can look at it as a Cup and Handle, when nifty starts trading above red zone For bearish bias - one can look at it as a ending diagonal (Ascending triangle), when nifty starts trading below blue trendline Use discretion!

Daily charts have formed lower lows on closing basis. Very important supports look 1530 (hdfc bank) and 2500 (hdfc). Clear rejection from breakout levels. View will be invalid if we get a close 1680 and 2800. Use discretion!!

USDINR has taken nice resistance of the upper trend line. And selling pressure is building up since morning. Short term trade is to trade till lower line. To some one who wants to play for longer view may add shorts at each peak done like today. Once it starts trending lower trendline, down rally may start after a retest. Smart think to do will be add after...

Early view - if current rally from March 16 bottom is Wave B then it has retraced by 0.78%, If this is A-B-C correction then nifty should head for 16399 and/or 15127. This down rally can be fast. Confirmation levels - 18000, 17800, 17550, intensity will increase at each confirmation. Invalidation above 18500 and safe to assume that Wave B is still...

NIFTY IT - be very very very cautions on positions. this index setup is looking really dangerous. Longs are advised only above 29400. If this scenarios gets played out, there other possibility is that it keeps consolidating for 2-3 years between 29400 and 27600 band. That will cause opportunity cost. Use discretion!!

Initial targets of USDINR on breakdown in dollar. High volatility can be expected - pyramiding will be best approach Use Discretion!

This may act as a support. Would prefer waiting, only topping up Bees. Anchored VWAP is yellow line Black trend line is from covid lows on a linear chart

Indicating reversals from all time trend line. Good to go long with PSUBEES

NIFTY - Why to keep bullish bias ☑️ 0.61% retracement done ☑️ buying from previous swing top ☑️ channel support taken ☑️ 18400 becomes confluence zone Friday selling looks more like a major shakeout. Once bulls reclaim 18600 and go above 18640-18670 band, upside should continue @TradeStrikes

Very high chances that GOLD could head for 68K levels. Use discretion!

1. important close above trendline 2. closed above 61 EMA 3. Higher low and Higher high confirmed As metals are moving up this will also add momentum to NALCO Use discretion!

Stage 2 bullishness confirms above 148-150 band. Weakens may continue below 130. Use discretion!

A probable VCP pattern looks in process to take nifty to 20992 View invalid on close below white trend line, for study only. Use discretion !

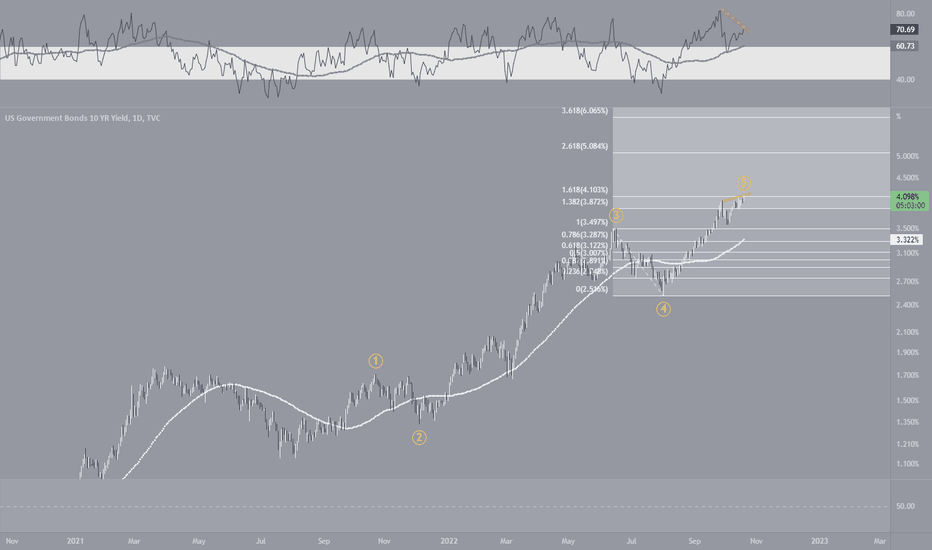

US10Y could be in at its peak in current wave cycle to stary a ABC correction. RSI on daily is also showing divergence indicating topping out sign. The correction in US10 will be good for equities. View will be invalid if the high 4.123 is broken and wave 5 might get extended. User discretion!

CIPLA may reach to 2037 as long as it stays above upper triangle trendline. User discretion!! for learning only!

SUNPHARMA can be a potential doubler. May form a coupe and handle or rounding bottom pattern and travel towards 2000-2080. Use Discretion, not for trading but for education

If in Wave 3, IDFCFIRSTB can travel towards 112. Also important challenge will be to cross long term trend line , crossing it will also support the breakout and further extension of wave 3 Use discretion & SLs