Understanding Tools, Confluence & Today’s Setup

I’ve been getting a lot of DMs asking what the best indicator is. The truth? There is no universal “best indicator” because indicators are tools, and every tool serves a different purpose. Trading is like carrying a toolbox: the skill isn’t in having the tools, but in knowing when and how to use them.

Educational Segment: Why Fibonacci Should Be Your Foundation

After years of studying different systems, I’ve come to a very simple conclusion:

👉 Fibonacci tools are the most powerful and reliable in my entire arsenal.

Why?

Indicators like oscillators etc. are best used as confirmation, not as the primary signal.

If I had to pick one indicator besides Fibonacci, it would absolutely be the VWAP.

Why the Anchored VWAP Is Incredibly Underrated

Fibonacci + VWAP is one of the strongest forms of confluence you can build.

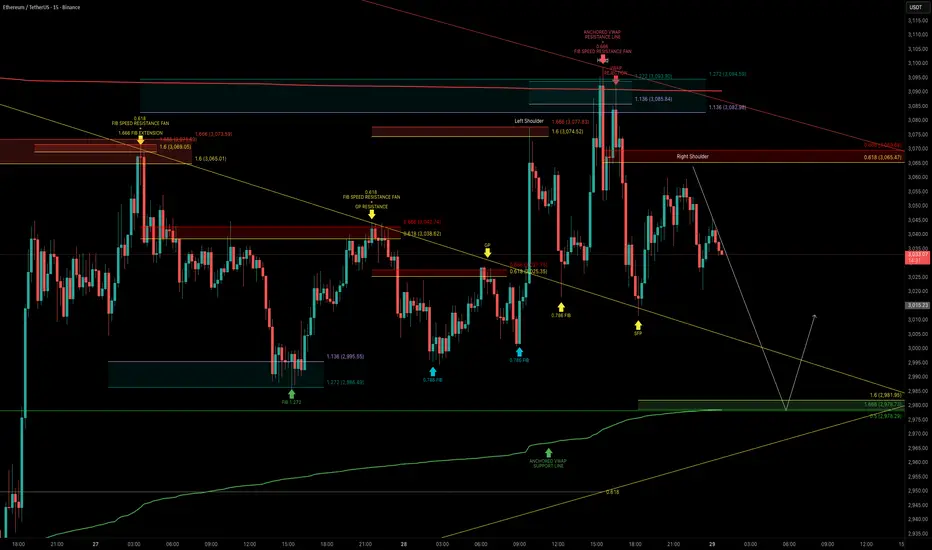

ETH Technical Breakdown

Today, ETH attempted a breakout but the move failed, and the rejection was clean.

ETH rejected at the anchored VWAP aligned with Fibonacci reversal zone:

Key Confluence Level Below:

My next major downside target lines up with a cluster of confluences:

Educational Takeaway → Confluence Is King

If there’s one lesson to internalize:

The more factors that align at the same level or zone, the higher the probability of a successful trade.

This ETH range has provided several high-quality setups for anyone who understands how to read price through Fibonacci.

Final Notes

ETH remains in a well-defined trading range use confluence, stay patient, and let the market come to your level.

_________________________________

💬 If you found this helpful, drop a like and comment!

I’ve been getting a lot of DMs asking what the best indicator is. The truth? There is no universal “best indicator” because indicators are tools, and every tool serves a different purpose. Trading is like carrying a toolbox: the skill isn’t in having the tools, but in knowing when and how to use them.

Educational Segment: Why Fibonacci Should Be Your Foundation

After years of studying different systems, I’ve come to a very simple conclusion:

👉 Fibonacci tools are the most powerful and reliable in my entire arsenal.

Why?

- They help you spot reversal zones with precision

- They work across all market conditions

- They are rooted in natural ratios that markets consistently gravitate toward

- They create predictable targets, retracements, extensions, and even timing when used correctly

Indicators like oscillators etc. are best used as confirmation, not as the primary signal.

If I had to pick one indicator besides Fibonacci, it would absolutely be the VWAP.

Why the Anchored VWAP Is Incredibly Underrated

- It shows where true volume-weighted market support + resistance lies

- It adapts dynamically

- It works extremely well as a dynamic support/resistance line

- It is fantastic as a trailing stop-loss tool

- It helps identify institutional footprints in price structure

Fibonacci + VWAP is one of the strongest forms of confluence you can build.

ETH Technical Breakdown

Today, ETH attempted a breakout but the move failed, and the rejection was clean.

ETH rejected at the anchored VWAP aligned with Fibonacci reversal zone:

- ETH tested the anchored VWAP near $3,090 twice, coinciding with the 1.136–1.272 Fibonacci Reversal Zone.

- This confluence acted as a strong resistance, leading to a swift selloff soon after.

Key Confluence Level Below:

My next major downside target lines up with a cluster of confluences:

- 1.6-1.666 Fibonacci extension

- 0.5 Fibonacci retracement

- Anchored VWAP (green support line)

- Liquidity zone (demand area)

- 0.618 Fibonacci speed fan support

Educational Takeaway → Confluence Is King

If there’s one lesson to internalize:

The more factors that align at the same level or zone, the higher the probability of a successful trade.

This ETH range has provided several high-quality setups for anyone who understands how to read price through Fibonacci.

Final Notes

ETH remains in a well-defined trading range use confluence, stay patient, and let the market come to your level.

_________________________________

💬 If you found this helpful, drop a like and comment!

Trade closed: target reached

Idea played out well, came close to the target before reversing. The next level I'm watching is the weekly VWAP lining up with the 0.618 fib around $2950🏆 Mastering Fibonacci for precision trading

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🏆 Mastering Fibonacci for precision trading

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.