avlnrao63

BCPL- 51.45 CMP, Can be taken with a sl of 42 on closing basis for a target of 58, 68, 75, 81, 111 and above. It is in to railway infrastructure project. Its book value is 43. Today's volumes are exceeding previous volumes with price rise. It is going to go up very soon and is on break out crossed 20, 50 EMAs today. This is only for educational purpose and any...

Can be bought with a sl of 24 on closing basis for a target of 40, 50, 60, 83 and above. It is on break out today and also trading above 50, 200 DMA with good volumes. Fundamentally also stock is good earlier it was Monnet ispat and after BIFR it was taken over by JSW and is in specialty alloys, recently they have expanded the capacity. All investments shall be...

Navkar-CMP 40.65, It is into logistics and is consolidating for quite some time in the range of 30 to 50. Once it breaks out of this range it can go up to 80, 130, 180 with a sl of 20. Its book value is 122. Just it crossed 50 weekly EMA. This is for educational purpose and investment shall be done by consulting your financial expert.

TVS Motor - 573.85. Today it has broken out of good consolidation with good volumes. It can go up to 593, 625, 650++ with a sl of 532 on closing basis. This is for educational purpose. Investment shall be done after taking advice of investment advisers.

PFC-148.95. It has done triangular breakout. Can be initiated long with SL of 138 for a tar of 166.6 and above soon. RSI, MACD, volumes are also favoring upward movement. This is for educational purpose and any investment advice shall be done with consultation of financial advisor.

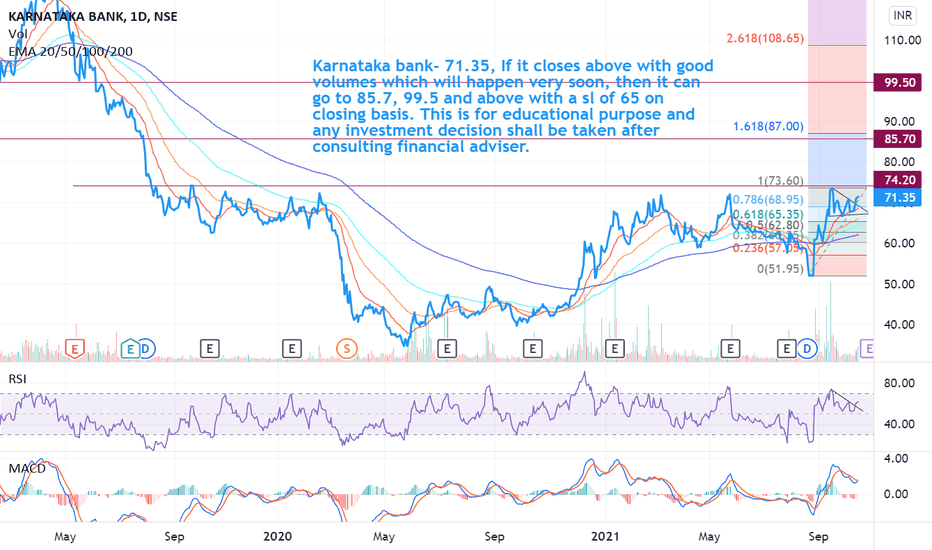

Karnataka bank- 71.35, If it closes above with good volumes (which will happen very soon), then it (will be on multiyear breakout) can go to 85.7, 99.5 and above with a sl of 65 on closing basis. This is for educational purpose and any investment decision shall be taken after consulting financial adviser.

PNB- 42.55, It is on cup and handle pattern breakout. Depth of cup is 6.5, breakout point is 41.75. Final target is 48.25. It can reach 44, 45, 48.25 with a sl of 38 on closing basis. Its volumes are good and RSI, MACD favouring upside. This for educational purpose and any investment decision shall be taken after consulting financial adviser.

PNB-CMP-39.15. It is following Elliot wave principle. It is in corrective phase which is against market trend. Means as index is falling it is going up. If it follows the trend it may go up to 40.5, 41.7, 42++. SL is 37 on closing basis. From yesterday it came out of F&O ban and it can actively participate in trades with volumes. This is for educational purpose...

BHEL-65.45. It is in cup and handle formation stage. If breakout happens with volumes it can go up to 82. Depth of cup=16, Breakout point = 66, Target = 16+66= 82. SL is 56. This is for educational purpose and not an investment advice.

Gail - 166.75. It is on verge of break out. If it closes above 168.5 then break out is confirmed. If breakout happens then it can go up to 168.5+31.5= 200. Depth of the cup is 31.5, top of the cup is 168.5. This is for educational purpose and investment shall be one in consultation with financial adviser.

Bank Baroda- CMP 84.35. Made a inverse head and shoulder pattern. MACD, RSI, volumes are in bullish zone. May soon breakout and go to the levels of 88, 90, 95++ which incidentally is depth of the cup (12) plus breakout point(84), 84+12=96 with a stop loss of 77 on closing basis. It is for educational purpose only any investment shall be done based your financial adviser.

Borosil Renewable- CMP 305.75 . It is leading solar glass manufacturer in India. Almost monopoly in India and also exports to other countries. Competitor is Chinese companies operating from Vietnam and Malasia. During FY20, the company successfully raised 200 Cr through QIP and the money raised through the issue will be utilized for its expansion. The company will...

BHEL- CMP 42.95. It has made reverse head and shoulder pattern on daily charts. It formed double top recently at 44.3. Breakout level is 44.3 If it crosses and stays there for some time then breakout happens. Its targets and SL are given on chart. Yesterdays cash volumes are good. Till yesterday it was in F&O ban and during ban generally price breakouts do not...

IOC - CMP105.45. Today IOC broke out with volumes on rounding bottom pattern with higher cash volumes and increase in price. It's future open interest rise is also at healthy 10%, indicates formation of longs. Very soon it can go up to 117 and 120 with a sl of 100 on CLBS.

ONGC-CMP 112.35. It formed cup and handle pattern it can be bought in the range of 112 to 108 with a sl of 104 for a target of 117, 125.5, 131++. This is for educational purpose and consult financial adviser before any trade

IDFC First Bank - CMP 59.8. Can buy for a target of 60.65, 61.55, 63.95, 65.9 with a sl of 57.85.

Josil- CMP 197, Can be taken with a sl of 185 for a target of 202, 210, 225, 243. It has broken out od cup and handle sort of formation and is presently in specialty chemical business which is a buzz word in market circles, due to good demand in market. This is not a recommendation and is only for educational purpose. Needs to consult yorr financial adviser before...