Market analysis from Alice Blue

The Nifty 50 opened with a gap-up of 30.95 points (0.13%) and ended the week at 24,346.70 with a gain of (1.28%) If Nifty sustains below 24,369, selling pressure may increase. However, a move above 24,426, could restore bullish momentum. Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The crucial range to watch for potential trend reversals or...

Bank Nifty ended the week at 55,115.35, registering a gain of 0.83%. Key Levels for the Upcoming Week 🔹Price Action Pivot Zone: The critical range to monitor for potential trend reversals or continuation is 55,018 to 55,253 🔹 Support & Resistance Levels: Support Levels: S1: 54,667 S2: 54,200 S3: 53,723 Resistance Levels: R1: 55,607 R2:...

Tube Investments of India Ltd (TIINDIA) has been a notable player in the Indian engineering sector, with a diversified portfolio spanning automotive components, bicycles, metal-formed products, and precision steel tubes. As of April 2025, the stock has experienced significant volatility, prompting investors to closely examine its fundamentals and technical...

The Nifty 50 opened with a gap-up of 97.5 points (0.41%) and ended the week at 24,039.35 (0.79%) If Nifty sustains below 23,962, selling pressure may increase. However, a move above 24,117 could restore bullish momentum. Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The crucial range to watch for potential trend reversals or continuation is...

Bank Nifty ended the week at 54,664.05, registering a gain of 0.69%. Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The critical range to monitor for potential trend reversals or continuation is 54,548 - 54,781 🔹 Support & Resistance Levels: Support Levels: S1: 54,198 S2: 53,733 S3: 52,493 Resistance Levels: R1: 55,134 R2:...

The Nifty 50 opened with a gap-up of 97.5 points (0.41%) and ended the week at 24,039.35 (0.79%) If Nifty sustains below 23,962, selling pressure may increase. However, a move above 24,117 could restore bullish momentum. Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The crucial range to watch for potential trend reversals or continuation is...

Bank Nifty ended the week at 54,664.05, registering a gain of 0.69%. Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The critical range to monitor for potential trend reversals or continuation is 54,548 - 54,781 🔹 Support & Resistance Levels: Support Levels: S1: 54,198 S2: 53,733 S3: 52,493 Resistance Levels: R1: 55,134 R2:...

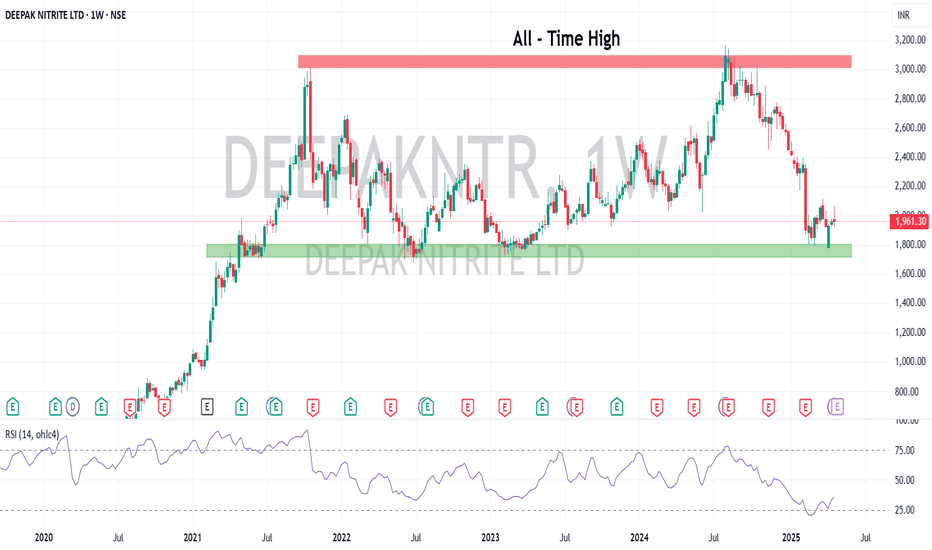

🔍Technical Analysis: Support-Driven Rebound in Sight Deepak Nitrite Ltd has maintained long-term strength, trending upward for over a decade with a clear pattern of higher highs and higher lows. The stock reached an all-time high of ₹3,020 in October 2021 but later corrected sharply to the ₹1,700–₹1,800 zone, where it has found strong support multiple times. In...

Key Price Levels: Bullish Projection for Bharat Dynamics Ltd (BDL) Key Price Levels: Current Price: ₹1,430.80 Primary Support: ₹1,345.15 (strong buying zone) Last Point of Support: ₹1,141.20 (critical point for trend continuation) Resistance: ₹1,449.95 (key resistance level) Target Price: ₹1,792.15 (long-term target) Bullish Setup: Break Above...

Key Zones: Bullish Order Block (OB): Found below at ₹1,146.30 (indicates strong demand area for price to rebound). Bullish FVG (Fair Value Gap): This suggests there's liquidity and demand at the current levels, supporting a potential upward move. Reasoning for Bullish Projection: Spring Setup: The recent price action shows a spring-like structure, with...

🏢 Company Overview Anant Raj Ltd is a leading real estate developer in India, focused on residential, commercial, and industrial infrastructure projects, primarily in the NCR. The company has consistently demonstrated strong execution, strategic land holdings, and diversified income streams. 📊 Fundamental Snapshot (FY 2023–24) ✅ Revenue & Profitability ...

🔍Technical Analysis: Resilience in a Defined Range Over the past decade, Hindustan Unilever Ltd (HUL) has exhibited a commendable upward trajectory, characterized by a consistent pattern of higher highs and higher lows from 2018 to 2021. Since 2021, the stock has been oscillating within a well-defined range of ₹2,000 to ₹3,000. Notably, the ₹3,000 mark has acted...

Analysis 1. PS (Preliminary Support): 569.00 The PS marks the initial support level at 569.00, where the market starts to find buying interest, and the downtrend begins to slow. This is where the market begins its accumulation phase. 2. AR (Automatic Rally): From 499.00 to 569.00 After the PS at 569.00, the price experiences an Automatic Rally from 499.00 to...

Projection for Bullish and Bearish Scenarios: 1. Bullish Projection: If the price continues its upward movement, the target mentioned on the chart is 615. This aligns with Phase D's expectation for a continuation of the markup. Beyond 615, the next major resistance might lie closer to 630-640 range, and further movement upwards could push the price to the...

📊 Technical Analysis Pidilite Industries, a dominant player in the adhesives and sealants market, has exhibited a consistent bullish trend over the past two decades, characterized by a pattern of higher highs and higher lows. All-Time High Resistance: In September 2024, the stock created an all-time high of ₹3,415. Since then, it has faced resistance at this...

📊 Technical Analysis ICICI Bank has shown a powerful uptrend over the past two decades. The stock has consistently moved higher, forming a steady pattern of higher lows since November 2013, indicating a strong bullish sentiment. In September 2024, the stock hit an all-time high of ₹1362, which has acted as a strong resistance zone between ₹1363 and ₹1373 for...

Bullish Scenario: Entry Signal: The current market price (CMP) is 482. For a bullish scenario, if the price breaks above the Sign of Strength level at 516.90, it could signal an upward movement. A break and hold above 516.90 would likely push the price towards Target 1 at 575.55 and then towards Target 2 at 701.00. Target Levels: Target 1: 575.55 Target...

1. Bullish Scenario: Entry Signal: The market price is currently at 6,834. A break above 6,834 and a move towards 7,138 (First Target) would signal continued bullish momentum. A breakout above 7,138 would indicate the next upward target is 7,533 (Final Target). Target Levels: First Target: 7,138. Final Target: 7,533. Support: If the price...