Bitcoin(

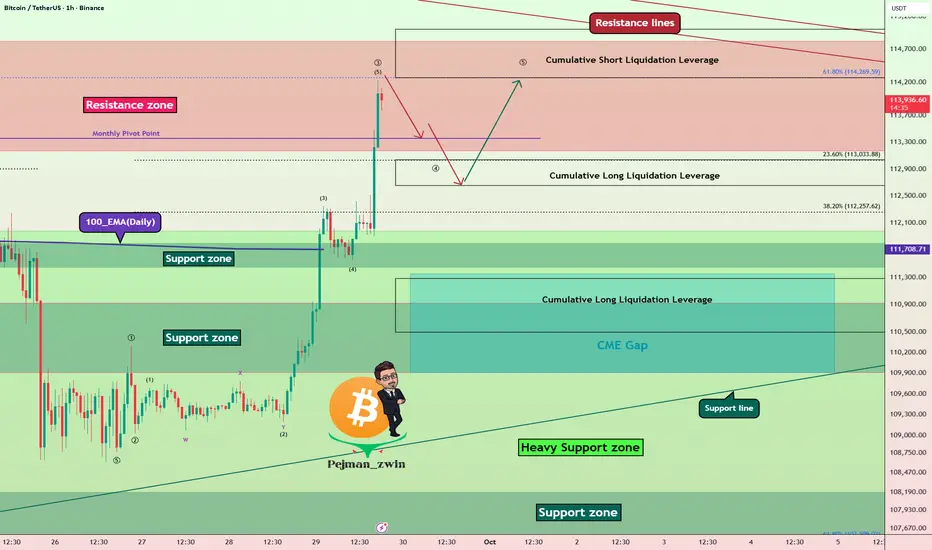

BTCUSDT) has shown strong momentum over the past 5 days, liquidating many traders in both Long and Short positions.

BTCUSDT) has shown strong momentum over the past 5 days, liquidating many traders in both Long and Short positions.

Bitcoin has now entered the Resistance zone($114,820-$113,170) and is moving near the Cumulative Short Liquidation Leverage($115,000-$114,272) and Resistance lines.

From an Elliott Wave Theory perspective, given Bitcoin’s strong bullish momentum over the past 24 hours, it appears to be completing Wave 3. This Wave 3 seems to be of the extended type.

I expect Bitcoin, after a correction, to make another attempt toward the Resistance zone($114,820-$113,170) and potentially test the Resistance lines.

Do you think this bullish move could lead to a new all-time high (ATH) for Bitcoin?

Cumulative Long Liquidation Leverage($113,037-$112,650) + Near Monthly Pivot Point($113,356): An area where Bitcoin could start rising again (if there is a correction, of course).

Cumulative Long Liquidation Leverage: $111,100-$110,500

CME Gap: $111,355-$109,915

Note: Also, Bitcoin approaching the 61.8% golden Fibonacci level could lead to a Bitcoin correction.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analysis (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Bitcoin has now entered the Resistance zone($114,820-$113,170) and is moving near the Cumulative Short Liquidation Leverage($115,000-$114,272) and Resistance lines.

From an Elliott Wave Theory perspective, given Bitcoin’s strong bullish momentum over the past 24 hours, it appears to be completing Wave 3. This Wave 3 seems to be of the extended type.

I expect Bitcoin, after a correction, to make another attempt toward the Resistance zone($114,820-$113,170) and potentially test the Resistance lines.

Do you think this bullish move could lead to a new all-time high (ATH) for Bitcoin?

Cumulative Long Liquidation Leverage($113,037-$112,650) + Near Monthly Pivot Point($113,356): An area where Bitcoin could start rising again (if there is a correction, of course).

Cumulative Long Liquidation Leverage: $111,100-$110,500

CME Gap: $111,355-$109,915

Note: Also, Bitcoin approaching the 61.8% golden Fibonacci level could lead to a Bitcoin correction.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analysis (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Trade active

Short position touched the target, and the Long position was activated in Cumulative Long Liquidation Leverage($113,037-$112,650).🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.