Education

Example of explanation of chart analysis and trading strategy

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

There was an inquiry asking for detailed information on how to analyze charts and create trading strategies accordingly, so I will take the time to explain it.

Before reading this article, you need a basic understanding of charts.

That is, you need to understand candles and price moving averages.

If you study this first and then read this content, I think you will have some understanding of trading.

---------------------------------------

Whether you are trading spot or futures, marking support and resistance points according to the arrangement of candles on the 1M, 1W, and 1D charts is the first task you need to do before trading.

To do this, you need to understand the arrangement of candles.

Therefore, before using my indicator, it is better to study candles first and understand the arrangement of candles.

When studying candles, it is better not to try to memorize the names or shapes of various patterns.

This is because the overall understanding of candles is important, not the various patterns of candles.

If you study with a book or video, you will be able to understand candles after reading or watching them at least 3 times.

We study charts to trade, not to analyze charts and teach them to others, so we need to study efficiently and save time.

-

If you study candles, you will naturally understand the price moving average.

The indicator corresponding to the price moving average is the MS-Signal indicator.

This MS-Signal indicator consists of the M-Signal indicator and the S-Signal indicator, and the main indicator is the M-Signal indicator.

Therefore, we added the M-Signal indicator of the 1W chart and the M-Signal indicator of the 1M chart to the 1D chart so that we can see the overall trend.

-

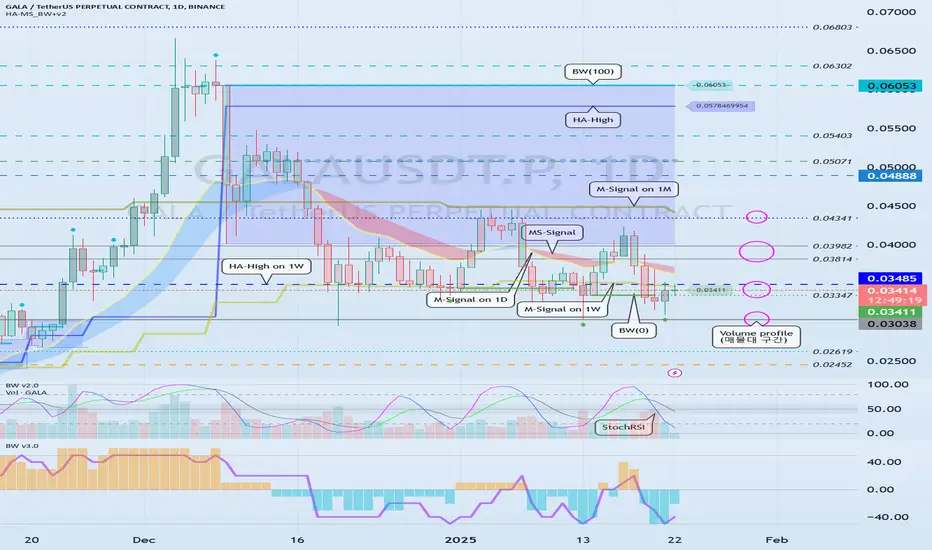

You can see the arrangement of the MS-Signal (M-Signal of 1M, 1W, 1D charts) indicators in the example chart.

Currently, since the M-Signal of the 1M chart > the M-Signal of the 1W chart, we can see that it is a reverse array.

If you understand the price moving average, you will understand that we should not trade when it is a reverse array, but when it is a regular array.

Therefore, since the current state of the example chart is a reverse array, it is not suitable for trading.

However, the reason we brought this chart in this state is because the M-Signal indicators of the 1M and 1W charts are converging.

As convergence progresses, it will eventually diverge.

Therefore, since the possibility of price volatility increases, the possibility of capturing the timing for trading increases depending on whether there is support at the support and resistance points.

-

The indicators included in the example chart are drawn as horizontal lines to indicate support and resistance points.

This work performs the same role as the support and resistance points drawn on the 1M, 1W, and 1D charts according to the arrangement of the candles mentioned above.

Therefore, on the 1M, 1W, and 1D charts, horizontal lines are drawn on the indicators to indicate support and resistance points.

You can draw horizontal lines on indicators that are horizontal for at least 3 candles, and if possible, 5 candles.

-

Among the HA-MS indicators, the important indicators are the HA-Low and HA-High indicators.

The HA-Low and HA-High indicators are indicators created for trading on the Heikin-Ashi chart.

Therefore, it is the next most important indicator after the MS-Signal (M-Signal on 1M, 1W, 1D charts) indicator that can tell the trend.

You can create a trading strategy depending on whether there is support near the HA-Low, HA-High indicators.

-

The next most important indicator is the BW(0), BW(100) indicator.

When this indicator is created or touched, it is time to respond in detail.

That is, when you are trading with a trading strategy created from the HA-Low, HA-High indicators, when the BW(0), BW(100) indicators are created or touched, you can choose whether to proceed with a split transaction.

In addition, you can understand the OBV, +100, -100 indicators as response points for split transactions.

Therefore, you do not need to indicate support and resistance points for the OBV, +100, -100 indicators.

However, it is recommended to mark support and resistance points for the HA-Low, HA-High, BW(0), BW(100) indicators.

-

If you look at the price position in the example chart, you can see that it is located in the 0.03347-0.03485 range.

And, the M-Signal indicator of the 1W chart is passing through this range, and the HA-High indicator of the 1W chart is acting as support and resistance.

Therefore, whether there is support near 0.03485 is an important key point.

If support is confirmed near 0.03485, it is a time to buy.

However, since the MS-Signal (M-Signal on the 1D chart) indicator is passing between 0.03485-0.03814, the point to watch is whether the MS-Signal (M-Signal on the 1D chart) indicator can break through upward.

As I mentioned earlier, if the MS-Signal indicator passes, a trend change will occur, so it is significant.

Therefore, in order to turn into a short-term uptrend, it is likely to be supported around 0.03814-0.03982.

Therefore, the first split selling section will be around 0.03814-0.03982.

At this time, whether to sell or hold depends on your investment style and investment period.

-

Since the M-Signal indicator on the 1M chart is passing around 0.04341, it is likely to start when the price is maintained above the M-Signal indicator on the 1M chart in order to turn into a long-term uptrend.

Therefore, the second split selling period will be around the M-Signal indicator on the 1M chart.

This is also something you can choose.

-

An important volume profile section is formed around 0.03038.

Therefore, the 0.03038 point corresponds to a strong support section.

-

(30m chart)

When the time frame chart you are trading is below the 1D chart, it is recommended to activate the 5EMA indicator on the 1D chart.

(I just used the 30m chart as an example. The same principle applies to any time frame chart you usually use.)

This is because there is a high possibility of volatility when the 5EMA of the 1D chart and the M-Signal indicator of the 1M, 1W, and 1D charts are touched.

In other words, you can understand that it plays a certain role of support and resistance.

If it touches the HA-High, BW(100) indicator and falls and falls below the MS-Signal indicator, it will basically touch the HA-Low or BW(0) indicator.

On the other hand, if it touches the HA-Low, BW(0) indicator and rises and rises above the MS-Signal indicator, it will basically touch the HA-High or BW(100) indicator.

However, since it may not do so and may rise or fall in the middle, it is necessary for the support and resistance points drawn on the 1M, 1W, and 1D charts as mentioned earlier.

The support and resistance points drawn on the 1D chart are currently indicated at the 0.03347 point.

Therefore, even if it falls below the MS-Signal indicator, you can understand that there is a possibility of rising again around 0.03347.

Since the 5EMA of the 1D chart and the M-Signal indicator of the 1W chart are passing around 0.03485, we can see that the area around 0.03485 is an important support and resistance zone.

-

Since the StochRSI indicator is currently above 50, we should focus on finding a time to sell.

Since it has fallen below the BW(100) and HA-High indicators, it has fallen too much to start trading with a sell (SHORT) position.

However, if you can respond quickly, you can enter a sell (SHORT) position when it falls from the 0.03411 point where the MS-Signal indicator is passing.

When the StochRSI indicator falls below 50, we should focus on finding a time to buy.

At this time, you can trade based on whether there is support or resistance at the support and resistance points drawn on the 1M, 1W, and 1D charts or around the MS-Signal (M-Signal on the 1M, 1W, and 1D charts), 5EMA, HA-Low, HA-High, BW(0), and BW(100) indicators on the 1D chart.

As mentioned earlier, you should not forget that trading strategies can be created based on whether there is support at the HA-Low and HA-High indicators.

Therefore, if possible, it is recommended to trade based on whether there is support near the HA-High indicator point of 0.03443.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

Note

The most important thing when trading futures is to avoid forced liquidation.To do that, you need to cut your losses well.

If you don't want to cut your losses, it is better to trade by lowering your investment ratio or lowering your leverage.

Futures trading is a high-risk transaction, so trading with too low an investment ratio or low leverage can be inefficient.

However, since futures trading can be traded in both directions, it can improve your trading strategy and judgment skills required for response.

Therefore, it is recommended to adjust your investment ratio or leverage according to your skill level in futures trading.

※ Follow X to check out the posts.

※ X를 팔로우하고 게시물을 확인하세요.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

※ X를 팔로우하고 게시물을 확인하세요.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

※ Follow X to check out the posts.

※ X를 팔로우하고 게시물을 확인하세요.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

※ X를 팔로우하고 게시물을 확인하세요.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.