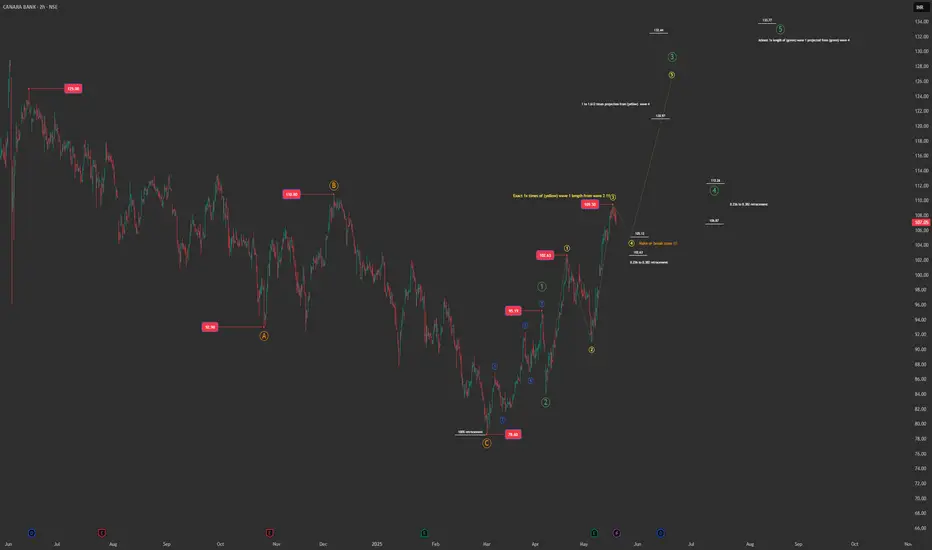

From the mid-June 2024 high, Canara Bank completed a textbook ABC correction, with Wave C terminating precisely at the 100% retracement of Wave A from B. This setup marked the end of the downtrend and the potential beginning of a new impulsive uptrend.

The current structure shows a higher-degree impulsive move (marked in green), within which Wave 3 appears to be subdividing into its own smaller impulse (yellow count). Notably, Wave 3 (yellow) has completed exactly 100% of Wave 1 from Wave 2 at 109.50, which aligns well with common Fibonacci projections.

A healthy retracement (Wave 4 of yellow) is now underway, typically expected to fall within the 0.236–0.382 retracement zone. This region is a critical make-or-break zone — sustaining above 102.63 keeps the bullish structure intact and sets the stage for Wave 5 (yellow), which could complete the larger Wave 3 (green).

Once Wave 3 (green) tops out, a correction in Wave 4 (green) could unfold, again within the 0.236–0.382 retracement zone. Monitoring RSI divergence will be essential to identify exhaustion at the top of Wave 3.

If the pattern continues to hold, Wave 5 (green) could push price to 130+ levels, assuming a minimum 1x projection of Wave 1 from the Wave 4 base.

The structure remains valid only as long as 105.12 and 102.63 are respected. A deeper breakdown would suggest the count is invalid and we may instead be dealing with a complex W-X-Y-X-Z correction, with Z potentially unfolding below 78.60.

Given that earnings and revenue reports in both Jan and May have been strong, the bullish case is fundamentally supported too. Still, alternate bearish counts must be kept in mind.

This is a technical analysis for educational purposes only and not a buy/sell recommendation.

Timeframe: 2hr

Tools Used: Elliott Wave, Fibonacci Retracements, RSI

The current structure shows a higher-degree impulsive move (marked in green), within which Wave 3 appears to be subdividing into its own smaller impulse (yellow count). Notably, Wave 3 (yellow) has completed exactly 100% of Wave 1 from Wave 2 at 109.50, which aligns well with common Fibonacci projections.

A healthy retracement (Wave 4 of yellow) is now underway, typically expected to fall within the 0.236–0.382 retracement zone. This region is a critical make-or-break zone — sustaining above 102.63 keeps the bullish structure intact and sets the stage for Wave 5 (yellow), which could complete the larger Wave 3 (green).

Once Wave 3 (green) tops out, a correction in Wave 4 (green) could unfold, again within the 0.236–0.382 retracement zone. Monitoring RSI divergence will be essential to identify exhaustion at the top of Wave 3.

If the pattern continues to hold, Wave 5 (green) could push price to 130+ levels, assuming a minimum 1x projection of Wave 1 from the Wave 4 base.

The structure remains valid only as long as 105.12 and 102.63 are respected. A deeper breakdown would suggest the count is invalid and we may instead be dealing with a complex W-X-Y-X-Z correction, with Z potentially unfolding below 78.60.

Given that earnings and revenue reports in both Jan and May have been strong, the bullish case is fundamentally supported too. Still, alternate bearish counts must be kept in mind.

This is a technical analysis for educational purposes only and not a buy/sell recommendation.

Timeframe: 2hr

Tools Used: Elliott Wave, Fibonacci Retracements, RSI

Note

The wave structure is still in play. Price action continues to respect key levels, and the ongoing move appears to be part of yellow Wave 4. As long as 102.63 holds, the setup remains valid with potential for a bullish Wave 5 push.(Still breathing, still waving 👋)

WaveXplorer | Elliott Wave insights

📊 X profile: @veerappa89

📊 X profile: @veerappa89

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

WaveXplorer | Elliott Wave insights

📊 X profile: @veerappa89

📊 X profile: @veerappa89

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.