forexfactory.com/news/1364063-the-government-shutdown-is-likely-to-cement-additional

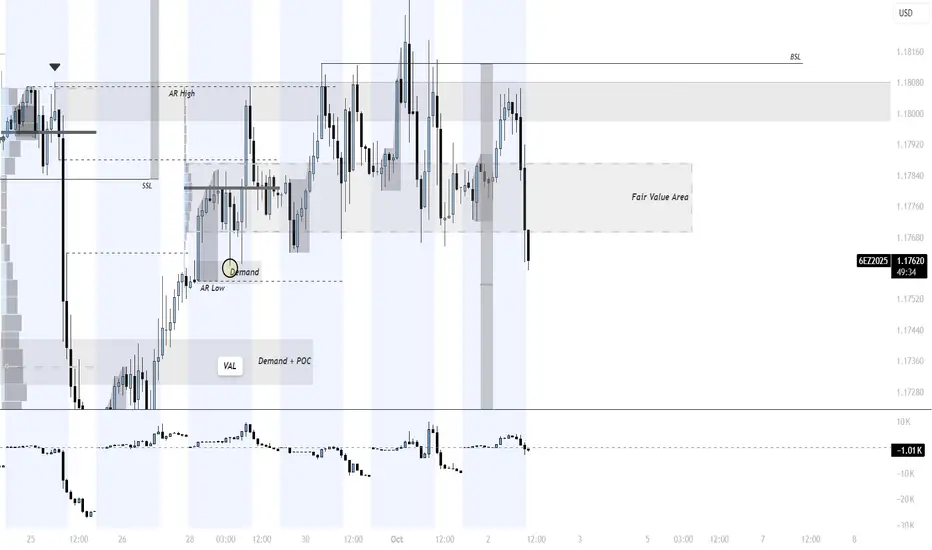

The current market environment reflects an absence of strong institutional conviction, with price rotating inside overlapping value areas as uncertainty from the government shutdown limits directional discovery. Without key economic data to anchor narratives, orderflow is dominated by retail participation, where stop-losses and emotional reactions provide the primary source of liquidity. This creates volatility spikes and false auctions that lack sustained follow-through, making the market prone to choppy, stop-driven moves rather than genuine intent. In such conditions, caution is essential, with asymmetric opportunities found only at extremes of value areas or in response to major liquidity events that can reintroduce institutional activity and restore directional flow.

https://www.tradingview.com/x/u6ZEtkJv/

The current market environment reflects an absence of strong institutional conviction, with price rotating inside overlapping value areas as uncertainty from the government shutdown limits directional discovery. Without key economic data to anchor narratives, orderflow is dominated by retail participation, where stop-losses and emotional reactions provide the primary source of liquidity. This creates volatility spikes and false auctions that lack sustained follow-through, making the market prone to choppy, stop-driven moves rather than genuine intent. In such conditions, caution is essential, with asymmetric opportunities found only at extremes of value areas or in response to major liquidity events that can reintroduce institutional activity and restore directional flow.

https://www.tradingview.com/x/u6ZEtkJv/

Note

How does this affect the crypto market?1. Risk Sentiment & Flight to “Alternative Assets”

When traditional markets grow uncertain (stocks, bonds, forex) due to political risk or fiscal instability, some capital allocates to crypto as an alternative or hedge. That said, crypto is also viewed as a risk asset, so in times of extreme crisis, it could also suffer alongside equities if investors broadly de-risk.

2. Dollar Strength / USD Flows

A U.S. government shutdown often leads to volatility or divergence in USD-based markets. If the dollar strengthens (due to safe-haven flows, or expectations of monetary tightening or fiscal stress), it can weighing on crypto valuations when expressed in USD. Conversely, if USD weakens, crypto could benefit from increased buying power/interest.

3. Liquidity & Capital Availability

Fiscal uncertainty might reduce institutional and retail willingness to deploy capital. In such climates, funds may stay on the sidelines. That reduces volume and the depth of markets, which in crypto means more slippage, larger impulse swings, and less reliable orderflow signals.

4. Regulatory & Policy Risk

A shutdown could slow or stall regulatory processes, decision-making in oversight bodies (e.g. SEC, CFTC), and legislative actions relevant to crypto (on taxation, regulation, innovation). That ambiguity adds additional risk premium to crypto assets.

5. Volatility & Market Manipulation Potential

In thinner, lower-liquidity environments, price is more easily moved by large players. This amplifies the “stop-run” games, false breakouts, and liquidity hunts, similar to what happens in forex when data/licensing is missing.

6. Correlations with Other Markets

Crypto often correlates (positively or inversely) with traditional risk assets. If equities fall on shutdown news, crypto might drop in sympathy. Or if safe havens (like USD, gold) rally, crypto might lag.

Note

In CFD particularly currencies to commoditiesTraders may focus on gold in the meantime because the ongoing U.S. government shutdown creates uncertainty, suppresses institutional participation, and reduces clarity in traditional markets, leaving investors searching for safer assets. With economic data releases delayed and the dollar’s direction unclear, liquidity in forex and equities remains fragile, increasing the risk of false auctions and stop-driven volatility. Gold, however, benefits from its role as a safe-haven asset during times of political and fiscal instability, attracting flows from participants seeking stability and protection against uncertainty. This shift in narrative supports the idea of temporarily favoring gold as a more reliable vehicle for capital preservation and controlled risk-taking until broader market conditions stabilize.

Note

For more information visit my discord server:discord.gg/Nj5x3GAS

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.