🔥 Palm Oil Weekly Roundup by Southwind 🔥

🗓️ Week ending: September 05, 2025

🇨🇳 China’s DCE RBD palm olein jumped ~150 pts—strong signal for FCPO!

📈 India & China demand are up, expected to absorb Malaysia’s higher August stocks.

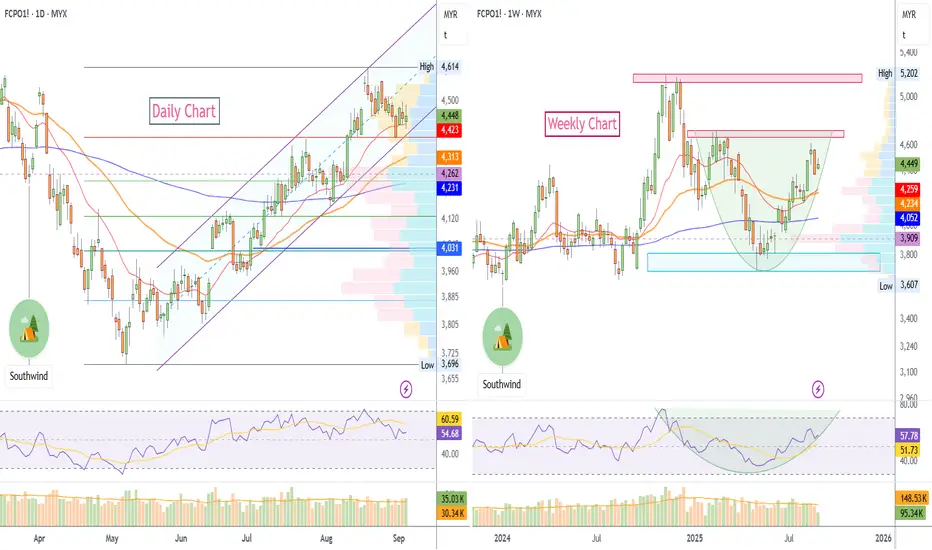

🧭 FCPO1 Technicals (Bursa Malaysia)

📊 Daily: Uptrend intact in a rising channel; bias bullish while above 20/50-DMA.

🚦 Trigger: Watch a break above 4,513 for a run to 4,568–4,614.

🛡️ Supports: 4,426/4,415, then 4,315 if pullback.

🥇 Weekly: Rounded bottom pattern forming; a close above 4,550–4,600 confirms strong reversal, eyeing supply zone below 5,200.

🌏 Fundamentals

🚢 Malaysia exports up ~10% m/m; festive demand boosts India’s imports.

📦 August stocks likely higher but may be absorbed by robust buying from India/China.

🇮🇩 Indonesia CPO reference price up; export tax/levy stays high.

⚡ Outlook: Momentum is bullish—watch for FCPO1 to rally strongly on demand strength and positive DCE cues. Key risk: stocks must not rise too sharply, and rival oils should stay competitive.

✅ Focus Next Week:

- Will FCPO1 break above 4,513?

- Sept 10 MPOB stocks report.

- China/India offtake, DCE/CBOT soyoil moves.

#PalmOil #CPO #FCPO #RDB PalmOil

🗓️ Week ending: September 05, 2025

🇨🇳 China’s DCE RBD palm olein jumped ~150 pts—strong signal for FCPO!

📈 India & China demand are up, expected to absorb Malaysia’s higher August stocks.

🧭 FCPO1 Technicals (Bursa Malaysia)

📊 Daily: Uptrend intact in a rising channel; bias bullish while above 20/50-DMA.

🚦 Trigger: Watch a break above 4,513 for a run to 4,568–4,614.

🛡️ Supports: 4,426/4,415, then 4,315 if pullback.

🥇 Weekly: Rounded bottom pattern forming; a close above 4,550–4,600 confirms strong reversal, eyeing supply zone below 5,200.

🌏 Fundamentals

🚢 Malaysia exports up ~10% m/m; festive demand boosts India’s imports.

📦 August stocks likely higher but may be absorbed by robust buying from India/China.

🇮🇩 Indonesia CPO reference price up; export tax/levy stays high.

⚡ Outlook: Momentum is bullish—watch for FCPO1 to rally strongly on demand strength and positive DCE cues. Key risk: stocks must not rise too sharply, and rival oils should stay competitive.

✅ Focus Next Week:

- Will FCPO1 break above 4,513?

- Sept 10 MPOB stocks report.

- China/India offtake, DCE/CBOT soyoil moves.

#PalmOil #CPO #FCPO #RDB PalmOil

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.