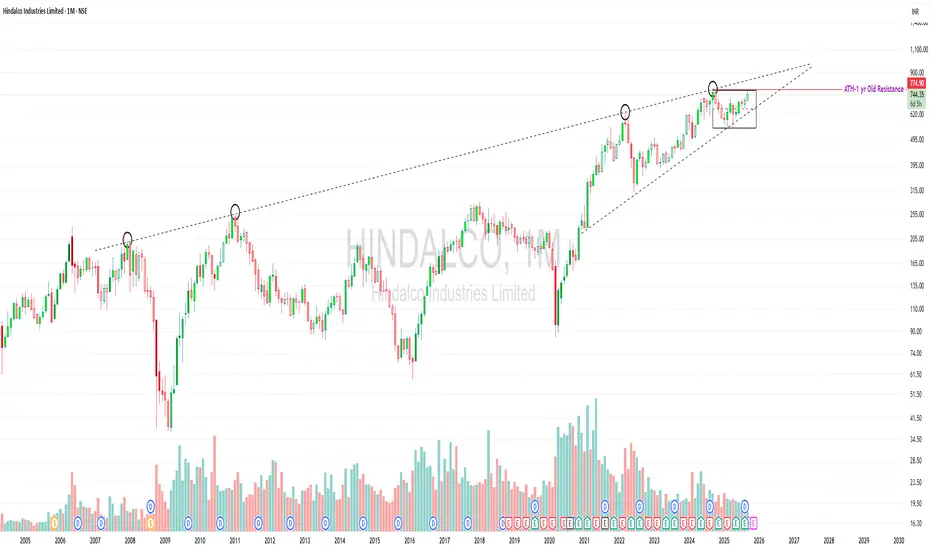

Near ATH, testing a 20-year trendline — worth studying.

- Price is trading inside a long-term rising wedge.

- The upper trendline has acted as resistance multiple times (2007, 2011, 2022, and now).

- Currently consolidating in a tight range near ATH (~₹775).

- Volume needs improvement — a decisive breakout above resistance should ideally come with strong volume confirmation.

⚠️ Risks / Watch-outs:

Rising wedge patterns can also resolve downwards if breakout fails.

Repeated rejections from the same long-term trendline may trigger profit-taking.

Without big volume, any breakout attempt may not sustain.

💡 Learning Point: Long-term trendlines and volume behavior are crucial in studying potential breakouts vs. failed attempts.

⚠️ Disclaimer: This post is for educational purposes only. It is not a buy/sell recommendation or financial advice. Please do your own research or consult a SEBI-registered advisor before making investment decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.