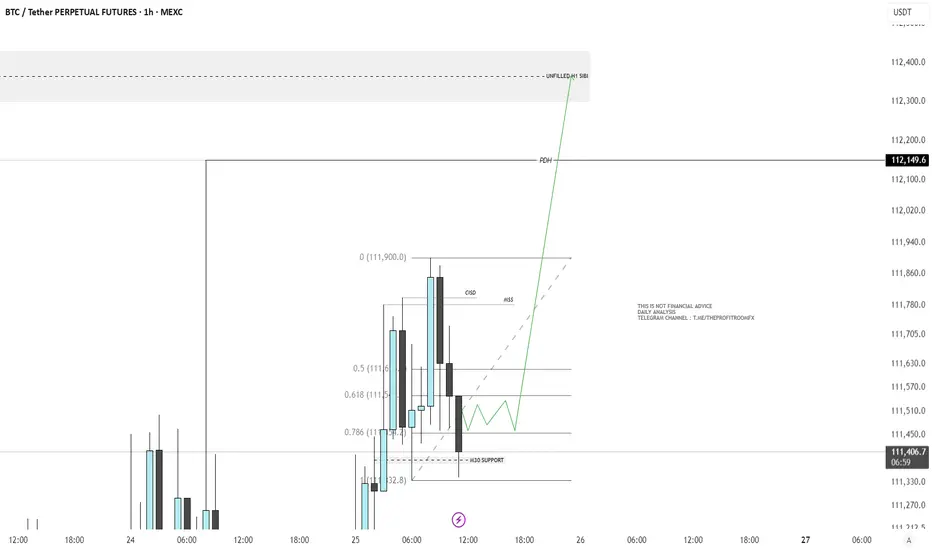

If the current H1 candle closes within the range of the previous candle, we may anticipate a potential movement toward the buy-side.

There is a notable draw on liquidity, with the Previous Daily High (PDH) and an unfilled H1 SIBI (Sell-Side Imbalance, Buy-Side Inefficiency) serving as key areas of interest.

Recently, we’ve also observed a Market Structure Shift (MSS) alongside a Change in Short-Term Direction (CISD)on the H1 timeframe.

In addition, price has shown multiple rejections from a support level formed by a M30 Fair Value Gap (FVG), reinforcing this area as a short-term accumulation zone.

Based on this structure, I expect price to accumulate between the 0.786 and 0.618 Fibonacci retracement levels, before redistributing toward our Draw On Liquidity (DOL).

Overall, my bias remains bearish, anticipating a sell opportunity after the SIBI imbalance has been filled and the PDH liquidity has been swept.

There is a notable draw on liquidity, with the Previous Daily High (PDH) and an unfilled H1 SIBI (Sell-Side Imbalance, Buy-Side Inefficiency) serving as key areas of interest.

Recently, we’ve also observed a Market Structure Shift (MSS) alongside a Change in Short-Term Direction (CISD)on the H1 timeframe.

In addition, price has shown multiple rejections from a support level formed by a M30 Fair Value Gap (FVG), reinforcing this area as a short-term accumulation zone.

Based on this structure, I expect price to accumulate between the 0.786 and 0.618 Fibonacci retracement levels, before redistributing toward our Draw On Liquidity (DOL).

Overall, my bias remains bearish, anticipating a sell opportunity after the SIBI imbalance has been filled and the PDH liquidity has been swept.

The Profit Room Fx

Telegram

t.me/theprofitroom_fx

Telegram Channel

t.me/theprofitroomfx

Email

theprofitroomfx@gmail.com

Telegram

t.me/theprofitroom_fx

Telegram Channel

t.me/theprofitroomfx

theprofitroomfx@gmail.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

The Profit Room Fx

Telegram

t.me/theprofitroom_fx

Telegram Channel

t.me/theprofitroomfx

Email

theprofitroomfx@gmail.com

Telegram

t.me/theprofitroom_fx

Telegram Channel

t.me/theprofitroomfx

theprofitroomfx@gmail.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.