Market analysis from Alice Blue

📈Technical Analysis: Bajaj Finance is one of the most bullish stocks in the Indian market, with a consistent uptrend visible over the last two decades – from just ₹3–4 to current levels. Looking at recent performance: Before COVID, the stock was hovering around ₹5,000 levels. Even during April–May 2021, the price remained near ₹5,000. Then, a sharp rally...

Technical Analysis: Bharti Airtel has shown a strong bullish structure ever since its listing. Starting from around ₹600 in 2020, the stock steadily climbed to ₹1,700+ levels by September 2024. Since then, it’s been consolidating, facing a strong resistance zone between ₹1,720 and ₹1,780, which is currently acting as the all-time high zone. Post Q3 results...

Wyckoff Method Levels Rejection area / BOS 2 (134.65 to 137.46) Automatic Rally / Support / Resistance BOS 1 – Breakout of structure Last point of support: 119.66 Primary Support: 116.30 Selling Climax: 106.68 Secondary Test: 100.81 1. Bullish Scenario: The price has likely completed the accumulation phase and is now entering the markup phase. A...

Cup formation: ~₹214 (peak) → ₹174 (base) → recovery to ~₹200 Handle: Currently consolidating between ₹188.83–₹198.66 CMP: ₹194 (inside the handle zone + Bullish Order Block) Key Levels to Watch: ₹187.13 Old BOS; support base for cup ₹188.83–₹192.02 Bullish Order Block ₹194.14 CMP: mid-handle, decent entry zone ₹198.66 BOS zone – handle breakout...

Wyckoff Method Phase A & B: Accumulation phase, price finds support, demand begins to emerge. Breakout: A breakout above resistance at 376.20 signals the start of an uptrend. Sign of Strength (SOS): Observed at 385, confirming bullish momentum. Bullish Target: Potential rise to 447 if the trend continues. Spring: Shakeout between 349-361, testing lower...

Wyckoff Phases: PS (Preliminary Supply): Bearish phase at 3757.65. SC (Selling Climax): Sharp drop to 3461.60, potential turning point. AR (Automatic Rally): Rally from 3461.60 to 3757.65. ST (Secondary Test): Tests support at 3461.60. Spring: Brief dip below support, confirms demand. LPS (Last Point of Support): Price at 3711, last support test. SOS...

Projection Based on Wyckoff Cycle: 1. If the price breaks above the resistance level of 1584: Bullish Scenario: A breakout above 1584 would signify a Sign of Strength (SOS), meaning that the market sentiment has shifted towards the buyers (demand overcoming supply). The upside target could be 1720-1863 based on the next logical resistance zone, considering...

The Wyckoff method is a comprehensive way to interpret market cycles and predict future price movements. By identifying the various phases of accumulation and distribution, traders can make more informed decisions about entries, exits, and trend continuation. It is particularly useful in identifying key turning points in the market, such as bullish breakouts or...

Aavas Financiers Ltd. is a housing finance company specializing in loans for low- and middle-income self-employed individuals in semi-urban and rural areas. Fundamental Highlights (FY 2023-24) Total Assets: ₹16,258.38 crore Net Worth: ₹3,773.32 crore Debt: ₹12,398.30 crore (Debt-to-Equity Ratio: 3.28) Total Income: ₹2,020.30 crore Profit After Tax:...

Bank Nifty ended the week at 51,564.85, registering a strong gain of 1.92%. Key Levels for the Upcoming Week 🔹Price Action Pivot Zone: The critical range to monitor for potential trend reversals or continuation is 51,452 - 51,679. 🔹Support & Resistance Levels: Support Levels: S1: 51,113 S2: 50,661 S3: 50,156 Resistance Levels: R1: 52,021 R2: 52,477 R3:...

The Nifty 50 opened with a gap-up of 165 points (0.71%) and ended the week at 23,519.35 (0.72%), forming a long upper shadow candle on the weekly timeframe. Understanding the Long Upper Shadow Candle A long upper shadow candle suggests that Nifty attempted to move higher but faced strong selling pressure, causing it to close significantly lower than its weekly...

Technical Analysis SRF Limited has shown a strong bullish breakout after being in a consolidation phase for the past three years. Before COVID-19, the stock traded around ₹800 levels, and even after the pandemic, it remained at the same levels until August 2020. From there, it witnessed a sharp rally, reaching ₹2,500 in January 2022. Between 2022 and 2024,...

Wyckoff Cycle Phases for Bandhan Bank Phase A: Accumulation (219 to 184) Within the ₹219 to ₹184 range as it prepares for the next phase (Phase B). The goal is to establish support at the lower end of this range. Phase B: Testing (184 to 163) Bandhan Bank moves sideways, indicating a period of uncertainty and indecision. A breakout above ₹163 or below...

Structure Analysis 1. Bullish Structure Development Bullish Order Block (₹1720–₹1800): First major reversal from bottom — strong demand zone created after a major drop of ~29%. Bullish Fair Value Gap (FVG) at ₹1853–₹1944): Price rallied quickly from this area. This FVG was mitigated, meaning smart money filled this imbalance — accumulation zone confirmed. ...

Technical Analysis JSW Steel has been in a steady uptrend since 2005, consistently forming higher highs and higher lows. The stock encountered a strong resistance level at ₹767 in May 2021, which acted as a barrier multiple times in 2021, 2022, and 2023. However, in 2023, this resistance was broken, and it turned into a strong support, propelling the stock...

Company Overview Bharat Dynamics Limited (BDL) is a leading defense PSU engaged in the manufacturing of missiles, torpedoes, and allied defense systems. The company plays a crucial role in India’s defense sector and continues to expand with strong government backing. Technical Analysis Bharat Dynamics Limited (BDL) has shown a strong technical pattern over...

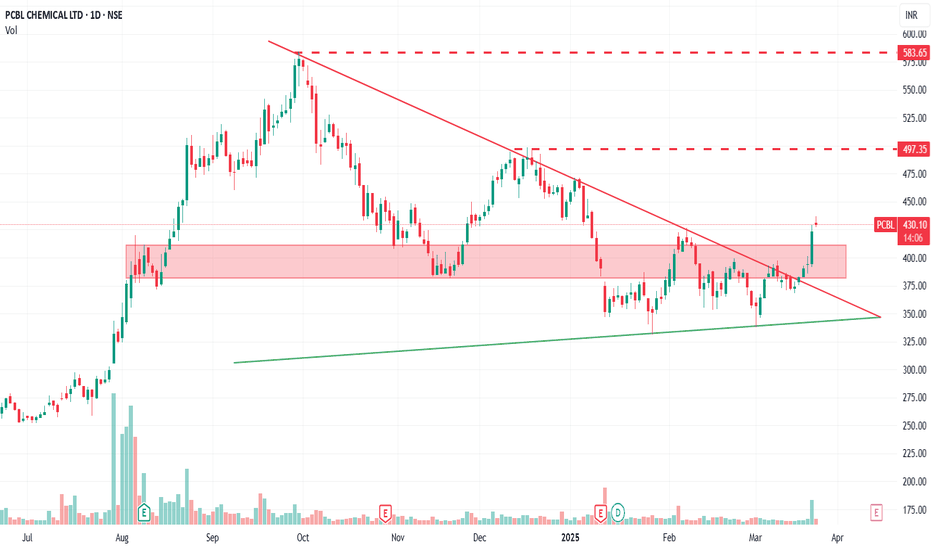

Technical Analysis PCBL Limited has been in a steady bull run for the past three decades. The stock created an All-Time high of ₹584 on September 30, 2024. From then entering a correction phase, it formed a lower high pattern multiple times. However, on March 19, 2025, this lower high trend was broken, and the breakout sustained on March 19, 20, and 21. A key...

The Nifty 50 ended the week at 23,350.40, recording a notable gain of 4.26%. Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The critical range to monitor for potential trend reversals or continuation is 23,274 - 23,427. 🔹 Support & Resistance Levels: Support: S1: 23,046 S2: 22,743 S3: 22,427 Resistance: R1: 23,658 R2: 23,965 R3:...