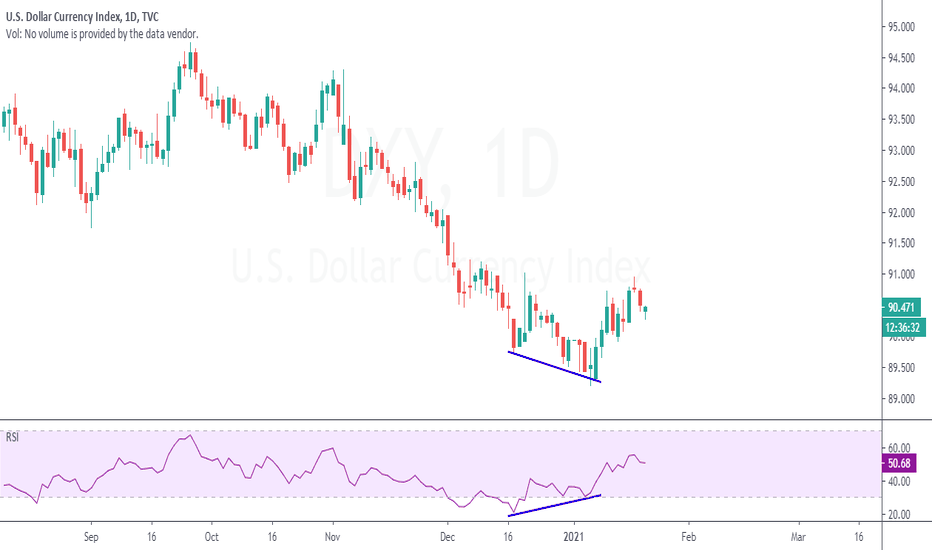

Dollar Index (DXY) is about to shot up - Cautious for NIFTY I believe the upside room is limited for NIFTY for next few weeks. NIFTY @ 14644 (Closing 20/01/2021) I expect for next few weeks we may trade below 14800

PETRONET | RSI divergence - High volatile stock - 10% CMP : 244 SL : 235 Target : 270 1:3 risk reward setup

KTKBANK | Breakout zone is retesting - Low volatile value stock - Looks good for 40% CMP : 62.70 SL : 58 Target : 84

M&MFIN | Hopefully it will breakout this time. Well respected the channel / wedge for the last 39 months, 168 weeks. CMP : 185 (Dip till 175) SL : 165 Target : 245 Safe player can enter after the breakout above the channel at 200+ Observation : Channel only broken and excess fall happened during corona crash , that has been recovered and well settled into the...

M&M | Flag accumulation is maturing, breakout may give us 30% It has strong support zone for the last 16 weeks - almost 4 months. CMP : 631 (Can buy upto 600) or buy above 660 SL : 560 Target : 810 1:7 risk reward from the dip (600 level)

HDFCLIFE | Small momentum for 8-10% CMP : 678 (Can buy upto 665) SL : 655 Target : 735 / Open We are chasing up this stock from 540 zone and related charts already posted, this just one more opportunity to enter into the momentum Almost 1:5 risk reward setup.

TRENT | Channel Support with confirmation - Looks good for 15% to 18% CMP : 699 SL : 660 Target : 800, 830 We frequently get this kind of setup - attached some of the recent stocks we came across similar to this pattern.

RELIANCE | Small swing opportunity - RSI making Lower high - Shall we can consider it as hidden divergence. CMP : 1976 SL : 1940 Target : 2120 Simple 1:3 risk reward setup

TATAPOWER | Inverted Head & Shoulder - Looks good High probablity setup and has potential of 35% Expecting breakout next week CMP : 62 Target : 85, 100

ITC | Retracement done and looks good to bounce - RSI divergence showing up - 7% CMP : 201 SL : 196 Target : 215 1:3 risk reward setup Ideal to sell PUT option with hedge, but cash pick also safe as it has limited risk.

COALINDIA | Somebody waking up this Kumbakarnan (Sleeping Giant) that under performed last 7 years ! Whether or not we have low risk and high probable INHS pattern here 😃 CMP : 146 SL : 130 Target : 180, 215 1:4 risk reward (Based on second target)

NIFTY | Small Flag pattern but with RSI divergence (15 Min's Time Frame) CMP : 14563 SL : 14510 Target : 14625, 14687

RBLBANK | Breakout and retracement to breakout candle - 70% upside CMP : 256 SL : 210 Target : 440 Analyzed using weekly time frame. It is a big trade and might need to hold for few months to get the target. Its a cash pick.

TATAMOTORS | NIFTY crash providing good dip again - Looks good for almost 50% CMP : 164 (Dip upto 155) SL : 145 Target : 200,240

KHADIM | Paisa double opportunity ! But make sure you don't put more than 5-10% of the capital, as the past volume history is very poor. The reason i'm interested in this stock is the risk is low CMP : 130 SL : 105 Target : 275

RAMCOCEM | Double Bottom & RSI Divergence - Looks good for a bounce - 6% Potential CMP : 780 SL : 760 Target : 825 Almost 1:4 risk reward setup

BHARTIARTL | One more flag now in Airtel for 23% CMP : 479 (Bup in dip upto 462 / Orange line recent support) SL : 450 Target : 550, 590 1:4+ risk reward for first target (550) 1:6+ risk reward set up for second target (590)

BAJFINANCE | Simple RSI divergence in 30 min's TF - Looks good for 7% (Attaching 30 min's Time frame chart in comment section) CMP : 5040 SL : 4940 Target : 5425 1:4+ risk reward setup.