Market analysis from Alice Blue

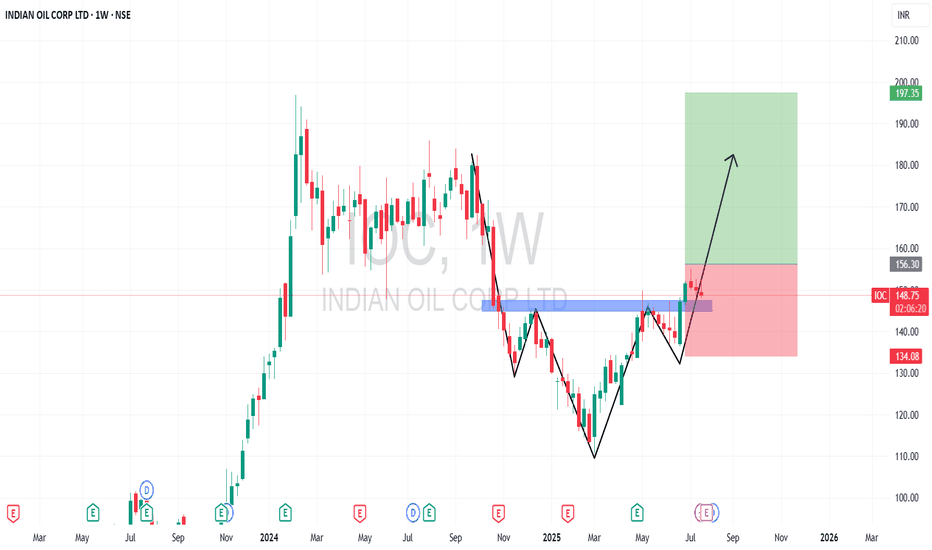

I am speaking about the IOC Ltd stock. Technically, I’ve been observing this stock’s chart for over two decades. In Feb 2024, it created an All-Time High at ₹197. From there, it consolidated till Sept 2024, followed by a sharp correction to ₹110 by March 2025. This ₹110 level acted as a strong demand zone and the stock rallied sharply from there. Currently, it's...

🔍Technical Analysis In June 2024, Tata Steel hit an all-time high of ₹185 but later corrected, bottoming near ₹120 in January 2025. The stock has since formed a higher-high, higher-low structure and currently trades around ₹162. If the pattern sustains, the next upside targets are: 🎯Target 1: ₹170 🎯Target 2 : ₹180 🎯Target 3: ₹190 (new all-time...

The S&P BSE Sensex is currently trading around ₹82,180, consolidating within a defined range. Key price levels and order block zones suggest important zones for directional moves: Key Resistance Levels: ₹82,782 – Strong resistance, aligned with an important order block. A breakout above this could open the path toward ₹83,000 and higher. ₹84,101 – Major...

SBI’s Board Meeting Today • The SBI board is meeting on July 16 to discuss capital-raising plans, including issuing Basel III-compliant bonds. This is key to reinforcing the bank's capital adequacy for FY26 • The agenda has attracted market attention, and SBI shares are in focus amid these announcements Planned QIP for Equity Capital • SBI intends to raise up...

Bank Nifty ended the week at 56,754.70, registering a marginal decline of -0.49%. 🔹 Key Levels for the Upcoming Week 📌 Price Action Pivot Zone: The critical zone to monitor for potential trend reversals or continuation lies between 56,636 and 56,875. 🔻 Support Levels: Support 1 (S1): 56,281 Support 2 (S2): 55,806 Support 3 (S3): 55,355 🔺 Resistance Levels:...

The Nifty 50 ended the week at 25,149.85, posting a loss of -1.22%. The index is now approaching a critical price action zone which could define the direction in the upcoming sessions. 🔹 Key Levels for the Upcoming Week 📌 Price Action Pivot Zone: 25,070 to 25,230—This is a crucial range to monitor for potential trend reversals or continuation. A breakout or...

📉Technical Overview Post-COVID Surge: From INR 400 pre-COVID, AFL India climbed steadily, forming higher highs and higher lows. Recent Breakout: Just two days ago, it exceeded its recent high and spiked to ₹2,080, now consolidating near ₹1,990. Next Move: If it clears ₹2,080 and sustains above that level, targets are: 🎯Target 1: ₹2,200 🎯Target 2:...

📉Technical View: Ramco Cement Limited has formed a beautiful ascending triangle pattern with a strong resistance zone at ₹1080–₹1130, tested since 2021. Today, it broke out and hit a new all-time high of ₹1152, now hovering around ₹1140. If the breakout holds, we may see: 🎯Target 1: ₹1200 🎯Target 2: ₹1240 🎯Target 3: ₹1300 If the stock falls back below...

📈Technical Analysis Breakout & Correction: After breaking ₹190 resistances in Jan 2024, GIPCL surged to ₹270 by June but later corrected sharply. Strong Demand Base: ₹150 acted as a reliable bottom during the downturn, supporting a rebound into a higher-high, higher-low pattern. Buy Trigger Zone: A breakout above ₹230–₹240 (former resistance) with...

Original Call Date: 27th March 2025 - Wyckoff-Based Price Projection for SBI Life: Bullish and Bearish Updated Overview: Breakout Level (SOS): 1584 was successfully breached – confirming a Sign of Strength. Price sustained above the resistance zone and moved toward projected targets 1720 → 1863. Current Price: 1835 (as of latest update) Bullish...

Strategic Diversification into High-Growth Sector GNEPL operates in the Energy & Battery Storage sector – a rapidly expanding industry driven by India's renewable energy push and EV adoption. Entry into this future-focused segment aligns with national priorities (e.g., National Green Hydrogen Mission), positioning GPIL for long-term growth beyond its core...

📈Technical Analysis Long-Term Rally: TVS Motor jumped from ₹100 over a decade to a peak of ₹2,958 in September 2024. Double Bottom & Recovery: After a correction, the stock formed a strong double-bottom around ₹2,200 and rebounded, now hovering near ₹2,928—just shy of the all-time high. Key Pivot Point: The ₹2,958 level is crucial. If this is decisively...

Bank Nifty ended the week at 57,031.90 with a slight drop of -0.72% 🔹 Key Levels for the Upcoming Week 📌 Price Action Pivot Zone: The critical range to monitor for potential trend reversals or continuation is 56,913 to 57,152 🔻 Support Levels: S1: 56,556 S2: 56,081 S3: 55,461 🔺 Resistance Levels: R1: 57,512 R2: 57,991 R3: 58,508 📈 Market Outlook ✅ Bullish...

The Nifty 50 ended the week at 25,461.00 with a loss of -0.69% 🔹 Key Levels for the Upcoming Week 📌 Price Action Pivot Zone: The crucial range to watch for potential trend reversals or continuation is 25,382 to 25,541 🔻 Support Levels: S1: 25,144 S2: 24,827 S3: 24,534 🔺 Resistance Levels: R1: 25,782 R2: 26,103 R3: 26,466 📈 Market Outlook ✅ Bullish Scenario:...

Asahi India Glass Ltd is India’s leading automotive and architectural glass manufacturer, backed by robust industry demand, especially in the auto and infrastructure space. The company holds a dominant position in OEM and aftermarket auto glass supply. Market Cap: ~₹21,300 Cr P/E Ratio: 48.19 (slightly overvalued but justified by strong growth) ROE: ~18.75%...

📈Technical Analysis SBI, a long-term bullish stock, peaked at ₹912 and then consolidated with a series of lower highs, recently trading around ₹797. If the recent lower high is taken out and the same level starts acting as support, with confirmation from bullish candlestick patterns, then only we can expect the stock to move towards all time high. Otherwise,...

📈Technical Analysis IPO & Surge: Listed in August 2023 near ₹200–₹250, the stock climbed impressively to ₹394 by April 2024. Correction & Support: Pullback followed, with the ₹300–₹310 zone providing strong support multiple times. Breakdown & Bounce: After dipping below ₹300 in December 2024 to around ₹200, the stock rebounded and now trades near ₹312. ...

What is ICT OTE? OTE (Optimal Trade Entry) is a specific price zone identified by the ICT method where high-probability entries are expected — especially after a market makes a move and then retraces. It is based on Fibonacci retracement levels and market structure, aiming to align your entry with institutional trading behavior (aka Smart Money). How is OTE...