Stock in lower lows lower highs in daily Current area also a flip zone in daily So the resistance in the below mentioned area will be possibly strong Area of Daily Resistance 3400 - 3500 SL area strictly above 3540 / 3550 Downside possible target 3050 Good risk reward Good option play possible

Making lows in all higher time frames Current area is a daily supply zone as well as a trend line rejection zone Current area of entry near 1400 - 1420 Upside SL above 1440 Downside targets near 1280 - 1300 Lower time frame confirmation compusory

Stock currently hovering near Weekly Strong support levels, which extends downside upto 2625 As we can see stock is not making new highs but also not making new lows as well There is also a daily strong area merged in the same zone, which can be considered as a good buying zone, with a downside Sl of 2600 (Closing basis) If it manages to hold the mentioned area,...

Area where the stock is trading right now is a supply zone in daily as well as weekly But as we can see it is trying to hold the area with VCP pattern not making any new highs or lows Current zone important between 376 - 384 Breaking of current trend line will decide the direction of the stock If it breaks upside it will struggle at the next resistance near 400 If...

Stock trying hard to consolidate and go up But as we can see there lies an opportunity on the upside with Drop - Base - Drop range (168 - 172) If stock reaches and pauses in the above mentioned area, It may be possibly give an sell opportunity in Lower Time Frame Keep an eye Sl will be above 175 Targets on the downside can be expected up to 150 Advance...

- As we can see stock is taking support from 2023 demand area near 750s - But a very strong supply area exist now between 910 - 940 - Keeping an alert of the supply range will give an opportunity initiate a bearish call in may ways like Bear Spread / CE Sell / PE Buy - Lower Time frame confirmation is a must before entry Looks like an excellent sell call with...

Chambal Fertilizers : Consolidating from June 2024 till a few days back between a range of 440 - 550 Finally it broke out of the zone and made a new ATH of 588 Currently pulling back in a strong demand zone between 525 - 545 If stops and tries to reacts (in lower time frame), then it will be an excellent opportunity to buy, as stock will make new ATHs in the...

From the Highs of 4400s to the recent lows of 3500s stock has almost corrected near 20% n finally started to rose from a good weekly demand zone But it seems the trouble is not over yet As we can see a strong supply zone with gaps is present in the daily time frame, with a supply range between 3600 - 3670 Any signs of bearishness in lower time frame will be a good...

Strong supply area in multiple time frames like Daily / 125 / 75 Also a strong gap area Expected resistance zone to fall between 22630 - 22730 Upside Sl above 22800 Downside targets 22400 & 22000 Entry with 15/25 min candle confirmation only

Daily supply zone 150 - 156 Flip Zone Resistance at 157 Downside supports at 142 - 138 1st targets 132 - 128 Second support area target Entry confirmation on lower time frame compulsory Upside Sl if any to be above 158 High probability option trade possible with low risk

Stock in LH LL Mode in Daily Currently has multiple strong selling areas It is bound to make another Lower Low in coming days First possibility of selling opportunity arises at 1200 to 1220 Second selling area is at 1250 -1290 Third strong selling area is between 1330 - 1355 Forth and final strongest selling pressure area is the Gap zone created between 1425 -...

Currently stock stuck between Strong Demand & Strong Supply Zone Demand zone 715 - 705 (Lowest point upto 700) Supply zone 755 780 (Highest point upto 785) A strong straddle trade opportunity can be created if stock settles near 735, and IV & Premium remains high Strong supply & demand zones are also formed in 125 as well as 75 min TF to support the...

690 - 715 Strong Supply Zone Sl Above 715 Entry confirmation on LTF compulsory Downside target expecting up to 620 / 600 If falls more it may go upto 555 Broader Market currently in bearish phase Any rise is a selling opportunity Nifty will not be bullish till it closes above 22800

Rejection / Supply area from 124 - 129 Area has RBD as well as Flip zone Upside Sl above 130 Downside target area near 115 Lower time frame confirmation required Entry can be planned in 15 / 30 Mins TF As market volatility is high be cautious with entry

Stock reaching its RBD area High possibility supply area 775 - 795 Trend line Rejection area too Upside Sl strictly above 810 Supply zone areas in 125 as well as 75 Mins as well Strong possibility of reversal from this area LTF confirmation required Downside target area near 735

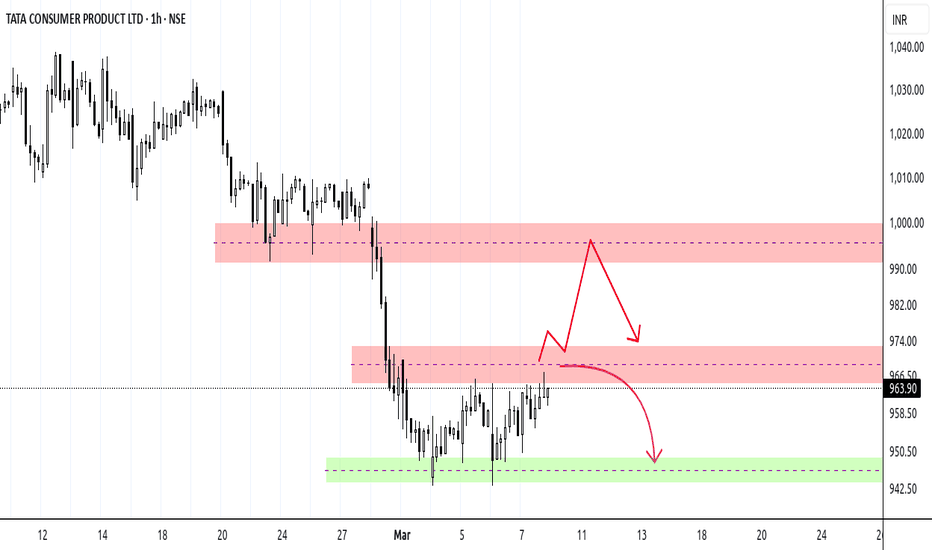

Stock mostly sideways to downtrend Right now trading in Hourly Range Standing at strong resistance area 965 - 975 If broader markets stay bearish to sideways, high possibility of stock turning bearish from the mentioned area till 950 or lower If it goes bullish then its sure to stop near 980 to 1000 area, as that area is resistance plus flip zone From 1000 it is...

Stock in DBD - Base Zone It also happens to be a flip zone Zone area from 1390 - 1435 Rejection in this area very much possible Any signs of bearishness in LTF will be significant for entry Expect downside Targets upto 1340 / 1300

Stock mildly bullish Reaching its resistance area in daily as well as hourly,also it happens to be a gap zone too Area marked is 495 - 510 Market sentiment bearish Wait for confirmation in lower time frame View negates above 515 Downside possibility of 435 - 440 Be Cautious