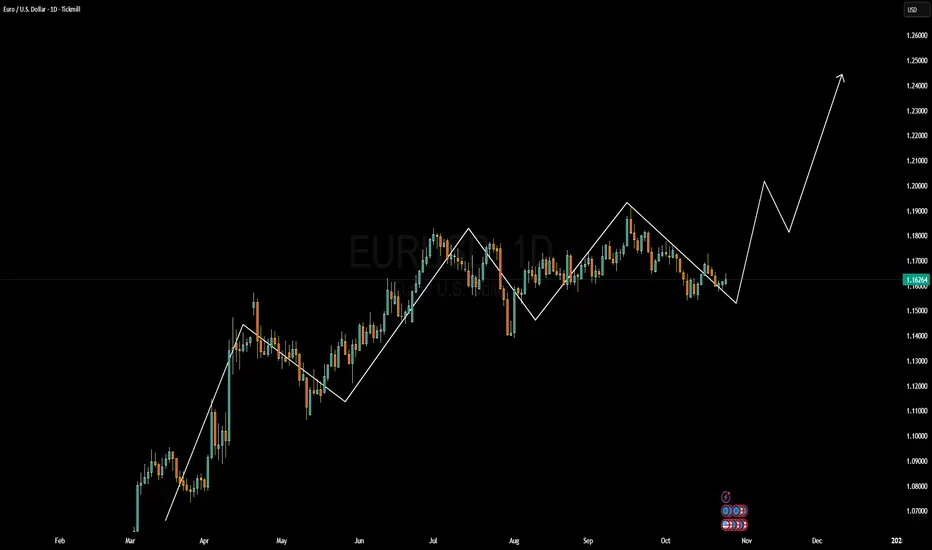

EURUSD is currently showing signs of potential bullish reversal on the daily timeframe after a prolonged consolidation phase. The pair has been fluctuating within a corrective structure for the past few months, maintaining higher lows around the 1.1500–1.1600 zone, which acts as a key demand area. The projected pattern indicates a possible breakout to the upside, suggesting a medium-term rally toward 1.2000 and beyond once momentum strengthens. This aligns with the expectation of renewed euro strength as buyers begin to accumulate positions at the current discounted levels.

From a fundamental perspective, the euro is supported by growing optimism surrounding the eurozone’s gradual economic recovery and easing inflation pressures. The European Central Bank’s stance is becoming more balanced, hinting at a potential policy shift if price stability continues to improve. On the other hand, the US dollar is beginning to face resistance as the Federal Reserve signals a slower pace of tightening due to cooling inflation data and mixed labor market figures. This divergence between the ECB and the Fed could fuel renewed buying pressure on EURUSD in the coming sessions.

Technically, a sustained close above the 1.1700 resistance area would confirm bullish continuation toward 1.1900 and later 1.2300. Traders should monitor momentum indicators and upcoming macro releases, such as US GDP and eurozone CPI data, for confirmation of strength. If sentiment continues to shift in favor of the euro, EURUSD could offer a strong buying opportunity, with pullbacks providing potential entries for long-term positions targeting higher liquidity levels above 1.2000. The setup highlights a potential profitable swing opportunity aligned with the broader market structure and fundamental direction.

From a fundamental perspective, the euro is supported by growing optimism surrounding the eurozone’s gradual economic recovery and easing inflation pressures. The European Central Bank’s stance is becoming more balanced, hinting at a potential policy shift if price stability continues to improve. On the other hand, the US dollar is beginning to face resistance as the Federal Reserve signals a slower pace of tightening due to cooling inflation data and mixed labor market figures. This divergence between the ECB and the Fed could fuel renewed buying pressure on EURUSD in the coming sessions.

Technically, a sustained close above the 1.1700 resistance area would confirm bullish continuation toward 1.1900 and later 1.2300. Traders should monitor momentum indicators and upcoming macro releases, such as US GDP and eurozone CPI data, for confirmation of strength. If sentiment continues to shift in favor of the euro, EURUSD could offer a strong buying opportunity, with pullbacks providing potential entries for long-term positions targeting higher liquidity levels above 1.2000. The setup highlights a potential profitable swing opportunity aligned with the broader market structure and fundamental direction.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.