YS9

It can be bought at 88.50. It seems there is hige demand stock is there. All the supply which has come at breakout point has been absorbed and stock has closed in green on last trading day. This is good bullish sign.

After long time the stock has closed above downward trendline. It has closed with good volume and there is inside buying also. It can be bought at 90 with SL of 84

Again VCP with 70% reduction in volatility with reduction in volume. Buy above 1011 with SL 949

VCP. Reduction in volatility by aprox 58%. It can be bought above 926 with SL of 869

Clear cut divergence can be seen in bank nifty. It is showing loss of momentum but doesn''t tell to short. It may happen that after some time wise correction again up move start.

It seems nifty is slowly losing it's momentum. It can be seen from RSI divergence. The same is also there in bank nifty while defensive sector like FMCG is gaining momentum. Either there will be some correction in nifty and defensive sectors will move up or nifty may go sideways and sector rotation will go on. Let's see.

Am I watching correctly ? inverted HS in spread chart of CNXAUTO/NIFTY. If yes then it can give huge upside in maruti and heromoto but after breakout only. This sector has also become necessirty in india so may be considered as defensive one only and while general market may be under consolidation it will run up.

CNXFMCG/NIFTY is another defensive sector. It seems money is moving from other sectors to pharma and FMCG.

CNXPHARMA/NIFTY is breaking out from downward trendline. Its bear market or correction play in general. We may see some correction time wise and price wise in general market while defensive play like pharma and FMCG may run up

It has broken down trending line with good volume. Stock has moved 10% yesterday itself. So either half position can be taken now and remaining half can be added at time of consolidation or we may wait for some consolidation. SL may be kept near 249 considering half buy near 268 level. Further the stock has closed at the highest point of the day.

200 Level is good resistance for the stock from it has been rejected 3 time before. Now it seems stock may broke out 200 level very soon. A small position can be added near 194 level and further it can be added above 200. SL can be kept at 182 level. A shakeout of weak holders is expected.

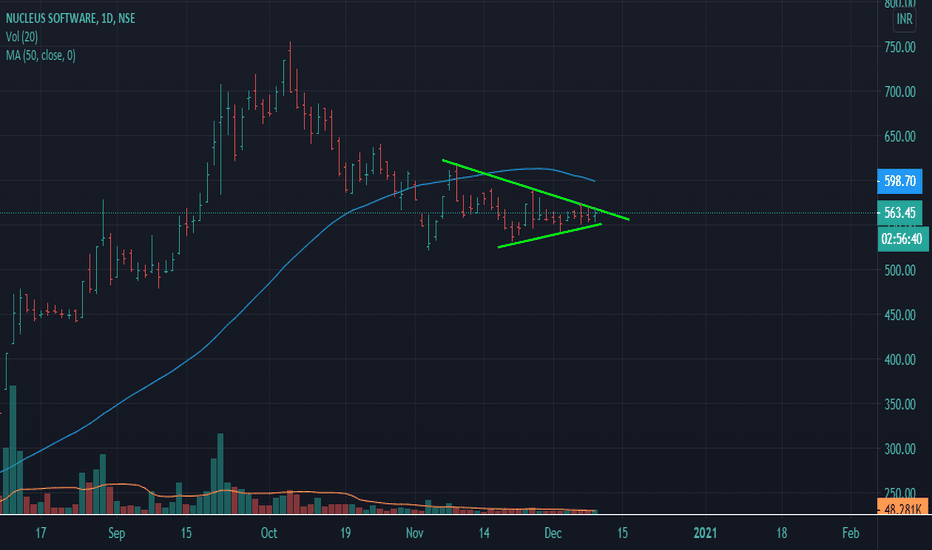

After good run up stock was consolidating near 50 DMA. Futher on 04-12 there was some increase in volume that has been bought into and stock has not corrected much. And on 05-12 it has closed at the highest point with volume higher than previous one. It seems supply for the stock is over and any small demand can also take stock higher very fast. It can be...