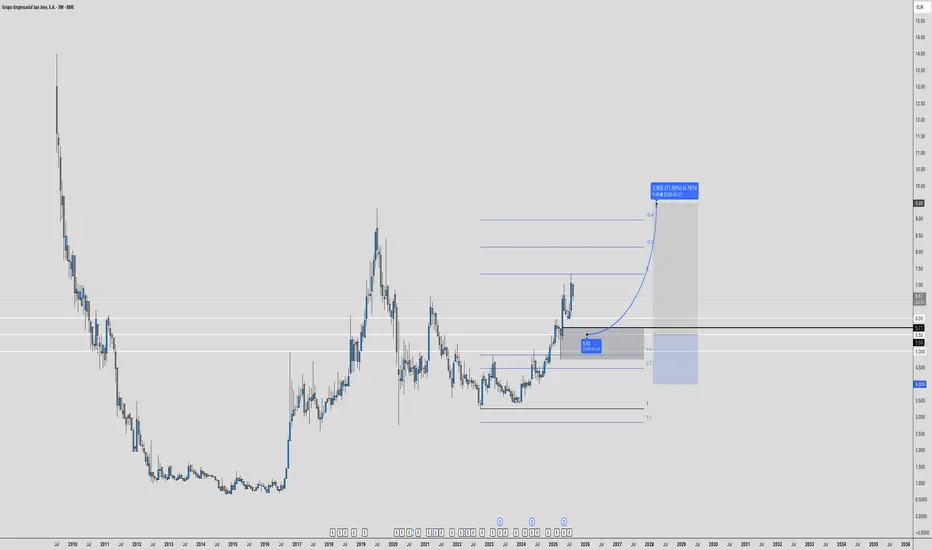

1/ I’ve evaluated Grupo San José (GSJ) as of 09/08/2025, 10:34 AM CEST. Currently at ~€6.25, its upward trend and solid fundamentals point to strong potential. Where’s it headed? 2/ Key drivers: construction sector recovery, rising demand in infrastructure and energy projects, and robust financial management. The chart shows support at €5.90 and resistance broken at €6.70.

3/ Projection: In 3-4 years (2028-2029), I estimate a range of €9-9.6 per share, based on a 15-18% CAGR. This assumes expansion into emerging markets and favorable interest rates. 4/ Risks to note: commodity price volatility, stricter environmental regs, and macro conditions. Suggest monitoring EBITDA and debt/EBITDA in upcoming reports.

5/ For moderate-risk investors, GSJ is a compelling long-term value play. Diversify and stay updated. Your thoughts? Let’s discuss. #GrupoSanJose #StockMarket #Investment

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.